19.1 Money Supply

Chapter 4 introduced the concept of “money supply’’ in a highly simplified manner. In that chapter we defined the quantity of money as the number of dollars held by the public, and we assumed that the Bank of Canada controls the supply of money by increasing or decreasing the number of dollars in circulation through open-market operations. Although this explanation is a good first approximation, it is incomplete, for it omits the role of the banking system in determining the money supply. We now present a more complete explanation.

634

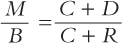

In this section we see that the money supply is determined not only by Bank of Canada policy, but also by the behaviour of households that hold money and of banks in which money is held. We begin by recalling that the money supply includes both currency in the hands of the public and deposits at banks that households can use on demand for transactions. That is, letting M denote the money supply, C currency, and D deposits, we can write

Money Supply = Currency + Deposits

M = C + D.

To understand the money supply, we must understand the interaction between currency and deposits and how Bank of Canada policy influences these two components of the money supply.

100-Percent-Reserve Banking

We begin by imagining a world without banks. In such a world, all money takes the form of currency, and the quantity of money is simply the amount of currency that the public holds. For this discussion, suppose that there is $1,000 of currency in the economy.

Now introduce banks. At first, suppose that banks accept deposits but do not make loans. The only purpose of the banks is to provide a safe place for depositors to keep their money.

The deposits that banks have received but have not lent out are called reserves. Some reserves are held in the vaults of local banks throughout the country, but most are held at a central bank, such as the Bank of Canada. In our hypothetical economy, all deposits are held as reserves: banks simply accept deposits, place the money in reserve, and leave the money there until the depositor makes a withdrawal or writes a cheque against the balance. This system is called 100-percent-reserve banking.

Suppose that households deposit the economy’s entire $1,000 in Firstbank. Firstbank’s balance sheet—its accounting statement of assets and liabilities—looks like this:

| Assets | Liabilities | ||

| Reserves | 1,000 | Deposits | 1,000 |

The bank’s assets are the $1,000 it holds as reserves; the bank’s liabilities are the $1,000 it owes to depositors. Unlike banks in our economy, this bank is not making loans, so it will not earn profit from its assets. The bank presumably charges depositors a small fee to cover its costs.

What is the money supply in this economy? Before the creation of Firstbank, the money supply was the $1,000 of currency. After the creation of Firstbank, the money supply is the $1,000 of deposits. A dollar deposited in a bank reduces currency by $1 and raises deposits by $1, so the money supply remains the same. If banks hold 100 percent of deposits in reserve, the banking system does not affect the supply of money.

Fractional-Reserve Banking

635

Now imagine that banks start to use some of their deposits to make loans—for example, to families who are buying houses or to firms that are investing in new plants and equipment. The advantage to banks is that they can charge interest on the loans. The banks must keep some reserves on hand so that reserves are available whenever depositors want to make withdrawals. But as long as the amount of new deposits approximately equals the amount of withdrawals, a bank need not keep all its deposits in reserve. Thus, bankers have an incentive to make loans. When they do so, we have fractional-reserve banking, a system under which banks keep only a fraction of their deposits in reserve.

Here is Firstbank’s balance sheet after it makes a loan:

| Assets | Liabilities | ||

| Reserves | $200 | Deposits | $1,000 |

| Loans | $800 | ||

This balance sheet assumes that the reserve–deposit ratio—the fraction of deposits kept in reserve—is 20 percent. Firstbank keeps $200 of the $1,000 in deposits in reserve and lends out the remaining $800.

Notice that Firstbank increases the supply of money by $800 when it makes this loan. Before the loan is made, the money supply is $1,000, equaling the deposits in Firstbank. After the loan is made, the money supply is $1,800: the depositor still has a deposit of $1,000, but now the borrower holds $800 in currency. Thus, in a system of fractional-reserve banking, banks create money.

The creation of money does not stop with Firstbank. If the borrower deposits the $800 in another bank (or if the borrower uses the $800 to pay someone who then deposits it), the process of money creation continues. Here is the balance sheet of Secondbank:

| Assets | Liabilities | ||

| Reserves | $160 | Deposits | $800 |

| Loans | $640 | ||

Secondbank receives the $800 in deposits, keeps 20 percent, or $160, in reserve, and then lends out $640. Thus, Secondbank creates $640 of money. If this $640 is eventually deposited in Thirdbank, this bank keeps 20 percent, or $128, in reserve and lends out $512, resulting in this balance sheet:

636

| Assets | Liabilities | ||

| Reserves | $128 | Deposits | $640 |

| Loans | $512 | ||

The process goes on and on. With each deposit and loan, more money is created.

Although this process of money creation can continue forever, it does not create an infinite amount of money. Letting rr denote the reserve–deposit ratio, the amount of money that the original $1,000 creates is

| Original Deposit | = $1,000 |

| Firstbank Lending | = (1 – rr) × $1,000 |

| Secondbank Lending | = (1 – rr)2 × $1,000 |

| Third Lending | = (1 – rr)3 × $1,000 |

| . | |

| . | |

| . | |

| Total Money Supply | = [1 + (1 – rr) + (1 – rr)2 + (1 – rr)3 + . . . ] × $1,000 |

| = (1/rr) × $1,000 |

Each $1 of reserves generates $(1/rr) of money. In our example, rr = 0.2, so the original $1,000 generates $5,000 of money.1

The banking system’s ability to create money is the primary difference between banks and other financial institutions. As we first discussed in Chapter 3, financial markets have the important function of transferring the economy’s resources from those households that wish to save some of their income for the future to those households and firms that wish to borrow to buy investment goods to be used in future production. The process of transferring funds from savers to borrowers is called financial intermediation. Many institutions in the economy act as financial intermediaries: the most prominent examples are the stock market, the bond market, mortgage loan companies, credit unions, trust companies, and the banking system. For simplicity, we focus in this chapter on just the chartered banks.

Note that although the system of fractional-reserve banking creates money, it does not create wealth. When a bank loans out some of its reserves, it gives borrowers the ability to make transactions and therefore increases the supply of money. The borrowers are also undertaking a debt obligation to the bank, however, so the loan does not make them wealthier. In other words, the creation of money by the banking system increases the economy’s liquidity, not its wealth.

A Model of the Money Supply

637

Now that we have seen how banks create money, let’s examine in more detail what determines the money supply. Here we present a model of the money supply under fractional-reserve banking. The model has three exogenous variables:

The monetary base B is the total number of dollars held by the public as currency C and by the banks as reserves R. It can be directly controlled by the Bank of Canada.

The reserve–deposit ratio rr is the fraction of deposits that banks hold in reserve. It is determined by the business policies of banks and, for many years, by the laws regulating banks. By mid-1994 the phasing out of reserve requirement laws was complete, and Canadian banks were no longer subject to any minimum reserve requirement.

The currency–deposit ratio cr is the amount of currency C people hold as a fraction of their holdings of deposits D. It reflects the preferences of households about the form of money they wish to hold.

Our model shows how the money supply depends on the monetary base, the reserve–deposit ratio, and the currency–deposit ratio. It allows us to examine how Bank of Canada policy and the choices of banks and households influence the money supply.

We begin with the definitions of the money supply and the monetary base:

M = C + D,

B = C + R.

The first equation states that the money supply is the sum of currency and deposits. The second equation states that the monetary base is the sum of currency and bank reserves. To solve for the money supply as a function of the three exogenous variables (B, rr, and cr), we begin by dividing the first equation by the second to obtain

Then divide both the top and bottom of the expression on the right by D.

Note that C/D is the currency–deposit ratio cr, and that R/D is the reserve–deposit ratio rr. Making these substitutions, and bringing the B from the left to the right side of the equation, we obtain

638

This equation shows how the money supply depends on the three exogenous variables.

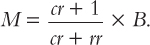

We can now see that the money supply is proportional to the monetary base. The factor of proportionality, (cr + 1)/(cr + rr), is denoted m and is called the money multiplier. We can write

M = m × B.

Each dollar of the monetary base produces m dollars of money. Because the monetary base has a multiplied effect on the money supply, the monetary base is sometimes called high-powered money.

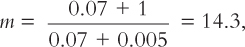

Here’s a numerical example that approximately describes the Canadian economy in 2008 if M2 is taken as the measure of the money supply. Suppose that the monetary base B is $50 billion, the reserve–deposit ratio rr is 0.005, and the currency–deposit ratio cr is 0.07. In this case, the money multiplier is

and the money supply is

M = 14.3 × $50 billion = $715 billion.

Each dollar of the monetary base generates 14.3 dollars of money, so the total M2 money supply is $715 billion.

We can now see how changes in the three exogenous variables—B, rr, and cr—cause the money supply to change.

The money supply is proportional to the monetary base. Thus, an increase in the monetary base increases the money supply by the same percentage.

The lower the reserve–deposit ratio, the more loans banks make, and the more money banks create from every dollar of reserves. Thus, a decrease in the reserve–deposit ratio raises the money multiplier and the money supply.

The lower the currency–deposit ratio, the fewer dollars of the monetary base the public holds as currency, the more base dollars banks hold as reserves, and the more money banks can create. Thus, a decrease in the currency–deposit ratio raises the money multiplier and the money supply.

This stark summary of the model makes it sound as if central bankers can control the value of the money supply rather precisely. In fact, they cannot, for two reasons. First, officials at the Bank of Canada do not know what reserve–deposit ratio will be chosen by the chartered banks. Years ago, chartered banks were forced by law to hold enough reserves to satisfy the reserve-requirement laws. Banks cannot make large profits if they hold too many low-yielding reserves, however; so they tended to satisfy the reserve-requirement laws by holding the very minimum possible. As a result, the reserve–deposit ratio was predictable after all. For many years now, there have been no minimum reserve-requirement laws. These regulations were removed when the chartered banks argued that it was unfair to have them subject to such regulations when their competitors (for example, trust companies) were not so constrained. The net result is that the reserve–deposit ratio is now less predictable. Given the formula that we have just developed, the money supply is somewhat unpredictable as well—even though the Bank of Canada can set the monetary base quite accurately to a specifically chosen value. The second reason the money supply is hard to set is that the other component of the multiplier—the public’s currency—deposit ratio—is a matter of choice (and therefore beyond the direct control of Bank of Canada officials).

639

Despite the imprecision in our ability to apply the money-supply model, we can use it as a guide to discuss the ways in which the Bank of Canada influences the money supply.

The Instruments of Monetary Policy

In previous chapters we made the simplifying assumption that the Bank of Canada controls the money supply directly. In fact, the Bank of Canada controls the money supply indirectly by altering the monetary base. To do this, the Bank of Canada has at its disposal two instruments of monetary policy: open-market operations and deposit-switching.

Open-market operations are the purchases and sales of federal government bonds by the Bank of Canada. When the Bank of Canada buys bonds from the public, the dollars it pays for the bonds increase the monetary base and thereby increase the money supply. When the Bank of Canada sells bonds to the public, the dollars it receives reduce the monetary base and thus decrease the money supply.

Open-market operations are also carried out in the foreign exchange market. To fix the exchange rate, and even just to limit what exchange-rate changes are occurring, the Bank of Canada can enter the foreign exchange market. To keep the Canadian dollar high when the market pressure is pushing it down, the Bank buys lots of Canadian dollars. This is done by selling some of Canada’s foreign exchange reserves, which are held by the Bank of Canada. Since the Canadian dollars bought by the Bank are no longer in private use, the monetary base is reduced. Similarly, to keep the Canadian dollar from rising in value, the Bank sells lots of Canadian dollars.The Bank does this by using the currency to purchase foreign exchange (thus building up the country’s foreign exchange reserves). The new currency that is used to pay for the foreign exchange forms part of the domestic monetary base. As a result, buying foreign exchange causes a multiple expansion in the money supply, just like an open-market purchase of bonds does.

Understanding the mechanics behind these open-market operations is fundamental to having an informed opinion about the plausibility of a small country like Canada having a monetary policy that is independent from that of the United States. If a completely floating exchange-rate policy is chosen, the Bank of Canada is under no obligation to make any trades in the foreign exchange market. Thus, open-market operations can be confined to the domestic bond market, and they can be initiated only when domestic monetary policy objectives call for action. If a fixed-exchange-rate policy is chosen, however, the Bank of Canada gets to decide neither the timing nor the magnitude of its open-market operations. These decisions are made by the private participants in the foreign exchange market, and the Bank’s role is a residual one—just issuing or withdrawing whatever quantity of domestic monetary base necessary to keep the exchange rate constant.

640

The moral of the story is this: We cannot fix both the quantity and the price of our currency. A fixed exchange rate is inconsistent with independent monetary policy. A floating exchange rate is what permits independent monetary policy.

Deposit-switching is the other method used by the Bank of Canada to alter the monetary base. The government of Canada holds large bank deposits because it receives tax payments on a daily basis. These deposits are held both at the Bank of Canada and at the various chartered banks. In terms of the security of its funds, the government does not care where these deposits are held. But from the perspective of monetary policy, the government does have a preference. To understand why, consider a switch of government deposits from the Bank of Canada to any one of the chartered banks. (This operation or its reverse is performed daily by the Bank of Canada, on behalf of the government.) The deposit switch increases chartered bank reserves and deposits on a one-for-one basis. With a fractional reserve system, we know that the chartered bank will use a good part of this increase in reserves to extend new loans. Thus, the deposit switch toward chartered banks sets in motion a multiple expansion of the money supply. Similarly, a switch of government deposits away from chartered banks depletes their reserves—inducing a contraction of loans and so a decrease in the money supply.

The Bank Rate is the interest rate that the Bank of Canada uses to determine how much it charges if it ever has to lend reserves to chartered banks. Because an increase in the Bank Rate can be interpreted as an increase in chartered bank costs, it is taken as a signal that banks will be cutting back loans and that the money supply is shrinking. Similarly, a decrease in the Bank Rate is a signal that banks can afford to expand loans and that the monetary policy is expansionary.

Although the broad outline of this interpretation is perfectly correct, it is misleading in its detail. Because Canada has only a few major banks, with branch offices all over the country, they rarely have to borrow reserves from the Bank of Canada. If one branch runs a bit short to meet its customers’ needs, reserves are just passed on from another branch, or from the “head office.” Also, chartered banks can borrow from each other on the “overnight” market. Given these facts, an increase in the Bank Rate has no direct effect on chartered bank costs.

Individuals and firms write a great many cheques every day to finance their purchases. When these cheques are cleared at the end of the day, they represent instructions for banks to transfer funds to each other (for honouring each other’s cheques). Banks make these transfers on a net basis by writing cheques to each other against their own deposit accounts at the Bank of Canada. The total of these accounts is known as the quantity of settlement balances. Banks are not allowed to end the day with a negative balance in their settlement account. The Bank of Canada uses deposit-switching to alter the overall quantity of settlement balances, and so affect the ability of charter banks to make loans.

641

It is convenient to pay attention to the changes in the Bank Rate because it represents a summary indicator of what the Bank of Canada has been doing. By following the Bank Rate, individuals can be aware of the stance of monetary policy without having to know the details of the fundamental instruments of policy—open-market operations and deposit-switching. To appreciate why, we must understand how the Bank Rate is set and how the overnight loan market operates.

The overnight lending rate is the rate at which chartered banks and other participants in the money market borrow from and lend to each other one-day funds. The Bank of Canada establishes a range—called the operating band—in which the overnight lending rate can move up or down. The Bank Rate is set at the upper limit of this band, which is half a percentage point wide.The Bank of Canada commits to lend out reserves at a rate given by the upper limit of the band, and to pay interest on the deposits of private financial institutions at the Bank at the lower limit of the band. These commitments ensure that the overnight rate stays within the band.

By changing the operating band and thus the overnight lending rate, the Bank of Canada sends a clear signal about the direction in which interest rates will be moving. On the one hand, Bank Rate changes are “trend-setting,” since it is the Bank that has announced any change in the operating band. But in another sense, Bank Rate changes follow the market. The Bank only changes the operating band (at one of the eight prespecified press-conference announcement dates each year) when it has been conducting behind-the-scenes trans-actions—deposit-switching and open-market operations—and these initiatives are what determine the change in both market yields and the overnight lending rate.

Although the two instruments—open-market operations and deposit-switching—and the summary indicator of these operations—the overnight lending rate—give the Bank of Canada substantial power to influence the money supply, the Bank cannot control the money supply perfectly. Chartered bank discretion in conducting business can cause the money supply to change. For example, banks may decide to hold more reserves than usual, and households may choose to hold more cash. Such increases in rr and cr reduce the money supply, even though the Bank of Canada might have thought the initial size of the money supply was the appropriate level for maintaining aggregate demand in the economy.

There is a frustrating irony in this sort of development. When banks and their customers get nervous about the future and rearrange their assets to have a higher proportion of cash, they raise the chances that there will actually be a recession. One of the reasons that the Bank of Canada constantly monitors financial market developments is to try to counteract events like this. The Bank tries to use open-market and deposit-switching operations in such a way that the monetary base moves in the opposite direction to the change in the money multiplier (which is caused by the changes in household and banking preferences and practices). By promising in advance to keep the overall money supply from shrinking—even when a crisis of confidence occurs and the consequent move toward cash lowers the money multiplier—the Bank of Canada makes it very unlikely that such panics will occur in the first place.

642

There is a second method of dealing with crises of confidence in financial institutions: the government can insure individuals’ deposits in banks and trust companies, a system called deposit insurance. Canada has the Canada Deposit Insurance Corporation (CDIC), which insures all deposits up to a maximum of $100,000 per customer. The idea is quite simple. If a bank or trust company extends too many risky loans and goes bankrupt as a result, customers do not lose their deposits. The general taxpayer, through the CDIC, will pay customers up to $100,000 to protect them from the company’s failure. Armed with this insurance, depositors do not have to move more into cash when they get nervous, and, as a result, the Bank of Canada has an easier job trying to keep the money supply on course.

CASE STUDY

Bank Failures, Quantitative Easing, and Deposit Insurance

As noted earlier, given Canada’s branch banking system, banks almost never go bankrupt. Some smaller trust companies, however, have failed. Indeed, there were several such failures in the late 1980s and early 1990s, and since the CDIC went beyond what was then the $60,000 limit and covered all deposits, the CDIC has run up quite a bill for taxpayers to cover. This development has sparked some controversy concerning possible reforms to the deposit insurance system. Before evaluating this controversy, however, it is instructive to consider the situation in the United States. U.S. banking is regulated at the state level, which means that there is much less branch banking. Many banks operate in only one state. This unit banking system is far more prone to bank failures. Indeed, whereas Canada had no bank failures during the Great Depression of the 1930s, there were a great many in the United States. And these failures help explain the severity of the Great Depression.

Between August 1929 and March 1933, the U.S. money supply fell 28 percent. As we discussed in Chapter 11, many economists believe that this large decline in the money supply was a primary cause of the Great Depression. But we did not discuss why the money supply fell so dramatically.

It is useful to focus individually on the three variables that determine the money supply—the monetary base, the reserve–deposit ratio, and the currency–deposit ratio—during this period. The monetary base rose by 18 percent, so the Fed was running monetary policy in the right direction. Despite this, however, the money supply fell because the money multiplier fell 38 percent. The money multiplier fell because the currency–deposit and reserve–deposit ratios both rose substantially, by 140 percent and 50 percent, respectively.

643

Most economists attribute the fall in the money multiplier to the large number of bank failures in the early 1930s. From 1930 to 1933, more than 9,000 banks suspended operations, often defaulting on their depositors. The bank failures caused the money supply to fall by altering the behaviour of both depositors and bankers.

Bank failures raised the currency–deposit ratio by reducing public confidence in the banking system. People feared that bank failures would continue, and they began to view currency as a more desirable form of money than deposits. When they withdrew their deposits, they drained the banks of reserves. The process of money creation reversed itself, as banks responded to lower reserves by reducing their outstanding balance of loans.

In addition, the bank failures raised the reserve–deposit ratio by making bankers more cautious. Having just observed many bank runs, bankers became apprehensive about operating with a small amount of reserves. They therefore increased their holdings of reserves to well above the legal minimum. Just as households responded to the banking crisis by holding more currency relative to deposits, bankers responded by holding more reserves relative to loans. Together these changes caused a large fall in the money multiplier.

Although it is easy to explain why the money supply fell, it is more difficult to decide whether to blame the Fed. One might argue that the monetary base did not fall, so the Fed should not be blamed. Critics of Fed policy during this period make two arguments. First, they claim that the Fed should have taken a more vigorous role in preventing bank failures by acting as a lender of last resort when banks needed cash during bank runs. This would have helped maintain confidence in the banking system and prevented the large fall in the money multiplier. Second, they point out that the Fed could have responded to the fall in the money multiplier by increasing the monetary base even more than it did. Either of these actions would likely have prevented such a large fall in the money supply, which in turn might have reduced the severity of the Great Depression.

The Fed was involved in a similar situation following the financial crisis and economic downturn of 2008. With the financial markets in turmoil, the Fed pursued its job as a lender of last resort with much more vigour than it did in the 1930s. It began by buying large quantities of mortgage-backed securities to restore order to the mortgage market. Later, the Fed pursued a policy of buying long-term government bonds to keep their prices up and long-term interest rates down. This policy, called quantitative easing, is a kind of open-market operation. But rather than buying short-term items as it normally does, the Fed bought longer-term and somewhat riskier securities. These open-market purchases led to a substantial increase in the monetary base (about 200 percent from 2007 to 2011). However, this huge expansion in the base did not lead to a similar increase in broader measures of the money supply. M1 increased by only 40 percent, and M2 increased by only 25 percent. As in the 1930s, and for the same reasons, these figures show that the tremendous expansion in the monetary base was accompanied by a large decline in the money multiplier

Why did banks choose to hold so much in excess reserves? Part of the reason is that banks had made many bad loans leading up to the financial crisis; when this fact became apparent, bankers tried to tighten their credit standards and make loans only to those they were confident could repay. In addition, interest rates had fallen to such low levels that making loans was not as profitable as it normally is. Banks did not lose much by leaving their financial resources idle as excess reserves.

644

Although the explosion in the monetary base did not lead to a similar explosion in the money supply, some observers fear that it still might. As the economy recovers from the economic downturn and interest rates rise to normal levels, they argue, banks will reduce their holdings of excess reserves. The Fed will need to engage in an aggressive set of open-market operations in the opposite direction, and/or it may choose to increase the interest rate it pays on reserves. Which of these “exit strategies” the Fed will use in the aftermath of the monetary base explosion is still to be determined as this book goes to press.

Like Canada, the United States now has deposit insurance, so a sudden fall in the money multiplier is much less likely today. But also like Canada, U.S. taxpayers are frustrated with how the deposit insurance system requires the general taxpayer to subsidize depositors that do not exercise care concerning where they deposit their funds. This is a classic problem that is involved with any form of insurance. In this case, insurance lowers the cost to depositors of failures, but it also raises the probability that those very failures will occur. This is because the insurance eliminates the need for depositors to assess and monitor the riskiness of financial institutions. Recent discussions in Canada have raised suggestions like following the “co-insurance” system of Great Britain. The essential feature of this reform is that there is a deductible, so that individuals lose 2 percent or 3 percent of their deposits when the institution fails. With this feature, depositors remain well protected, but they still have some incentive to avoid institutions that are obviously shaky. During the panic of the financial crisis of 2008–2009 in the United States, the authorities were not concerned about this moral hazard issue. The only change in legislation in that case was that the Federal Deposit Insurance Corporation raised the amount guaranteed from $100,000 to $250,000 per depositor.

Bank Capital, Leverage, and Capital Requirements

The model of the banking system presented in this chapter is simplified. That is not necessarily a problem; after all, all models are simplified. But it is worth drawing attention to one particular simplifying assumption.

In the bank balance sheets presented so far, a bank takes in deposits and uses those deposits to make loans or to hold reserves. Based on this discussion, you might think that it does not take any resources to open a bank, but that is not true. Starting a bank requires some capital. That is, the bank owners must start with some financial resources to get the business going. Those resources are called bank capital or, equivalently, the equity of the bank’s owners.

Here is what a more realistic balance sheet for a bank would look like:

| Assets | Liabilities and Owners’ Equity | ||

| Reserves | $200 | Deposits | $750 |

| Loans | $500 | Debt | $200 |

| Securities | $300 | Capital (owners’ equity) | $50 |

645

The bank obtains resources from its owners, who provide capital, and also by taking in deposits and issuing debt. It uses these resources in three ways. Some funds are held as reserves; some are used to make bank loans; and some are used to buy financial securities, such as government or corporate bonds. The bank allocates its resources among these asset classes, taking into account the risk and return that each offers and any regulations that restrict its choices. The reserves, loans, and securities on the left side of the balance sheet must equal, in total, the deposits, debt, and capital on the right side of the balance sheet.

This business strategy relies on a phenomenon called leverage, which is the use of borrowed money to supplement existing funds for purposes of investment. The leverage ratio is the ratio of the bank’s total assets (the left side of the balance sheet) to bank capital (the one item on the right side of the balance sheet that represents the owners’ equity). In this example, the leverage ratio is $1,000/$50, or 20. This means that for every dollar of capital that the bank owners have contributed, the bank has $20 of assets and, thus, $19 of deposits and debts.

One implication of leverage is that, in bad times, a bank can lose much of its capital very quickly. To see how, let’s continue with this numerical example. If the bank’s assets fall in value by a mere 5 percent, then the $1,000 of assets are now worth only $950. Because the depositors and debt holders have the legal right to be paid first, the value of the owners’ equity falls to zero. That is, when the leverage ratio is 20, a 5-percent fall in the value of the bank assets leads to a 100-percent fall in bank capital. The fear that bank capital may be running out, and thus that depositors may not be fully repaid, is typically what generates bank runs when there is no deposit insurance.

One of the restrictions that bank regulators put on banks is that the banks must hold sufficient capital. The goal of such a capital requirement is to ensure that banks will be able to pay off their depositors. The amount of capital required depends on the kind of assets a bank holds. If the bank holds safe assets such as government bonds, regulators require less capital than if the bank holds risky assets such as loans to borrowers whose credit is of dubious quality.

In 2008 and 2009, many U.S. banks found themselves with too little capital after they had incurred losses on mortgage loans and mortgage-backed securities. The shortage of bank capital reduced bank lending, contributing to a severe economic downturn. (This event was discussed in a Case Study in Chapter 11.) In response to this problem, the U.S. Treasury, working together with the Federal Reserve, started putting public funds into the banking system, increasing the amount of bank capital and making the U.S. taxpayer a part owner of many banks. The goal of this unusual policy was to recapitalize the banking system so bank lending could return to a more normal level.