1.2 How Economists Think

Economists often study politically charged issues, but they try to address these issues with a scientist’s objectivity. Like any science, economics has its own set of tools—

6

Theory as Model Building

Young children learn much about the world around them by playing with toy versions of real objects. For instance, they often put together models of cars, trains, or planes. These models are far from realistic, but the model-

Economists also use models to understand the world, but an economist’s model is more likely to be made of symbols and equations than plastic and glue. Economists build their “toy economies” to help explain economic variables, such as GDP, inflation, and unemployment. Economic models illustrate, often in mathematical terms, the relationships among the variables. Models are useful because they help us dispense with irrelevant details and focus on underlying connections. (In addition, for many economists, building models is fun.)

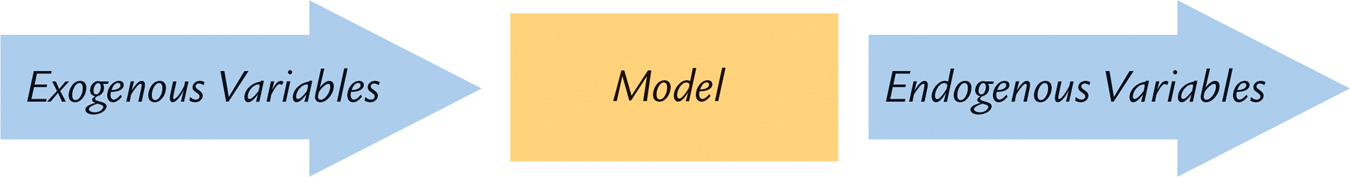

Models have two kinds of variables: endogenous variables and exogenous variables. Endogenous variables are those variables that a model tries to explain. Exogenous variables are those variables that a model takes as given. The purpose of a model is to show how the exogenous variables affect the endogenous variables. In other words, as Figure 1-4 illustrates, exogenous variables come from outside the model and serve as the model’s input, whereas endogenous variables are determined within the model and are the model’s output.

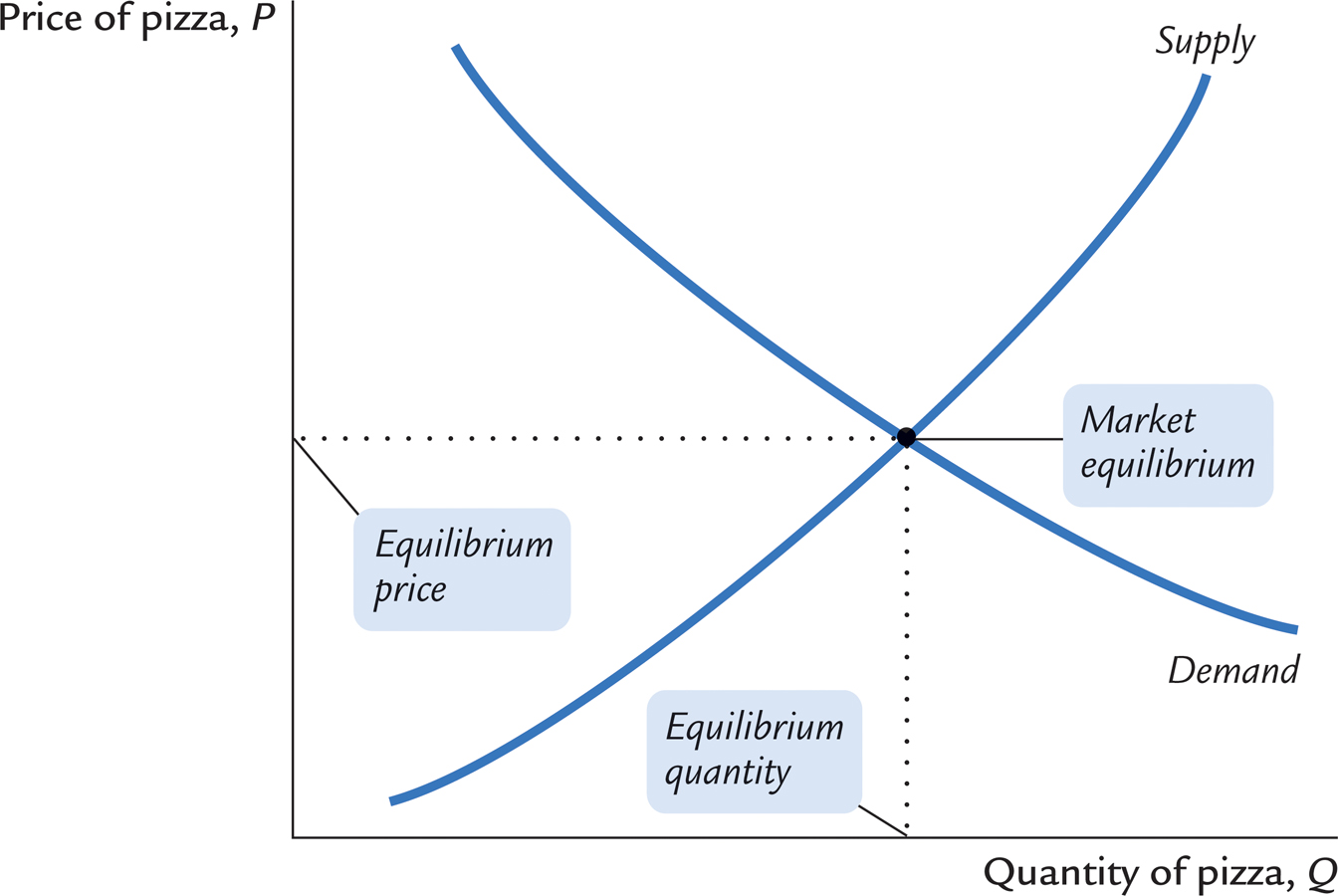

To make these ideas more concrete, let’s review the most celebrated of all economic models—

Qd = D(P, Y),

where D( ) represents the demand function. Similarly, the economist supposes that the quantity of pizza supplied by pizzerias Q s depends on the price of pizza P and on the price of materials Pm, such as cheese, tomatoes, flour, and anchovies. This relationship is expressed as

7

Qs = S(P, Pm),

where S( ) represents the supply function. Finally, the economist assumes that the price of pizza adjusts to bring the quantity supplied and quantity demanded into balance:

Qs = Qd.

These three equations compose a model of the market for pizza.

The economist illustrates the model with a supply-

This model of the pizza market has two exogenous variables and two endogenous variables. The exogenous variables are aggregate income and the price of materials. The model does not attempt to explain them but instead takes them as given (perhaps to be explained by another model). The endogenous variables are the price of pizza and the quantity of pizza exchanged. These are the variables that the model attempts to explain.

8

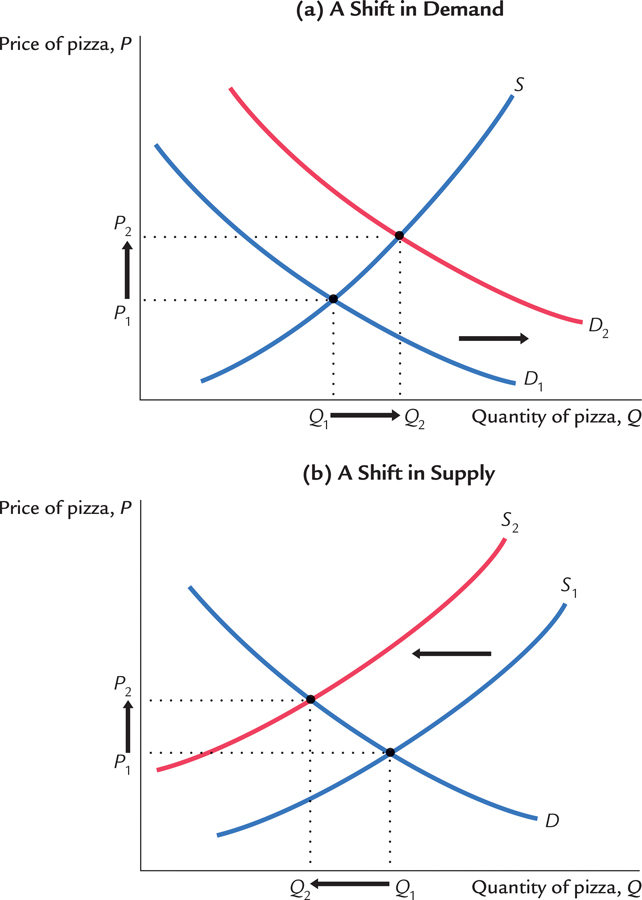

The model can be used to show how a change in one of the exogenous variables affects both endogenous variables. For example, if aggregate income increases, then the demand for pizza increases, as in panel (a) of Figure 1-6. The model shows that both the equilibrium price and the equilibrium quantity of pizza rise. Similarly, if the price of materials increases, then the supply of pizza decreases, as in panel (b) of Figure 1-6. The model shows that in this case the equilibrium price of pizza rises and the equilibrium quantity of pizza falls. Thus, the model shows how changes either in aggregate income or in the price of materials affect price and quantity in the market for pizza.

9

Like all models, this model of the pizza market makes simplifying assumptions. The model does not take into account, for example, that every pizzeria is in a different location. For each customer, one pizzeria is more convenient than the others, and thus pizzerias have some ability to set their own prices. The model assumes that there is a single price for pizza, but in fact there could be a different price at every pizzeria.

How should we react to the model’s lack of realism? Should we discard the simple model of pizza supply and demand? Should we attempt to build a more complex model that allows for diverse pizza prices? The answers to these questions depend on our purpose. If our goal is to explain how the price of cheese affects the average price of pizza and the amount of pizza sold, then the diversity of pizza prices is probably not important. The simple model of the pizza market does a good job of addressing that issue. Yet if our goal is to explain why towns with ten pizzerias have lower pizza prices than towns with only two, the simple model is less useful.

FYI

Using Functions to Express Relationships Among Variables

All economic models express relationships among economic variables. Often, these relationships are expressed as functions. A function is a mathematical concept that shows how one variable depends on a set of other variables. For example, in the model of the pizza market, we said that the quantity of pizza demanded depends on the price of pizza and on aggregate income. To express this, we use functional notation to write

Qd = D(P, Y).

This equation says that the quantity of pizza demanded Q d is a function of the price of pizza P and aggregate income Y. In functional notation, the variable preceding the parentheses denotes the function. In this case, D( ) is the function expressing how the variables in parentheses determine the quantity of pizza demanded.

If we knew more about the pizza market, we could give a numerical formula for the quantity of pizza demanded. For example, we might be able to write

Qd = 60 − 10P + 2Y.

In this case, the demand function is

D(P, Y) = 60 − 10P + 2Y.

For any price of pizza and aggregate income, this function gives the corresponding quantity of pizza demanded. For example, if aggregate income is $10 and the price of pizza is $2, then the quantity of pizza demanded is 60 pies; if the price of pizza rises to $3, the quantity of pizza demanded falls to 50 pies.

Functional notation allows us to express the general idea that variables are related, even when we do not have enough information to indicate the precise numerical relationship. For example, we might know that the quantity of pizza demanded falls when the price rises from $2 to $3, but we might not know by how much it falls. In this case, functional notation is useful: as long as we know that a relationship among the variables exists, we can express that relationship using functional notation.

The art in economics lies in judging when a simplifying assumption (such as assuming a single price of pizza) clarifies our thinking and when it misleads us. Simplification is a necessary part of building a useful model: any model constructed to be completely realistic would be too complicated for anyone to understand. Yet if models assume away features of the economy that are crucial to the issue at hand, they may lead us to conclusions that do not hold in the real world. Economic modeling therefore requires care and common sense.

10

The Use of Multiple Models

Macroeconomists study many facets of the economy. For example, they examine the role of saving in economic growth, the impact of minimum-

Economists use models to address all of these issues, but no single model can answer every question. Just as carpenters use different tools for different tasks, economists use different models to explain different economic phenomena. Students of macroeconomics therefore must keep in mind that there is no single “correct” model that is always applicable. Instead, there are many models, each of which is useful for shedding light on a different facet of the economy. The field of macroeconomics is like a Swiss army knife—

This book presents many different models that address different questions and make different assumptions. Remember that a model is only as good as its assumptions and that an assumption that is useful for some purposes may be misleading for others. When using a model to address a question, the economist must keep in mind the underlying assumptions and judge whether they are reasonable for studying the matter at hand.

Prices: Flexible Versus Sticky

Throughout this book, one group of assumptions will prove especially important—

Yet the assumption of continuous market clearing is not entirely realistic. For markets to clear continuously, prices must adjust instantly to changes in supply and demand. In fact, many wages and prices adjust slowly. Labor contracts often set wages for up to three years. Many firms leave their product prices the same for long periods of time—

11

The apparent stickiness of prices does not make market-

For studying short-

Microeconomic Thinking and Macroeconomic Models

Microeconomics is the study of how households and firms make decisions and how these decisionmakers interact in the marketplace. A central principle of microeconomics is that households and firms optimize—they do the best they can for themselves given their objectives and the constraints they face. In microeconomic models, households choose their purchases to maximize their level of satisfaction, which economists call utility, and firms make production decisions to maximize their profits.

Because economy-

Although microeconomic decisions underlie all economic models, in many models the optimizing behavior of households and firms is implicit rather than explicit. The model of the pizza market we discussed earlier is an example. Households’ decisions about how much pizza to buy underlie the demand for pizza, and pizzerias’ decisions about how much pizza to produce underlie the supply of pizza. Presumably, households make their decisions to maximize utility, and pizzerias make their decisions to maximize profit. Yet the model does not focus on how these microeconomic decisions are made; instead, it leaves these decisions in the background. Similarly, although microeconomic decisions underlie macroeconomic phenomena, macroeconomic models do not necessarily focus on the optimizing behavior of households and firms; again, they sometimes leave that behavior in the background.

12

FYI

Nobel Macroeconomists

The Nobel Prize in economics is announced every October. Over the years, many winners have been macroeconomists. Here are a few of them, along with some of their own words about how they chose their career paths:

Milton Friedman (Nobel 1976): “I graduated from college in 1932, when the United States was at the bottom of the deepest depression in its history before or since. The dominant problem of the time was economics. How to get out of the depression? How to reduce unemployment? What explained the paradox of great need on the one hand and unused resources on the other? Under the circumstances, becoming an economist seemed more relevant to the burning issues of the day than becoming an applied mathematician or an actuary.”

James Tobin (Nobel 1981): “I was attracted to the field for two reasons. One was that economic theory is a fascinating intellectual challenge, on the order of mathematics or chess. I liked analytics and logical argument…. The other reason was the obvious relevance of economics to understanding and perhaps overcoming the Great Depression.”

Franco Modigliani (Nobel 1985): “For a while it was thought that I should study medicine because my father was a physician…. I went to the registration window to sign up for medicine, but then I closed my eyes and thought of blood! I got pale just thinking about blood and decided under those conditions I had better keep away from medicine…. Casting about for something to do, I happened to get into some economics activities. I knew some German and was asked to translate from German into Italian some articles for one of the trade associations. Thus I began to be exposed to the economic problems that were in the German literature.”

Robert Solow (Nobel 1987): “I came back [to college after being in the army] and, almost without thinking about it, signed up to finish my undergraduate degree as an economics major. The time was such that I had to make a decision in a hurry. No doubt I acted as if I were maximizing an infinite discounted sum of one-

Robert Lucas (Nobel 1995): “In public school science was an unending and not very well organized list of things other people had discovered long ago. In college, I learned something about the process of scientific discovery, but what I learned did not attract me as a career possibility…. What I liked thinking about were politics and social issues.”

George Akerlof (Nobel 2001): “When I went to Yale, I was convinced that I wanted to be either an economist or an historian. Really, for me it was a distinction without a difference. If I was going to be an historian, then I would be an economic historian. And if I was to be an economist, I would consider history as the basis for my economics.”

Edward Prescott (Nobel 2004): “Through discussion with [my father], I learned a lot about the way businesses operated. This was one reason why I liked my microeconomics course so much in my first year at Swarthmore College. The price theory that I learned in that course rationalized what I had learned from him about the way businesses operate. The other reason was the textbook used in that course, Paul A. Samuelson’s Principles of Economics. I loved the way Samuelson laid out the theory in his textbook, so simply and clearly.”

Edmund Phelps (Nobel 2006): “Like most Americans entering college, I started at Amherst College without a predetermined course of study or without even a career goal. My tacit assumption was that I would drift into the world of business—

Christopher Sims (Nobel 2011): “[My Uncle] Mark prodded me regularly, from about age 13 onward, to study economics. He gave me von Neumann and Morgenstern’s Theory of Games for Christmas when I was in high school. When I took my first course in economics, I remember arguing with him over whether it was possible for the inflation rate to explode upward if the money supply were held constant. I took the monetarist position. He questioned whether I had a sound argument to support it. For years I thought he was having the opposite of his intended effect, and I studied no economics until my junior year of college. But as I began to doubt that I wanted to be immersed for my whole career in the abstractions of pure mathematics, Mark’s efforts had left me with a pretty clear idea of an alternative.”

13

If you want to learn more about the Nobel Prize and its winners, go to http:/