17.1 Business Fixed Investment

The largest piece of investment spending, accounting for about three-quarters of the total, is business fixed investment. The term business means that these investment goods are bought by firms for use in future production. The term fixed means that this spending is for capital that will stay put for a while, as opposed to inventory investment, which will be used or sold within a short time. Business fixed investment includes everything from office furniture to factories, computers to company cars.

509

The standard model of business fixed investment is called the neoclassical model of investment. The neoclassical model examines the benefits and costs to firms of owning capital goods. The model shows how the level of investment—the addition to the stock of capital—is related to the marginal product of capital, the interest rate, and the tax rules affecting firms.

To develop the model, imagine that there are two kinds of firms in the economy. Production firms produce goods and services using capital that they rent. Rental firms make all the investments in the economy; they buy capital and rent it out to the production firms. Most firms in the real world perform both functions: they produce goods and services, and they invest in capital for future production. We can simplify our analysis and clarify our thinking, however, if we separate these two activities by imagining that they take place in different firms.

The Rental Price of Capital

Let’s first consider the typical production firm. As we discussed in Chapter 3, this firm decides how much capital to rent by comparing the cost and benefit of each unit of capital. The firm rents capital at a rental rate R and sells its output at a price P; the real cost of a unit of capital to the production firm is R/P. The real benefit of a unit of capital is the marginal product of capital MPK—the extra output produced with one more unit of capital. The marginal product of capital declines as the amount of capital rises: the more capital the firm has, the less an additional unit of capital will add to its output. Chapter 3 concluded that, to maximize profit, the firm rents capital until the marginal product of capital falls to equal the real rental price.

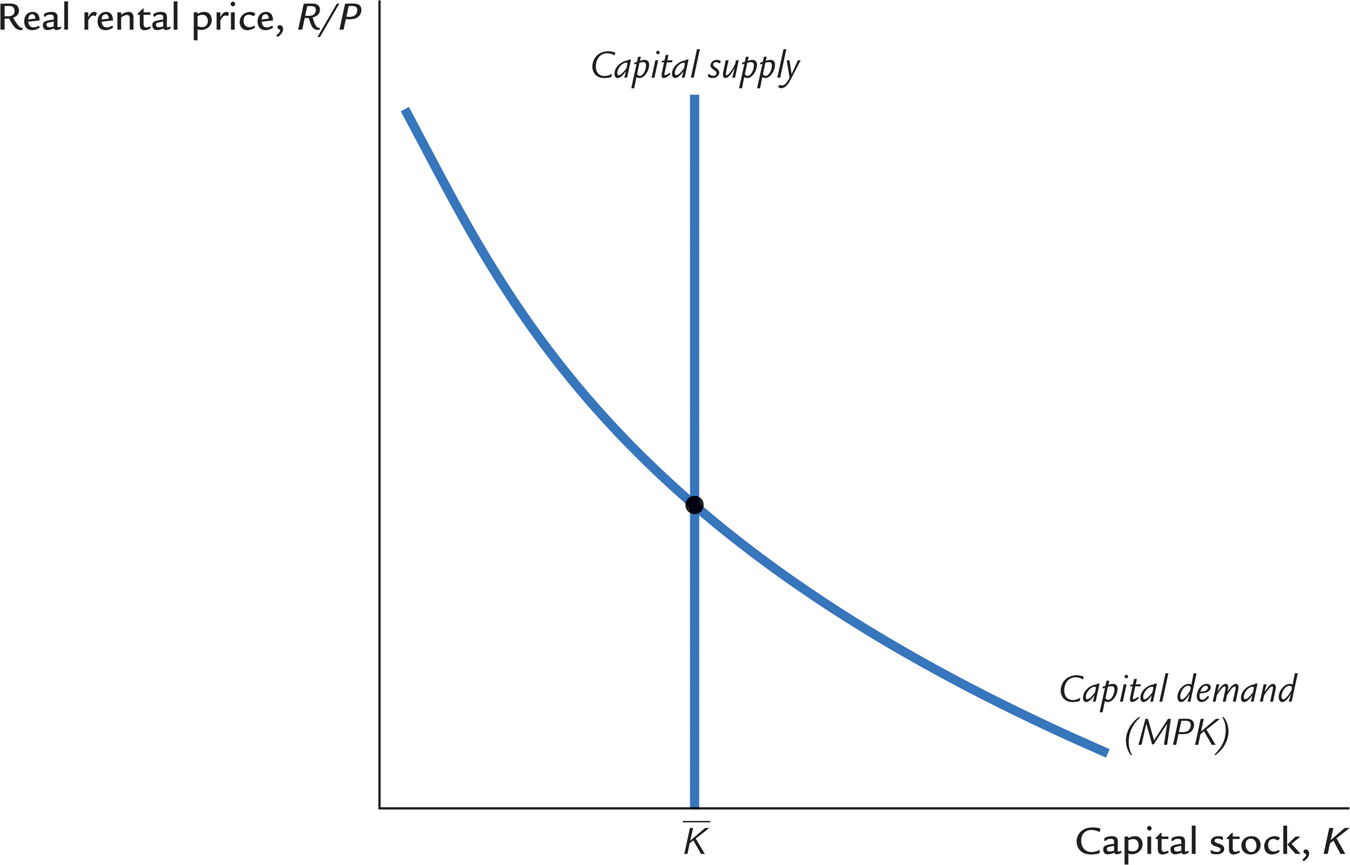

Figure 17-2 shows the equilibrium in the rental market for capital. For the reasons just discussed, the marginal product of capital determines the demand curve. The demand curve slopes downward because the marginal product of capital is low when the level of capital is high. At any point in time, the amount of capital in the economy is fixed, so the supply curve is vertical. The real rental price of capital adjusts to equilibrate supply and demand.

510

To see what variables influence the equilibrium rental price, let’s consider a particular production function. As we saw in Chapter 3, many economists consider the Cobb–Douglas production function a good approximation of how the actual economy turns capital and labor into goods and services. The Cobb–Douglas production function is

Y = AKαL1−α,

where Y is output, K is capital, L is labor, A is a parameter measuring the level of technology, and α is a parameter between zero and one that measures capital’s share of output. The marginal product of capital for the Cobb–Douglas production function is

MPK = αA(L/K)1−α.

Because the real rental price R/P equals the marginal product of capital in equilibrium, we can write

R/P = αA(L/K)1−α.

This expression identifies the variables that determine the real rental price. It shows the following:

The lower the stock of capital, the higher the real rental price of capital.

The greater the amount of labor employed, the higher the real rental price of capital.

The better the technology, the higher the real rental price of capital.

Events that reduce the capital stock (a tornado), or raise employment (an expansion in aggregate demand), or improve the technology (a scientific discovery) raise the equilibrium real rental price of capital.

The Cost of Capital

Next consider the rental firms. These firms, like car-rental companies, buy capital goods and rent them out. Because our goal is to explain the investments made by the rental firms, we begin by considering the benefit and cost of owning capital.

The benefit of owning capital is the revenue earned by renting it to the production firms. The rental firm receives the real rental price of capital R/P for each unit of capital it owns and rents out.

The cost of owning capital is more complex. For each period of time that it rents out a unit of capital, the rental firm bears three costs:

When a rental firm borrows to buy a unit of capital, it must pay interest on the loan. If PK is the purchase price of a unit of capital and i is the nominal interest rate, then iPK is the interest cost. Notice that this interest cost would be the same even if the rental firm did not have to borrow: if the rental firm buys a unit of capital using cash on hand, it loses out on the interest it could have earned by depositing this cash in the bank. In either case, the interest cost equals iPK.

511

While the rental firm is renting out the capital, the price of capital can change. If the price of capital falls, the firm loses, because the firm’s asset has fallen in value. If the price of capital rises, the firm gains, because the firm’s asset has risen in value. The cost of this loss or gain is −ΔPK. (The minus sign is here because we are measuring costs, not benefits.)

While the capital is rented out, it suffers wear and tear, called depreciation. If δ is the rate of depreciation—the fraction of capital’s value lost per period because of wear and tear—then the dollar cost of depreciation is δPK.

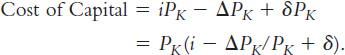

The total cost of renting out a unit of capital for one period is therefore

The cost of capital depends on the price of capital, the interest rate, the rate at which capital prices are changing, and the depreciation rate.

For example, consider the cost of capital to a car-rental company. The company buys cars for $30,000 each and rents them out to other businesses. The company faces an interest rate i of 10 percent per year, so the interest cost iPK is $3,000 per year for each car the company owns. Car prices are rising at 6 percent per year, so, excluding wear and tear, the firm gets a capital gain ΔPK of $1,800 per year. Cars depreciate at 20 percent per year, so the loss due to wear and tear δPK is $6,000 per year. Therefore, the company’s cost of capital is

The cost to the car-rental company of keeping a car in its capital stock is $7,200 per year.

To make the expression for the cost of capital simpler and easier to interpret, we assume that the price of capital goods rises with the prices of other goods. In this case, ΔPK/PK equals the overall rate of inflation π. Because i − π equals the real interest rate r, we can write the cost of capital as

Cost of Capital = PK(r + δ).

This equation states that the cost of capital depends on the price of capital, the real interest rate, and the depreciation rate.

Finally, we want to express the cost of capital relative to other goods in the economy. The real cost of capital—the cost of buying and renting out a unit of capital measured in units of the economy’s output—is

Real Cost of Capital = (PK/P)(r + δ).

512

This equation states that the real cost of capital depends on the relative price of a capital good PK/P, the real interest rate r, and the depreciation rate δ.

The Determinants of Investment

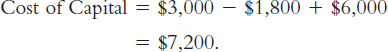

Now consider a rental firm’s decision about whether to increase or decrease its capital stock. For each unit of capital, the firm earns real revenue R/P and bears the real cost (PK/P)(r + δ). The real profit per unit of capital is

Because the real rental price in equilibrium equals the marginal product of capital, we can write the profit rate as

Profit Rate = MPK − (PK/P)(r + δ).

The rental firm makes a profit if the marginal product of capital is greater than the cost of capital. It incurs a loss if the marginal product is less than the cost of capital.

We can now see the economic incentives that lie behind the rental firm’s investment decision. The firm’s decision regarding its capital stock—that is, whether to add to it or to let it depreciate—depends on whether owning and renting out capital is profitable. The change in the capital stock, called net investment, depends on the difference between the marginal product of capital and the cost of capital. If the marginal product of capital exceeds the cost of capital, firms find it profitable to add to their capital stock. If the marginal product of capital falls short of the cost of capital, they let their capital stock shrink.

We can also now see that the separation of economic activity between production and rental firms, although useful for clarifying our thinking, is not necessary for our conclusion regarding how firms choose how much to invest. For a firm that both uses and owns capital, the benefit of an extra unit of capital is the marginal product of capital, and the cost is the cost of capital. Like a firm that owns and rents out capital, this firm adds to its capital stock if the marginal product exceeds the cost of capital. Thus, we can write

ΔK = In [MPK − (PK/P)(r + δ)],

where In( ) is the function showing how net investment responds to the incentive to invest. How much the capital stock responds (and thus the precise form of this function) depends on how costly the adjustment process is.

We can now derive the investment function. Total spending on business fixed investment is the sum of net investment and the replacement of depreciated capital. The investment function is

I = In [MPK − (PK/P)(r + δ)] + δK.

Business fixed investment depends on the marginal product of capital, the cost of capital, and the amount of depreciation.

513

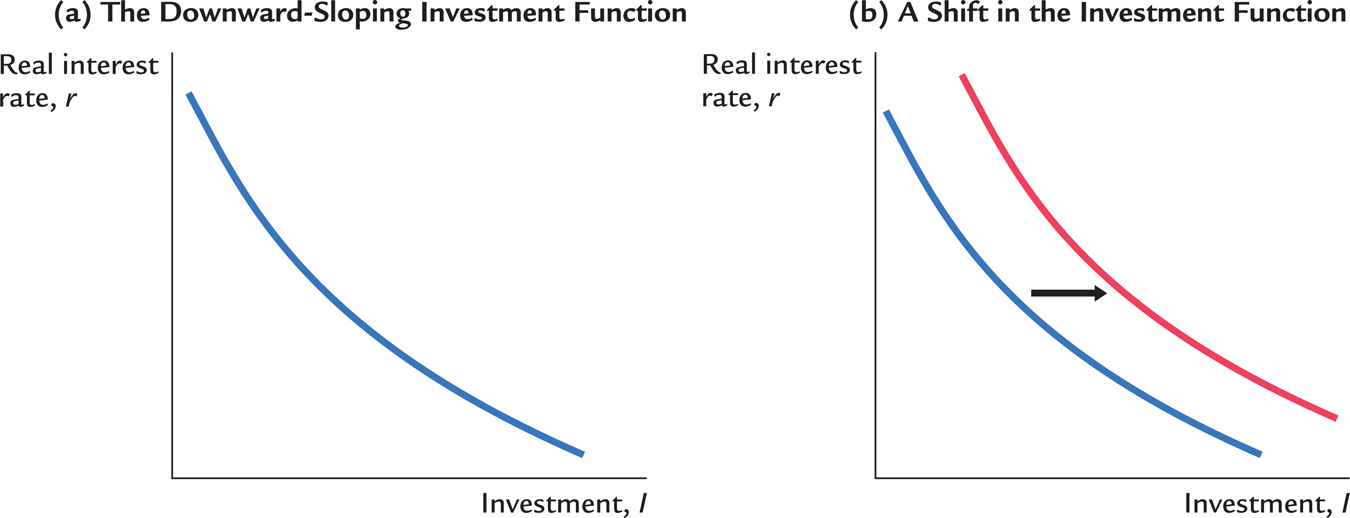

This model shows why investment depends on the interest rate. A decrease in the real interest rate lowers the cost of capital. It therefore raises the amount of profit from owning capital and increases the incentive to accumulate more capital. Similarly, an increase in the real interest rate raises the cost of capital and leads firms to reduce their investment. For this reason, the investment schedule relating investment to the interest rate slopes downward, as in panel (a) of Figure 17-3.

The model also shows what causes the investment schedule to shift. Any event that raises the marginal product of capital increases the profitability of investment and causes the investment schedule to shift outward, as in panel (b) of Figure 17-3. For example, a technological innovation that increases the production function parameter A raises the marginal product of capital and, for any given interest rate, increases the amount of capital goods that rental firms wish to buy.

Finally, consider what happens as this adjustment of the capital stock continues over time. If the marginal product begins above the cost of capital, the capital stock will rise and the marginal product will fall. If the marginal product of capital begins below the cost of capital, the capital stock will fall and the marginal product will rise. Eventually, as the capital stock adjusts, the marginal product of capital approaches the cost of capital. When the capital stock reaches a steady-state level, we can write

MPK = (PK/P)(r + δ).

Thus, in the long run, the marginal product of capital equals the real cost of capital. The speed of adjustment toward the steady state depends on how quickly firms adjust their capital stock, which in turn depends on how costly it is to build, deliver, and install new capital.1

514

Taxes and Investment

Tax laws influence firms’ incentives to accumulate capital in many ways. Sometimes policymakers change the tax code to shift the investment function and influence aggregate demand. Here we consider two of the most important provisions of corporate taxation: the corporate income tax and the investment tax credit.

The corporate income tax is a tax on corporate profits. Throughout much of its history, the corporate tax rate levied by the U.S. federal government was 46 percent. The rate was lowered to 34 percent in 1986 and then raised to 35 percent in 1993, and it remained at that level as of 2014, when this book was going to press. Many states impose an additional corporate tax as well, bringing the total corporate tax rate in the United States to about 40 percent. By contrast, the average corporate tax rate in Europe in 2014 was 19.7 percent.

The effect of a corporate income tax on investment depends on how the law defines “profit” for the purpose of taxation. Suppose, first, that the law defined profit as we did previously—the rental price of capital minus the cost of capital. In this case, even though firms would be sharing a fraction of their profits with the government, it would still be rational for them to invest if the rental price of capital exceeded the cost of capital and to disinvest if the rental price fell short of the cost of capital. A tax on profit, measured in this way, would not alter investment incentives.

Yet, because of the tax law’s definition of profit, the corporate income tax does affect investment decisions. There are many differences between the law’s definition of profit and ours. For example, one difference is the treatment of depreciation. Our definition of profit deducts the current value of depreciation as a cost. That is, it bases depreciation on how much it would cost today to replace worn-out capital. By contrast, under the corporate tax laws, firms deduct depreciation using historical cost. That is, the depreciation deduction is based on the price of the capital when it was originally purchased. In periods of inflation, replacement cost is greater than historical cost, so the corporate tax tends to understate the cost of depreciation and overstate profit. As a result, the tax law sees a profit and levies a tax even when economic profit is zero, which makes owning capital less attractive. For this and other reasons, many economists believe that the corporate income tax discourages investment.

Policymakers often change the rules governing the corporate income tax in an attempt to encourage investment or at least mitigate the disincentive the tax provides. One example is the investment tax credit, a tax provision that reduces a firm’s taxes by a certain amount for each dollar spent on capital goods. Because a firm recoups part of its expenditure on new capital in lower taxes, the credit reduces the effective purchase price of a unit of capital PK. Thus, the investment tax credit reduces the cost of capital and raises investment.

515

In 1985 the investment tax credit was 10 percent. Yet the Tax Reform Act of 1986, which reduced the corporate income tax rate, also eliminated the investment tax credit. When Bill Clinton ran for president in 1992, he campaigned on a platform of reinstituting the investment tax credit, but he did not succeed in getting this proposal through Congress. Many economists agreed with Clinton that the investment tax credit is an effective way to stimulate investment, and the idea of reinstating the investment tax credit still arises from time to time.

The tax rules regarding depreciation are another example of how policymakers can influence the incentives for investment. When George W. Bush became president, the economy was sliding into recession, attributable in large measure to a significant decline in business investment. The tax cuts Bush signed into law during his first term included provisions for temporary “bonus depreciation.” This meant that for purposes of calculating their corporate tax liability, firms could deduct the cost of depreciation earlier in the life of an investment project. This bonus, however, was available only for investments made before the end of 2004. The goal of the policy was to encourage investment at a time when the economy particularly needed a boost to aggregate demand. According to a study by economists Christopher House and Matthew Shapiro, the goal was achieved to some degree. They write, “While their aggregate effects were probably modest, the 2002 and 2003 bonus depreciation policies had noticeable effects on the economy. For the U.S. economy as a whole, these policies may have increased GDP by $10 to $20 billion and may have been responsible for the creation of 100,000 to 200,000 jobs.” In 2011, as the economy was in the midst of the next recession, President Obama signed into law a similar measure for temporary bonus depreciation.2

CASE STUDY

Inversions and Corporate Tax Reform

“Some people are calling these companies ‘corporate deserters.’” That is what President Obama said in 2013 about a wave of tax inversions sweeping across corporate America, and he did not disagree with the description.

A tax inversion occurs when an American company merges with a foreign one and, in the process, reincorporates abroad. Such mergers have many motives, but often one of them is to take advantage of the more favorable tax treatment offered by some other nations. Because such tax inversions mean less money for the U.S. Treasury, everyone else ends up either paying higher taxes to support the government or enjoying fewer government services. So the president had good reason to be concerned.

516

Yet demonizing the companies and their executives may not be the best response. A corporate chief who arranges a merger that increases the company’s after-tax profit is doing her job. Forgoing that opportunity would be failing to act as a responsible fiduciary for shareholders. The great twentieth-century jurist Learned Hand put the principle this way: “Anyone may arrange his affairs so that his taxes shall be as low as possible; he is not bound to choose that pattern which best pays the treasury. There is not even a patriotic duty to increase one’s taxes.”

If tax inversions are a problem, perhaps the blame lies not with business leaders who are doing their jobs, but rather with a tax code that provides incentives for these inversions.

One obvious issue is that the corporate tax rate in the United States is about twice the average rate in Europe. National tax systems differ along many dimensions, making international comparisons difficult and controversial. Nonetheless, some economists suggest that simply cutting the rate to be more in line with norms abroad would do a lot to stop inversions.

A more subtle issue is that the United States has a type of corporate tax that differs from that of most nations. The United States has a worldwide corporate tax: for companies incorporated in the United States, the tax is based on all income, regardless of where it is earned. Most other nations have a territorial corporate tax: they tax economic activity that occurs within their borders and exclude from taxation income earned abroad. (That foreign-source income, however, is usually taxed by the nation where it is earned.) Canada, France, Germany, Italy, Japan, and the United Kingdom all have territorial tax systems. Again, some economists suggest that moving the U.S. tax code toward international norms would help slow corporate inversions.

If the U.S. government were to make these changes in its corporate tax, it might well collect less in tax revenue and so other taxes would need to increase to finance government spending. The debate about the corporate tax is thus intertwined with the broader debate about tax policy in general. An important principle when considering these issues is that corporations are more like tax collectors than taxpayers. The burden of the corporate tax is ultimately borne by people—some combination of the companies’ employees, customers, and shareholders. After recognizing that corporations are mere conduits, policymakers can focus more directly on the people.

A long tradition in political philosophy and economics, dating back about four centuries to English philosopher Thomas Hobbes, suggests that the amount that a person consumes is the right basis for taxation. A consumption tax asks a person to contribute to support the government according to how much of the economy’s output of goods and services she enjoys. Some economists have suggested scaling back the corporate income tax and replacing the lost revenue with a broad-based tax on consumption, such as a value-added tax, which many European nations use to raise government revenue.

517

Policymakers of many political stripes have advocated reform of the U.S. corporate tax, but the devil is in the details. Three questions loom large: To what extent should the United States cut the corporate tax rate to match rates abroad? Should the United States switch from a worldwide to a territorial system? Which other taxes should increase to make up for the lost revenue? Corporate tax reform will become possible only when policymakers agree on the answers to these key questions.

The Stock Market and Tobin’s q

Many economists see a link between fluctuations in investment and fluctuations in the stock market. The term stock refers to shares in the ownership of corporations, and the stock market is the market in which these shares are traded. Stock prices tend to be high when firms have many opportunities for profitable investment because these profit opportunities mean higher future income for the shareholders. Thus, stock prices reflect the incentives to invest.

The Nobel Prize–winning economist James Tobin proposed that firms base their investment decisions on the following ratio, which is now called Tobin’s q:

The numerator of Tobin’s q is the value of the economy’s capital as determined by the stock market. The denominator is the price of that capital if it were purchased today.

Tobin reasoned that net investment should depend on whether q is greater or less than 1. If q is greater than 1, then the stock market values installed capital at more than its replacement cost. In this case, managers can raise the market value of their firms’ stock by buying more capital. Conversely, if q is less than 1, the stock market values capital at less than its replacement cost. In this case, managers will not replace capital as it wears out.

At first the q theory of investment may appear very different from the neoclassical model developed previously, but the two theories are closely related. To see the relationship, note that Tobin’s q depends on current and future expected profits from installed capital. If the marginal product of capital exceeds the cost of capital, then firms are earning profits on their installed capital. These profits make the firms more desirable to own, which raises the market value of these firms’ stock, implying a high value of q. Similarly, if the marginal product of capital falls short of the cost of capital, then firms are incurring losses on their installed capital, implying a low market value and a low value of q.

The advantage of Tobin’s q as a measure of the incentive to invest is that it reflects the expected future profitability of capital as well as the current profitability. For example, suppose that Congress legislates a reduction in the corporate income tax beginning next year. This expected fall in the corporate tax means greater profits for the owners of capital. These higher expected profits raise the value of stock today, raise Tobin’s q, and therefore encourage investment today. Thus, Tobin’s q theory of investment emphasizes that investment decisions depend not only on current economic policies but also on policies expected to prevail in the future.3

518

CASE STUDY

The Stock Market as an Economic Indicator

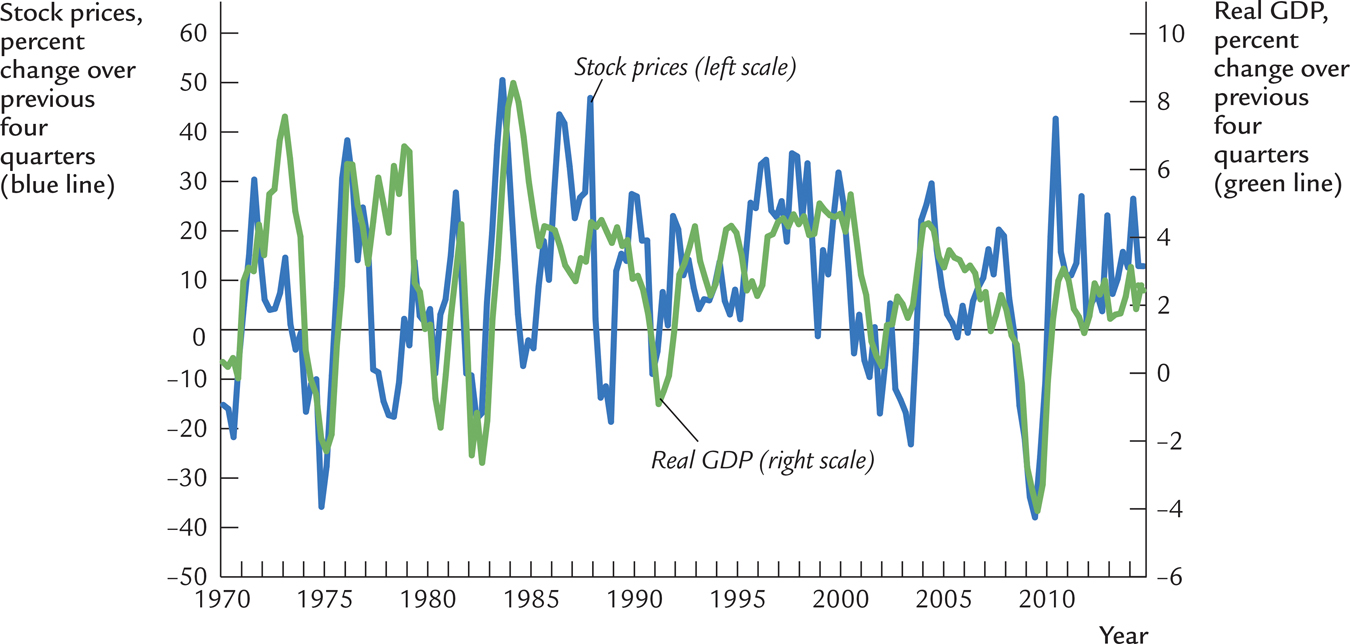

“The stock market has predicted nine out of the last five recessions.” So goes Paul Samuelson’s famous quip about the stock market’s reliability as an economic indicator. The stock market is in fact quite volatile, and it can give false signals about the future of the economy. Yet one should not ignore the link between the stock market and the economy. Figure 17-4 shows that changes in the stock market often reflect changes in real GDP. Whenever the stock market experiences a substantial decline, there is reason to fear that a recession may be around the corner.

519

Why do stock prices and economic activity tend to fluctuate together? One reason is given by Tobin’s q theory, together with the model of aggregate demand and aggregate supply. Suppose, for instance, that you observe a fall in stock prices. Because the replacement cost of capital is fairly stable, a fall in the stock market is usually associated with a fall in Tobin’s q. A fall in q reflects investors’ pessimism about the current or future profitability of capital. This means that the investment function has shifted inward: investment is lower at any given interest rate. As a result, the aggregate demand for goods and services contracts, leading to lower output and employment.

There are two additional reasons that stock prices are associated with economic activity. First, because stock is part of household wealth, a fall in stock prices makes people poorer and thus depresses consumer spending, which also reduces aggregate demand. Second, a fall in stock prices might reflect bad news about technological progress and long-run economic growth. If so, this means that the natural level of output—and thus aggregate supply—will be growing more slowly in the future than was previously expected.

These links between the stock market and the economy are not lost on policymakers, such as those at the Federal Reserve. Indeed, because the stock market often anticipates changes in real GDP, and because data on the stock market are available more quickly than data on GDP, the stock market is a closely watched economic indicator. A case in point is the deep economic downturn in 2008 and 2009: the substantial declines in production and employment coincided with a steep decline in stock prices.

Alternative Views of the Stock Market: The Efficient Markets Hypothesis Versus Keynes’s Beauty Contest

One continuing source of debate among economists is whether stock market fluctuations are rational.

Some economists subscribe to the efficient markets hypothesis, according to which the market price of a company’s stock is the fully rational valuation of the company’s value, given current information about the company’s business prospects. This hypothesis rests on two foundations:

Each company listed on a major stock exchange is followed closely by many professional portfolio managers, such as the individuals who run mutual funds. Every day, these managers monitor news stories to try to determine the company’s value. Their job is to buy a stock when its price falls below its value and to sell it when its price rises above its value.

The price of each stock is set by the equilibrium of supply and demand. At the market price, the number of shares being offered for sale exactly equals the number of shares that people want to buy. That is, at the market price, the number of people who think the stock is overvalued exactly balances the number of people who think it’s undervalued. As judged by the typical person in the market, the stock must be fairly valued.

520

According to this theory, the stock market is informationally efficient: it reflects all available information about the value of the asset. Stock prices change when information changes. When good news about the company’s prospects becomes public, the value and the stock price both rise. When the company’s prospects deteriorate, the value and price both fall. But at any moment in time, the market price is the rational best guess of the company’s value based on available information.

One implication of the efficient markets hypothesis is that stock prices should follow a random walk. This means that the changes in stock prices should be impossible to predict from available information. If, using publicly available information, a person could predict that a stock price would rise by 10 percent tomorrow, then the stock market must be failing to incorporate that information today. According to this theory, the only thing that can move stock prices is news that changes the market’s perception of the company’s value. But such news must be unpredictable—otherwise, it wouldn’t really be news. For the same reason, changes in stock prices should be unpredictable as well.

What is the evidence for the efficient markets hypothesis? Its proponents point out that it is hard to beat the market by buying allegedly undervalued stocks and selling allegedly overvalued stocks. Statistical tests show that stock prices are random walks, or at least approximately so. Moreover, index funds, which buy stocks from all companies in a stock market index, outperform most actively managed mutual funds run by professional money managers.

Although the efficient markets hypothesis has many proponents, some economists are less convinced that the stock market is so rational. These economists point out that many movements in stock prices are hard to attribute to news. They suggest that when buying and selling, stock investors are less focused on companies’ fundamental values and more focused on what they expect other investors will later pay.

John Maynard Keynes proposed a famous analogy to explain stock market speculation. In his day, some newspapers held beauty contests in which the paper printed the pictures of 100 women and readers were invited to submit a list of the five most beautiful. A prize went to the reader whose choices most closely matched those of the consensus of the other entrants. Naive entrants would simply have picked those they considered the five most beautiful women. But a slightly more sophisticated strategy would have been to guess the five women whom other people considered the most beautiful. Other people, however, were likely thinking along the same lines. So an even more sophisticated strategy would have been to try to guess who other people thought other people thought were the most beautiful women. And so on. In the end of the process, judging true beauty would be less important to winning the contest than guessing other people’s opinions about other people’s opinions.

Similarly, Keynes reasoned that because stock market investors will eventually sell their shares to others, they are more concerned about other people’s valuation of a company than the company’s true worth. The best stock investors, in his view, are those who are good at outguessing mass psychology. He believed that movements in stock prices often reflect irrational waves of optimism and pessimism, which he called the “animal spirits” of investors.

521

These two views of the stock market persist to this day. Some economists see the stock market through the lens of the efficient markets hypothesis. They believe fluctuations in stock prices are a rational reflection of changes in underlying economic fundamentals. Other economists, however, accept Keynes’s beauty contest as a metaphor for stock speculation. In their view, the stock market often fluctuates for no good reason, and because the stock market influences the aggregate demand for goods and services, these fluctuations are a source of short-run economic fluctuations.4

Financing Constraints

When a firm wants to invest in new capital—say, by building a new factory—it often raises the necessary funds in financial markets. This financing may take several forms: obtaining loans from banks, selling bonds to the public, or selling shares in future profits on the stock market. The neoclassical model assumes that if a firm is willing to pay the cost of capital, the financial markets will make the funds available.

Yet sometimes firms face financing constraints—limits on the amount they can raise in financial markets. Financing constraints can prevent firms from undertaking profitable investments. When a firm is unable to raise funds in financial markets, the amount it can spend on new capital goods is limited to the amount it is currently earning. Financing constraints influence the investment behavior of firms just as borrowing constraints influence the consumption behavior of households. Borrowing constraints cause households to determine their consumption on the basis of current rather than permanent income; financing constraints cause firms to determine their investment on the basis of their current cash flow rather than expected profitability.

To see the impact of financing constraints, consider the effect of a short recession on investment spending. A recession reduces employment, the rental price of capital, and profits. If firms expect the recession to be short-lived, however, they will want to continue investing, knowing that their investments will be profitable in the future. That is, a short recession will have only a small effect on Tobin’s q. For firms that can raise funds in financial markets, the recession should have only a small effect on investment.

Quite the opposite is true for firms that face financing constraints. The fall in current profits restricts the amount that these firms can spend on new capital goods and may prevent them from making profitable investments. Thus, financing constraints make investment more sensitive to current economic conditions.5

522

The extent to which financing constraints impede investment spending can vary over time, depending on the health of the financial system, and this can in turn become a source of short-run fluctuations. As we discussed in Chapter 12, for example, during the Great Depression of the 1930s, many banks found themselves insolvent, as the value of their assets fell below the value of their liabilities. These banks were forced to suspend operations, making it more difficult for their previous customers to obtain financing for potential investment projects. Many economists believe the widespread bank failures during this period help explain the Depression’s depth and persistence. Similarly, the severe recession of 2008–2009 came on the heels of a widespread financial crisis that began with a downturn in the housing market. Chapter 20 discusses the causes and effects of such financial crises in greater detail.