7.4 GLOBALIZATION AND DEVELOPMENT

Sub-Saharan Africa emerged from the exploitation and dependence of the colonial era just in time to get sucked into the vortex of globalization, where small or weak countries are often left with little control over their fates.

GEOGRAPHIC INSIGHT 2

Globalization and Development: Most sub-Saharan African economies are dependent on the export of raw materials. This pattern, a legacy of the era of European colonialism, results in economic instability because prices for raw materials can vary widely from year to year. While a few countries are diversifying and industrializing, most still sell raw materials and all rely on expensive imports of food and manufactured goods.

For many centuries, sub-Saharan Africa has contributed human labor and raw materials to the global economy, but the profits from turning these human resources and raw materials into higher-value manufactured and processed products have gone to wealthier countries. Raw materials that are traded (usually to other countries) for processing or manufacturing into more valuable goods are called commodities. Sub-Saharan commodities include cotton, cacao beans, coffee, timber, palm oil, unrefined oil, gas, precious stones, and metals. The profits of commodity production are usually too low to lift poor countries out of poverty. Because many other poor countries are producing the same commodities, competition between them on the world market often drives down profits.

commodities raw materials that are traded, usually to other countries, for processing or manufacturing into more valuable goods

Commodity prices are also subject to wide fluctuations that create economic instability. This is because commodities are of more or less uniform quality and are traded as such on a global basis. For example, on the major commodities exchanges, a pound of copper may sell for U.S.$3 to $5, regardless of whether it is mined in South Africa, Chile, or Papua New Guinea. Because of the global scale of commodity trading, a change anywhere in the world that influences the supply or demand for a particular commodity can cause immediate instability in the pricing of that commodity. For example, an earthquake in Chile could damage a major copper mine, restricting the supply of copper and sending up the price on world markets. In response, governments that make money from sales of raw copper may overestimate their future revenues and commit to expensive infrastructure projects. But the demand for copper can be decreased for many reasons; for example, innovations in the construction industry can reduce the use of copper in wiring and plumbing, resulting in a rapid drop in the price of copper on world markets. Governments that depend on revenues from copper may suddenly need to halt infrastructure projects and cut essential services such as electricity, road maintenance, or health care.

Since 2000, there has been a noticeable shift in many African countries away from reliance on just one or two commodities. Nearly all have diversified to some extent, a trend that is discussed in the section “The Current Era of Diverse Globalization”.

Successive Eras of Globalization

Successive eras of globalization have transformed Africa over the past several centuries. They include the era of colonial exploitation; the transition from colonial status to political independence; and the current era, in which some African countries are moving away from a dependence—known as commodity dependence—on raw materials exports, and toward new types of economic development and regional integration.

commodity dependence economic dependence on exports of raw materials

Most early European colonial administrations in Africa (Britain, France, Germany, Belgium) evolved directly out of private resource-extracting corporations, such as the German East Africa Company. The welfare of Africans and their future development was a low priority for most colonial administrators. Education and health care for Africans were generally neglected by colonial governments, which were guided by mercantilism (see Chapter 3)—the idea that colonies existed to benefit their colonizers. Laborers and farmers were paid poorly and the colonial governments strongly discouraged any economic activities that might compete with those of Europe. African economies were thus hindered from making a transition to the more profitable manufacturing-based industries that were transforming Europe and North America.

For years, commodity dependence, widespread poverty, and the lack of internal markets for local products and services characterized all sub-Saharan African economies, with the partial exception of South Africa, the only sub-Saharan African country with a manufacturing base. Early on, profits from its commodity exports (mainly minerals) were reinvested in the manufacturing of mining and railway equipment. In the late twentieth century, South Africa developed a large service sector with particular strengths in finance and communications that support the mining and manufacturing industries. Today, with only 6 percent of sub-Saharan Africa’s population, South Africa produces 30 percent of the region’s economic output.

Unfortunately, the relics of colonialism and apartheid have left most sub-Saharan countries, including South Africa, with a dual economy—one part rich and industrialized, the other below the poverty level and primarily reliant on low-wage labor and small-scale informal enterprises. By the 1940s, even though the labor of black South Africans was essential to the country’s prosperity, 84 percent of black South Africans lived at a bare subsistence level. By 2009, fifty percent of black South Africans still lived below the poverty line (compared with just 7 percent of white South Africans), and only 22 percent of black South Africans had finished high school (compared with 70 percent of white South Africans).

dual economy an economy in which the population is divided by economic disparities into two groups, one prosperous and the other near or below the poverty level

The Era of Structural Adjustment By the 1980s, most African countries remained poor and dependent on their volatile and relatively low-value commodity exports. Attempts at investing in manufacturing industries failed (discussed below); and governments struggled to make payments on the large loans taken out for these projects. Infrastructure (roads, water, and utilities) was either not built or not maintained. A breaking point came in the early 1980s, when an economic crisis swept through the region and much of the rest of the developing world, leaving most countries unable to repay their debts at all.

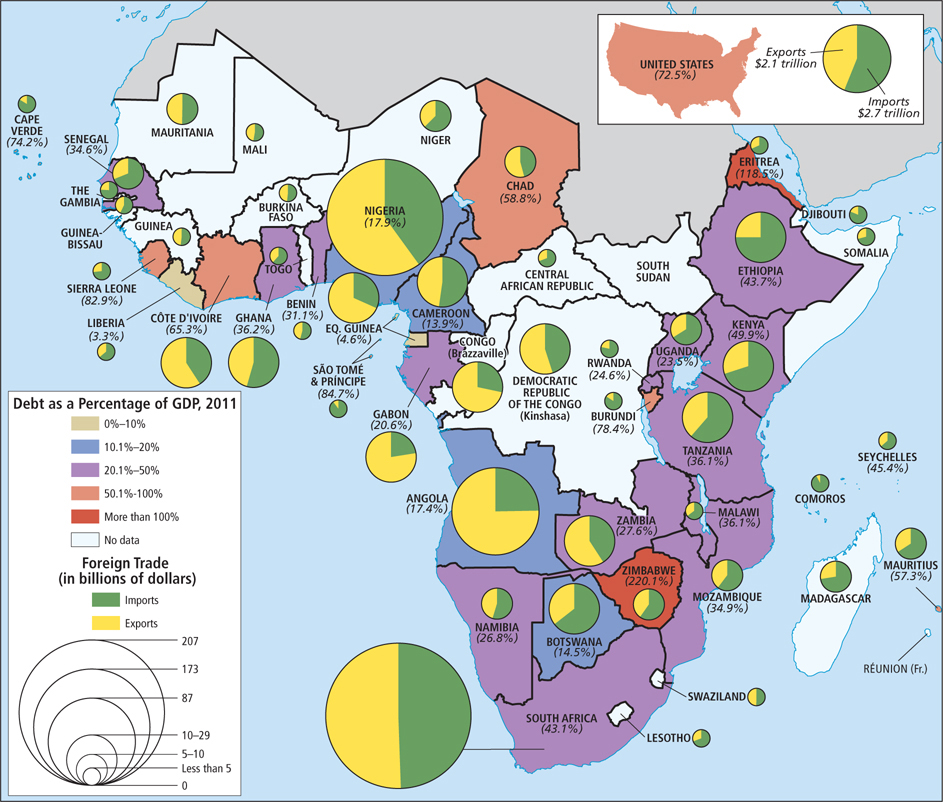

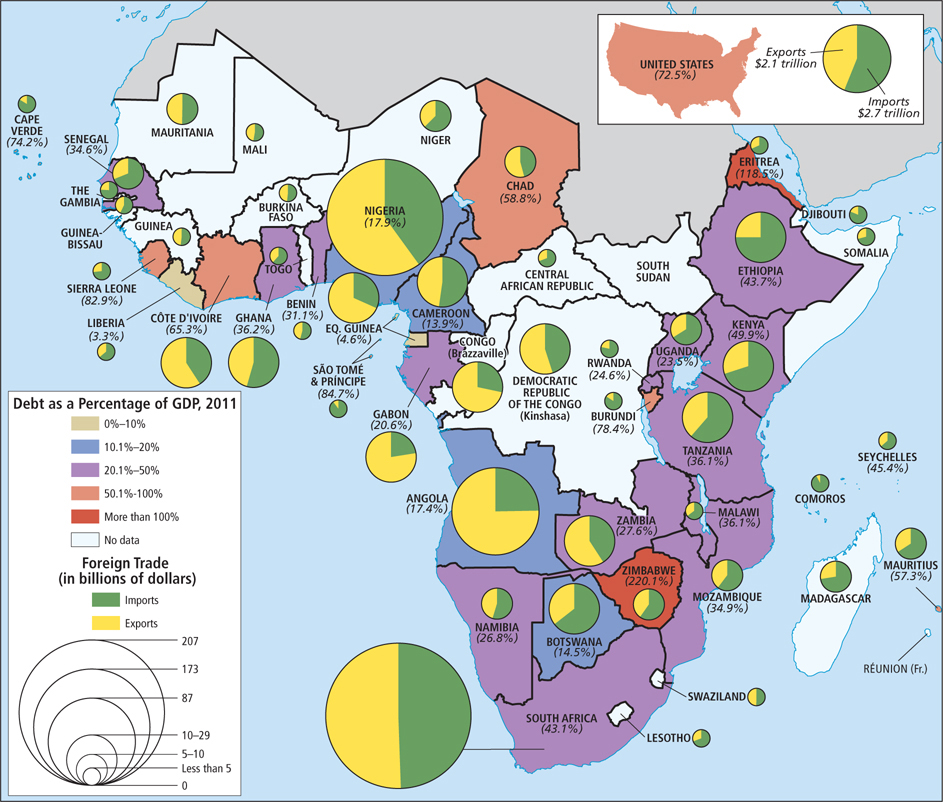

In response, the IMF and the World Bank designed structural adjustment programs (SAPs; see Chapter 3) to enforce repayment of the loans. SAPs did have some useful results. They tightened bookkeeping procedures and thereby curtailed corruption and waste in bureaucracies. They closed some corrupt state-owned industrial and service monopolies, opened some sectors of the economy to medium- and small-scale business entrepreneurs, and made tax collection more efficient. But overall, SAPs had many unintended consequences and failed at their primary objective—reducing debt (Figure 7.16).

Figure 7.16: Economic issues: Public debt, imports, and exports. Public debt is increasing across Africa, partly as a result of borrowing to fund development projects; but the U.S. public debt (see inset) far exceeds that of most sub-Saharan countries. In all but ten of the countries in sub-Saharan Africa, imports exceed exports. These ten are Angola, Chad, Democratic Republic of the Congo (indicated in the text as Congo [Kinshasa]), Republic of Congo (indicated in the text as Congo [Brazzaville]), Equatorial Guinea, Gabon, Nigeria, South Africa, Zambia, and Côte d’Ivoire. Minerals (copper and cobalt) are the main export earners for Zambia; cocoa, coffee, and timber for Côte d’Ivoire; and the export earnings of the other eight are from oil and petroleum products.

[Sources consulted: World Fact Book 2012: Africa: South Africa, Central Intelligence Agency, at https://www.cia.gov/library/publications/the-world-factbook/geos/sf.html]

To facilitate loan repayment, SAPs required governments to sell off inefficient government-owned enterprises, often at bargain-basement prices. In addition, government jobs in social services, education, health, and agricultural programs were slashed so that tax revenues could be devoted to loan repayment. If countries refused to implement SAP requirements, the international banks cut off any future lending for economic development.

As unemployment rose, so did political instability. The deteriorating infrastructure reduced the quality of the remaining social services, transportation, and financial services, which scared away potential investors. SAPs also reduced food security because agricultural resources were shifted toward the production of cash crops for export. Between 1961 and 2009, per capita food production in sub-Saharan Africa actually decreased by 14 percent, making it the only region on Earth where people were not eating as well as they had in the past (see Figure 1.18).

Informal Economies to the Rescue Ultimately, Africa’s informal eco n omies provided relief from the hardships created by SAPs. Informal economies in Africa are ancient and varied, providing employment and useful services and products. People grow and sell garden produce, prepare food, vend a wide array of products on the street, sell time cards (or credits) for mobile phones, make craft items and utensils, or do child and elder care. Others in the informal economy, however, earn a living at sex work, distilling liquor, or smuggling scarce or illegal items, including drugs, weapons, endangered animals, bushmeat, and ivory. Because most of these activities take place “under the radar,” informal jobs may involve criminal acts, wildly unsafe activities, and hazardous substances.

In most African cities, the role of the informal economy has grown from one-third of all employment to more than two-thirds. Such jobs are a godsend to the poor, but they create problems for governments because the informal economy typically goes untaxed, so less money is available to pay for government services or to repay debts. Moreover, as the informal sector grows, profits have declined as more people compete to sell goods and services to those with little disposable income. And although women typically dominate informal economies, when large numbers of men lose their jobs in factories or the civil service, they may crowd into the streets and bazaars as vendors, displacing the women and young people.

In 2000, in response to the now widely recognized failures of SAPs, and the overemphasis on the power of markets to guide development, the IMF and the World Bank replaced SAPs with Poverty Reduction Strategy Programs, or PRSPs, and with Sustainable Structural Transformation (SST) strategies. These policies are similar to SAPs in that they push market-based solutions intended to reduce the role of government in the economy, but they differ in several ways. They focus on reducing poverty and diversifying economies into manufacturing, rather than on just “development” and debt repayment per se, and are generally promoting more democratic reforms. They also include the possibility that a country may have all or most of its debt “forgiven” (paid off by the IMF, the World Bank, or the African Development Bank) if the country follows the PRSP rules. Forty sub-Saharan countries had qualified for and been approved to receive debt relief as of July 2010.

The Current Era of Diverse Globalization The current wave of globalization promises a different role for Africa, and is resulting in new sources of investment that bring jobs and strengthen infrastructure. As discussed at the beginning of the chapter, one significant trend is that young African professionals at home and abroad are supporting development in a multitude of ways. Another trend is foreign direct investment (FDI) at the corporate level. While Europe and the United States are still the largest sources of investment in sub-Saharan Africa, Asia’s influence on African economies is increasing significantly, but there are potential problems involved in Asia’s role.

In recent years, China and, to a lesser extent, India have begun to view sub-Saharan Africa as a new frontier for their large and growing economies. These two countries now exert a powerful influence on the region through their demand for Africa’s export commodities, direct investment in agribusiness, mining and industry, and the sale of their manufactured goods. It is not clear whether Asian investments will ultimately prove beneficial or hurtful to sub-Saharan African economies.

Together, China and India consume about 15 percent of Africa’s exports, but their share is growing twice as fast as is that of any of Africa’s other trading partners. Improved infrastructure (roads, ports, utilities, and technology) could ultimately facilitate intra-African trade, linking countries that have never before been able to trade. China’s and India’s investment in African agriculture, undertaken to meet rising demands for food in China and India, could result in more efficient production overall through technology transfer, and thus create higher earnings for Africa and more food supplies for African internal urban markets. Overall, African food security could increase.

It is important, however, to keep an eye on the extent to which Asian investments in Africa actually benefit Africans rather than simply replicate the injustices of colonialism. For example, Chinese investments in mining and infrastructure development could have boosted local African economies by providing construction jobs for African laborers and professional design and management experience for mid-level educated Africans, but this benefit never materialized because African governments agreed to China’s demand that all work be done by Chinese companies using Chinese workers (Figure 7.17). Most controversial has been the willingness of Chinese companies to deal with brutal and corrupt local leaders, such as Liberia’s now-convicted and imprisoned Charles Taylor (diamonds and timber extraction) and Zimbabwe’s Robert Mugabe (mining), who bartered away their countries’ resources at bargain prices and used the profits to enrich themselves and to wage war against their own citizens.

Figure 7.17: China in Angola. The man on the right is one of the estimated 20,000 Chinese workers in Angola. China has given loans and aid to Angola in excess of U.S.$4 billion since 2004, and in return, China has been guaranteed a large portion of Angola’s future oil production. In addition, 70 percent of Angola’s development projects, such as building and upgrading railways, have been given to Chinese companies, most of which import workers from China.

THINKING GEOGRAPHICALLY

Question

7.15

8wtj+ED8l+d4gGaKVq3Hrgd3lAkg7umAaTG5Xo/tuYNcw6QEsKR7Xdew9EVsvZsJ9XeIa7mIyYDyCyill6b0MxjgwE1qzRaJDLMO8oulS+l0RhAvQEq72dXuPNAxTb9nq0jUIpggxvDNZMUB

The expansion of communication technology within this region would not have been possible without numerous innovations supplied by Africans. For example, in order to make service available to the very poor, prepayment credits are sold in very small units. In fact, many people now make a living selling these small credits. Other Africans have created ways to charge mobile phones in remote villages where there is no electricity, as the Malawian William Kamkwamba figured out how to do (for more on William Kamkwamba’s story, see the vignette later in this chapter).

Foreign private investment is also transforming the communications environment in ways that encourage regional economic development in Africa. The India-based cell phone company Airtel operates a borderless network that now covers 18 countries: Burkina Faso, Chad, Congo (Kinshasa), Congo (Brazzaville), Gabon, Ghana, Kenya, Madagascar, Malawi, Niger, Nigeria, Rwanda, Seychelles, Sierra Leone, Tanzania, South Sudan, Uganda, and Zambia. Airtel’s customers can make calls across the network at local rates without incurring surcharges, and recently, the company added Internet access, SMS, international roaming, and portal applications to the local rate. The border-less aspect of Airtel’s network, and others like it, is helping increase trade and interaction between African countries, which have long been goals of African regional economic development efforts.  160. SOMALILAND EXPATRIATES RETURN HOME TO HELP NATIVE LAND DEVELOP

160. SOMALILAND EXPATRIATES RETURN HOME TO HELP NATIVE LAND DEVELOP

161. AFRICAN UNION APPEALS TO DIASPORA TO AID HOMELANDS

161. AFRICAN UNION APPEALS TO DIASPORA TO AID HOMELANDS

Regional and Local Economic Development

As they create alternatives to past development strategies, many African governments have been focusing on regional economic integration similar to that of the European Union. Hoping to utilize existing talent and consumer demand for African-made products, local agencies and public and private donors are pursuing grassroots development designed to foster very basic innovation at the local level that can then be marketed across the region.

ON THE BRIGHT SIDE

Africans Investing in Africa

The role of African professionals in globalization is growing. As was noted in the opening vignette, perhaps the most dramatic sign of change for African economies is that educated Africans who are skilled in IT and other high-tech fields are staying home and starting businesses instead of migrating to richer regions. Their incomes, along with remittances (money sent to family members from Africans working and living abroad, primarily in Europe and North America), allow them and those they help support to buy mobile phones, start small businesses, fund education for children, build houses, and help the needy. Remittances are a more stable source of investment than foreign direct investment, in that they tend to come regularly from committed donors who will continue their support for years. They are also much more likely to reach poorer communities. But payments will stop if remitters lose their jobs in America or Europe.

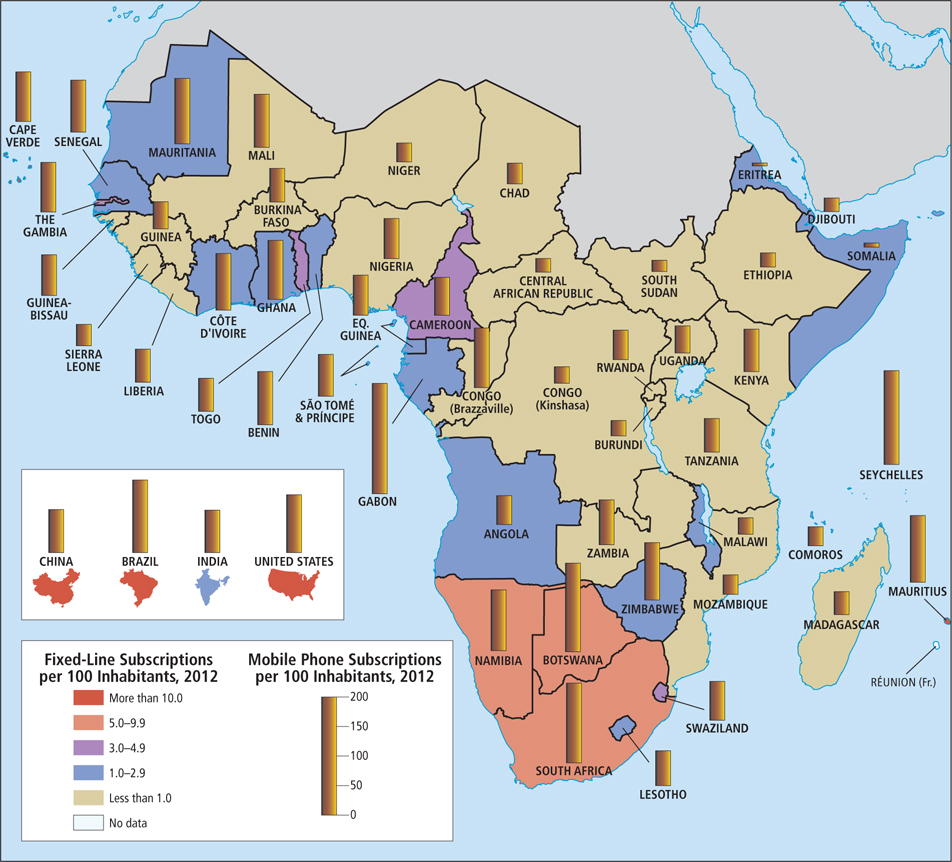

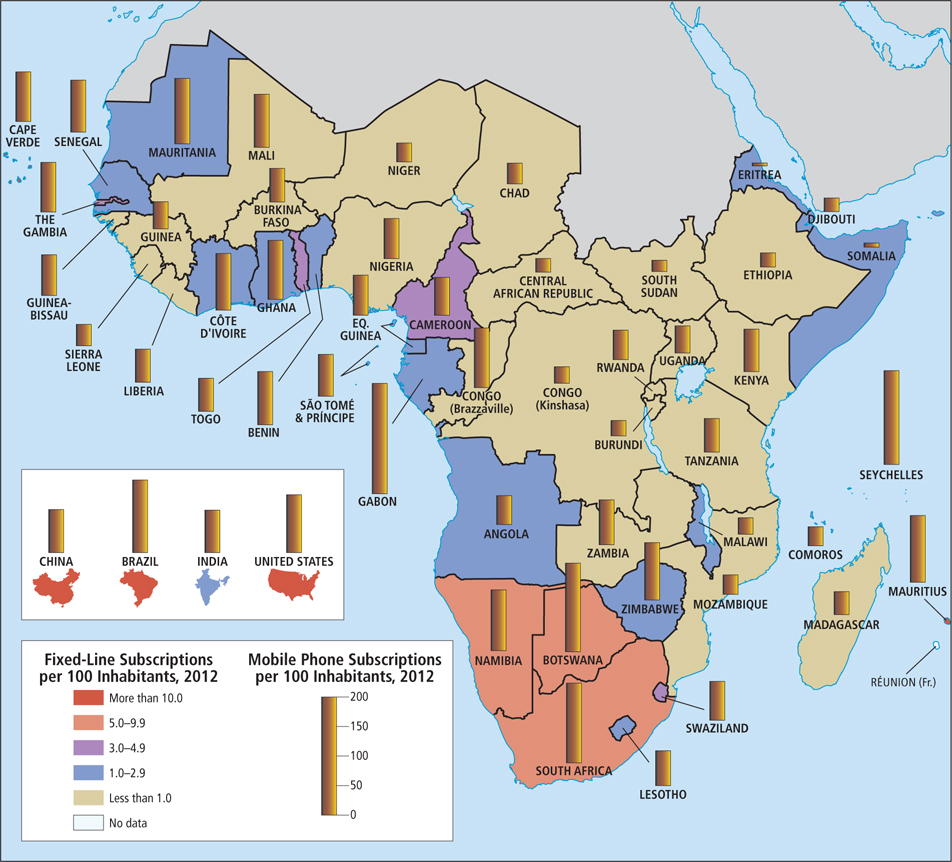

Young, educated adults are profoundly changing the trajectory of Africa’s development. They have been largely responsible for the rapid spread of mobile phones and have developed a wide array of new and important uses of cell phone technology. Figure 7.18 is a map of mobile phone subscriptions by country as of 2012. Between 1998 and 2010, mobile phone subscribers in sub-Saharan Africa increased by more than 100 times, from about 4 million to about 450 million. Google estimates that by 2016 there will be a billion mobile phones in sub-Saharan Africa, or one for every person.

Figure 7.18: Mobile phone users in sub-Saharan Africa. In the past decade, mobile phone use in sub-Saharan Africa has boomed. It is estimated that by 2016, there will be more than a billion mobile phones in the region, including in the hands of even very poor citizens, because of innovations that make it possible to buy service access in tiny amounts. One of the most popular uses of phones in Africa is to move money from one account to another.

The Potential of Regional Integration According to the World Trade Organization (WTO), less than 20 percent of the total trade of sub-Saharan Africa in 2011 was conducted between African countries. This is true partly because so many countries produce the same raw materials for export. And everywhere except South Africa, industrial capacity is so low that the raw materials cannot be absorbed within the continent, so African countries compete with each other and with all other global producers to sell to the main customers, which are currently in Europe, North America, and industrialized Asia. This failure to trade with each other can be traced to divisive colonial policies, lack of transportation and communication grids, and arcane bureaucratic regulations.

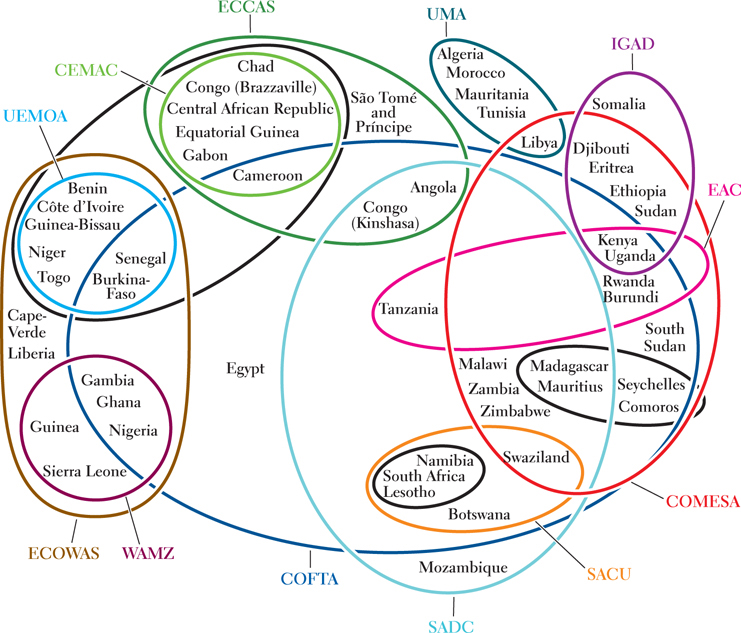

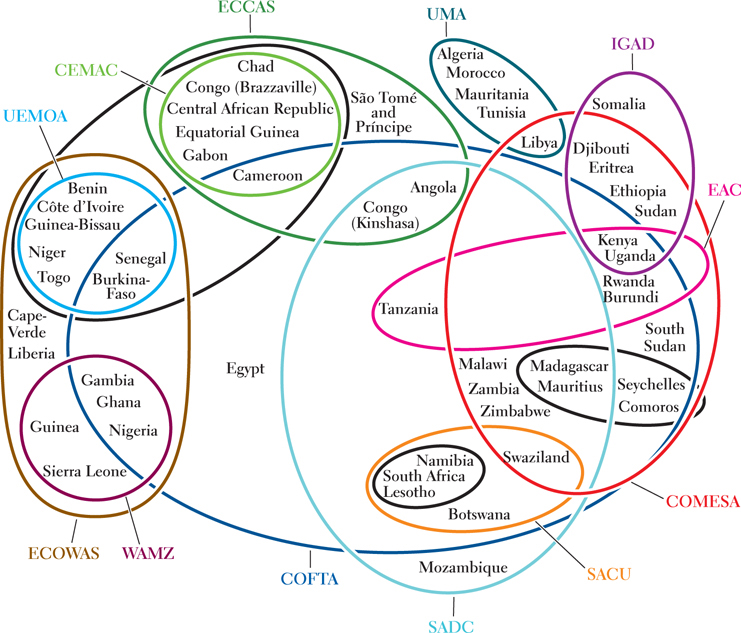

African Regional Integration Over the last several decades, regional trading blocs have been formed to encourage neighboring countries to trade with each other and cooperate in the production of manufactured (value-added) exports. The trade blocs are somewhat fluid; they form and then reorganize, as is depicted in Figure 7.19, a list and simplified map of the evolving African Regional Economic Communities (RECS). By combining the markets of several countries (as do NAFTA and the EU), regional trade blocs can create a market size sufficient to foster industrialization and entrepreneurialism. Africa’s many different regional trade blocs share several goals: reducing tariffs between members, forming common currencies, reestablishing peace in war-torn areas, cooperating to upgrade transportation and communication infrastructure, and building regional industrial capacity. Building a full-scale, continent-wide economic union along the lines of the European Union is a long-term goal. According to studies by the WTO, if sub-Saharan countries could increase trade with each other by just 1 percent, the region would show a total added income of $200 billion per year—a substantial internal contribution toward the alleviation of poverty.

Figure 7.19: Principal trade organizations in sub-Saharan Africa. There is a lot of overlap between the countries and the regional trade organizations, but often one country is dominant in each group. South Africa and Nigeria, for example, are dominant in three regional trade organizations; but in fact, South Africa uses its many well-established relationships to trade with nearly all countries in the region. Because political stability is essential to trade, some of the strongest trade organizations, such as the Economic Community of West African States (ECOWAS), have become involved in the amelioration of conflicts.

[Source consulted: UN Conference on Trade and Development, Economic Development in Africa Report 2009: Strengthening Regional Economic Integration for Africa‘s Development (New York: United Nations, 2009), p. 12, Figure 1, at http://www.unctad.org/en/docs/aldcafrica2009_en.pdf]

The goals of regional and local economic development are being boosted by the creation of value chains. These link parts of the production chain of a final product in order to maximize the regional or local economic impact. For example, farmers in Endau, Kenya, were able to increase their profits five-fold by switching from growing corn to producing sorghum after a local nongovernmental organization (NGO) negotiated a deal with a brewery in Nairobi to use the sorghum in their beer. Some farmers have used their boosted income to increase their profits further by buying milling equipment and grinding the sorghum of other local farmers into sorghum flour, which is more valuable than unprocessed sorghum. Countries and regions with strong value chains are more able to keep the profits their industries create from going elsewhere. Such value chains are one of the fastest-growing aspects of economic development worldwide.

Local Development An increasingly common strategy for improving living standards in this region is grassroots economic development. Projects using this strategy are designed to provide sustainable livelihoods in rural and urban areas, and often use simple technology that requires minimal or no investment in imported materials. One such approach is self-reliant development, which consists of small-scale self-help projects that use local skills to create products or services for local consumption. One of the most important aspects of this type of development is that control of the projects remains in local hands, so that participants retain a sense of ownership and commitment in difficult economic times. One district in Kenya has more than 500 such self-reliant groups. Most members are women who build water tanks, plant trees, and terrace land so that it can be farmed for food. They also build schools and form credit societies.

grassroots economic development economic development projects designed to provide sustainable livelihoods in rural and urban areas; these often use simple technology that requires minimal or no investment in imported materials

self-reliant development small-scale development in rural areas that is focused on developing local skills, creating local jobs, producing products or services for local consumption, and maintaining local control so that participants retain a sense of ownership over the process

Transportation Needs The issue of improving rural transportation illustrates how a focus on local African needs can generate unique solutions. When non-Africans learn that transportation facilities in Africa are in need of development, they usually imagine building and repairing roads for cars and trucks. But a recent study that analyzed village transportation on a local level found that 87 percent of the goods moved are carried via narrow footpaths on the heads of women. Women “head up” (their term) firewood from the forests, crops from the fields, and water from wells. An average adult woman spends about 1.5 hours each day moving the equivalent of 44 pounds (20 kilograms) more than 1.25 miles (2 kilometers). Unfortunately, the often-treacherous footpaths trodden by Africa’s load-bearing women have been virtually ignored by African governments and international development agencies, which tend to focus solely on roads for motorized vehicles (which are also badly needed). Grassroots-oriented nongovernmental organizations are now making far less expensive but equally necessary improvements to Africa’s footpaths. Some women have been provided with bicycles, donkeys, and even motorcycles that can travel on the footpaths. This saves time and energy for women, who can direct more of their efforts to becoming educated and generating income.

Energy Needs Africa exports oil but its own energy needs, which are currently unmet even at the most basic level of home electricity, can be addressed by local solutions, as the vignette illustrates.

VIGNETTE

In Malawi, 14-year-old William Kamkwamba was forced to drop out of school when a famine struck his country in 2001 and his family could no longer afford the $80 school fee. Depressed at the prospect of having no future, he went to a local library when he was able. There he found a book in English called Using Energy that described an electricity-generating windmill. With an old bicycle frame, tractor fan blades, PVC pipes, and scraps of wood, he built a windmill that generated enough power (stored in a car battery) to light his home, run a radio, and charge neighborhood cell phones. More elaborate energy projects followed.

Now known as “the boy who harnessed the wind,” William appeared on Jon Stewart’s Daily Show in the United States in 2009 to explain how he plans to start his own windmill company and other ventures that will bring power to remote places across Africa. He graduated from the first pan-African prep school in South Africa and now attends Dartmouth College in the United States. William’s web page is http://www.williamkamkwamba.com.

THINGS TO REMEMBER

Globalization and Development Most sub-Saharan African economies are dependent on the export of raw materials. This pattern, a legacy of the era of European colonialism, results in economic instability because prices for raw materials can vary widely from year to year. While a few countries are diversifying and industrializing, most still sell raw materials and all rely on expensive imports of food and manufactured goods.

Prospective investors in sub-Saharan Africa have been discouraged by problems that structural adjustment programs (SAPs) either ignored or worsened.

Recently, Africa has become a new frontier for Asia’s large and growing economies, especially those of China and India, which both buy and sell in sub-Saharan Africa.

Africa’s informal economies have provided some relief from the hardships created by SAPs. These economies are ancient, varied, and agile; they provide employment and useful services and products.

A major and enduring source of investment funds in Africa comes from members of the African diaspora, who send regular remittances to friends and families.

Many African governments are focusing on regional economic integration along the lines of the European Union. Grassroots economic development is also being pursued.

160. SOMALILAND EXPATRIATES RETURN HOME TO HELP NATIVE LAND DEVELOP

160. SOMALILAND EXPATRIATES RETURN HOME TO HELP NATIVE LAND DEVELOP 161. AFRICAN UNION APPEALS TO DIASPORA TO AID HOMELANDS

161. AFRICAN UNION APPEALS TO DIASPORA TO AID HOMELANDS