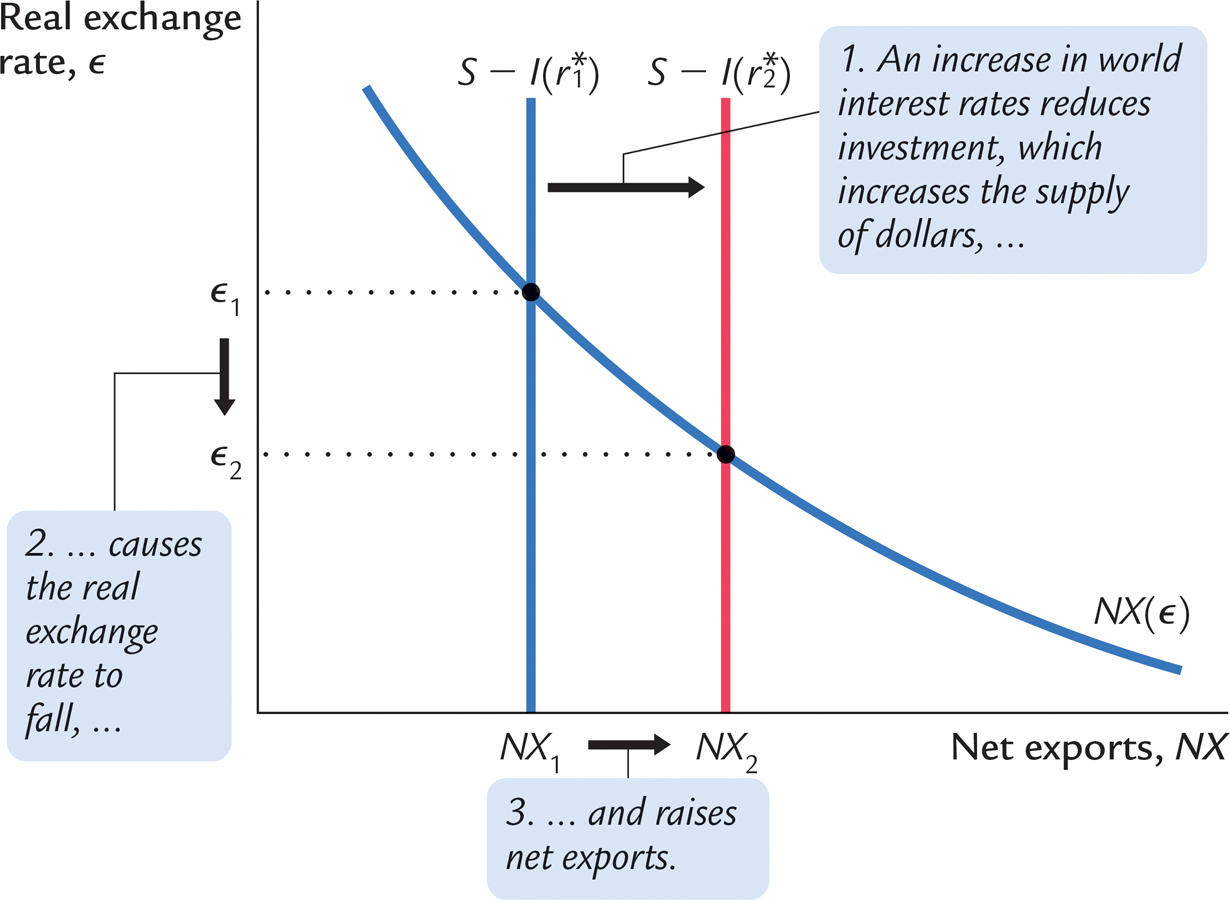

FIGURE 6-