Railroads: America’s First Big Business

The military conquest of America’s inland empire and the dispossession of Native Americans (see chapter 17) was fed by an elaborate new railroad system in the West built on speculation and government giveaways. Between 1870 and 1880, the amount of track in the country doubled, and it nearly doubled again in the following decade. By 1900, the nation boasted more than 193,000 miles of railroad track—more than in all of Europe and Russia combined (Map 18.1). The railroads had become America’s first big business. Credit fueled the railroad boom. Privately owned but publicly financed, and subsidized by enormous land grants from the federal government and the states, the railroads epitomized the insidious nexus of business and politics in the Gilded Age.[[LP Map: M18.01 Railroad Expansion, 1870–1890 – MAP ACTIVITY/

To understand how the railroads came to dominate American life, there is no better place to start than with the career of Jay Gould, the era’s most notorious speculator. Jason “Jay” Gould bought his first railroad before he turned twenty-five. It was only sixty-two miles long, in bad repair, and on the brink of failure, but within two years he sold it at a profit of $130,000.

> CONSIDER CAUSE

AND EFFECT

How did the federal government contribute to the growth and wealth of the railroad industry in the decades following the Civil War?

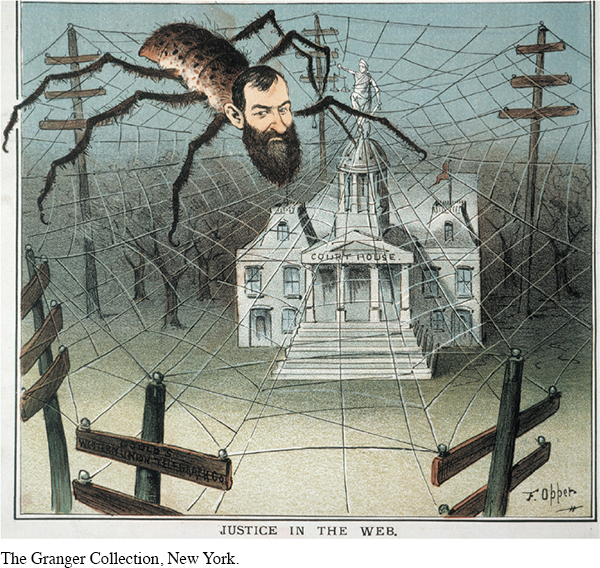

The secretive Gould operated in the stock market like a shark, looking for vulnerable railroads, buying enough stock to take control, and threatening to undercut his competitors until they bought him out at a high profit. The railroads that fell into his hands often went bankrupt. Gould’s genius lay not in providing transportation, but in cleverly buying and selling railroad stock on Wall Street. Gould soon realized that a corporate failure could still mean financial success. His strategy of expansion and consolidation encouraged overbuilding even as it stimulated a new national market.[[LP Photo: P18.02 Jay Gould as a Spider – VISUAL ACTIVITY/

The first transcontinental railway had been completed in 1869 at Promontory Point, Utah. In the 1880s, Gould moved to put together a second transcontinental railroad. To defend their interests, his competitors had little choice but to adopt his strategy of expansion. The railroads built ahead of demand, regardless of the social and environmental costs. Soon more railroads trailed into the West—by 1893, Kansas alone had at least six competing lines.

The railroad moguls put up little of their own money to build the roads and instead relied on the largesse of government and the sale of railroad bonds and stock. Bondholders were creditors who required repayment at a specific time. Stockholders bought a share in the company and received dividends if the company prospered. Thus, railroad moguls received money from these sales of financial interests but did not need to pay out until later. If the railroad failed, a receiver was appointed to determine how many pennies on the dollars shareholders would receive. The owners, astutely using the market, came out ahead. Novelist Charles Dudley Warner described how wrecking a railroad could yield profits:

[They fasten upon] some railway that is prosperous, . . . and has a surplus. They contrive to buy . . . a controlling interest in it. . . . Then they absorb its surplus; they let it run down so that it pays no dividends, and by-and-by cannot even pay its interest; then they squeeze the bondholders, who may be glad to accept anything that is offered out of the wreck, and perhaps they throw the property into the hands of a receiver, or consolidate it with some other road at a value far greater than it cost them in stealing it. Having one way or another sucked it dry, they look around for another road.

With help from railroad growth and speculation, the New York Stock Exchange expanded. The volume of stock increased sixfold between 1869 and 1901. The line between investment and speculation blurred, causing many Americans to question whether the manipulation of speculators fueled the boom and bust cycles that led to panic and depression in 1873 and again twenty years later. The dramatic growth of the railroads created the country’s first big business. Before the Civil War, even the largest textile mill in New England employed no more than 800 workers. By contrast, the Pennsylvania Railroad by the 1870s boasted a payroll of more than 55,000 workers. Capitalized at more than $400 million, the Pennsylvania Railroad constituted the largest private enterprise in the world.

The big business of railroads bestowed enormous riches on a handful of tycoons. Both Gould and his competitor “Commodore” Cornelius Vanderbilt amassed fortunes estimated at $100 million. Such staggering wealth eclipsed the power and influence of upper-class Americans from previous generations and created an abyss between the nation’s rich and poor. In its wake it left a legacy of lavish spending for an elite crop of ultrarich heirs.

The Republican Party, firmly entrenched in Washington after the Civil War, worked closely with business interests, subsidizing the transcontinental railroad system. Significant amounts of money changed hands to move bills through Congress. Along with “friends,” often on the railroads’ payrolls, lobbyists worked to craft legislation favorable to railroad interests. Friends of the railroads in state legislatures and Congress lavished the new western roads with land grants of a staggering 100 million acres (mostly owned by the Indians) and $64 million in tax incentives and direct aid. States and local communities joined the railroad boom, betting that only those towns and villages along the tracks would grow and flourish. A revolution in communication accompanied and supported the growth of the railroads. The telegraph, developed by Samuel F. B. Morse, marched across the continent alongside the railroad. By transmitting coded messages along electrical wire, the telegraph formed the “nervous system” of the new industrial order. Telegraph service quickly replaced Pony Express mail carriers in the West and transformed business by providing instantaneous communication. Again Jay Gould took the lead. In 1879, through stock manipulation, he seized control of Western Union, the company that monopolized the telegraph industry.

The railroads soon fell on hard times. Already by the 1870s, lack of planning led to overbuilding. Across the nation, railroads competed fiercely for business. Manufacturers in areas served by competing railroads could get substantially reduced shipping rates in return for promises of steady business. Because railroad owners lost money through this kind of competition, they tried to set up agreements, or “pools,” to divide up territory and set rates. But these informal gentlemen’s agreements invariably failed because men like Gould, intent on undercutting all competitors, refused to play by the rules.

The public’s alarm at the control wielded by the new railroad magnates and the tactics they employed came to light in the Crédit Moblier scandal of 1872. Crédit Mobilier, a fiscal enterprise set up by partners including Thomas Durant, an executive of Union Pacific Railroad, would provide sole bids on construction work. Using money procured from investors and government bonds, the work was then subcontracted out, leaving profits in the hands of the financiers. With profits booming, senators clambered to profit as well. Charles Dana’s New York Sun described the Crédit Mobilier money-making scheme as “The King of Frauds” and attempted to document the way the railroads controlled their friends in government with lavish gifts of stock. Although the press never got the financial dealings straight, the scandal and resulting investigation implicated the Union Pacific Railroad, the vice president, and numerous congressmen. The real revelation was how little the key players knew about how railroads were built or operated. The promoters knew little about building the roads; the investors had an even shakier grasp on what they were investing in; and the politicians who subsidized the roads, instead of overseeing them, remained vague on specifics and failed to provide governmental oversight. All that was clear was that the Union Pacific had sold stock below market prices to its friends. In the end, no one was punished and no money returned.

The Crédit Mobilier scandal increased public suspicion of the corrupt relationship between business and government and led to a strong antipathy toward speculators and a movement to end monopoly.

Understanding the American Promise 3ePrinted Page 499

Section Chronology