Selling Books Online

Since the late 1990s, online booksellers have created an entirely new book distribution system on the Internet. The strength of online sellers lies in their convenience and low prices, and especially their ability to offer backlist titles and the works of less famous authors that retail stores aren’t able to carry on their shelves. Online customers are also drawn to the interactive nature of these sites, which allow readers to post their own book reviews, read those of fellow customers, and receive book recommendations based on book searches and past purchases.

The trailblazer is Amazon.com, established in 1995 by then-thirty-year-old Jeff Bezos, who left Wall Street to start a Web-based business. Bezos realized books were an untapped and ideal market for the Internet, with more than 3 million publications in print and plenty of distributors to fulfill orders. He moved to Seattle and started Amazon.com, so named because search engines like Yahoo! listed categories in alphabetical order, putting Amazon near the top of the list. In 1997, Barnes & Noble, the leading retail store bookseller, launched its own online book site, bn.com. The site’s success, however, remains dwarfed by Amazon. By 2013, Amazon.com controlled 27 percent of book sales.16

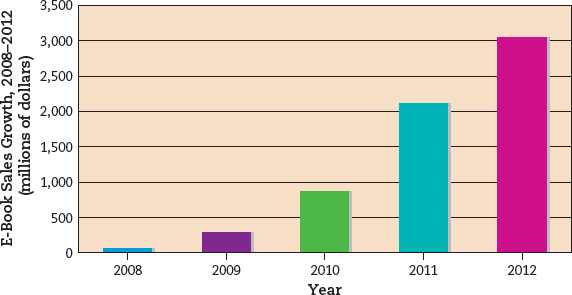

But Amazon’s bigger objective for the book industry was to transform the entire industry itself, from one based on bound paper volumes to digital files. The introduction of the Kindle in 2007 made Amazon the fastest book delivery system in the world. Instead of going to a bookstore or ordering from Amazon and waiting for the book to be delivered in a box, one could buy a book in a few seconds from the Amazon store. (See Figure 10.5 on Page 371.) Amazon quickly grew to control 90 percent of the e-book market, which it used as leverage to force book publishers to comply with their low prices or risk getting dropped from Amazon’s bookstore (something that has happened to several independent book publishers who complained).17 Amazon has done the same in print book sales, where it is also a major player.

Source: Jim Miliot, “The E-book Boom Years: The Format Moved from Sideline to Vital Category in Five Years,” Book Expo America, 2013: The Digital Spotlight, Publishers Weekly, May 2013, p. 1.

As noted earlier, Amazon’s price slashing resulted in most of the major trade book publishing corporations endorsing Apple’s agency-model pricing, in which the publishers set the book prices and the digital bookseller gets a 30-percent commission. The new agency pricing system for e-books began in 2011; by 2013, Amazon’s share of the e-book market dropped from about 90 percent to about 60 percent, while Barnes & Noble and Apple each held about a 25 percent market share. When the U.S. Department of Justice ruled in 2013 that Apple and the major publishers colluded to set book prices (thus denying consumers the lower prices that Amazon’s deep discounts might offer), the booksellers responded that government investigators should have been more concerned about Amazon, which has grown to be one of the most powerful players in the publishing industry. Of particular concern to publishers is that Amazon has been expanding into the field of traditional publishers with the establishment of Amazon Publishing, which has grown rapidly since 2009. With a publishing arm that can sign authors to book contracts, the Amazon store’s distribution, and millions of Kindle devices in the hands of readers, Amazon is becoming a vertically integrated company and too powerful, traditional publishers fear (see “What Amazon Owns,”).

Amazon’s biggest rivals in the digital book business are those with their own tablet devices. Apple has its iBookstore, which is available for iPads and iPhones through an app in the iTunes store. Google Play, Google’s digital media store, combines newly released and backlist books, along with the out-of-print titles that Google has been digitizing since 2004. Google also introduced its Nexus 7 tablet in 2012 to promote its store. Barnes & Noble has been less successful shoring up its flagging bricks-and-mortar bookstores with its Nook device and online store. The Kobo e-book device, introduced in 2010 by a Toronto-based company, has become the most popular e-book device in Canada and is making inroads with independent booksellers in the United States.

Independent bookstores are an increasingly rare breed in the retail book industry. But, to support independents, in 2008 the American Booksellers Association created IndieBound.org, a social network that doesn’t sell books online but encourages book discussion and emphasizes localism by advocating shopping at local independent bookstores.

WHAT AMAZON OWNS

Consider how Amazon connects to your life, then turn the page for the bigger picture.

INTERNET

- Amazon.com

- IMDb.com

- Woot.com

PUBLISHING

- Amazon Publishing

- Kindle Direct Publishing

- CreateSpace

ELECTRONICS

- Kindle

- Kindle Fire

- Kindle Dx

WEB SERVICES

- Amazon MP3 (data storage on cloud servers)

- Amazon EC2 (use of Amazon’s computers for large-scale computational tasks)

TELEVISION

- Amazon Unbox

- LOVEFiLM.com

- Amazon Instant Video

MUSIC

- Amazon MP3

CLOTHING

- Zappos.com

- MYHABIT.com

- Shopbop.com

CLOUD STORAGE

- Simple Storage Service (S3)

WHAT DOES THIS MEAN?

Amazon has grown into the most dominant Internet retailer on the planet. Amazon pioneered online ordering and fast delivery, now, it is working toward delivering digital media content instantly from its cloud servers.

- Employees. Amazon has approximately 88,400 full-time and part-time employees.1

- Revenue. Amazon’s net sales in 2012 were $61 billion.2

- e-Books. Amazon doesn’t release complete figures on Kindle sales, but Kindles were its biggest-selling item for the 2011 holiday season, with more than 1 million sold per week, and sales of Kindle e-books increased 175 percent over the previous year.3

- Publishing. Amazon runs more than six in-house publishing companies. In addition, it operates Kindle Direct Publishing (KDP), which by 2012 had more than 1,000 KDP authors who sold at least 1,000 e-book copies a month, and pays authors royalties of up to 70 percent.4

- Cloud Storage. S3 (Simple Storage Service) holds over 900 billion data objects and handles more than 500,000 transactions per second.5

- Fashion sales. Zappos.com, the largest online shoe store, was purchased by Amazon in 2009. Amazon is expanding its high-end fashion lines with Shopbop and MYHABIT.com.6

- Global. In 2012, sales outside North America accounted for 43 percent of Amazon’s revenue.7 Amazon’s global retail Web sites include those in the U.K., Germany, Japan, France, Canada, China, Italy, and Spain.

- Television. Amazon Instant Video carries more than 100,000 TV shows and movies to rent or buy. Amazon also owns LOVEFiLM, the top film subscription service in Europe.