12.5 Should Exchange Rates Be Floating or Fixed?

Having analyzed how an economy works under floating and fixed exchange rates, we turn to the question of which exchange-rate regime is preferable.

Pros and Cons of Different Exchange-Rate Systems

405

The primary argument for a floating exchange rate is that it allows monetary policy to be used for other purposes. Under fixed rates, monetary policy is committed to the single goal of maintaining the exchange rate at its announced level. Yet the exchange rate is only one of many macroeconomic variables that monetary policy can influence. A system of floating exchange rates leaves monetary policymakers free to pursue other goals, such as stabilizing prices.

Advocates of fixed exchange rates argue that exchange-rate uncertainty makes international trade more difficult. After the world abandoned the Bretton Woods system of fixed exchange rates in the early 1970s, both real and nominal exchange rates became (and have remained) much more volatile than anyone had expected. Some economists attribute this volatility to irrational and destabilizing speculation by international investors. Business executives often claim that this volatility is harmful because it increases the uncertainty that accompanies international business transactions. Yet, despite this exchange-rate volatility, the amount of world trade has continued to rise under floating exchange rates.

Advocates of fixed exchange rates sometimes argue that a commitment to a fixed exchange rate is one way to discipline a nation’s monetary authority and prevent excessive growth in the money supply. Yet there are many other policy rules to which the central bank could be committed. In Chapter 15, for instance, we discuss policy rules such as targets for nominal GDP or the inflation rate. Fixing the exchange rate has the advantage of being simpler to implement than these other policy rules, because the money supply adjusts automatically, but this policy may lead to greater volatility in income and employment. Indeed, in the Mundell–Fleming model, shocks to the IS* curve must affect real GDP more under fixed exchange rates. In the appendix to this chapter, we explore the generality of this strong prediction. We extend the Mundell–Fleming model to allow for a direct effect of the exchange rate on the cost of living index, and for the interest rate differential to depend on the expected change in the exchange rate. In this more general setting, the shock-absorber feature of a floating rate is weakened.

In the end, the choice between floating and fixed rates is not as stark as it may seem at first. Under systems of fixed exchange rates, countries can change the value of their currency if maintaining the exchange rate conflicts too severely with other goals. Under systems of floating exchange rates, countries often use informal targets for the exchange rate when deciding whether to expand or contract the money supply. We rarely observe exchange rates that are completely fixed or completely floating. Instead, under both systems, stability of the exchange rate is usually one among many of the central bank’s objectives.

406

CASE STUDY

Monetary Union: The Debate Over the Euro

If you have ever driven the 6,000 kilometres from Halifax to Vancouver, you will recall that you never needed to change your money from one form of currency to another. In all provinces, local residents are happy to accept the Canadian dollar for the items you might buy. Such a monetary union is the most extreme form of a fixed exchange rate. The exchange rate between Nova Scotia dollars and British Columbia dollars is irrevocably fixed.

If you made a similar 6,000-kilometre trip across Europe during the 1990s, however, your experience was very different. You didn’t have to travel far before needing to exchange your French francs for German marks, Dutch guilders, Spanish pesetas, or Italian lira. The large number of currencies in Europe made travelling less convenient and more expensive. Every time you crossed a border, you had to wait in line at a bank to get the local money, and you had to pay the bank a fee for the service.

Today, however, the situation in Europe is more like that in Canada. Many European countries have given up having their own currencies and have formed a monetary union that uses a common currency called the euro. As a result, the exchange rate between France and Germany is now as fixed as the exchange rate between Nova Scotia and British Columbia.

The introduction of a common currency has its costs. The most important is that the nations of Europe are no longer able to conduct their own monetary policies. Instead, the European Central Bank, with the participation of all member countries, sets a single monetary policy for all of Europe. The central banks of the individual countries monitor local conditions but they have no control over the money supply or interest rates. Critics of the move toward a common currency argue that the cost of losing national monetary policy is large. When a recession hits one country but not others in Europe, that country does not have the tool of monetary policy to combat the downturn. This argument is one reason some European nations, such as the United Kingdom, have chosen not to give up their own currency in favour of the euro.

Why, according to the euro critics, is monetary union a bad idea for Europe if it works so well in Canada and the United States? These economists argue that the North American economies are different from Europe in two important ways. First, labour is more mobile among Canadian provinces and among U.S. states than among European countries. This is in part because much of Canada and the United States has a common language and in part because many North Americans are descended from immigrants, who have shown a willingness to move. Therefore, when a regional recession occurs, North American workers are more likely to move from high-unemployment areas to low-unemployment ones. Second, Canada and the United States have strong central governments that can use fiscal policy to redistribute resources among regions. Because Europe does not have these two advantages, it bears a larger cost when it restricts itself to a single monetary policy.

Advocates of a common currency believe this cost is offset by another gain: a common currency may have the political advantage of making Europeans feel more connected to one another. The twentieth century was marked by two world wars, both of which were sparked by European discord. If a common currency makes the nations of Europe more harmonious, it benefits the entire world. But in recent years, the euro has come under severe strain. The Greek government has run such a large budget deficit that it has had to default on some of its debt. To receive bailouts from the rest of Europe, the Greeks had to agree to major fiscal cutbacks. Without a separate currency, the Greeks cannot have an expansionary monetary policy to counteract this contractionary fiscal policy. Much hardship has ensued, and as other European countries develop similar difficulties, scepticism concerning the future of the euro has grown. We discuss this development further in Chapter 20.

Speculative Attacks, Currency Boards, and Dollarization

407

Imagine that you are a central banker of a small country. You and your fellow policymakers decide to fix your currency—let’s call it the peso—at par against the U.S. dollar. From now on, one peso will sell for one dollar.

As discussed earlier, you now have to stand ready to buy and sell pesos for a dollar each. The money supply will adjust automatically to make the equilibrium exchange rate equal your target. There is, however, one potential problem with this plan: you might run out of dollars. If people come to the central bank to sell large quantities of pesos, the central bank’s dollar reserves might dwindle to zero. In this case, the central bank has no choice but to abandon the fixed exchange rate and let the peso depreciate.

This fact raises the possibility of a speculative attack—a change in investors’ perceptions that makes the fixed exchange rate untenable. Suppose that, for no good reason, a rumor spreads that the central bank is going to abandon the exchange-rate peg. People would respond by rushing to the central bank to convert pesos into dollars before the pesos lose value. This rush would drain the central bank’s reserves and could force the central bank to abandon the peg. In this case, the rumor would prove self-fulfilling.

To avoid this possibility, some economists argue that a fixed exchange rate should be supported by a currency board, such as that used by Argentina in the 1990s. A currency board is an arrangement by which the central bank holds enough foreign currency to back each and every unit of the domestic currency. In our example, the central bank would hold one U.S. dollar (or one dollar invested in a U.S. government bond) for every peso. No matter how many pesos turned up at the central bank to be exchanged, the central bank would never run out of dollars. Despite this fact, countries with currency boards still suffer from speculative attacks. The reason is that, when previously circulating pesos are turned in for foreign exchange, the country’s money supply is automatically reduced. With a severe attack, this development can recess the domestic economy so much that the government loses the political will to maintain the currency board. This is what speculators are testing when a run against such a country’s currency occurs.

To avoid any possibility of a speculative attack, once a central bank has decided to adopt a currency board, it might just as well consider the natural next step: it can abandon the peso altogether and let its country use the U.S. dollar. Such a plan is called dollarization. It happens on its own in high-inflation economies, where foreign currencies offer a more reliable store of value than the domestic currency. But it can also occur as a matter of public policy, as in Panama. If a country really wants its currency to be irrevocably fixed to the dollar, the most reliable method is to make its currency the dollar. The only loss from dollarization is the seigniorage revenue that a government gives up by relinquishing its control over the printing press. The U.S. government then gets the revenue generated by growth in the money supply.5

The Impossible Trinity

408

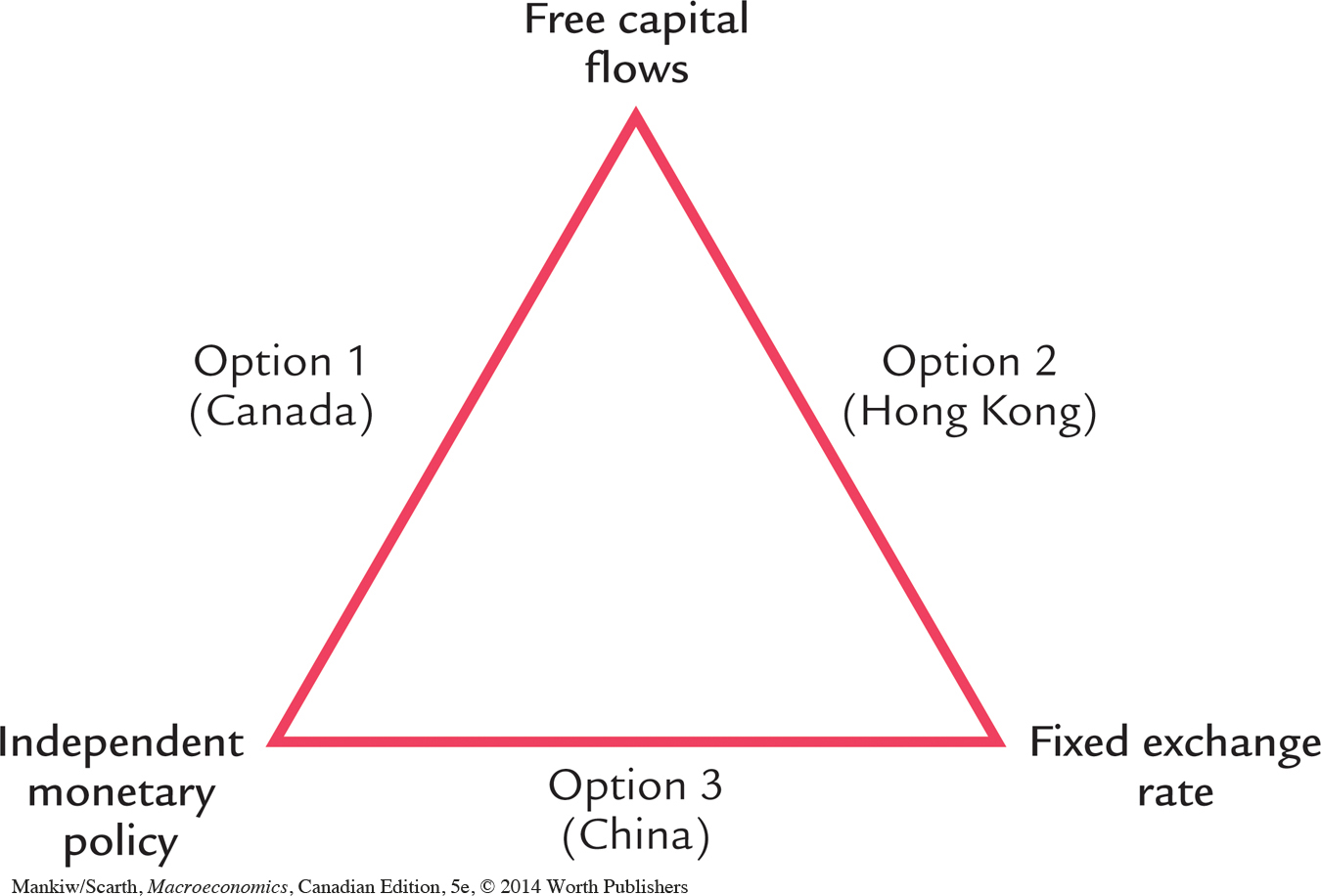

The analysis of exchange-rate regimes leads to a simple conclusion: you can’t have it all. To be more precise, it is impossible for a nation to have free capital flows, a fixed exchange rate, and independent monetary policy. This fact, often called the impossible trinity, is illustrated in Figure 12-15. A nation must choose one side of this triangle, giving up the institutional feature at the opposite corner.

The first option is to allow free flows of capital and to conduct an independent monetary policy, as Canada has done since 1970. In this case, it is impossible to have a fixed exchange rate. Instead, the exchange rate must float to equilibrate the market for foreign-currency exchange.

409

The second option is to allow free flows of capital and to fix the exchange rate, as Hong Kong has done in recent years. In this case, the nation loses the ability to run an independent monetary policy. The money supply must adjust to keep the exchange rate at its predetermined level. In effect, when a nation fixes its currency to that of another nation, it is adopting that other nation’s monetary policy.

The third option is to restrict the international flow of capital in and out the country, as China has done in recent years. In this case, the interest rate is no longer fixed by world interest rates but is determined by domestic forces, much as is the case in a completely closed economy. In this case, it is possible to both fix the exchange rate and conduct an independent monetary policy.

History has shown that nations can, and do, choose different sides of the trinity. Every nation must ask itself the following question: does it want to live with exchange-rate volatility (option one), does it want to give up the use of monetary policy for purposes of domestic stabilization (option two), or does it want to restrict its citizens from participating in world financial markets (option three)? The impossible trinity says that no nation can avoid making one of these choices.

CASE STUDY

The Chinese Currency Controversy

From 1995 to 2005 the Chinese currency, the yuan, was pegged to the U.S. dollar at an exchange rate of 8.28 yuan per U.S. dollar. In other words, the Chinese central bank stood ready to buy and sell yuan at this price. This policy of fixing the exchange rate was combined with a policy of restricting international capital flows. Chinese citizens were not allowed to convert their savings into dollars or euros and invest abroad.

Many observers believed that, by the early 2000s, the yuan was significantly undervalued. They suggested that if the yuan were allowed to float, it would increase in value relative to the U.S. dollar. The evidence in favour of this hypothesis was that China was accumulating large dollar reserves in its efforts to maintain the fixed exchange rate. That is, the Chinese central bank had to supply yuan and demand dollars in foreign-exchange markets to keep the yuan at the pegged level. If this intervention in the currency market ceased, the yuan would rise in value compared to the dollar.

The pegged yuan became a contentious political issue in the United States. U.S. producers that competed against Chinese imports complained that the undervalued yuan made Chinese goods cheaper, putting the U.S. producers at a disadvantage. (Of course, U.S. consumers benefited from inexpensive imports, but in the politics of international trade, producers usually shout louder than consumers.) In response to these concerns, President George W. Bush called on China to let its currency float. Several senators proposed a more drastic step—a steep tariff on Chinese imports until China adjusted the value of its currency.

China no longer completely fixes its exchange rate. In July 2005, China announced that it would move in the direction of a floating exchange rate, and today it no longer completely fixes the yuan’s exchange rate. Under the new policy, it still intervenes in foreign-exchange markets to prevent large and sudden movements in the exchange rate, but it does allow gradual changes. Moreover, it judges the value of the yuan not just relative to the dollar but relative to a broad basket of currencies. By October 2011, the exchange rate had moved to 6.38 yuan per dollar—a 30 percent appreciation of the yuan. Despite this large change in the exchange rate, China’s critics including President Obama, continue to complain about that nation’s intervention in foreign-exchange markets.