Kelly D. Brownell and Thomas R. Frieden, Ounces of Prevention—The Public Policy Case for Taxes on Sugared Beverages

| Kelly D. Brownell and Thomas R. Frieden | Ounces of Prevention—The Public Policy Case for Taxes on Sugared Beverages |

KELLY D. BROWNELL is a professor of psychology as well as a professor of epidemiology and public health at Yale, where he is also director of the Rudd Center for Food Policy and Obesity. An international expert who has published numerous books and articles, including Food Fight: The Inside Story of the Food Industry, America’s Obesity Crisis, and What We Can Do About It (2003), Brownell received the 2012 American Psychological Association Award for Outstanding Lifetime Contributions to Psychology. He was also featured in the Academy Award–nominated film Super Size Me.

THOMAS R. FRIEDEN, a physician specializing in public health, is the director of the U.S. Centers for Disease Control and Prevention (CDC) and served for several years as the health commissioner for the City of New York.

Brownell and Frieden’s proposal “Ounces of Prevention—The Public Policy Case for Taxes on Sugared Beverages” was originally published in 2009 in the highly respected New England Journal of Medicine, which calls itself “the most widely read, cited, and influential general medical periodical in the world.” In fact, research published there is often referred to widely throughout the media.

As you read, consider the effect that Brownell and Frieden’s use of graphs and formal citation of sources has on their credibility:

- How do the graphs help establish the seriousness of the problem? How do they also help demonstrate the feasibility of the solution the authors propose?

- How do the citations help persuade you to accept the authors’ solution? What effect might they have had on their original readers? (Note that the authors use neither of the two citation styles covered in Part 4 of this text. Instead, they use one common to medical journals and publications of the U.S. National Library of Medicine.)

Sugar, rum, and tobacco are commodities which are nowhere necessaries of life, which are become objects of almost universal consumption, and which are therefore extremely proper subjects of taxation.

—Adam Smith, The Wealth of Nations, 1776

1The obesity epidemic has inspired calls for public health measures to prevent diet-related diseases. One controversial idea is now the subject of public debate: food taxes. Forty states already have small taxes on sugared beverages and snack foods, but in the past year, Maine and New York have proposed large taxes on sugared beverages, and similar discussions have begun in other states. The size of the taxes, their potential for generating revenue and reducing consumption, and vigorous opposition by the beverage industry have resulted in substantial controversy. Because excess consumption of unhealthful foods underlies many leading causes of death, food taxes at local, state, and national levels are likely to remain part of political and public health discourse.

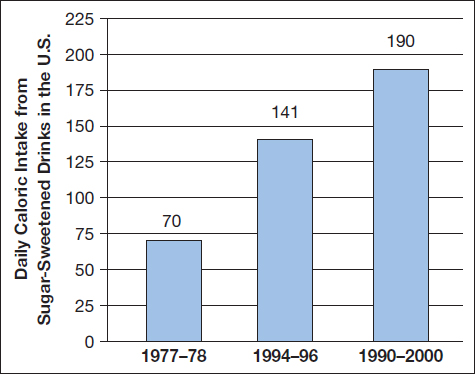

2Sugar-sweetened beverages (soda sweetened with sugar, corn syrup, or other caloric sweeteners and other carbonated and uncarbonated drinks, such as sports and energy drinks) may be the single largest driver of the obesity epidemic. A recent meta-analysis found that the intake of sugared beverages is associated with increased body weight, poor nutrition, and displacement of more healthful beverages; increasing consumption increases risk for obesity and diabetes; the strongest effects are seen in studies with the best methods (e.g., longitudinal and interventional vs. correlational studies);* and interventional studies show that reduced intake of soft drinks improves health.1 Studies that do not support a relationship between consumption of sugared beverages and health outcomes tend to be conducted by authors supported by the beverage industry.2 Sugared beverages are marketed extensively to children and adolescents, and in the mid-1990s, children’s intake of sugared beverages surpassed that of milk. In the past decade, per capita intake of calories from sugar-sweetened beverages has increased by nearly 30 percent (see bar graph Daily Caloric Intake from Sugar-Sweetened Drinks in the United States);3 beverages now account for 10 to 15 percent of the calories consumed by children and adolescents. For each extra can or glass of sugared beverage consumed per day, the likelihood of a child’s becoming obese increases by 60 percent.4

3Taxes on tobacco products have been highly effective in reducing consumption, and data indicate that higher prices also reduce soda consumption. A review conducted by Yale University’s Rudd Center for Food Policy and Obesity suggested that for every 10 percent increase in price, consumption decreases by 7.8 percent. An industry trade publication reported even larger reductions: as prices of carbonated soft drinks increased by 6.8 percent, sales dropped by 7.8 percent, and as Coca-Cola prices increased by 12 percent, sales dropped by 14.6 percent.5 Such studies—and the economic principles that support their findings—suggest that a tax on sugared beverages would encourage consumers to switch to more healthful beverages, which would lead to reduced caloric intake and less weight gain.

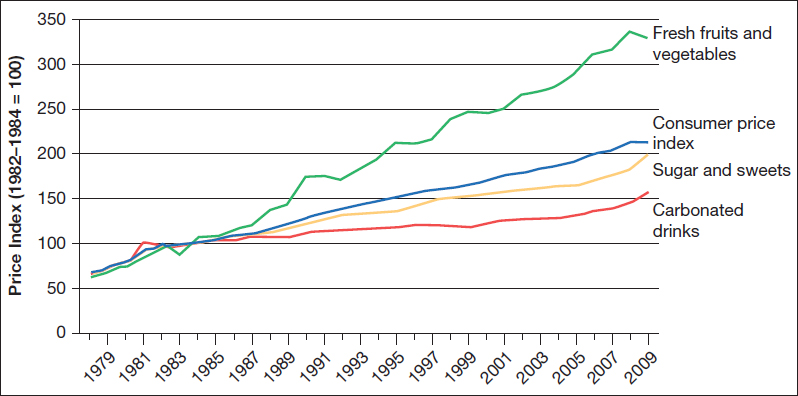

4The increasing affordability of soda—and the decreasing affordability of fresh fruits and vegetables (see line graph)—probably contributes to the rise in obesity in the United States. In 2008, a group of child and health care advocates in New York proposed a one-penny-per-ounce excise tax on sugared beverages, which would be expected to reduce consumption by 13 percent—about two servings per week per person. Even if one quarter of the calories consumed from sugared beverages are replaced by other food, the decrease in consumption would lead to an estimated reduction of 8,000 calories per person per year—slightly more than 2 pounds each year for the average person. Such a reduction in calorie consumption would be expected to substantially reduce the risk of obesity and diabetes and may also reduce the risk of heart disease and other conditions.

5Some argue that government should not interfere in the market and that products and prices will change as consumers demand more healthful food, but several considerations support government action. The first is externality—costs to parties not directly involved in a transaction. The contribution of unhealthful diets to health care costs is already high and is increasing—an estimated $79 billion is spent annually for overweight and obesity alone—and approximately half of these costs are paid by Medicare and Medicaid, at taxpayers’ expense. Diet-related diseases also cost society in terms of decreased work productivity, increased absenteeism, poorer school performance, and reduced fitness on the part of military recruits, among other negative effects. The second consideration is information asymmetry between the parties to a transaction. In the case of sugared beverages, marketers commonly make health claims (e.g., that such beverages provide energy or vitamins) and use techniques that exploit the cognitive vulnerabilities of young children, who often cannot distinguish a television program from an advertisement. A third consideration is revenue generation, which can further increase the societal benefits of a tax on soft drinks. A penny-per-ounce excise tax would raise an estimated $1.2 billion in New York State alone. In times of economic hardship, taxes that both generate this much revenue and promote health are better options than revenue initiatives that may have adverse effects.

6Objections have certainly been raised: that such a tax would be regressive, that food taxes are not comparable to tobacco or alcohol taxes because people must eat to survive, that it is unfair to single out one type of food for taxation, and that the tax will not solve the obesity problem. But the poor are disproportionately affected by diet-related diseases and would derive the greatest benefit from reduced consumption; sugared beverages are not necessary for survival; Americans consume about 250 to 300 more calories daily today than they did several decades ago, and nearly half this increase is accounted for by consumption of sugared beverages; and though no single intervention will solve the obesity problem, that is hardly a reason to take no action.

7The full impact of public policies becomes apparent only after they take effect. We can estimate changes in sugared-drink consumption that would be prompted by a tax, but accompanying changes in the consumption of other foods or beverages are more difficult to predict. One question is whether the proportions of calories consumed in liquid and solid foods would change. And shifts among beverages would have different effects depending on whether consumers substituted water, milk, diet drinks, or equivalent generic brands of sugared drinks.

8Effects will also vary depending on whether the tax is designed to reduce consumption, generate revenue, or both; the size of the tax; whether the revenue is earmarked for programs related to nutrition and health; and where in the production and distribution chain the tax is applied. Given the heavy consumption of sugared beverages, even small taxes will generate substantial revenue, but only heftier taxes will significantly reduce consumption. Sales taxes are the most common form of food tax, but because they are levied as a percentage of the retail price, they encourage the purchase of less-expensive brands or larger containers. Excise taxes structured as a fixed cost per ounce provide an incentive to buy less and hence would be much more effective in reducing consumption and improving health. In addition, manufacturers generally pass the cost of an excise tax along to their customers, including it in the price consumers see when they are making their selection, whereas sales taxes are seen only at the cash register.

9Although a tax on sugared beverages would have health benefits regardless of how the revenue was used, the popularity of such a proposal increases greatly if revenues are used for programs to prevent childhood obesity, such as media campaigns, facilities and programs for physical activity, and healthier food in schools. Poll results show that support of a tax on sugared beverages ranges from 37 to 72 percent; a poll of New York residents found that 52 percent supported a “soda tax,” but the number rose to 72 percent when respondents were told that the revenue would be used for obesity prevention. Perhaps the most defensible approach is to use revenue to subsidize the purchase of healthful foods. The public would then see a relationship between tax and benefit, and any regressive effects would be counteracted by the reduced costs of healthful food.

10A penny-per-ounce excise tax could reduce consumption of sugared beverages by more than 10 percent. It is difficult to imagine producing behavior change of this magnitude through education alone, even if government devoted massive resources to the task. In contrast, a sales tax on sugared drinks would generate considerable revenue, and as with the tax on tobacco, it could become a key tool in efforts to improve health.

References

- Vartanian LR, Schwartz MB, Brownell KD. Effects of soft drink consumption on nutrition and health: a systematic review and meta-analysis. Am J Public Health 2007;97:667–675.

- Forshee RA, Anderson PA, Storey ML. Sugar-sweetened beverages and body mass index in children and adolescents: a meta-analysis. Am J Clin Nutr 2008;87:1662–71.

- Nielsen SJ, Popkin BM. Changes in beverage intake between 1977 and 2001. Am J Prev Med 2004;27:205–210.

- Ludwig DS, Peterson KE, Gortmaker SL. Relation between consumption of sugar-sweetened drinks and childhood obesity: a prospective, observational analysis. Lancet 2001;357:505–508.

- Elasticity: big price increases cause Coke volume to plummet. Beverage Digest. November 21, 2008:3–4.

*In a longitudinal study, researchers observe changes taking place over a long period of time; in an interventional study, investigators give research subjects a measured amount of whatever is being studied and note its effects; and in a correlational study, researchers examine statistics to see if two or more variables have a mathematically significant similarity. [Editor’s note]