16.3 Franco Modigliani and the Life-Cycle Hypothesis

In a series of papers written in the 1950s, Franco Modigliani and his collaborators Albert Ando and Richard Brumberg used Fisher’s model of consumer behavior to study the consumption function. One of their goals was to solve the consumption puzzle—that is, to explain the apparently conflicting pieces of evidence that came to light when Keynes’s consumption function was confronted with the data. According to Fisher’s model, consumption depends on a person’s lifetime income. Modigliani emphasized that income varies systematically over people’s lives and that saving allows consumers to move income from those times in life when income is high to those times when it is low. This interpretation of consumer behavior formed the basis for his life-cycle hypothesis.1

490

The Hypothesis

One important reason that income varies over a person’s life is retirement. Most people plan to stop working at about age 65, and they expect their incomes to fall when they retire. Yet they do not want a large drop in their standard of living, as measured by their consumption. To maintain their level of consumption after retirement, people must save during their working years. Let’s see what this motive for saving implies for the consumption function.

Consider a consumer who expects to live another T years, has wealth of W, and expects to earn income Y per year until he retires R years from now. What level of consumption will the consumer choose if he wishes to maintain a smooth level of consumption over the course of his life?

The consumer’s lifetime resources are composed of initial wealth W and lifetime earnings of R × Y. (For simplicity, we are assuming an interest rate of zero; if the interest rate were greater than zero, we would need to take account of interest earned on savings as well.) The consumer can divide up his lifetime resources among his T remaining years of life. We assume that he wishes to achieve the smoothest possible path of consumption over his lifetime. Therefore, he divides this total of W + RY equally among the T years and each year consumes

C = (W + RY)/T.

We can write this person’s consumption function as

C = (1/T)W + (R/T)Y.

For example, if the consumer expects to live for 50 more years and work for 30 of them, then T = 50 and R = 30, so his consumption function is

C = 0.02W + 0.6Y.

This equation says that consumption depends on both income and wealth. An extra $1 of income per year raises consumption by $0.60 per year, and an extra $1 of wealth raises consumption by $0.02 per year.

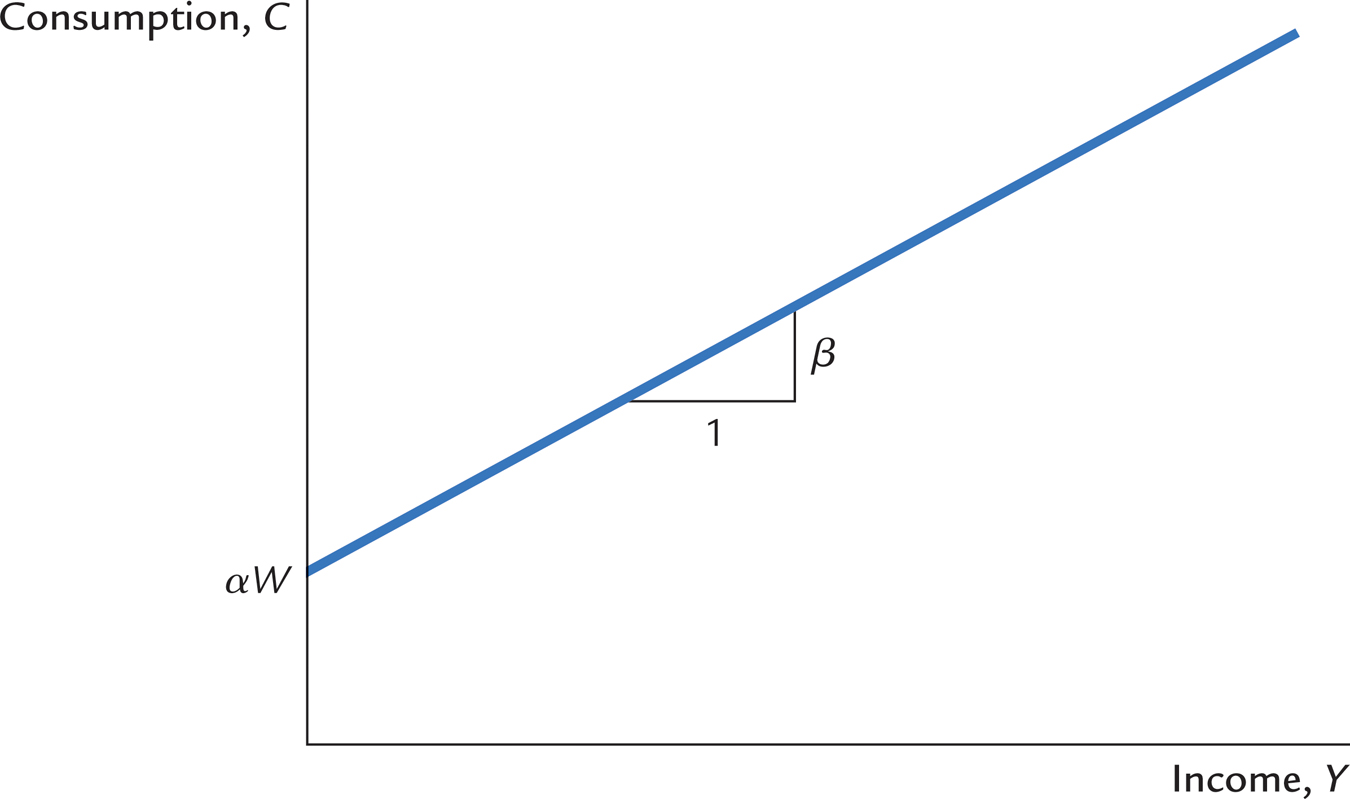

If every individual in the economy plans consumption like this, then the aggregate consumption function is much the same as the individual one. In particular, aggregate consumption depends on both wealth and income. That is, the economy’s consumption function is

C = αW + βY,

where the parameter α is the marginal propensity to consume out of wealth, and the parameter β is the marginal propensity to consume out of income.

Implications

Figure 16-10 graphs the relationship between consumption and income predicted by the life-cycle model. For any given level of wealth W, the model yields a conventional consumption function similar to the one shown in Figure 16-1. Notice, however, that the intercept of the consumption function, which shows what would happen to consumption if income ever fell to zero, is not a fixed value, as it is in Figure 16-1. Instead, the intercept here is αW and, thus, depends on the level of wealth.

491

This life-cycle model of consumer behavior can solve the consumption puzzle. According to the life-cycle consumption function, the average propensity to consume is

C/Y = α(W/Y) + β.

Because wealth does not vary proportionately with income from person to person or from year to year, we should find that high income corresponds to a low average propensity to consume when we look at data across individuals or over short periods of time. But over long periods of time, wealth and income grow together, resulting in a constant ratio W/Y and thus a constant average propensity to consume.

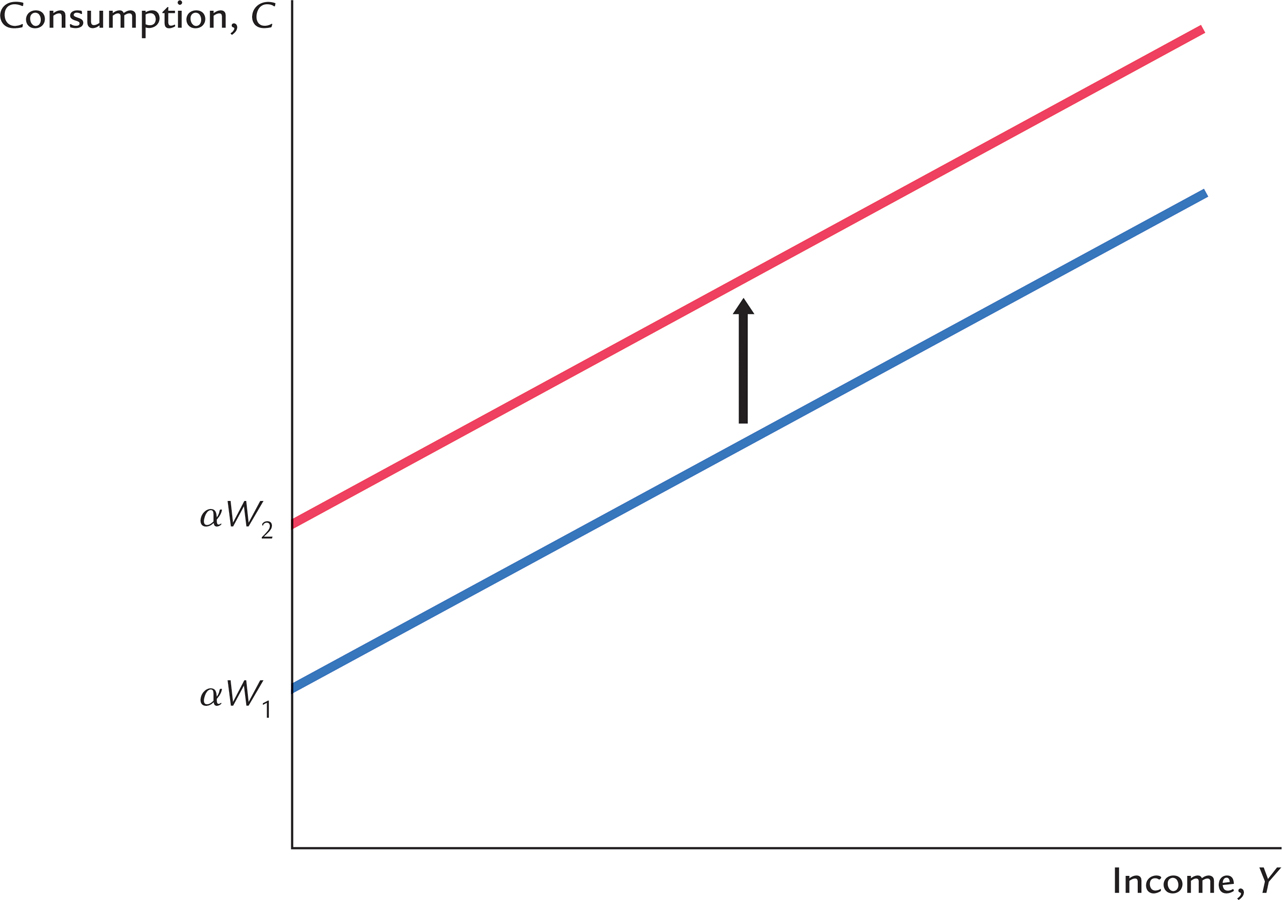

To make the same point somewhat differently, consider how the consumption function changes over time. As Figure 16-10 shows, for any given level of wealth, the life-cycle consumption function looks like the one Keynes suggested. But this function holds only in the short run when wealth is constant. In the long run, as wealth increases, the consumption function shifts upward, as in Figure 16-11. This upward shift prevents the average propensity to consume from falling as income increases. In this way, Modigliani resolved the consumption puzzle posed by Simon Kuznets’s data.

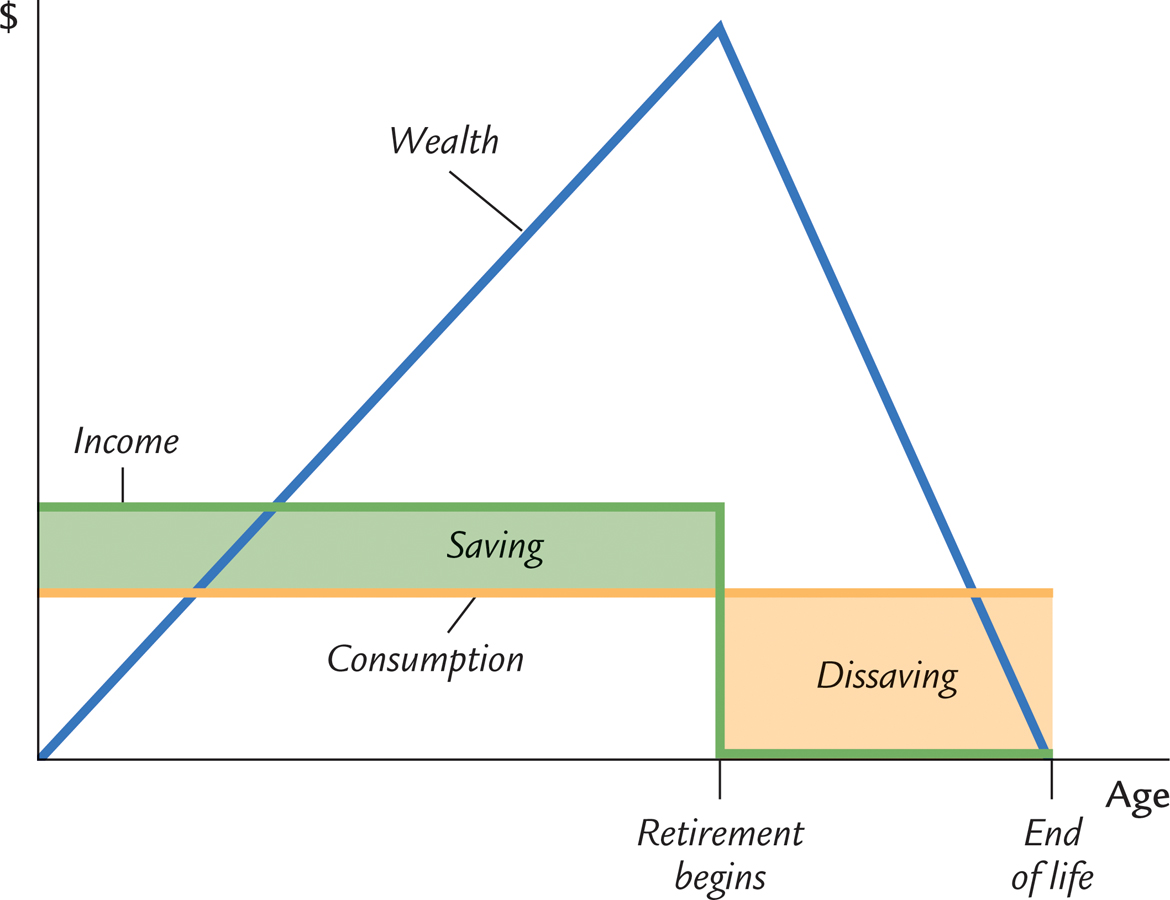

The life-cycle model makes many other predictions as well. Most important, it predicts that saving varies over a person’s lifetime. If a person begins adulthood with no wealth, he will accumulate wealth during his working years and then run down his wealth during his retirement years. Figure 16-12 illustrates the consumer’s income, consumption, and wealth over his adult life. According to the life-cycle hypothesis, because people want to smooth consumption over their lives, the young who are working save, while the old who are retired dissave.

492

493

CASE STUDY

The Consumption and Saving of the Elderly

Many economists have studied the consumption and saving of the elderly. Their findings present a problem for the life-cycle model. It appears that the elderly do not dissave as much as the model predicts. In other words, the elderly do not run down their wealth as quickly as one would expect if they were trying to smooth their consumption over their remaining years of life.

There are two chief explanations for why the elderly do not dissave to the extent that the model predicts. Each suggests a direction for further research on consumption.

The first explanation is that the elderly are concerned about unpredictable expenses. Additional saving that arises from uncertainty is called precautionary saving. One reason for precautionary saving by the elderly is the possibility of living longer than expected and thus having to provide for a longer than average span of retirement. Another reason is the possibility of illness and large medical bills. The elderly may respond to this uncertainty by saving more in order to be better prepared for these contingencies.

The precautionary-saving explanation is not completely persuasive because the elderly can largely insure against these risks. To protect against uncertainty regarding life span, they can buy annuities from insurance companies. For a fixed fee, annuities offer a stream of income that lasts as long as the recipient lives. Uncertainty about medical expenses should be largely eliminated by Medicare, the government’s health insurance plan for the elderly, and by private insurance plans.

The second explanation for the failure of the elderly to dissave is that they may want to leave bequests to their children. Economists have proposed various theories of the parent–child relationship and the bequest motive. In Chapter 19 we will discuss some of these theories and their implications for consumption and fiscal policy.

Overall, research on the elderly suggests that the simplest life-cycle model cannot fully explain consumer behavior. There is no doubt that providing for retirement is an important motive for saving, but other motives, such as precautionary saving and bequests, appear to be important as well.2