Rational Models for Irrational People?

So why do economists still use models based on rational behavior when people are at times manifestly irrational? For one thing, models based on rational behavior still provide robust predictions about how people behave in most markets. For example, the great majority of farmers will use less fertilizer when it becomes more expensive—

Another explanation is that sometimes market forces can compel people to behave more rationally over time. For example, if you are a small-

Finally, economists depend on the assumption of rationality for the simple but fundamental reason that it makes modeling so much simpler. Remember that models are built on generalizations, and it’s much harder to extrapolate from messy, irrational behavior. Even behavioral economists, in their research, search for predictably irrational behavior in an attempt to build better models of how people behave. Clearly, there is an ongoing dialogue between behavioral economists and the rest of the economics profession, and economics itself has been irrevocably changed by it.

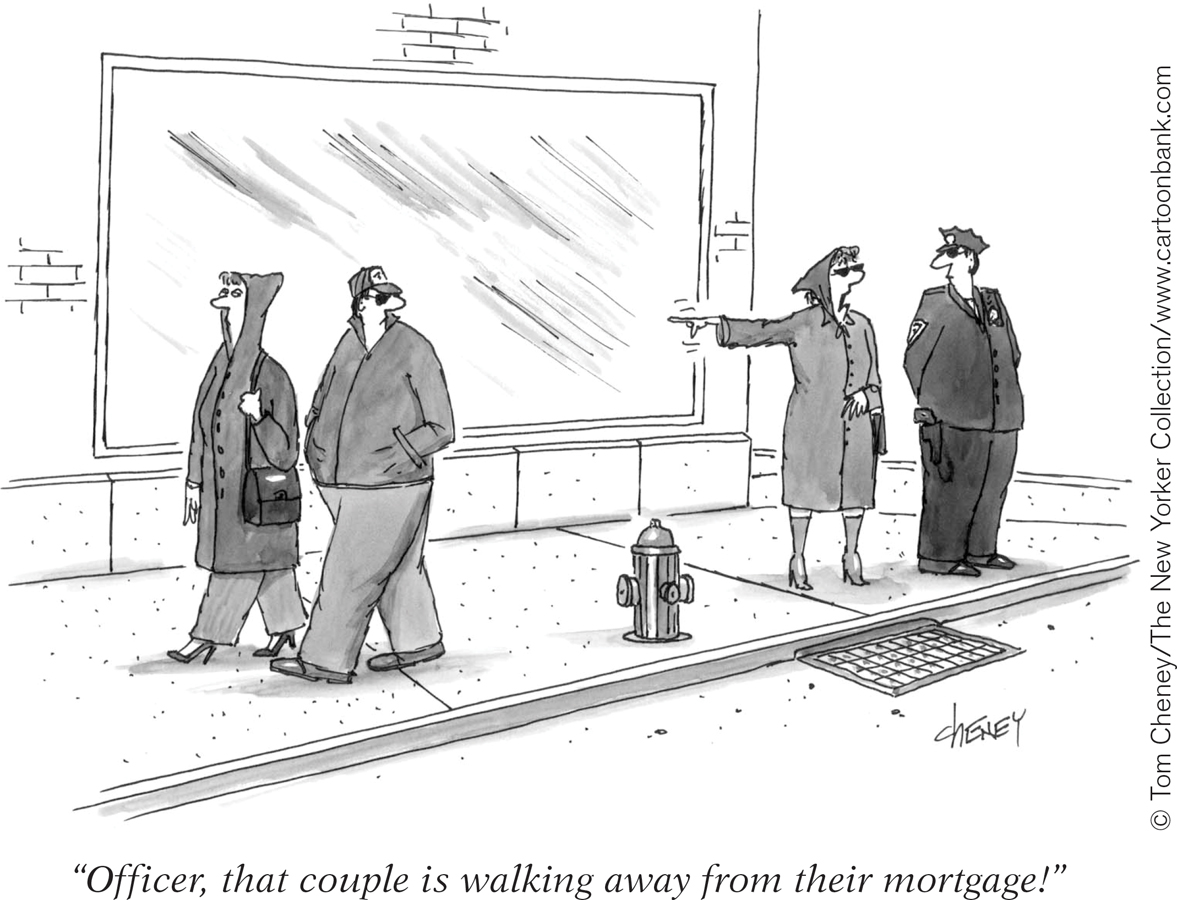

ECONOMICS in Action: “The Jingle Mail Blues”

“The Jingle Mail Blues”

It’s called jingle mail—

To default on a mortgage—

What happened? After decades of huge increases, house prices began a precipitous fall in 2008, known as the Great American Housing Bust. Prices dropped so much that a significant proportion of homeowners found their homes “underwater”—they owed more on their homes than the homes were worth. And with house prices projected to stay depressed for several years, possibly a decade, there appeared to be little chance that an underwater house would recover its value enough in the foreseeable future to move “abovewater.”

Many homeowners suffered a major loss. They lost their down payment, money spent on repairs and renovation, moving expenses, and so on. And because they were paying a mortgage that was greater than the house was now worth, they found they could rent a comparable dwelling for less than their monthly mortgage payments. In the words of a Florida resident, who paid $215,000 for an apartment in Miami where similar units were now selling for $90,000, “There is no financial sense in staying.”

Realizing their losses were sunk costs, underwater homeowners walked away. Perhaps they hadn’t made the best economic decision when purchasing their houses, but in leaving them showed impeccable economic logic.

Quick Review

Behavioral economics combines economic modeling with insights from human psychology.

Rational behavior leads to the outcome a person most prefers. Bounded rationality, risk aversion, and concerns about fairness are reasons why people might prefer outcomes with worse economic payoffs.

Irrational behavior occurs because of misperceptions of opportunity costs, overconfidence, mental accounting, and unrealistic expectations about the future. Loss aversion and status quo bias can also lead to choices that leave people worse off than they would be if they chose another available option.

9-4

9-

Question 9.8

Which of the types of irrational behavior are suggested by the following events?

Although the housing market has fallen and Jenny wants to move, she refuses to sell her house for any amount less than what she paid for it.

Dan worked more overtime hours last week than he had expected. Although he is strapped for cash, he spends his unexpected overtime earnings on a weekend getaway rather than trying to pay down his student loan.

Carol has just started her first job and deliberately decided to opt out of the company’s savings plan. Her reasoning is that she is very young and there is plenty of time in the future to start saving. Why not enjoy life now?

Jeremy’s company requires employees to download and fill out a form if they want to participate in the company-

sponsored savings plan. One year after starting the job, Jeremy had still not submitted the form needed to participate in the plan.

Question 9.9

How would you determine whether a decision you made was rational or irrational?

Solutions appear at back of book.

J. C. Penney’s One-Price Strategy Upsets Its Customers

In early 2013, the department store chain J. C. Penney unceremoniously dumped its recently hired chief executive, Ron Johnson. The action followed a disastrous 2012 for the company, in which sales dropped 25% to $13 billion. And it was a humbling defeat for Mr. Johnson’s strategy of “everyday” low prices, implemented in early 2012.

A year before the one-

So the new strategy seemed like a no-

The company reaped benefits from the strategy in the form of cost-

But, there were problems with this pricing strategy as well. Just how low the prices were wasn’t clear. “Trust us,” was the message J. C. Penney communicated to its shoppers, “We will give you a fair deal.” In addition, unlike Walmart, Penney did not offer to match competitors’ prices, and it could not depend on making up for tiny per-

Mr. Johnson’s strategy clearly alienated Tracie Fobes, who runs Penny Pinchin’ Mom, a blog about couponing strategies, who said, “… seeing that something is marked down 20% off, then being able to hand over the coupon to save, it just entices me.”

So with Johnson’s departure, J. C. Penney backtracked and began offering coupons and weekly sales again. And the store assistants went back to work, marking items up in order to then immediately mark them down.

QUESTIONS FOR THOUGHT

Question 9.10

vTnJmMqswBMmZwVvaPAGq2qgpT9R7cunqMm/v7UJdmYVe+8g3PtZ+glnjdvBuJ4o0w8cseCCNHWJaHYIaA1Q8jn0YVG+bXSA0KLSkqJt0QmLOwanbfqI8DIcOV7mOnOpt/1a7Sk3PvH5m6YkGive an example of a type of rational decision making illustrated by this case and explain your choice.Question 9.11

XAKTdVm+/iEvUxZeoSzBduKZe8yF0olcODOygTVJkoB5C+VixjMramSIFwzae00Djnmj58peoYW87F611slBzY1ZnZ1zrTzly7jZFvxSKQKbnyAUtg1uTn8RHnTuRov6AoWwPDNeQYdNu8vNlmIILw==Give an example of a type of irrational decision making illustrated by this case and explain your choice.Question 9.12

556Kcy//MC+qikxX3PqN0MyQ7TSsI+3FOYBLgsNq8rt6jlhIMPC4xvifFVZ/GivilPnfDqz/dt72bDijTc00jL3T94FYMpuN+S/rMIM9f/NKk68YcQ2Dyvm2JLIjKbME3KOXAYRewhxEEsjBBj7Hjh0Khl2mFhtfIOufSSnNsSLoVItV4Ml1798W9W5SUd69LSWCh7ommlVQqzON1r9+OKl7vUC5kXbR08wGObJOKuy/qlNuDXTYwtW7JNDA6jSmPExZi/vRpes3j9KLCgCGHUio6/QjcwDsQd27vAE4J+OXXf27U250WVX6MfNBpJhI6Sk4lnJ5nfjEL4V+1keYfv2bqVYdvXCiwLkBW53oAYmDTT0iy3Q4FjBufJh6+dPu90fQzHrMCTnvdfhypj5o9w3peeO4BohqCGpqJa38g/xQJYS9KJEDUOyznnwzIPbH/FoT8E8NgYp/njGGHgtmhkBKckXkksIuYWr62yv1MRWVpi9Sm/AL+1j/p+bG9/DLG2duYpawruAd2XD3Nib3bEYKuP4b2Nn3GkbJpZokai4=What purpose does Walmart’s price-match guarantee serve? What do you predict would happen if it dropped this policy? Would you predict its competitors— say, the local supermarket or K- Mart— would adopt the same policy?