6.3 Real-Wage Rigidity and Structural Unemployment

183

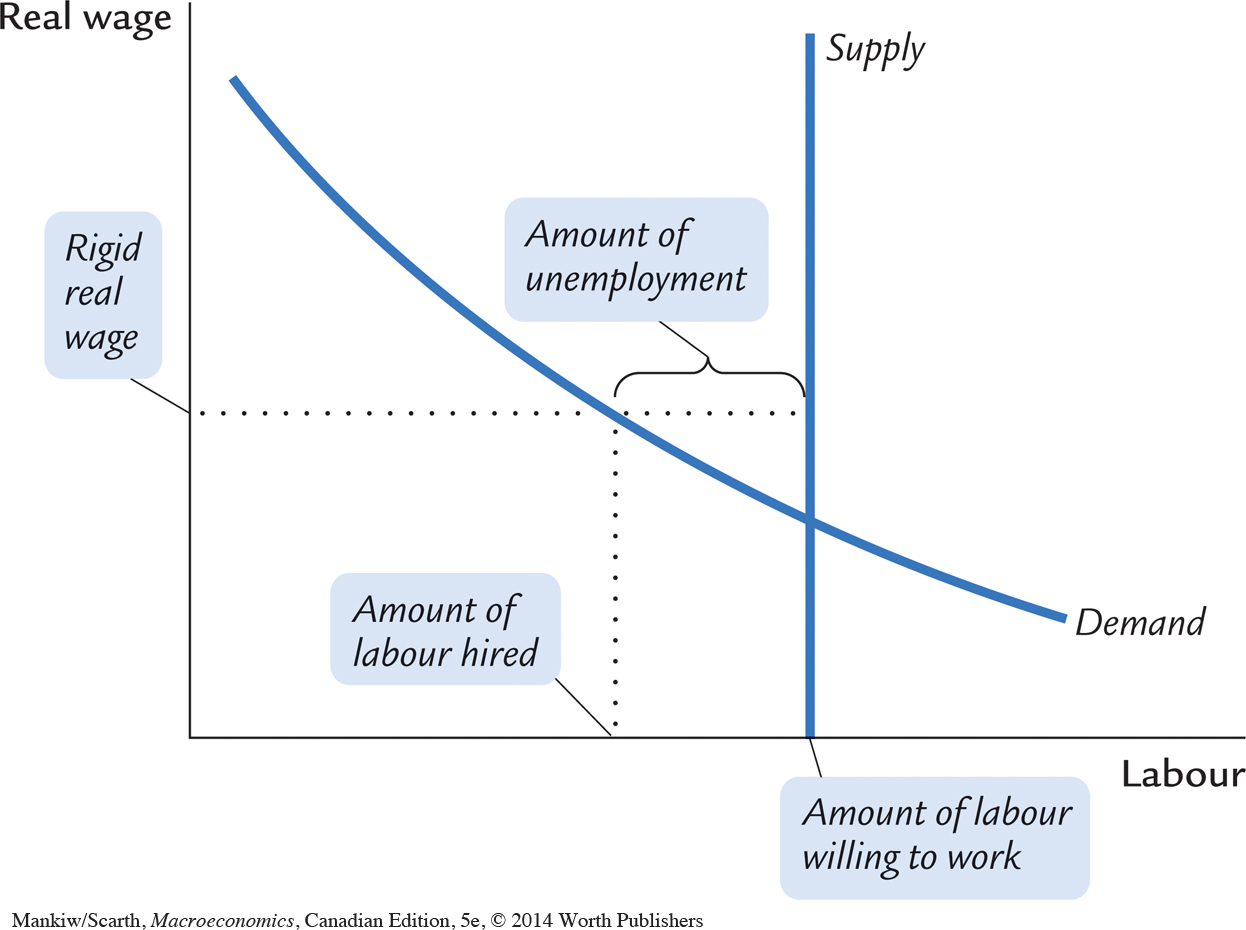

A second reason for unemployment is wage rigidity—the failure of wages to adjust to a level at which labour supply equals labour demand. In the equilibrium model of the labour market, as outlined in Chapter 3, the real wage adjusts to equilibrate labour supply and labour demand. Yet wages are not always flexible. Sometimes the real wage is stuck above the market-clearing level.

Figure 6-3 shows why wage rigidity leads to unemployment. When the real wage is above the level that equilibrates supply and demand, the quantity of labour supplied exceeds the quantity demanded. Firms must in some way ration the scarce jobs among workers. Real-wage rigidity reduces the rate of job finding and raises the level of unemployment.

The unemployment resulting from wage rigidity and job rationing is often called structural unemployment. Workers are unemployed not because they are actively searching for the jobs that best suit their individual skills but because there is a fundamental mismatch between the number of people who want to work and the number of jobs available. At the going wage, the quantity of labour supplied exceeds the quantity of labour demanded, so many workers are simply waiting for jobs to open up.

To understand wage rigidity and structural unemployment, we must examine why the labour market does not clear. When the real wage exceeds the equilibrium level and the supply of workers exceeds the demand, we might expect firms to lower the wages they pay. Structural unemployment arises because firms fail to reduce wages despite an excess supply of labour. We now turn to three causes of this wage rigidity: minimum-wage laws, the monopoly power of unions, and efficiency wages.

Minimum-Wage Laws

184

The government causes wage rigidity when it prevents wages from falling to equilibrium levels. Minimum-wage laws set a legal minimum on the wages that firms pay their employees. For most workers, this minimum wage is not binding, because they earn well above the minimum. Yet for some workers, especially the unskilled and inexperienced, the minimum wage raises their wage above its equilibrium level and therefore reduces the quantity of their labour that firms demand.

Economists believe that the minimum wage has its greatest impact on teenage unemployment. The equilibrium wages of teenagers tend to be low for two reasons. First, because teenagers are among the least skilled and least experienced members of the labour force, they tend to have low marginal productivity. Second, teenagers often take some of their “compensation’’ in the form of on-the-job training rather than direct pay. An apprenticeship is a classic example of training offered in place of wages. For both these reasons, the wage at which the supply of teenage workers equals the demand is low. The minimum wage is therefore more often binding for teenagers than for others in the labour force.

Many economists have studied the impact of the minimum wage on teenage employment. These researchers compare the variation in the minimum wage over time with the variation in the number of teenagers with jobs. These studies find that a 10-percent increase in the minimum wage reduces teenage employment by 1 to 3 percent.6

185

Canadian studies have reached similar conclusions. Estimates reported by the Ontario Ministry of Labour in 1989 showed that a 10-percent increase in the minimum wage eliminated 25,000 jobs. Also, economist Walter Block performed a cross-sectional study of provincial minimum-wage laws.7 Back in 1985 when the study was done, Manitoba and Saskatchewan had the highest minimum-wage laws—some 15 percent above those provinces (British Columbia and Alberta) with the lowest legal minimums. Block compared all provinces according to the ratio of their youth unemployment rate to that of their prime-aged residents (those over 24 years old). By comparing this ratio of unemployment rates, rather than just youth unemployment rates directly, Block was trying to ensure that he was not focusing inadvertently on the differences across provinces that were due to influences other than the minimum wage. Block found that Manitoba and Saskatchewan had the highest youth unemployment ratios (2.9 times and 2.6 times the unemployment rate for prime-aged labour), while British Columbia and Alberta had the lowest youth unemployment ratios (1.9 times and 1.8 times the unemployment rate for prime-aged workers).

The minimum wage is a perennial source of political debate. Advocates of a higher minimum wage view it as a means of raising the income of the working poor. Certainly, the minimum wage provides only a meager standard of living. In most provinces, a full-time worker receiving the minimum wage earns an income that is below the official poverty line. While minimum-wage advocates often admit that the policy causes unemployment for some workers, they argue that this cost is worth bearing to raise others out of poverty.

Opponents of a higher minimum wage claim that it is not the best way to help the working poor. They contend not only that the increased labour costs would raise unemployment, but also that the minimum wage is poorly targeted. Many minimum-wage earners are teenagers from middle-class homes working for discretionary spending money, rather than heads of households working to support their families.

Many economists and policymakers believe that tax credits are a better way to increase the incomes of the working poor. A refundable income tax credit is an amount that poor working families are allowed to subtract from the taxes they owe. For a family with very low income, the credit exceeds its taxes, and the family receives a payment from the government. Unlike the minimum wage, the refundable income tax credit does not raise labour costs to firms and, therefore, does not reduce the quantity of labour that firms demand. It has the disadvantage of reducing the government’s tax revenue, but in the appendix to this chapter we explore how the government can offer initiatives of this sort as part of a revenue-neutral package. In the final economic document of the Chretien/Martin Liberal government—the Fiscal Update (November 2005)—this very policy (called the Working Income Tax Benefit) was introduced and promised to start in 2008. The funding for this program was expanded by the Conservatives in the 2009 federal budget. Noting the success of the similar earned income tax credit program in the United States, our governments have argued that such a policy is fundamentally needed if the Government is to make progress in reducing—simultaneously—our high unemployment problem and our lagging productivity growth problem. There is growing evidence that such programs can make a significant contribution in promoting the transition from welfare to work.8

Unions and Collective Bargaining

186

A second cause of wage rigidity is the monopoly power of unions. Table 6-1 shows the importance of unions in a number of major countries. In Canada, just under one-third of workers belong to unions. This rate of union membership is about two and one half times that of the United States, but unions play a greater role in many European countries.

| South Korea | 12% |

| United States | 13 |

| Japan | 16 |

| Turkey | 24 |

| Canada | 32 |

| Poland | 35 |

| United Kingdom | 35 |

| Switzerland | 48 |

| Israel | 56 |

| Australia | 60 |

| Russian Federation | 62 |

| Germany | 63 |

| Italy | 80 |

| Spain | 80 |

| Netherlands | 82 |

| Greece | 85 |

| Sweden | 92 |

| France | 95 |

| Belgium | 96 |

|

Source: Danielle Venn, “Legislation, Collective Bargaining and Enforcement: Updating the OECD Employment Protection Indicators.” OECD Social, Employment and Migration Working Papers, 2009. |

|

|---|---|

187

The wages of unionized workers are determined not by the equilibrium of supply and demand but by bargaining between union leaders and firm management. Often, the final agreement raises the wage above the equilibrium level and allows the firm to decide how many workers to employ. The result is a reduction in the number of workers hired, a lower rate of job finding, and an increase in structural unemployment.

Unions can also influence the wages paid by firms whose work forces are not unionized because the threat of unionization can keep wages above the equilibrium level. Most firms dislike unions. Unions not only raise wages but also increase the bargaining power of labour on many other issues, such as hours of employment and working conditions. A firm may choose to pay its workers high wages to keep them happy in order to discourage them from forming a union.

The unemployment caused by unions and by the threat of unionization is an instance of conflict between different groups of workers—insiders and outsiders. Those workers already employed by a firm, the insiders, typically try to keep their firm’s wages high. The unemployed, the outsiders, bear part of the cost of higher wages because at a lower wage they might be hired. These two groups inevitably have conflicting interests. The effect of any bargaining process on wages and employment depends crucially on the relative influence of each group.

The conflict between insiders and outsiders is resolved differently in different countries. In some countries, such as those in North America, wage bargaining takes place at the level of the firm or plant. In other countries, such as Sweden, wage bargaining takes place at the national level—with the government often playing a key role. Despite a highly unionized labour force, Sweden has not experienced extraordinarily high unemployment throughout its history. One possible explanation is that the centralization of wage bargaining and the role of the government in the bargaining process give more influence to the outsiders, which keeps wages closer to the equilibrium level.

Efficiency Wages

Efficiency-wage theories propose a third cause of wage rigidity in addition to minimum-wage laws and unionization. These theories hold that high wages make workers more productive. The influence of wages on worker efficiency may explain the failure of firms to cut wages despite an excess supply of labour. Even though a wage reduction would lower a firm’s wage bill, it would also—if these theories are correct—lower worker productivity and the firm’s profits.

Economists have proposed various theories to explain how wages affect worker productivity. One efficiency-wage theory, which is applied mostly to poorer countries, holds that wages influence nutrition. Better-paid workers can afford a more nutritious diet, and healthier workers are more productive. A firm may decide to pay a wage above the equilibrium level to maintain a healthy work force. Obviously, this consideration is not important for employers in wealthy countries, such as Canada, the United States, and most of Europe, since the equilibrium wage is well above the level necessary to maintain good health.

188

A second efficiency-wage theory, which is more relevant for developed countries, holds that high wages reduce labour turnover. Workers quit jobs for many reasons—to accept better positions at other firms, to change careers, or to move to other parts of the country. The more a firm pays its workers, the greater their incentive to stay with the firm. By paying a high wage, a firm reduces the frequency at which its workers quit, thereby decreasing the time and money spent hiring and training new workers.

A third efficiency-wage theory holds that the average quality of a firm’s work force depends on the wage it pays its employees. If a firm reduces its wage, the best employees may take jobs elsewhere, leaving the firm with inferior employees who have fewer alternative opportunities. Economists recognize this unfavourable sorting as an example of adverse selection—the tendency of people with more information (in this case, the workers, who know their own outside opportunities) to self-select in a way that disadvantages people with less information (the firm). By paying a wage above the equilibrium level, the firm may reduce adverse selection, improve the average quality of its work force, and thereby increase productivity.

A fourth efficiency-wage theory holds that a high wage improves worker effort. This theory posits that firms cannot perfectly monitor their employees’ work effort, and that employees must themselves decide how hard to work. Workers can choose to work hard, or they can choose to shirk and risk getting caught and fired. Economists recognize this possibility as an example of moral hazard—the tendency of people to behave inappropriately when their behaviour is imperfectly monitored. The firm can reduce the problem of moral hazard by paying a high wage. The higher the wage, the greater the cost to the worker of getting fired. By paying a higher wage, a firm induces more of its employees not to shirk and thus increases their productivity.

Although these four efficiency-wage theories differ in detail, they share a common theme: because a firm operates more efficiently if it pays its workers a high wage, the firm may find it profitable to keep wages above the level that balances supply and demand. The result of this higher-than-equilibrium wage is a lower rate of job finding and greater structural unemployment.9

CASE STUDY

Henry Ford’s $5 Workday

In 1914 the Ford Motor Company started paying its U.S. workers $5 per day. Since the prevailing wage at the time was between $2 and $3 per day, Ford’s wage was well above the equilibrium level. Not surprisingly, long lines of job seekers waited outside the Ford plant gates hoping for a chance to earn this high wage.

189

What was Ford’s motive? Henry Ford later wrote, “We wanted to pay these wages so that the business would be on a lasting foundation. We were building for the future. A low wage business is always insecure . . . . The payment of five dollars a day for an eight hour day was one of the finest cost cutting moves we ever made.’’

From the standpoint of traditional economic theory, Ford’s explanation seems peculiar. He was suggesting that high wages imply low costs. But perhaps Ford had discovered efficiency-wage theory. Perhaps he was using the high wage to increase worker productivity.

Evidence suggests that paying such a high wage did benefit the company. According to an engineering report written at the time, “The Ford high wage does away with all the inertia and living force resistance. . . . The workingmen are absolutely docile, and it is safe to say that since the last day of 1913, every single day has seen major reductions in Ford shops’ labor costs.’’ Absenteeism fell by 75 percent, suggesting a large increase in worker effort. Alan Nevins, a historian who studied the early Ford Motor Company, wrote, “Ford and his associates freely declared on many occasions that the high wage policy had turned out to be good business. By this they meant that it had improved the discipline of the workers, given them a more loyal interest in the institution, and raised their personal efficiency.’’10