Monopolistic Competition in the Long Run

Obviously, an industry in which existing firms are losing money, like the one in panel (b) of Figure 15-1, is not in long-run equilibrium. When existing firms are losing money, some firms will exit the industry. The industry will not be in long-run equilibrium until the persistent losses have been eliminated by the exit of some firms.

It may be less obvious that an industry in which existing firms are earning profits, like the one in panel (a) of Figure 15-1, is also not in long-run equilibrium. Given that there is free entry into the industry, persistent profits earned by the existing firms will lead to the entry of additional producers. The industry will not be in long-run equilibrium until the persistent profits have been eliminated by the entry of new producers.

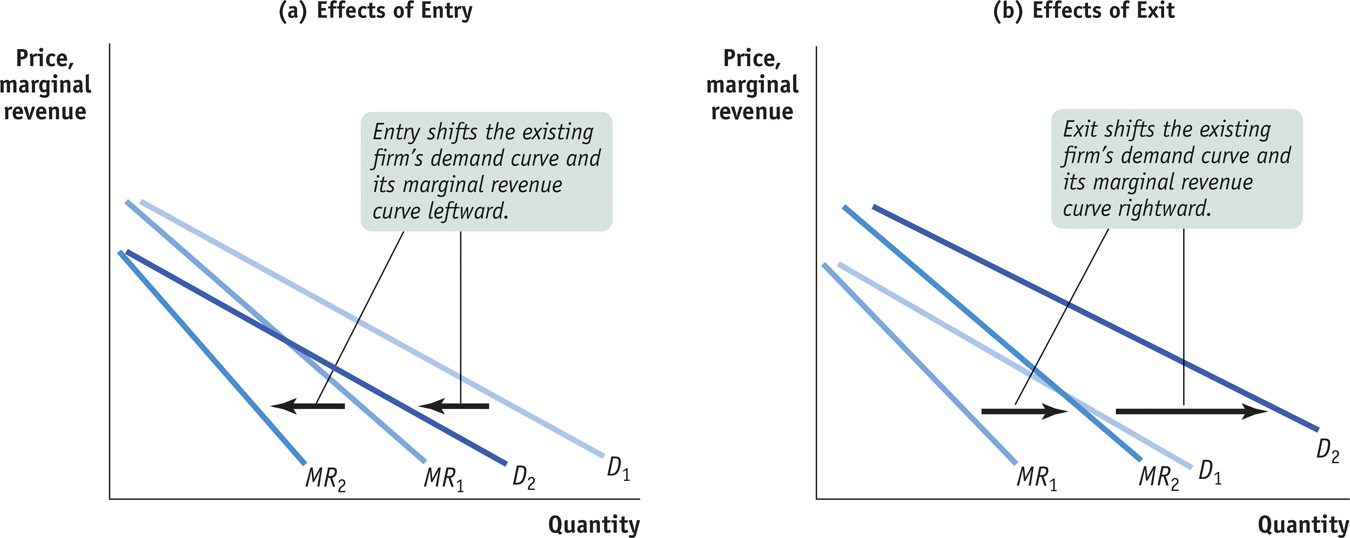

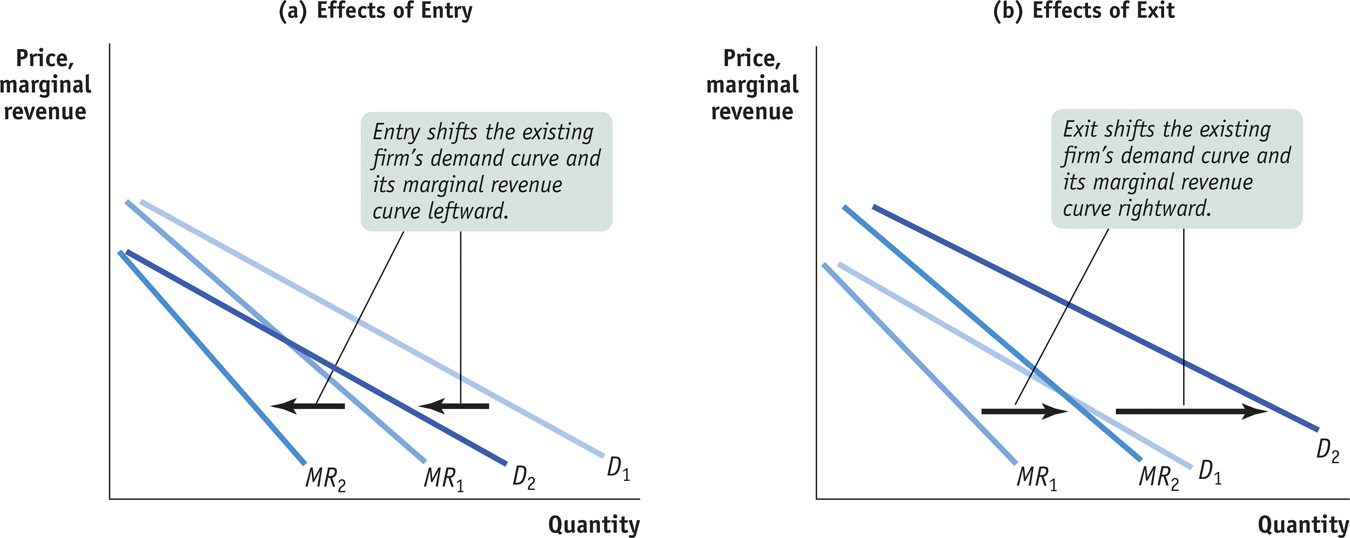

How will entry or exit by other firms affect the profits of a typical existing firm? Because the differentiated products offered by firms in a monopolistically competitive industry compete for the same set of customers, entry or exit by other firms will affect the demand curve facing every existing producer. If new gas stations open along a highway, each of the existing gas stations will no longer be able to sell as much gas as before at any given price. So, as illustrated in panel (a) of Figure 15-2, entry of additional producers into a monopolistically competitive industry will lead to a leftward shift of the demand curve and the marginal revenue curve facing a typical existing producer.

Entry and Exit Shift Existing Firm’s Demand Curve and Marginal Revenue Curve Entry will occur in the long run when existing firms are profitable. In panel (a), entry causes each existing firm’s demand curve and marginal revenue curve to shift to the left. The firm receives a lower price for every unit it sells, and its profit falls. Entry will cease when firms make zero profit. Exit will occur in the long run when existing firms are unprofitable. In panel (b), exit from the industry shifts each remaining firm’s demand curve and marginal revenue curve to the right. The firm receives a higher price for every unit it sells, and profit rises. Exit will cease when the remaining firms make zero profit.

Conversely, suppose that some of the gas stations along the highway close. Then each of the remaining stations will be able to sell more gasoline at any given price. So, as illustrated in panel (b), exit of firms from an industry will lead to a rightward shift of the demand curve and marginal revenue curve facing a typical remaining producer.

In the long run, a monopolistically competitive industry ends up in zero-profit equilibrium: each firm makes zero profit at its profit-maximizing quantity.

The industry will be in long-run equilibrium when there is neither entry nor exit. This will occur only when every firm earns zero profit. So in the long run, a monopolistically competitive industry will end up in zero-profit equilibrium, in which firms just manage to cover their costs at their profit-maximizing output quantities.

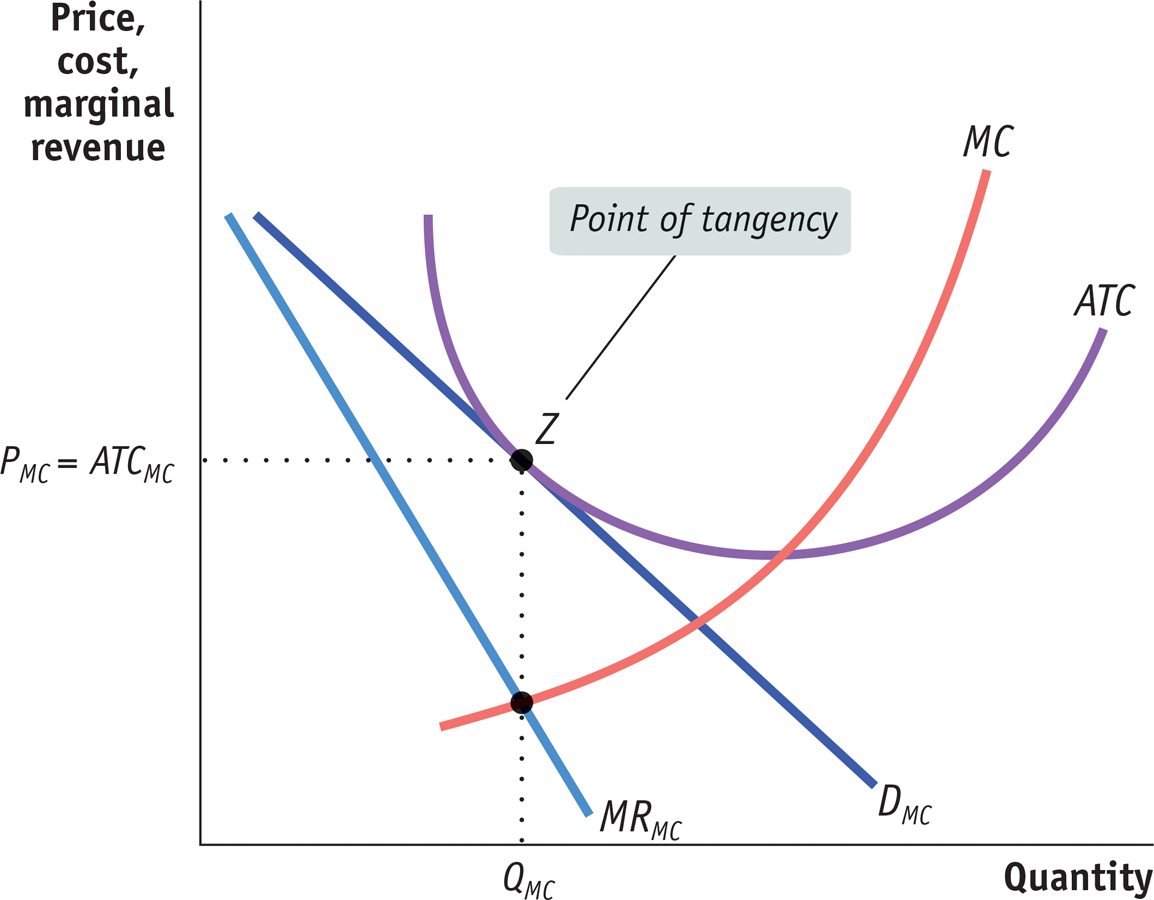

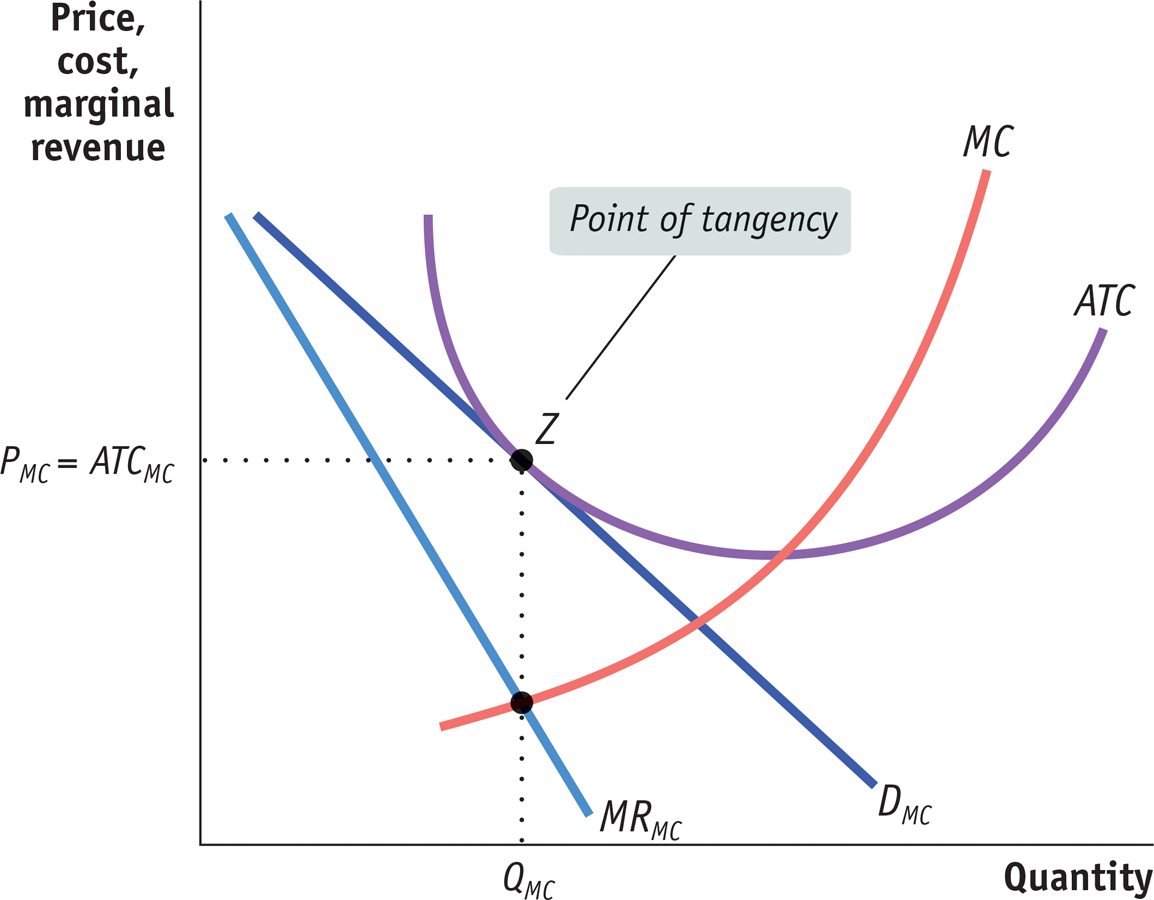

We have seen that a firm facing a downward-sloping demand curve will earn positive profits if any part of that demand curve lies above its average total cost curve; it will incur a loss if its demand curve lies everywhere below its average total cost curve. So in zero-profit equilibrium, the firm must be in a borderline position between these two cases; its demand curve must just touch its average total cost curve. That is, it must be just tangent to it at the firm’s profit-maximizing output quantity—the output quantity at which marginal revenue equals marginal cost.

If this is not the case, the firm operating at its profit-maximizing quantity will find itself making either a profit or loss, as illustrated in the panels of Figure 15-1. But we also know that free entry and exit means that this cannot be a long-run equilibrium. Why? In the case of a profit, new firms will enter the industry, shifting the demand curve of every existing firm leftward until all profits are extinguished. In the case of a loss, some existing firms will exit and so shift the demand curve of every remaining firm to the right until all losses are extinguished. All entry and exit ceases only when every existing firm makes zero profit at its profit-maximizing quantity of output.

FOR INQUIRING MINDS: Hits and Flops

On the face of it, the movie business seems to meet the criteria for monopolistic competition. Movies compete for the same consumers; each movie is different from the others; new companies can and do enter the business. But where’s the zero-profit equilibrium? After all, some movies are enormously profitable.

The key is to realize that for every successful blockbuster, there are several flops—and that the movie studios don’t know in advance which will be which. And by the time it becomes clear that a movie will be a flop, it’s too late to cancel it.

The difference between movie-making and the type of monopolistic competition we model in this chapter is that the fixed costs of making a movie are also sunk costs—once they’ve been incurred, they can’t be recovered.

Yet there is still, in a way, a zero-profit equilibrium. If movies on average were highly profitable, more studios would enter the industry and more movies would be made. If movies on average lost money, fewer movies would be made.

In fact, as you might expect, the movie industry on average earns just about enough to cover the cost of production—that is, it earns roughly zero economic profit.

This kind of situation—in which firms earn zero profit on average but have a mixture of highly profitable hits and money-losing flops—can be found in other industries characterized by high up-front sunk costs. A notable example is the pharmaceutical industry, where many research projects lead nowhere but a few lead to highly profitable drugs.

Figure 15-3 shows a typical monopolistically competitive firm in such a zero-profit equilibrium. The firm produces QMC, the output at which MRMC = MC, and charges price PUE. At this price and quantity, represented by point Z, the demand curve is just tangent to its average total cost curve. The firm earns zero profit because price, PUE, is equal to average total cost, ATCMC.

The Long-Run Zero-Profit Equilibrium If existing firms are profitable, entry will occur and shift each existing firm’s demand curve leftward. If existing firms are unprofitable, each remaining firm’s demand curve shifts rightward as some firms exit the industry. Entry and exit will cease when every existing firm makes zero profit at its profit-maximizing quantity. So, in long-run zero-profit equilibrium, the demand curve of each firm is tangent to its average total cost curve at its profit-maximizing quantity: at the profit-maximizing quantity, QMC, price, PMC, equals average total cost, ATCMC. A monopolistically competitive firm is like a monopolist without monopoly profits.

The normal long-run condition of a monopolistically competitive industry, then, is that each producer is in the situation shown in Figure 15-3. Each producer acts like a monopolist, facing a downward-sloping demand curve and setting marginal cost equal to marginal revenue so as to maximize profits. But this is just enough to achieve zero economic profit. The producers in the industry are like monopolists without monopoly profits.

ECONOMICS in Action: The Housing Bust and the Demise of the 6% Commission

The Housing Bust and the Demise of the 6% Commission

The vast majority of home sales in the United States are transacted with the use of real estate agents. A home owner looking to sell hires an agent, who lists the house for sale and shows it to interested buyers. Correspondingly, prospective home buyers hire their own agent to arrange inspections of available houses. Traditionally, agents were paid by the seller: a commission equal to 6% of the sales price of the house, which the seller’s agent and the buyer’s agent would split equally. If a house sold for $300,000, for example, the seller’s agent and the buyer’s agent each received $9,000 (equal to 3% of $300,000).

The real estate brokerage industry fits the model of monopolistic competition quite well: in any given local market, there are many real estate agents, all competing with one another, but the agents are differentiated by location and personality as well as by the type of home they sell (some focus on condominiums, others on very expensive homes, and so on). And the industry has free entry: it’s relatively easy for someone to become a real estate agent (take a course and then pass a test to obtain a license).

But for a long time there was one feature that didn’t fit the model of monopolistic competition: the fixed 6% commission that had not changed over time and was unaffected by the ups and downs of the housing market. How could this be? Why didn’t new agents enter the market and drive the commission down to the zero-profit level?

One tactic used by agents was their control of the Multiple Listing Service, or MLS, which lists nearly all the homes for sale in a community. Traditionally, only sellers who agreed to the 6% commission were allowed to list homes on the MLS.

But protecting the 6% commission was always an iffy endeavor because any action by the brokerage industry to fix the commission rate at a given percentage would run afoul of antitrust laws. And by the early to mid-2000s, as the housing boom intensified, discount brokers had appeared on the scene. But traditional agents refused to work with them. So in 2005, the Justice Department sued the National Association of Realtors, the powerful trade group of agents.

Oversight by regulators and the housing market bust which began in 2006 hastened the demise of the non-negotiable 6% commission. With sellers forced to accept less for their houses than expected, pressure built for agents to accept less as well. In addition, the Internet and sites like Zillow.com and Redfin.com have made it much easier for homeowners to sell on their own or find a discount realtor who is willing to charge a much lower percentage. As a result, even full-service realtors regularly accept commissions less than 6%. As Steve Murray, the editor of a real estate trade publication said, “The standard 6 percent went out the window a long time ago.”

Quick Review

Like a monopolist, each firm in a monopolistically competitive industry faces a downward-sloping demand curve and marginal revenue curve. In the short run, it may earn a profit or incur a loss at its profit-maximizing quantity.

If the typical firm earns positive profit, new firms will enter the industry in the long run, shifting each existing firm’s demand curve to the left. If the typical firm incurs a loss, some existing firms will exit the industry in the long run, shifting the demand curve of each remaining firm to the right.

The long-run equilibrium of a monopolistically competitive industry is a zero-profit equilibrium in which firms just break even. The typical firm’s demand curve is tangent to its average total cost curve at its profit-maximizing quantity.

15-2

Question

15.3

Currently a monopolistically competitive industry, composed of firms with U-shaped average total cost curves, is in long-run equilibrium. Describe how the industry adjusts, in both the short and long run, in each of the following situations.

A technological change that increases fixed cost for every firm in the industry

A technological change that decreases marginal cost for every firm in the industry

Question

15.4

Why, in the long run, is it impossible for firms in a monopolistically competitive industry to create a monopoly by joining together to form a single firm?

Solutions appear at back of book.