6.5 Labour Market Experience: Europe

Although our discussion has focused on Canada (and to some extent on the United States), many fascinating and sometimes puzzling phenomena become apparent when economists compare the experiences of North Americans in the labour market with those of Europeans.

The Rise in European Unemployment

197

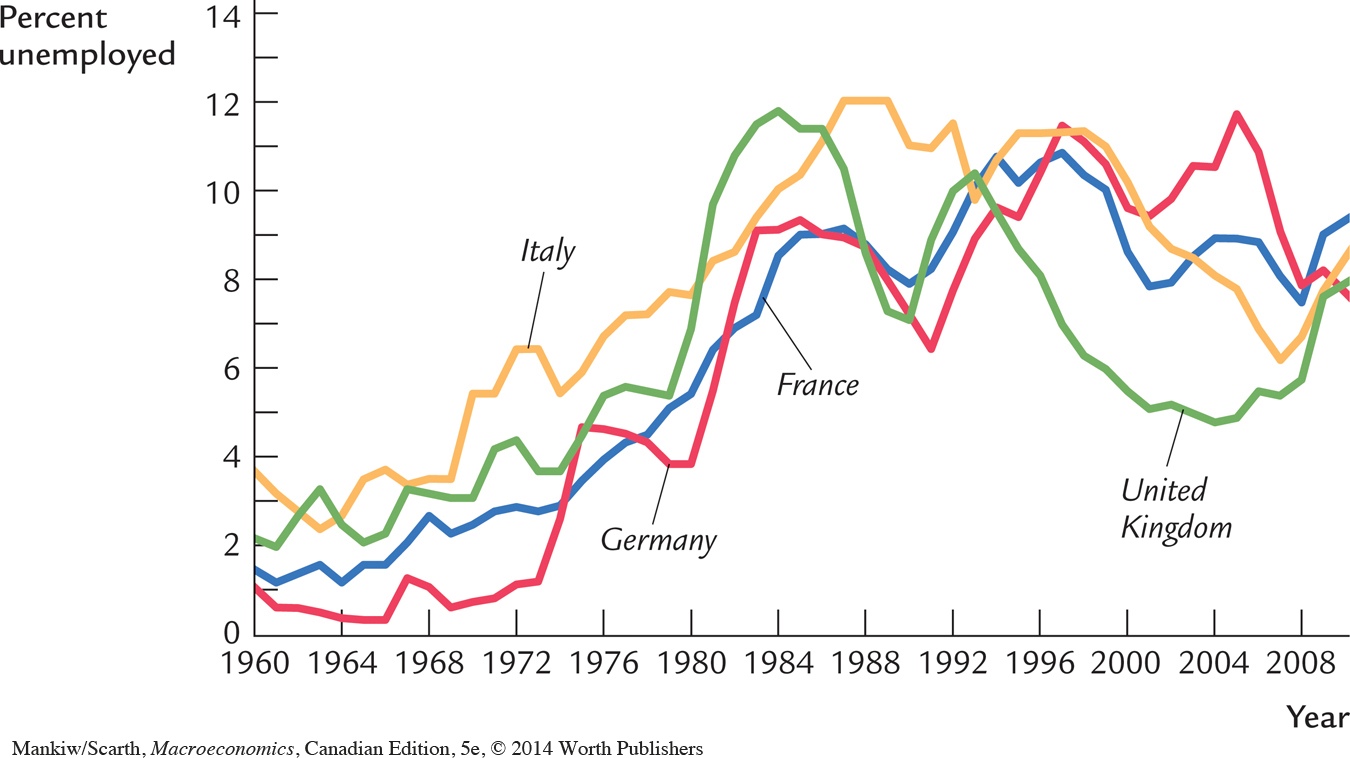

Figure 6-4 shows the rate of unemployment from 1960 to 2007 in the four largest European countries—France, Germany, Italy, and the United Kingdom. As you can see, the rate of unemployment in these countries has risen substantially. For France and Germany, the change is particularly pronounced: unemployment averaged about 2 percent in the 1960s and about 10 percent in recent years.

What is the cause of rising European unemployment? No one knows for sure, but there is a leading theory. Many economists believe that the problem can be traced to the interaction between a long-standing policy and a more recent shock. The long-standing policy is generous benefits for unemployed workers. The recent shock is a technologically driven fall in the demand for unskilled workers relative to skilled workers (the so-called skill-biased technical change phenomenon that we noted earlier in this chapter).

There is no question that most European countries have generous programs for those without jobs. These programs go by various names: social insurance, the welfare state, or simply “the dole.” Many countries allow the unemployed to collect benefits for years, rather than for only a short period of time (such as a maximum of 26 weeks). In some sense, those living on the dole are really out of the labour force: given the employment opportunities available, taking a job is less attractive than remaining without work. Yet these people are often counted as unemployed in government statistics.

198

There is also no question that the demand for unskilled workers has fallen relative to the demand for skilled workers. This change in demand is probably due to changes in technology: computers, for example, increase the demand for workers who can use them and reduce the demand for those who cannot. In the United States, this change in demand has been reflected in wages rather than in unemployment: over the past two decades, the wages of unskilled workers have fallen substantially relative to the wages of skilled workers in the United States. In Europe, however, the welfare state provides unskilled workers with an alternative to working for low wages. As the wages of unskilled workers fall, more workers view the dole as their best available option. The result is higher unemployment. Many analysts see Canada as occupying an intermediate position in this regard—with more commitment to a welfare state than the United States, but less compared to some European countries. Perhaps, then, it is not surprising that the Canadian unemployment rate is usually between the U.S. and European levels.

This diagnosis of high European unemployment does not suggest an easy remedy. Reducing the magnitude of government benefits for the unemployed would encourage workers to get off the dole and accept low-wage jobs. But it would also exacerbate economic inequality—the very problem that welfare state policies were designed to address.17

Unemployment Variation Within Europe

Europe is not a single labour market but rather a collection of national labour markets, separated not only by national borders but also by differences in culture and language. Because these countries differ in their labour market policies and institutions, variation within Europe provides a useful perspective on the causes of unemployment. Many empirical studies have therefore focused on the international differences,

The first noteworthy fact is that the unemployment rate varies substantially from country to country. For example, in August 2011, when the unemployment rate was 9 percent in the United States, it was 3 percent in Switzerland and 21 percent in Spain. Although in recent years average unemployment has been higher in Europe than in the United States, about a third of Europeans have been living in nations with unemployment rates lower than the U.S. rate.

A second notable fact is that much of the variation in unemployment rates is attributable to the long-term unemployed. The unemployment rate can be separated into two pieces—the percentage of the labour force that has been unemployed for less than a year and the percentage of the labour force that has been unemployed for more than a year. The long-term unemployment rate exhibits more variability from country to country than does the short-term unemployment rate.

199

National unemployment rates are correlated with a variety of labour market policies. Unemployment rates are higher in nations with more generous employment insurance, as measured by the replacement rate—the percentage of previous wages that are replaced when a worker loses a job. In addition, nations tend to have higher unemployment, especially higher long-term unemployment, if benefits can be collected for longer periods of time.

Although government spending on employment insurance seems to raise unemployment, spending on “active” labour market policies appears to decrease it. These active labour market policies include job training, assistance with job search, and subsidized employment. Spain, for instance, has historically had a high rate of unemployment, a fact that can be explained by the combination of generous payments to the unemployed with minimal assistance at helping them find new jobs.

The role of unions also varies from country to country, as we saw in Table 6-1. This fact also helps explain differences in labour-market outcomes. National unemployment rates are positively correlated with the percentage of the labour force whose wages are set by collective bargaining with unions. The adverse impact of unions on unemployment is smaller, however, in nations with substantial coordination among employers in bargaining with unions, perhaps because coordination may moderate the upward pressure on wages.

A word of warning: Correlation does not imply causation, so empirical results such as these should be interpreted with caution. But they do suggest that a nation’s unemployment rate, rather than being immutable, is instead a function of the choices a nation makes.18

CASE STUDY

The Secrets to Happiness

Why are some people more satisfied with their lives than others? This is a deep and difficult question, most often left to philosophers, psychologists, and self-help gurus. But part of the answer is macroeconomic. Recent research has shown that people are happier when they are living in a country with low inflation and low unemployment.

From 1975 to 1991, a survey called the Euro-Barometer Survey Series asked 264,710 people living in 12 European countries about their happiness and overall satisfaction with life. One question asked, “On the whole, are you very satisfied, fairly satisfied, not very satisfied, or not at all satisfied with the life you lead?” To see what determines happiness, the answers to this question were correlated with individual and macroeconomic variables. Other things equal, people are more satisfied with their lives if they are rich, educated, married, in school, self-employed, retired, female, and young or old (as opposed to middle-aged). They are less satisfied if they are unemployed, divorced, or living with adolescent children. (Some of these correlations may reflect the effects, rather than causes, of happiness: for example, a happy person may find it easier than an unhappy one to keep a job and a spouse.)

200

Beyond these individual characteristics, the economy’s overall rates of unemployment and inflation also play a significant role in explaining reported happiness. An increase in the unemployment rate of 4 percentage points is large enough to move 11 percent of the population down from one life satisfaction category to another. The overall unemployment rate reduces satisfaction even after controlling for an individual’s employment status. That is, the employed in a high-unemployment nation are less happy than their counterparts in a low-unemployment nation, perhaps because they are more worried about job loss or perhaps out of sympathy with their fellow citizens.

High inflation is also associated with lower life satisfaction, although the effect is not as large. A 1.7 percentage point increase in inflation reduces happiness by about as much as a 1 percentage point increase in unemployment. The commonly cited “misery index,” which is the sum of the inflation and unemployment rates, apparently gives too much weight to inflation relative to unemployment.19

The Rise of European Leisure

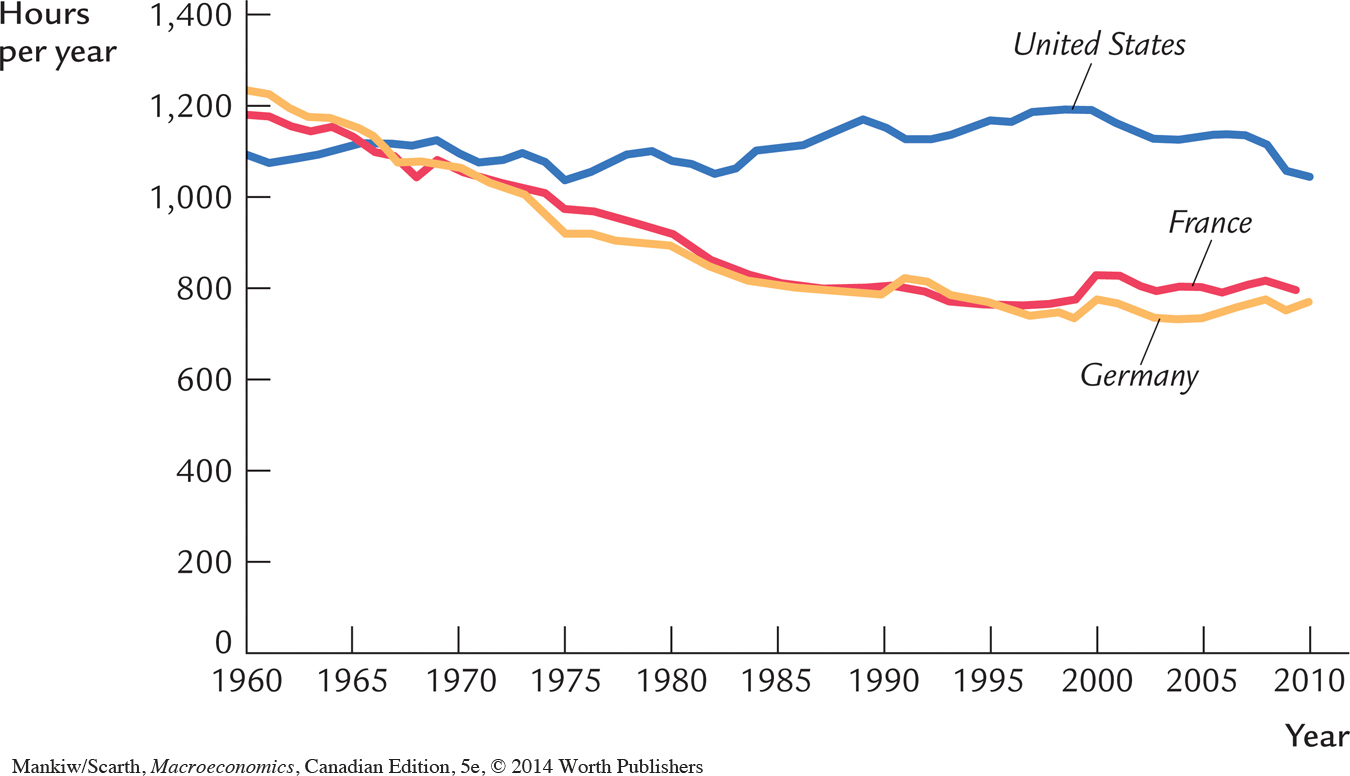

Not only are Europeans more likely to be unemployed than Americans, but they also typically work fewer hours than do their American counterparts. Figure 6-5 presents some data on how many hours a typical person works in the United States, France, and Germany. In the 1960s, the number of hours worked was about the same in each of these countries. Since then, hours worked have stayed fairly constant in the United States, while this statistic has declined dramatically in Europe. Today, the typical American works many more hours than does the typical resident of western Europe. The difference in hours worked reflects two facts. First, the average employed person in the United States works more hours per year than the average employed person in Europe. Europeans typically enjoy shorter workweeks and more frequent holidays. Second, more potential workers are employed in the United States. That is, the employment-to-population ratio is higher in the United States than it is in Europe. Earlier retirement in Europe is another source of the differing employment rates.

What is the underlying cause of these differences in work patterns? Economists have proposed several hypotheses. Edward Prescott, the 2004 winner of the Nobel Prize in economics, has concluded that “virtually all of the large differences between U.S. labour supply and those of Germany and France are due to differences in tax systems.” This hypothesis is consistent with two facts: (1) Europeans face higher tax rates than Americans, and (2) European tax rates have risen significantly over the past several decades. Some economists take these facts as powerful evidence for the impact of taxes on work effort. Yet others are skeptical, arguing that to explain the differences in hours worked by tax rates alone requires an implausibly large wage elasticity of labour supply.

201

A related hypothesis is that the difference in observed work effort may be attributable to the underground economy. When tax rates are high, people have a greater incentive to work “off the books” to evade taxes. For obvious reasons, data on the underground economy are hard to come by. But economists who study the subject believe the underground economy is larger in Europe than it is in the United States. This fact suggests that the difference in actual hours worked, including work in the underground economy, may be smaller than the difference in measured hours worked.

Another hypothesis stresses the role of unions. As we have seen, collective bargaining is more important in European than in U.S. labour markets. Unions often push for shorter workweeks in contract negotiations, and they lobby the government for a variety of labor market regulations, such as official holidays. Economists Alberto Alesina, Edward Glaeser, and Bruce Sacerdote conclude that “mandated holidays can explain 80 percent of the difference in weeks worked between the U.S. and Europe and 30 percent of the difference in total labor supply between the two regions.” They suggest that Prescott may overstate the role of taxes because, looking across countries, tax rates and unionization rates are positively correlated; as a result, the effects of high taxes and the effects of widespread unionization are hard to disentangle.

202

A final hypothesis emphasizes the possibility of different preferences. As technological advance and economic growth have made all advanced countries richer, people around the world must decide whether to take the greater prosperity in the form of increased consumption of goods and services or increased leisure. According to economist Olivier Blanchard, “the main difference [between the continents] is that Europe has used some of the increase in productivity to increase leisure rather than income, while the U.S. has done the opposite.” Blanchard believes that Europeans simply have more taste for leisure than do Americans. (As a French economist working in the United States, he may have special insight into this phenomenon.) If Blanchard is right, this raises the even harder question of why tastes vary by geography.

Economists continue to debate the merits of these alternative hypotheses. In the end, there may be some truth to all of them.20