PROBLEMS AND APPLICATIONS

Use the Keynesian cross to predict the impact on equilibrium GDP of

An increase in government purchases.

An increase in taxes.

An equal increase in both government purchases and taxes.

In the Keynesian cross, assume that the consumption function is given by

C = 200 + 0.75 (Y – T).

Planned investment is 100; government purchases and taxes are both 100.

Graph planned expenditure as a function of income.

What is the equilibrium level of income?

If government purchases increase to 125, what is the new equilibrium income?

What level of government purchases is needed to achieve an income of 1,600?

Although our development of the Keynesian cross in this chapter assumes that taxes are a fixed amount, in many countries taxes depend on income. Let’s represent the tax system by writing tax revenue as

where

and t are parameters of the tax code. The parameter t is the marginal tax rate: if income rises by $1, taxes rise by t × $1.

and t are parameters of the tax code. The parameter t is the marginal tax rate: if income rises by $1, taxes rise by t × $1.How does this tax system change the way consumption responds to changes in GDP?

In the Keynesian cross, how does this tax system alter the government-purchases multiplier?

In the IS–LM model, how does this tax system alter the slope of the IS curve?

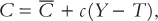

Consider the impact of an increase in thriftiness in the Keynesian cross. Suppose the consumption function is

where

is a parameter called autonomous consumption and c is the marginal propensity to consume.

is a parameter called autonomous consumption and c is the marginal propensity to consume.What happens to equilibrium income when the society becomes more thrifty, as represented by a decline in

What happens to equilibrium saving?

Why do you suppose this result is called the paradox of thrift?

Does this paradox arise in the classical model of Chapter 3? Why or why not?

341

Suppose that the money demand function is

(M/P)d = 1,000 – 100r,

where r is the interest rate in percent. The money supply M is 1,000 and the price level P is 2.

Graph the supply and demand for real money balances.

What is the equilibrium interest rate?

Assume that the price level is fixed. What happens to the equilibrium interest rate if the supply of money is raised from 1,000 to 1,200?

If the central bank wishes to raise the interest rate to 7 percent, what money supply should it set?