Chapter 1. Chapter 12 – Problem 4

Step 1

Question

An economy is initially described by the following equations:

C = 80 + 0.8(Y – T)

I = 120 –5r

M/P = Y – 25r

G = 100

T = 100

M = 2,700

P = 3

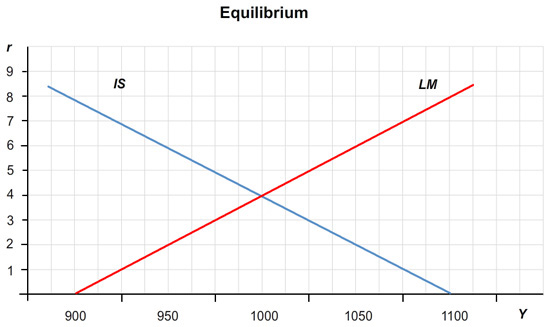

Below is the graph of the IS curve and the LM curve. Calculate the equilibrium interest rate and level of income and fill in those values below.

IS: Y = 1100 – 25r

LM: Y = 900 + 25r

The equilibrium interest rate, r, = h4XZagboIgc=%.

The equilibrium level of income, Y, = VjnJvkd43LCDGhCVeIJi3Q==.

Step 2

Question

An economy is initially described by the following equations:

C = 80 + 0.8(Y – T)

I = 120 –5r

M/P = Y – 25r

G = 100

T = 100

M = 2,700

P = 3

Suppose that a newly elected president cuts taxes by 20 percent. Assuming the money supply is held constant, what are the new equilibrium interest rate and level of income? What is the tax multiplier?

The equilibrium interest rate, r, = OPz0s/Y8/ec=%.

The equilibrium level of income, Y, = 92L3L4iFZh/3Ftx92J51Mw==.

Tax multiplier = BLWB09T71TyDwHBH.

Step 3

Question

An economy is initially described by the following equations:

C = 80 + 0.8(Y – T)

I = 120 –5r

M/P = Y – 25r

G = 100

T = 100

M = 2,700

P = 3

Now assume that the central bank adjusts the money supply to hold the interest rate constant. What is the new level of income? What must the new money supply be? What is the tax multiplier?

The equilibrium level of income, Y, = xY5+LsONVglHPD9FpcjyEg==.

Money supply, M, = qlf9/HNvHEwn/Q/zdrQYYA==.

Tax multiplier = mxfEa2F1skIZd/O4

Question

Now assume that the central bank adjusts the money supply to hold the level of income constant. What is the new equilibrium interest rate? What must the money supply be? What is the tax multiplier?

The equilibrium interest rate, r, = H+eBUSfRCrI=%.

Money supply, M, = KpMQWBR69vAMaHSkA71DKA==.

Tax multiplier = 1Wh3cvJ2xF4=