The Theory of Investment

507

The social object of skilled investment should be to defeat the dark forces of time and ignorance which envelope our future.

—John Maynard Keynes

While spending on consumption goods provides utility to households today, spending on investment goods is aimed at providing a higher standard of living at a later date. Investment is the component of GDP that links the present and the future.

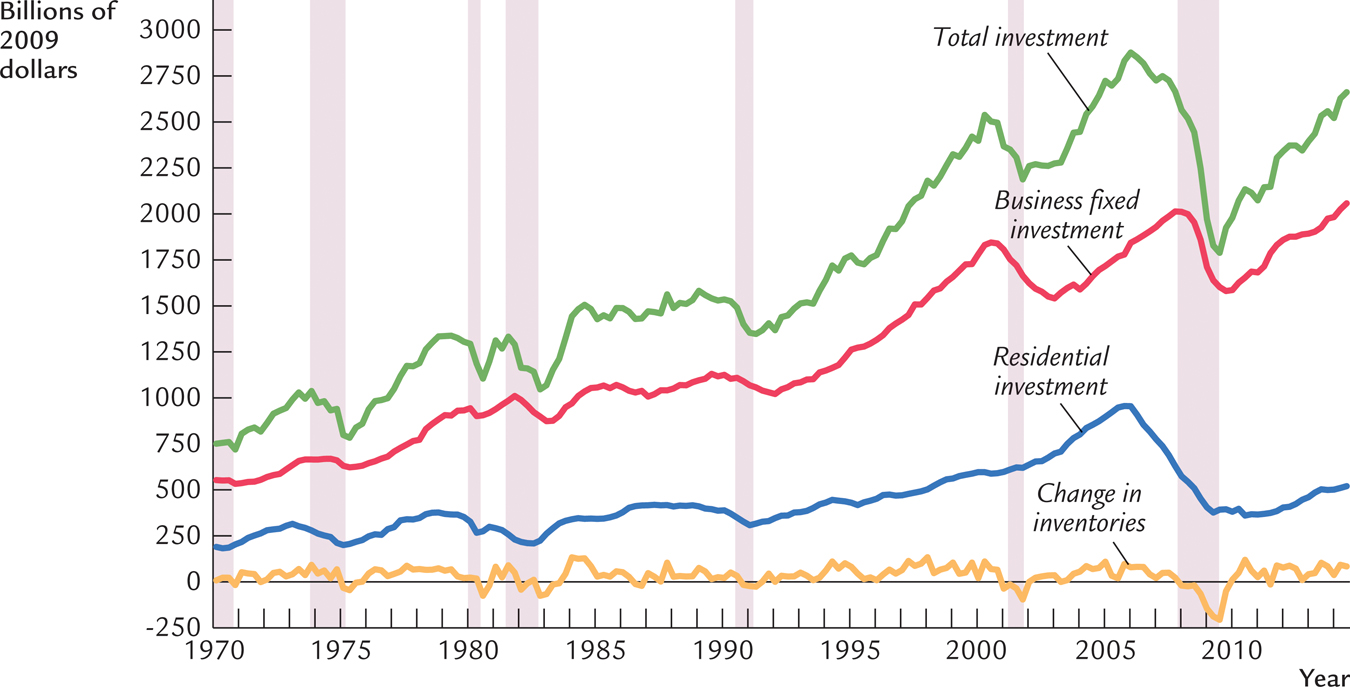

Investment spending plays a key role not only in long-run growth but also in the short-run business cycle because it is the most volatile component of GDP. When expenditure on goods and services falls during a recession, much of the decline is usually due to a drop in investment. In the severe U.S. recession of 2008–2009, for example, real GDP fell $636 billion from its peak in the fourth quarter of 2007 to its trough in the second quarter of 2009. Investment spending over the same period fell $785 billion, accounting for more than the entire fall in spending.

Economists study investment to better understand fluctuations in the economy’s output of goods and services. The models of GDP we saw in previous chapters, such as the IS–LM model in Chapter 11 and Chapter 12, were based on a simple investment function relating investment to the real interest rate: I = I(r). That function states that an increase in the real interest rate reduces investment. In this chapter we look more closely at the theory behind this investment function.

There are three types of investment spending. Business fixed investment includes the equipment, structures, and intellectual property that businesses buy to use in production. Residential investment includes the new housing that people buy to live in and that landlords buy to rent out. Inventory investment includes those goods that businesses put aside in storage, including materials and supplies, work in process, and finished goods. Figure 17-1 plots total investment and its three components in the United States between 1970 and 2014. You can see that all types of investment usually fall during recessions, which are shown as shaded areas in the figure.

508

In this chapter we build models of each type of investment to explain these fluctuations. The models will shed light on the following questions:

Why is investment negatively related to the interest rate?

What causes the investment function to shift?

Why does investment rise during booms and fall during recessions?

At the end of the chapter, we return to these questions and summarize the answers that the models offer.