5.6 Hyperinflation

Hyperinflation is often defined as inflation that exceeds 50 percent per month, which is just over 1 percent per day. Compounded over many months, this rate of inflation leads to very large increases in the price level. An inflation rate of 50 percent per month implies a more than 100-

The Costs of Hyperinflation

Although economists debate whether the costs of moderate inflation are large or small, no one doubts that hyperinflation extracts a high toll on society. The costs are qualitatively the same as those we discussed earlier. When inflation reaches extreme levels, however, these costs are more apparent because they are so severe.

The shoeleather costs associated with reduced money holding, for instance, are serious under hyperinflation. Business executives devote much time and energy to cash management when cash loses its value quickly. By diverting this time and energy from more socially valuable activities, such as production and investment decisions, hyperinflation makes the economy run less efficiently.

Menu costs also become larger under hyperinflation. Firms have to change prices so often that normal business practices, such as printing and distributing catalogs with fixed prices, become impossible. In one restaurant during the German hyperinflation of the 1920s, a waiter would stand up on a table every 30 minutes to call out the new prices.

Similarly, relative prices do not do a good job of reflecting true scarcity during hyperinflations. When prices change frequently by large amounts, it is hard for customers to shop around for the best price. Highly volatile and rapidly rising prices can alter behavior in many ways. According to one report, when patrons entered a pub during the German hyperinflation, they would often buy two pitchers of beer. Although the second pitcher would lose value by getting warm over time, it would lose value less rapidly than the money left sitting in the patron’s wallet.

127

Tax systems are also distorted by hyperinflation—

Finally, no one should underestimate the sheer inconvenience of living with hyperinflation. When carrying money to the grocery store is as burdensome as carrying the groceries back home, the monetary system is not doing its best to facilitate exchange. The government tries to overcome this problem by adding more and more zeros to the paper currency, but often it cannot keep up with the exploding price level.

Eventually, these costs of hyperinflation become intolerable. Over time, money loses its role as a store of value, unit of account, and medium of exchange. Barter becomes more common. And more stable unofficial monies—

The Causes of Hyperinflation

Why do hyperinflations start, and how do they end? This question can be answered at different levels.

The most obvious answer is that hyperinflations are due to excessive growth in the supply of money. When the central bank prints money, the price level rises. When it prints money rapidly enough, the result is hyperinflation. To stop the hyperinflation, the central bank must reduce the rate of money growth.

This answer is incomplete, however, for it leaves open the question of why central banks in hyperinflating economies choose to print so much money. To address this deeper question, we must turn our attention from monetary to fiscal policy. Most hyperinflations begin when the government has inadequate tax revenue to pay for its spending. Although the government might prefer to finance this budget deficit by issuing debt, it may find itself unable to borrow, perhaps because lenders view the government as a bad credit risk. To cover the deficit, the government turns to the only mechanism at its disposal—

Once the hyperinflation is under way, the fiscal problems become even more severe. Because of the delay in collecting tax payments, real tax revenue falls as inflation rises. Thus, the government’s need to rely on seigniorage is self-

128

The ends of hyperinflations almost always coincide with fiscal reforms. Once the magnitude of the problem becomes apparent, the government musters the political will to reduce government spending and increase taxes. These fiscal reforms reduce the need for seigniorage, which allows a reduction in money growth. Hence, even if inflation is always and everywhere a monetary phenomenon, the end of hyperinflation is often a fiscal phenomenon as well.9

CASE STUDY

Hyperinflation in Interwar Germany

After World War I, Germany experienced one of history’s most spectacular examples of hyperinflation. At the war’s end, the Allies demanded that Germany pay substantial reparations. These payments led to fiscal deficits in Germany, which the German government eventually financed by printing large quantities of money.

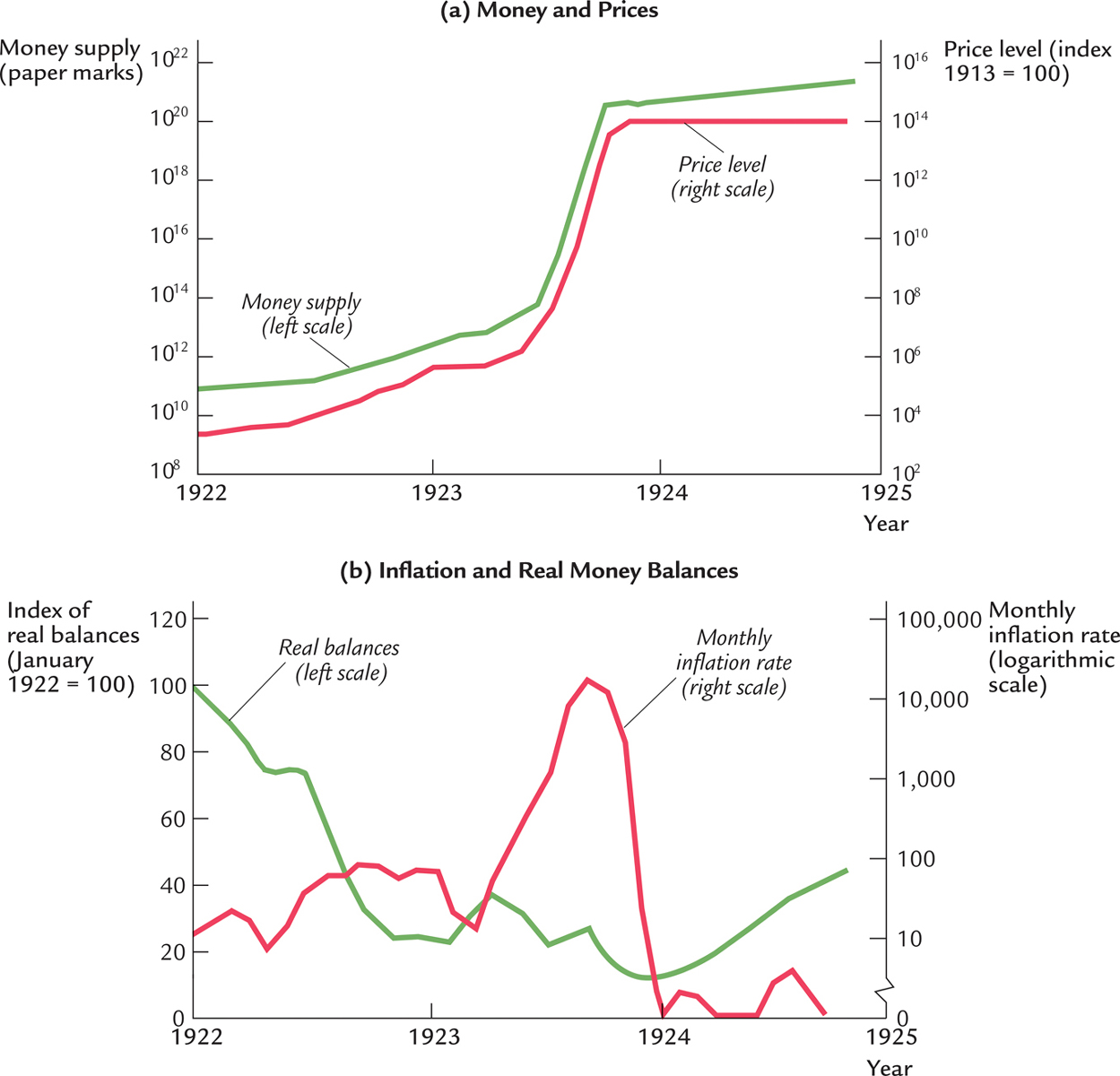

Panel (a) of Figure 5-6 shows the quantity of money and the general price level in Germany from January 1922 to December 1924. During this period both money and prices rose at an amazing rate. For example, the price of a daily newspaper rose from 0.30 mark in January 1921 to 1 mark in May 1922, to 8 marks in October 1922, to 100 marks in February 1923, and to 1,000 marks in September 1923. Then, in the fall of 1923, prices took off: the newspaper sold for 2,000 marks on October 1, 20,000 marks on October 15, 1 million marks on October 29, 15 million marks on November 9, and 70 million marks on November 17. In December 1923 the money supply and prices abruptly stabilized.10

Just as fiscal problems caused the German hyperinflation, a fiscal reform ended it. At the end of 1923, the number of government employees was cut by one-

According to our theoretical analysis of money demand, an end to a hyperinflation should lead to an increase in real money balances as the cost of holding money falls. Panel (b) of Figure 5-6 shows that real money balances in Germany did fall as inflation increased and then increased again as inflation fell. Yet the increase in real money balances was not immediate. Perhaps the adjustment of real money balances to the cost of holding money is a gradual process. Or perhaps it took time for people in Germany to believe that the inflation had ended, so that expected inflation fell more gradually than actual inflation.

129

130

CASE STUDY

Hyperinflation in Zimbabwe

In 1980, after years of colonial rule, the old British colony of Rhodesia became the new African nation of Zimbabwe. A new currency, the Zimbabwe dollar, was introduced to replace the Rhodesian dollar. For the first decade, inflation in the new nation was modest—

The hero of the Zimbabwe independence movement was Robert Mugabe. In general elections in 1980, he became the nation’s first prime minister and later, after a government reorganization, its president. Over the years, he continued to get reelected. In his 2008 reelection, however, there were widespread claims of electoral fraud and threats against voters who supported rival candidates. At the age of 84, Mugabe was no longer as popular as he once was, but he gave no sign of any willingness to relinquish power.

Throughout his tenure, Mugabe’s economic philosophy was Marxist, and one of his goals was to redistribute wealth. In the 1990s his government instituted a series of land reforms with the ostensible purpose of redistributing land from the white minority who ruled Zimbabwe during the colonial era toward the historically disenfranchised black population. One result of these reforms was widespread corruption. Many abandoned and expropriated white farms ended up in the hands of cabinet ministers and senior government officials. Another result was a substantial decline in farm output. Productivity fell as many of the experienced white farmers fled the country.

The decline in the economy’s output led to a fall in the government’s tax revenue. The government responded to this revenue shortfall by printing money to pay the salaries of government employees. As textbook economic theory predicts, the monetary expansion led to higher inflation.

Mugabe tried to deal with inflation by imposing price controls. Once again, the result was predictable: a shortage of many goods and the growth of an underground economy where price controls and tax collection were evaded. The government’s tax revenue declined further, inducing even more monetary expansion and yet higher inflation. In July 2008, the officially reported inflation rate was 231 million percent. Other observers put the inflation rate even higher.

The repercussions of the hyperinflation were widespread. In an article in the Washington Post, one Zimbabwean citizen describes the situation as follows: “If you don’t get a bill collected in 48 hours, it isn’t worth collecting, because it is worthless. Whenever we get money, we must immediately spend it, just go and buy what we can. Our pension was destroyed ages ago. None of us have any savings left.”

The Zimbabwe hyperinflation finally ended in March 2009, when the government abandoned its own money. The U.S. dollar became the nation’s official currency. Inflation quickly stabilized. Zimbabwe still had its problems, but at least hyperinflation was not among them.

131