Environmental Policy

We have seen that market failure can lead to excessive amounts of products that pollute or generate other negative externalities, or to overuse of commonly owned resources that result in environmental degradation. This section puts these market failures together by looking at environmental policy. First, we look at how government policies can fail to improve such situations if the incentives of politicians and policymakers are not aligned with the public interest. Then, we look at the actual policies used by government regulators to reduce pollution, ranging from direct intervention and control to the use of various market instruments. Policymakers also occasionally use publicity and moral suasion to encourage polluters to reduce emissions voluntarily.

Government Failure

government failure The result when the incentives of politicians and government bureaucrats do not align with the public interest.

Market failure is one reason why unregulated markets may produce inequitable or inefficient results. Government policies, however, do not always make things better. The terrible environmental record the Eastern Bloc countries accumulated during the Soviet era illustrates that, in environmental policy as elsewhere, governments—like markets—can fail.

Government failure occurs when (1) public policies do not bring about an optimal allocation of resources, and/or (2) the incentives of politicians and government bureaucrats are not in line with the public interest. As Nobel Prize—winner George Stigler has argued, economic regulation often benefits the group being regulated at the expense of the larger public. Government failures are often more acute in nondemocratic societies. Yet, even in the United States, public policy formation involves a struggle among interest groups, lobbyists, politicians, large corporate interests, and the public at large. The sausage calling itself “public policy” that results from this tug-of-war is often not pretty.

Government failure may result from the practical inability of policymakers to gather enough information to set good policies. Water pollution, for instance, is well understood, resulting in fairly obvious regulatory policies, but the same is not true for issues such as global climate change. Even if we all agree that the Earth is getting warmer and humans are partly to blame, controversy remains about the adequacy of public policy to address this problem. Although calls for government action—“there ought to be a law”—are often justified, we would do well to maintain a healthy skepticism about the ability of the public sector to solve our problems.

Intergenerational Questions

Should politicians consider the interests of voters whose great-grandparents have not yet been born? Environmental issues raise complex questions involving how resources are to be allocated across generations. Some resources, such as sunlight, are continual and renewable. Others, such as forests, fisheries, and the soil are renewable but exhaustible if overexploited. And some resources are nonrenewable, such as oil and coal. These resources are finite and cannot be renewed, but their available stock can be expanded through exploration or the use of new technologies that allow greater extraction or more efficient use.

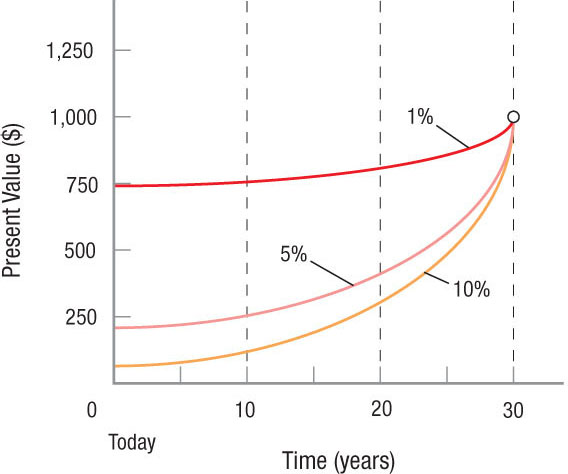

When we develop environmental policies, we need to consider and evaluate different possible futures. Figure 5 is a reminder of the effects that discount rates have on the present value of a fixed payment that will come due at some date in the future. For environmental policies, the discount rate we choose is crucially important.

FIGURE 5

Present Value of $1,000 to Be Paid in 30 Years Discounted at 1%, 5%, and 10% This figure is a reminder of the effects discount rates have on the present value of a fixed payment that will come due at a future date. A higher discount rate means that the value today of a future payment will be lower. The higher the discount rate we choose, the lower the value we place on the environmental damage to be suffered by future generations. The lower our discount rate, the more we are willing to protect the health of the future environment.

A higher discount rate means that the value today of a future payment will be less. At a 10% discount, a payment of $1,000 in 30 years is worth only $42 today, whereas discounting the same $1,000 at 1% yields a present value of $748. The higher the discount rate we choose, the lower the value we place on the environmental damage to be suffered by future generations. The lower our discount rate, conversely, the more we are willing to protect the health of the future environment. As always, craffing good public policies requires striking a balance between the two.

Socially Efficient Levels of Pollution

We have already seen that some pollution is acceptable to society. To require that no one pollute, period, would bring most economic activity as we know it to a halt. Yet, pollution damages our environment. The harmful effects of pollution range from direct threats to our health coming from air and water pollution to reductions in species from deforestation.

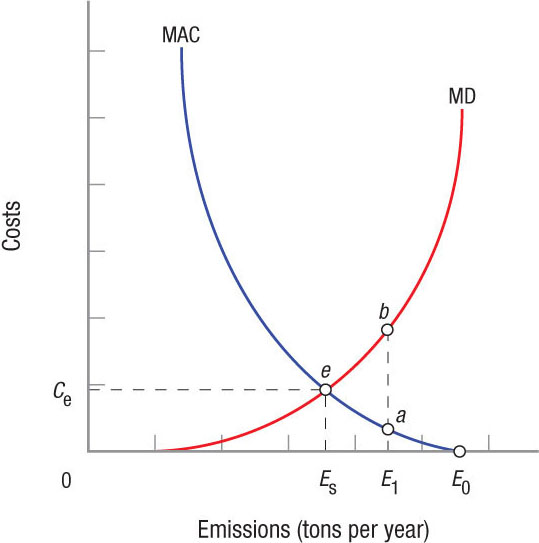

The damages that come from pollution are a cost we incur for living: To be alive is to generate some pollution. Our focus is on marginal damage, which resembles the marginal cost curves we have studied earlier. The marginal damage (MD) curve in Figure 6 shows the change in damages that comes from a given change in emission levels. Notice that as emissions levels rise, the added damages rise.

FIGURE 6

Marginal Damages and Marginal Abatement Costs The marginal damage curve (MD) shows the change in damages that come from a given change in emission levels. The horizontal axis measures pollution. Note that E0 is the maximum pollution that can occur without environmental cleanup. The vertical axis measures the environmental costs of this pollution. Marginal abatement costs curve (MAC) begins at zero at E0, then rises as emission levels are reduced (moving leftward from E0). Socially optimal pollution is ES, at a cost to society of Ce (point e).

The horizontal axis of Figure 6 measures the tons of pollution emitted into the environment (tons per year). Note that E0 represents the maximum pollution (no environmental cleanup at all). The vertical axis measures the environmental costs in dollars. These costs represent a dollar value for various environmental losses, including the physical costs of pollution (asthma attacks and other lung diseases), the aesthetic losses (visual impact of clear-cutting), and the losses associated with species reduction.

Abatement costs are the costs associated with reducing emissions. A utility plant dumping effluent into a river can treat the effluent before discharge, but this costs money. In Figure 6, marginal abatement costs (MAC) begin at zero at E0, then rise as emission levels are reduced (moving left ward from E0). The MAC curve in Figure 6 is a generalized abatement cost function, but in practice, the costs vary for different sources of pollution and the technologies available for reducing them. Chemical plants face different problems than utilities that release hot water into rivers. Cooling the water before release clearly requires a different technology—and is much easier—than eliminating toxic chemicals from effluent flow.

The socially optimal level of pollution in Figure 6 is ES, at a cost to society of Ce (point e). To see why this is so, assume that we are at pollution level E1. The cost to reduce another unit of emissions is equal to point a (measuring on the vertical axis), while the damage that would result from this pollution is shown at point b. Since b > a, society is better off if emissions are reduced. Once we begin reducing emissions below ES, however, abatement costs overtake marginal damages, or the costs of cleanup begin to outweigh the benefits.

The total damage from pollution in Figure 6 is represented by the area beneath the marginal damages curve and to the left of ES. Total abatement costs, meanwhile, are equal to the area beneath the marginal abatement costs curve and to the right of ES. Combined, these two costs represent the total social costs from emissions. We turn now to consider how environmental policy can ensure that emissions approach this optimal level.

Overview of Environmental Policies

Over the years, many types of environmental policies have been developed in response to different problems, covering the spectrum from centralized control to decentralized economic incentives. To be effective, all environmental policies must be efficient, fair, and enforceable, and they must provide incentives for improvement in the environment.

command and control policies Environmental policies that set standards and issue regulations, which are then enforced by the legal and regulatory system.

market-based policies Environmental policies that use charges, taxes, subsidies, deposit-refund systems, or tradable emission permits to achieve environmental goals.

As a general rule, the more centralized an environmental policy, the more likely it represents a command and control philosophy. This means that a centralized agency sets the rules for emissions, including levels of effluents allowed, usable technologies, and enforcement procedures. Command and control policies usually set standards of conduct that are enforced by the legal and regulatory system. Abatement costs at this point become compliance costs of meeting the standards. Standards are popular because they are simple, they treat all firms in an industry the same way, and they prevent competing firms from polluting.

At the other end of the spectrum are market-based policies, which use charges, taxes, subsidies, deposit-refund systems, or tradable emission permits to achieve the same ends. Examples of this approach include water effluent charges, user charges for water and wastewater management, glass and plastic bottle refund systems, and tradable permits for ozone reduction. We begin with a brief look at command and control policies, contrasting them with abatement taxes, then look at the case for tradable emission permits.

Command and Control Policies

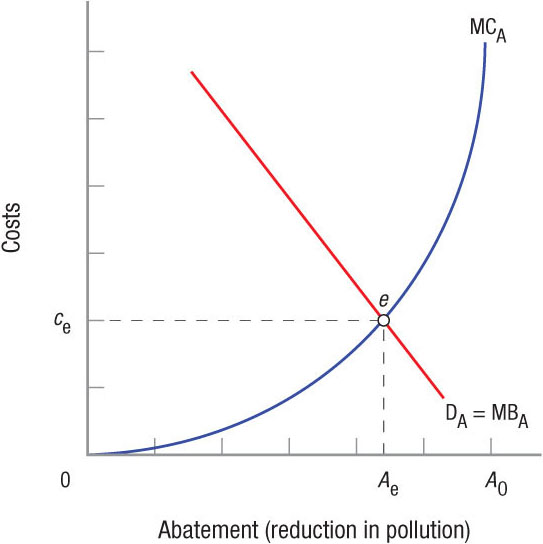

Policymakers determine the pollution control or abatement that is best, then introduce the most efficient policies to achieve those ends. Figure 7 shows the supply and demand for pollution abatement. Demand curve DA = MBA represents society’s demand for abatement; it is a reflection of the marginal damage curve we looked at earlier. Note that the demand curve for abatement is negatively sloped because the marginal benefit from abatement declines as the environment becomes cleaner. The gains from an ever cleaner environment eventually become smaller and smaller because of the law of diminishing returns.

FIGURE 7

Marginal Cost of Abatement and Abatement Demand Demand curve DA represents society’s demand for abatement. The marginal benefit from abatement (MBA) declines as the environment becomes cleaner, because the gains from an ever cleaner environment become smaller and smaller (diminishing returns). The marginal costs of abatement are the costs of reducing pollution. These costs rise with abatement efforts and become high as zero pollution A0 is approached (again, because of the law of diminishing returns, or increasing costs). Optimal abatement is Ae, costing ce. This means optimal pollution, A0 − Ae, is greater than zero.

The marginal costs of abatement are the costs of cleaning up pollution. These costs rise with abatement efforts and become high as zero pollution, A0, is approached. Optimal abatement comes at Ae, costing ce. This means that optimal pollution, A0 − Ae, is greater than zero. Command and control policies could set Ae as the abatement requirement and then set the right standards to meet this requirement. Aiming for abatement higher than Ae would be inefficient, because marginal costs would exceed marginal benefits.

Setting abatement requirements (or standards) equal to Ae in Figure 7 is a classic example of command and control policies. Again, command and control policies that set rigid standards for polluters have long been a favorite of policymakers. Yet, this approach can lead to inefficiencies, because different industries may emit the same (or equivalently dangerous) substances but face different technical problems and costs in reducing their pollution. To minimize the cost of reducing pollution, each source of pollution needs to be reduced to the point at which the marginal cost of abatement is equal for all sources. This can be achieved through market-based policies.

Market-Based Policies

Economists argue that market-oriented, or indirect, approaches to environmental policy are more efficient than command and control policies. Two of the most popular and effective of these indirect approaches are the use of emissions taxes and marketable or tradable permits.

Pigouvian tax A tax that is placed on an activity generating negative externalities in order to achieve a socially efficient outcome.

Emission Taxes An alternative to command and control policies is to enact an emissions tax on every unit of pollution produced to achieve the socially efficient outcome. Taxes of this sort are known as Pigouvian taxes (named after Arthur Pigou who developed the idea in 1920). Unlike command and control policies, polluting firms are not limited to a fixed amount of pollution. Instead, by forcing firms to pay for every unit of pollution created, firms would invest in pollution reduction measures up to the point at which the cost of abatement measures is no longer less than the tax. Such policies take into account the fact that some firms are able to reduce pollution at less cost than others. Therefore, it creates efficiencies by allowing firms with higher costs of pollution abatement to pollute more by paying more taxes, while encouraging firms with lower costs of pollution abatement to utilize such measures to reduce their tax burden.

Returning to Figure 7, achieving the optimal level of pollution abatement, Ae, could be achieved by charging a tax equal to ce per unit of pollution. Firms would adopt pollution controls up to Ae, because the costs to reduce pollution to this point are less than the tax. Firms would emit only A0 − Ae pollution. As a result, the same level of abatement is achieved using taxes as with using command and control policies; however, allowing the market to achieve this outcome through taxes allows for a more efficient outcome for the firms involved.

Marketable or Tradable Permits Another way that markets are used to limit pollution is through the use of marketable or tradable permits. Economists first proposed marketable or tradable permits when environmental laws were first being debated and enacted in the 1960s and 1970s. Environmental regulators essentially ignored this suggestion until the 1990s.

Today, tradable permits are used to reduce water effluents in the Fox River in Wisconsin, Tar-Pamlico River in North Carolina, and Dillon Reservoir in Colorado. One of the most successful uses of marketable permits for air pollution, described in the Issue in this section, has reduced the sulfur dioxide (SO2) emissions in the Midwest that create acid rain in the East. Originally, the cost of this cleanup was expected to be significant, but technical advances steadily reduced abatement costs, causing the price of the permits to decline sharply.

Marketable permits require that a regulatory body set a maximum allowable quantity of effluents allowed, typically called the “cap,” and issue permits granting the “right” to pollute a certain amount. These permits can be bought and sold, thus creating the property rights that permit transactions of the sort Coase advocated. Sales are normally between two polluters, with one polluter buying a permit from a more efficient operator. Polluters do not have to be the only purchasers: Victims or environmental groups could conceivably purchase pollution rights and hold them off the market, thereby reducing pollution below the established cap.

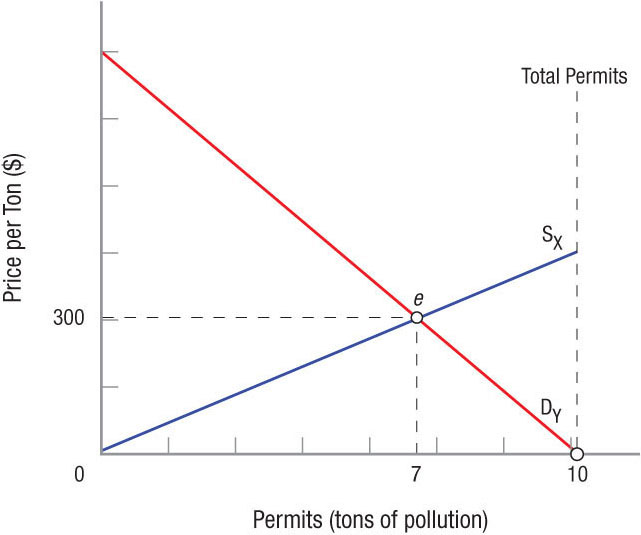

Figure 8 illustrates how such a market works. We assume that there are two firms in the market, each producing 10 tons of pollution, and that the government wishes to limit pollution to a total of 10 tons. Without restrictions, firms do zero abatement and total pollution is 20 tons. Setting a goal of 10 tons amounts to cutting pollution in half.

FIGURE 8

Tradable Permits This figure illustrates how a market for tradable pollution permits works. Assume there are only two firms (X and Y) in the market and the government wishes to limit total pollution to 10 tons. Without restrictions, both firms do zero abatement and pollution is 20 tons. Setting a goal of 10 tons therefore amounts to cutting pollution in half. Assume that the government gives the permits to firm X. Demand curve DY represents firm Y’s demand for these permits. Given a competitive market for permits, equilibrium will be at point e with a permit price equal to $300. Firm Y buys 7 permits and pollutes that amount, and firm X emits 3 tons of pollution.

Assume, for simplicity, that the government at first gives the permits to firm X. (Remember that the Coase theorem suggests efficiency is not affected by who owns the rights to pollute.) Demand curve DY represents firm Y’s demand for these permits. Assume that the market for permits is competitive, thus equilibrium will be at point e with a permit price equal to $300. Firm Y buys 7 permits and pollutes that amount, and firm X pollutes 3 tons.

Firm X pollutes less and sells 7 permits to firm Y because it can reduce more of its pollution before its marginal abatement costs reach $300. In this case, firm Y faces high clean-up costs that reach $300 a ton at 3 tons. Thus, it buys 7 tons of pollution rights from firm X. Firm X in this example ends up with the revenue from permit sales, while firm Y’s income declines by the same amount ($2,100). Auctioning off the permits produces the same result, but the government receives the revenue.

Keep in mind that regulators could have set a $300 per ton tax on effluents and achieved the same result. One advantage of permits over taxes is that no knowledge of marginal abatement costs is needed to ensure that the tax rate is optimal. The market price of permits will adjust to variances in abatement costs. All the regulator must determine is how much to reduce pollution levels. If reducing pollution by a certain amount, regardless of the cost, is the goal, permits will achieve this goal.

Other Market-Based Policies We have looked at two of the most frequently used market-based policies, taxes and marketable permits. Emission taxes and charges have been used for water effluents, waste management, pesticide packaging, batteries, tires, and other products and processes. User charges are the most common way to finance wastewater treatment facilities.

Cap-and-Trade: The Day Liberal Environmentalists and Free-Market Conservatives Agreed

Environmental policies in recent decades have epitomized the battle between liberal environmentalists and free-market conservatives, with the former arguing for more limits on pollution while the latter want more market freedom. How then, could the two sides come to an agreement that would satisfy both of their primary objectives?

In the late 1980s, the problem of acid rain reached a boiling point, with heavy pollution from sulfur dioxide emissions causing health issues, polluted lakes and rivers, and reduced visibility. Further, it heightened tensions with Canada, which suffered negative externalities from the pollution from American power plants. With the environmental damage reaching front page news and a fierce political battle on how to fix it, it looked like a lost cause.

Then came a very unlikely alliance between Dan Dukek of the Environmental Defense Fund and Boyden Gray, a multimillionaire conservative who was appointed President Bush’s White House counsel in 1988. Gray, a strong proponent of free-market principles, had long supported a method of allowing individuals and firms to buy and sell permits to pollute. The acid rain crisis allowed Dudek and Gray to propose an emissions permit trading program that placed significant caps on sulfur dioxide (placating environmentalists) while eliminating regulations and allowing the marketplace to determine permit prices (placating free-market proponents).

The program became law with the Clean Air Act of 1990. When the law, which became known as “cap-and-trade,” took effect in 1995, emissions fell and led to significant external cost savings in what has been considered a resounding success in solving a major environmental program using a market-based approach as opposed to a command-and-control approach.

Today, much discussion centers on the proposed use of cap-and-trade to reduce carbon dioxide emissions. Such programs are law in the European Union and elsewhere, but proposals to pass cap-and-trade legislation in the United States since 2008 have been held up, ironically by the same market-based proponents who created the strategy that worked in the past. Opponents of cap-and-trade today argue that cap-and-trade still imposes harsh limits on the broader market, which they support. Yet, without cap-and-trade, resolutions to reduce global warming become less likely. It may take another unlikely alliance before the problem of global warming is solved.

Source: Richard Conniff, “The Political History of Cap and Trade,” Smithsonian, August 2009.

Federal subsidies, the flip side of taxes or charges, are used when local communities do not have the resources for pollution control. Marketable permits have been most successful in programs to reduce air pollution, as well as those targeting acid rain and ozone reduction. Deposit-refund systems have been used mainly for recyclable products such as cans, bottles, tires, and batteries.

Over the years, most environmental policies have been of the command and control variety. The 1970 Clean Air Act focused on specific forms of air pollution—particulates, carbon monoxide, and so forth—and established air quality standards. Today, economic or market-based approaches to environmental policy are considered more efficient than command and control policies. Most environmental agencies, however, in this country and abroad, have not used these tools until recently.

One reason for this is probably that many people in the regulatory and environmental communities resist viewing environmental resources as commodities to be subjected to market forces of supply and demand. It is market failures, after all, that led to environmental decay in the first place. Why would we want to put the environment on the market? Many pollutants, moreover, are frequently mixed together and their individual impacts are difficult to determine. Consequently, setting the right tax rate or issuing the right number of allowable permits is difficult. Finally, some policymakers balk at giving corporations the right to pollute, even a limited amount.

ENVIRONMENTAL POLICY

- Government failure can occur when politicians and government do not have the right incentives to bring about an optimal allocation of resources.

- The discount rate chosen for environmental policies determines the intergenerational impact of policy.

- The socially optimal level of pollution occurs where the marginal damage is equal to the marginal abatement costs.

- Policymakers determine the optimal pollution levels and then often use command and control policies to set the most efficient regulations or levels of abatement.

- Tradable permits use market forces to bring pollution within limits set by regulators.

QUESTION: If a “cap-and-trade” program for carbon dioxide emissions is implemented in the United States, with the overall limit slowly reduced each year, what would happen to the price of permits if all production activity stays the same and the cost of pollution abatement remains unchanged? What would need to happen in order for the price of permits to fall over time?

If the “cap” on total carbon dioxide emissions is reduced each year while economic activity stays the same, permit prices would rise to encourage firms to produce less to meet the cap. In order for permit prices to fall, the costs of pollution abatement must fall due to technological advances, or new production methods (using clean energy) must be introduced to emit lesser carbon dioxide to begin with.