568

APPENDIX

Estimating the Benefits of Deficit and Debt Reduction

As noted in this chapter, deficit and debt reduction is motivated by a desire to increase living standards for future generations. No specific answer can be given, concerning how much to pursue this policy, because many people have different views concerning what amount of redistribution across generations is appropriate. But debate on this topic can be more constructive if all persons involved have some feel for the magnitude of the effect on future living standards.

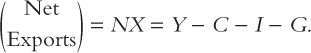

We can provide an answer to this question by recalling a key relationship from our analysis of a small open economy in Chapter 5. We learned there that a country’s net exports equal the excess of the country’s output over total spending. That is,

Now let us note how each of the terms in this equation is determined. First, long-run equilibrium implies that the level of a country’s international indebtedness be a constant proportion of its GDP. If we define Z as the quantity of bonds sold to foreigners, then the foreign debt–GDP ratio is Z/Y. If this ratio is constant, ΔZ/Z = ΔY/Y. Denoting the output growth rate by n, this constant-ratio requirement is satisfied when

ΔZ = nZ.

The country’s debt increases each period by ΔZ and this debt must rise whenever the trade surplus, NX, earns less foreign exchange than is necessary to cover the existing interest obligations to foreigners, rZ. That is,

ΔZ = rZ = NX.

Combining this definition of debt growth with long-run equilibrium requirement that the debt–GDP ratio be constant yields

NX = (r – n)Z.

This expression for net exports can be substituted into the left side of the GDP identity above. Now we present expressions for the terms on the right side of that identity.

We take consumption to be proportional to disposable income:

C = a(Y + rB – T – rZ),

where B is the outstanding stock of government bonds. Disposable income is pre-tax factor earnings plus interest payment receipts from the domestic government debt minus taxes and interest payment obligations to foreigners.

569

The government budget deficit, D, is

D = G + rB – T.

Using this equation to replace the transfer payments less taxes term, rB – T, in the consumption function, we have

C = a(Y + D – G – rZ).

Finally, investment is a function of the interest rate:

Investment = I(r).

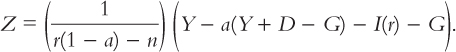

All these relationships can be combined to yield

(r – n)Z = Y – a(Y + D – G – rZ) – I(r) – G

or

This expression for foreign debt obligations can be used to estimate the effects of deficit reduction on domestic living standards. For simplicity, and to ensure that our calculation underestimates the full benefits of deficit reduction, we assume that lower debt does not decrease the risk premium demanded by foreign lenders.9 With no change in the interest rate premium, the interest rate is exogenous for a small open economy. This fact means that investment spending is not affected by deficit reduction. Also, since the marginal product of capital equals the interest rate in long-run equilibrium, the quantity of capital and overall real GDP must be independent of deficit reduction as well.

But even though GDP for a small open economy is unaffected by deficit reduction in the long run, GNP is affected. GNP equals GDP minus interest payments to foreigners, so we can estimate the benefits of deficit reduction by calculating how much a lower deficit reduces our debt to foreigners.

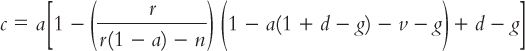

As just noted, GNP represents the level of domestic income, Y – rZ. We substitute the expression for Z into this definition. We divide the resulting equation and the consumption function through by Y and use lowercase letters to denote ratios to GDP: d = D/Y, g = G/Y, v = I/Y, and c = C/Y. The result is

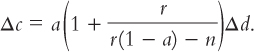

We assume that deficit reduction is accomplished through variations in taxes and transfer payments, so that, as a proportion of the economy, the size of government is constant (Δg = 0). Given this assumption, and the fact that the interest rate is exogenous for a small open economy (so that Δv = 0), this equation implies the following relationship when written in change form:

570

Representative parameter values for the marginal propensity to consume, the average growth rate, and the yield earned by foreigners on stocks and bonds in Canada at the time when the deficit reduction program was initiated were a = 0.9, n = 0.05, and r = 0.08. Given recent fiscal policy, an interesting reduction in the deficit ratio is 5 percentage points so Δd = –.05 is representative. Substituting these values into the last equation indicates that consumption can be expected to rise by 3.2 percentage points of GDP. The fact that this is such a large increase in living standards is the reason why some individuals have been so passionate about deficit and debt reduction.10 But while this estimated benefit is large, it is not quite as big as the estimated reduction in the growth of average living standards that will accompany the aging of the baby boom generation (as discussed in the first case study in this chapter). This is why our government has made a formal commitment to achieve significant debt reduction by 2015—before the aging problem is fully upon us.