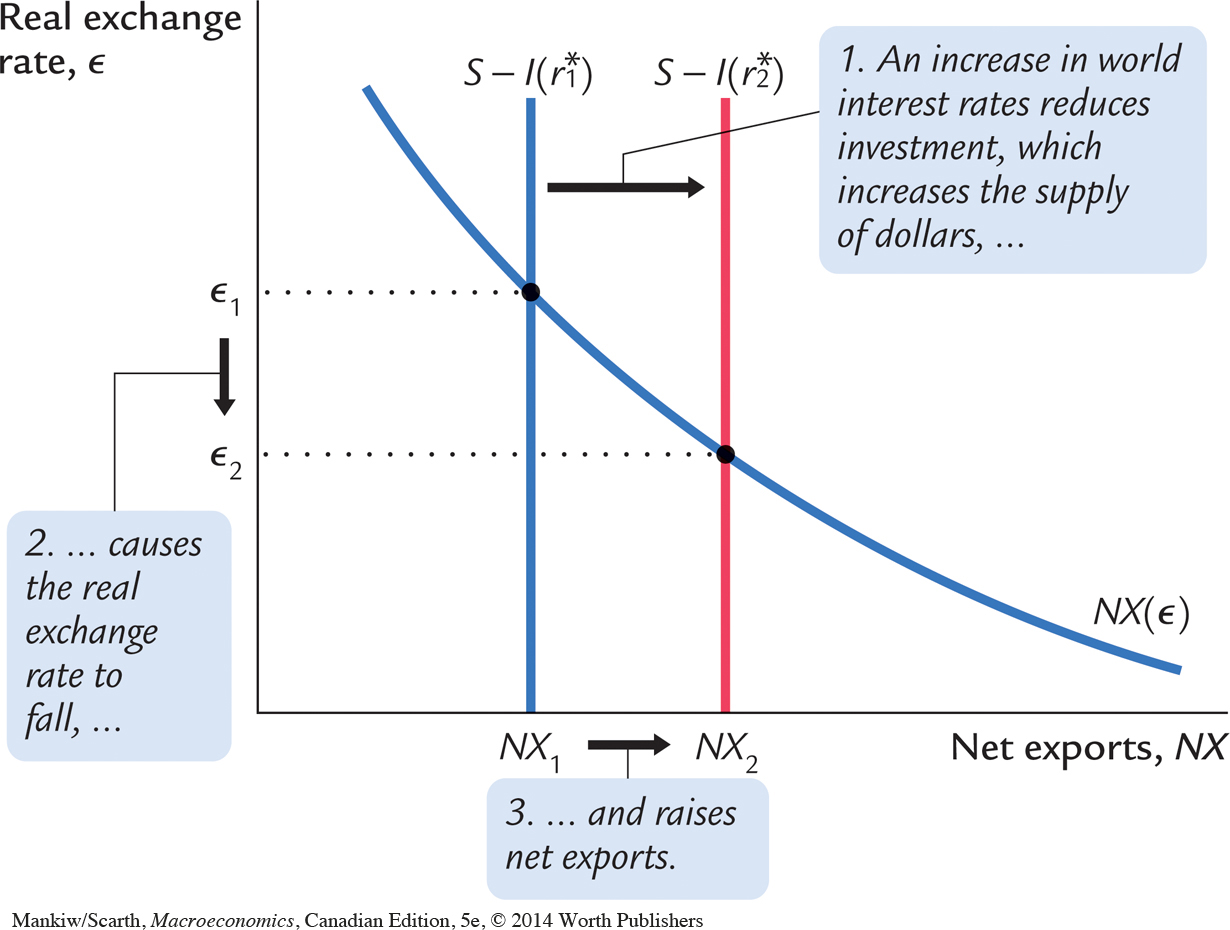

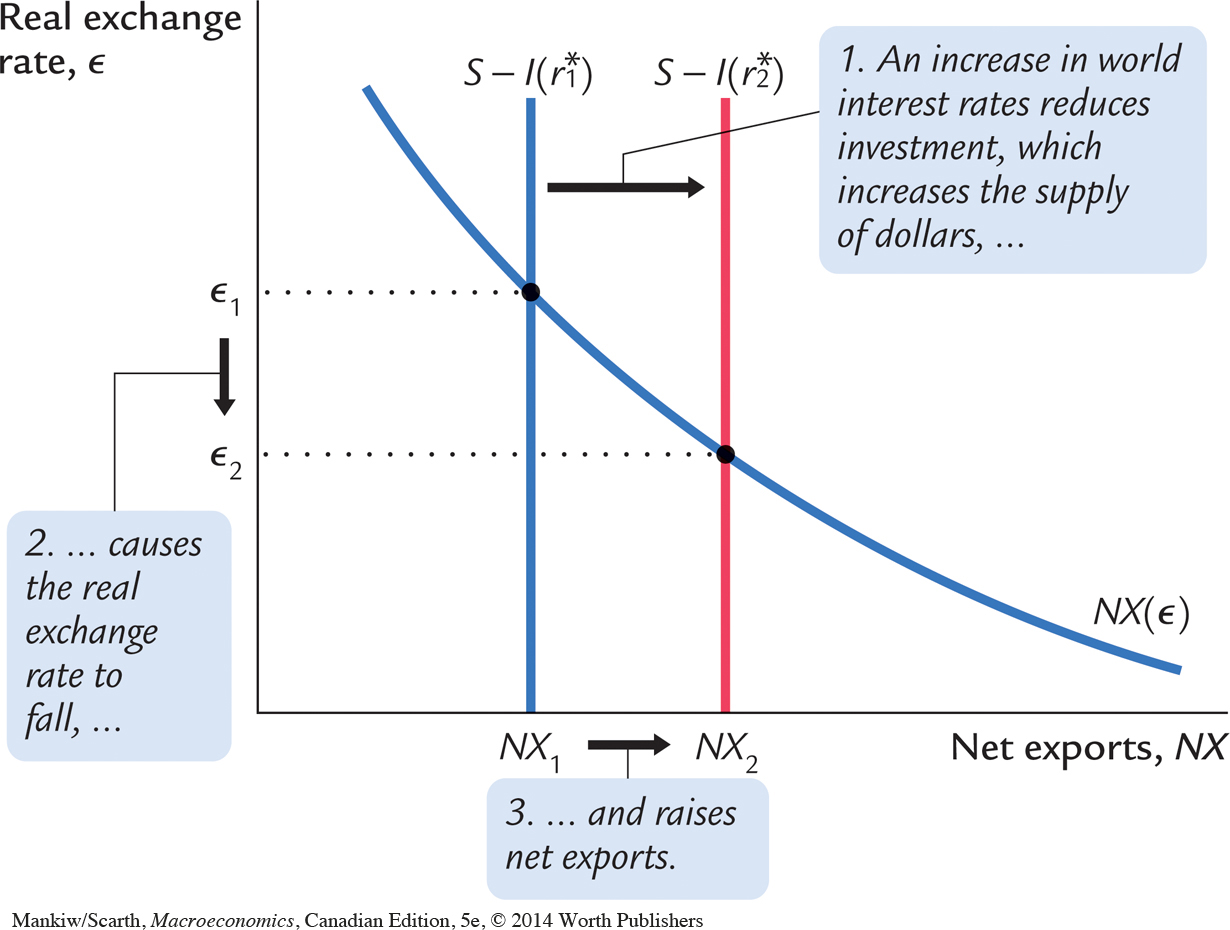

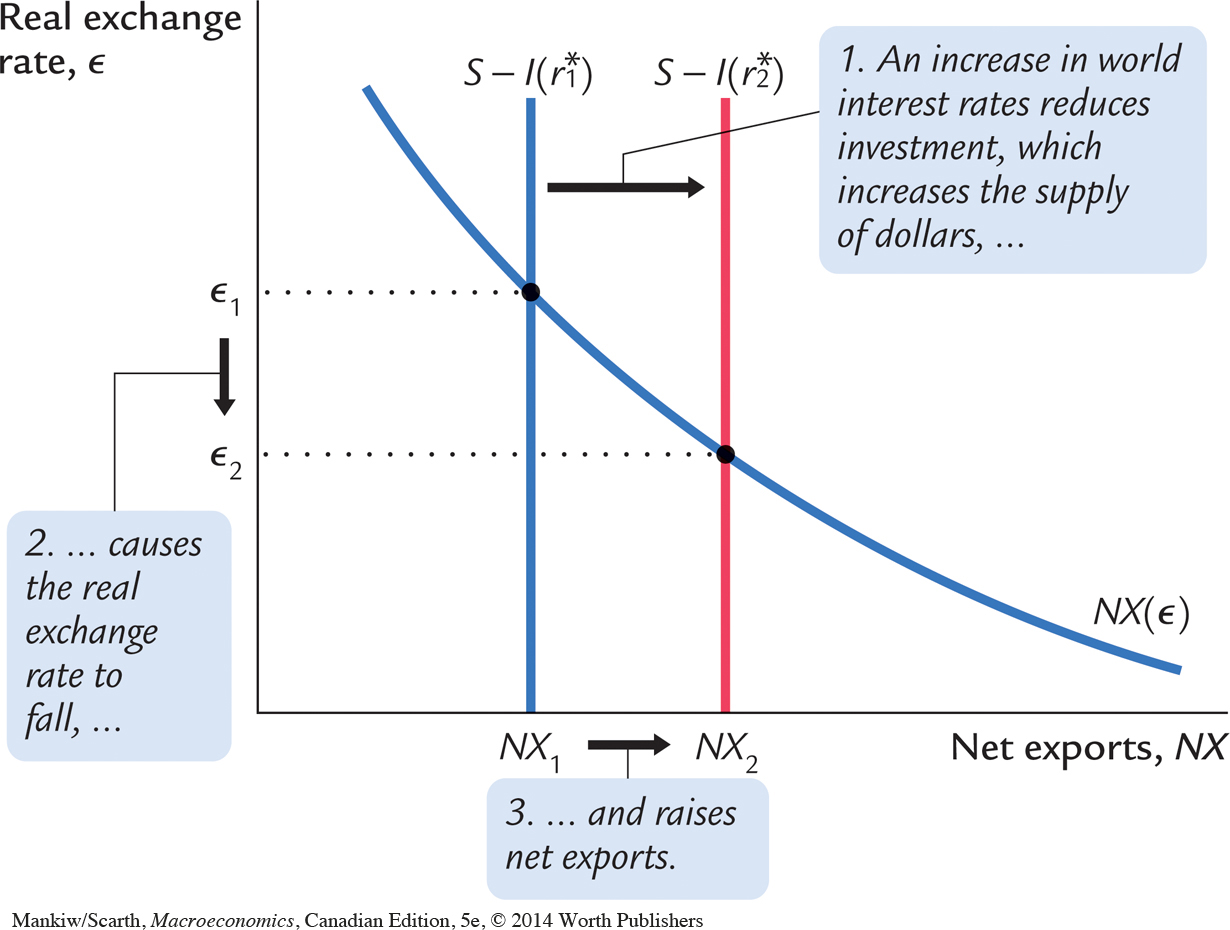

FIGURE 5-11

The Impact of Expansionary Fiscal Policy Abroad on the Real Exchange Rate Expansionary fiscal policy abroad reduces world saving and raises the world interest rate from r1* to r2*. The increase in the world interest rate reduces investment at home, which in turn raises the supply of Canadian dollars to be exchanged into foreign currencies. As a result, the equilibrium real exchange rate falls from ϵ1 to ϵ2.

The Impact of Expansionary Fiscal Policy Abroad on the Real Exchange Rate Expansionary fiscal policy abroad reduces world saving and raises the world interest rate from r1* to r2*. The increase in the world interest rate reduces investment at home, which in turn raises the supply of Canadian dollars to be exchanged into foreign currencies. As a result, the equilibrium real exchange rate falls from ϵ1 to ϵ2.