129

The Open Economy

No nation was ever ruined by trade.

— Benjamin Franklin

Even if you never leave your home town, you are an active participant in a global economy. When you go to the grocery store, for instance, you might choose between apples grown in British Columbia and oranges grown in Florida. When you make a deposit into your local bank, the bank might lend those funds to your next-door neighbour or to a Japanese company building a factory outside Tokyo. Because our economy is integrated with many others around the world, consumers have more goods and services from which to choose, and savers have more opportunities to invest their wealth.

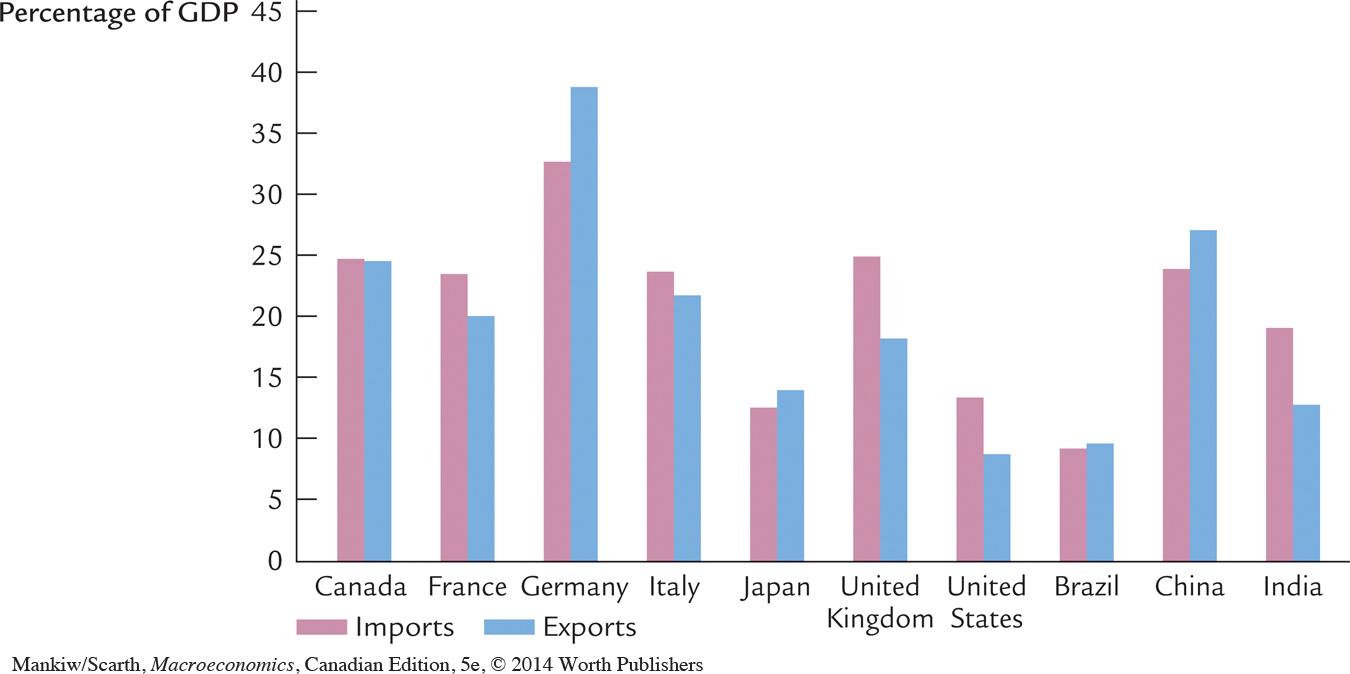

In previous chapters we simplified our analysis by assuming a closed economy. In actuality, however, most economies are open: they export goods and services abroad, they import goods and services from abroad, and they borrow and lend in world financial markets. Figure 5-1 gives some sense of the importance of these international interactions by showing imports and exports as a percentage of GDP for seven major industrial countries. As the figure shows, receipts from Canadian exports of goods and services were about 25 percent of GDP in 2010. This proportion has been rising—from 22 percent in 1950, to today’s higher level of economic integration. In countries such as Canada, international trade is central to analyzing economic developments and formulating economic policies.

This chapter begins our study of open-economy macroeconomics. We begin in Section 5-1 with questions of measurement. To understand how an open economy works, we must understand the key macroeconomic variables that measure the interactions among countries. Accounting identities reveal a key insight: the flow of goods and services across national borders is always matched by an equivalent flow of funds to finance capital accumulation.

In Section 5-2 we examine the determinants of these international flows. We develop a model of the small open economy that corresponds to our model of the closed economy in Chapter 3. The model shows the factors that determine whether a country is a borrower or a lender in world markets, and how policies at home and abroad affect the flows of capital and goods.

In Section 5-3 we extend the model to discuss the prices at which a country makes exchanges in world markets. We examine what determines the price of domestic goods relative to foreign goods. We also examine what determines the rate at which the domestic currency trades for foreign currencies. Our model shows how protectionist trade policies—policies designed to protect domestic industries from foreign competition—influence the amount of international trade and the exchange rate.