Questions and Problems

Check Your Understanding

Question

Using a budget line, why does a decrease in the price of a good allow one to potentially consume more of both goods?

Prob 6 1. Using a budget line, why does a decrease in the price of a good allow one to potentially consume more of both goods?Question

Why do price changes cause a budget line to pivot while income changes cause a budget line to shift in a parallel manner?

Prob 6 2. Why do price changes cause a budget line to pivot while income changes cause a budget line to shift in a parallel manner?Question

Describe the utility-maximizing condition in words. Explain why it makes sense.

Prob 6 3. Describe the utility-maximizing condition in words. Explain why it makes sense.Question

What conditions are necessary for total utility to be positive while marginal utility is negative?

Prob 6 4. What conditions are necessary for total utility to be positive while marginal utility is negative?Question

Why should sunk costs not be taken into consideration when making decisions about the present or the future?

Prob 6 5. Why should sunk costs not be taken into consideration when making decisions about the present or the future?Question

Why do the prices of many goods and services end in 99 cents? Why don’t businesses just round to the nearest whole dollar?

Prob 6 6. Why do the prices of many goods and services end in 99 cents? Why don’t businesses just round to the nearest whole dollar?

Apply the Concepts

Question

Scruffie the cat has $15 to spend each month on cat toys, which cost $3 each, and cat treats, which cost $1.50 each. Draw a budget line to show the combinations of each good that Scruffie can afford if she spends her entire budget. Now suppose that cat treats go on sale for $1 each. How does this change in price affect the budget line (show on a graph)?

Prob 6 7. Scruffie the cat has $15 to spend each month on cat toys, which cost $3 each, and cat treats, which cost $1.50 each. Draw a budget line to show the combinations of each good that Scruffie can afford if she spends her entire budget. Now suppose that cat treats go on sale for $1 each. How does this change in price affect the budget line (show on a graph)?Question

Eric enjoys having sushi and sashimi for lunch every day. Suppose the marginal utility of the last sushi roll Eric eats is 40 and the marginal utility of the last piece of sashimi Eric eats is 20. If the price of a roll of sushi is $8 and the price per piece of sashimi is $2, did Eric maximize his utility? Explain.

Prob 6 8. Eric enjoys having sushi and sashimi for lunch every day. Suppose the marginal utility of the last sushi roll Eric eats is 40 and the marginal utility of the last piece of sashimi Eric eats is 20. If the price of a roll of sushi is $8 and the price per piece of sashimi is $2, did Eric maximize his utility? Explain.Question

One luxury goods manufacturer noted that, “Our customers do not want to pay less. If we halved the price of all our products, we would double our sales for six months, and then we would sell nothing.” Is there something about luxury goods that suggests consumers are irrational? Do luxury goods not follow the law of demand?

Prob 6 9. One luxury goods manufacturer noted that, “Our customers do not want to pay less. If we halved the price of all our products, we would double our sales for six months, and then we would sell nothing.” Is there something about luxury goods that suggests consumers are irrational? Do luxury goods not follow the law of demand?Question

Advertisements on television both inform consumers and persuade them to purchase products in differing proportions, depending on the ad. But today, because digital video recorders can be found in virtually all households, much of what these households watch is recorded, and the vast bulk of the ads are skipped. If this trend continues, where will consumers find out about new products?

Prob 6 10. Advertisements on television both inform consumers and persuade them to purchase products in differing proportions, depending on the ad. But today, because digital video recorders can be found in virtually all households, much of what these households watch is recorded, and the vast bulk of the ads are skipped. If this trend continues, where will consumers find out about new products?Question

Critics of marginal utility analysis argue that it is unrealistic to assume that people make the mental calculus of marginal utility per dollar for large numbers of products. But when you are making a decision to either go to a first-run movie or to buy a used DVD of last summer’s blockbuster, does this analysis seem so complex? Is it a reasonable representation of your thought process?

Prob 6 11. Critics of marginal utility analysis argue that it is unrealistic to assume that people make the mental calculus of marginal utility per dollar for large numbers of products. But when you are making a decision to either go to a first-run movie or to buy a used DVD of last summer’s blockbuster, does this analysis seem so complex? Is it a reasonable representation of your thought process?Question

A common practice at many supermarkets is to show the customer’s total “savings” on their purchase at the bottom of the receipt. Such savings include the total discounts from goods purchased along with savings from coupons used. How would listing the total savings on a receipt influence an individual’s consumption habits? Of what type of behavioral factor does this strategy take advantage?

Prob 6 12. A common practice at many supermarkets is to show the customer’s total “savings” on their purchase at the bottom of the receipt. Such savings include the total discounts from goods purchased along with savings from coupons used. How would listing the total savings on a receipt influence an individual’s consumption habits? Of what type of behavioral factor does this strategy take advantage?

In the News

Question

Richard Layard, in his book Happiness: Lessons from a New Science, states that once a country’s annual income exceeds $20,000 per capita, there is little relationship between happiness and income. But if you are poor, more money does make you happier. Does this fact suggest that the marginal utility from more income above $20,000 per capita is small?

Prob 6 13. Richard Layard, in his book Happiness: Lessons from a New Science, states that once a country’s annual income exceeds $20,000 per capita, there is little relationship between happiness and income. But if you are poor, more money does make you happier. Does this fact suggest that the marginal utility from more income above $20,000 per capita is small?Question

In the summer of 2009, Chrysler announced that beginning with its 2010 models it was dropping the current lifetime powertrain (engine and transmission parts) warranty and replacing it with a five-year, 100,000-mile guarantee. The Wall Street Journal (August 20, 2009) reported that “Chrysler spokesman Rick Deneau said that the decision was driven by market research that showed customers prefer warranties with a fixed time period.” The new five-year warranty was transferable if the vehicle was sold, while the prior lifetime warranty applied only to the original owner.

Given marginal utility analysis, does it seem reasonable that consumers really prefer a five-year, 100,000-mile warranty to a lifetime warranty? What customers actually benefit from this new warranty?Prob 6 14. In the summer of 2009, Chrysler announced that beginning with its 2010 models it was dropping the current lifetime powertrain (engine and transmission parts) warranty and replacing it with a five-year, 100,000-mile guarantee. The Wall Street Journal (August 20, 2009) reported that “Chrysler spokesman Rick Deneau said that the decision was driven by market research that showed customers prefer warranties with a fixed time period.” The new five-year warranty was transferable if the vehicle was sold, while the prior lifetime warranty applied only to the original owner.

Given marginal utility analysis, does it seem reasonable that consumers really prefer a five-year, 100,000-mile warranty to a lifetime warranty? What customers actually benefit from this new warranty?

Solving Problems

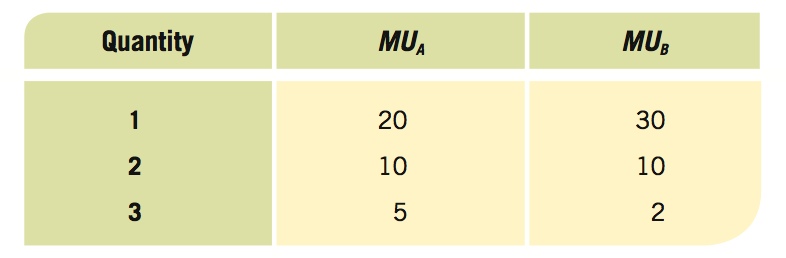

- Assume a consumer has $20 to spend and for both products the marginal utilities are shown in the table below:

Assume that each product sells for $5 per unit.Question

How many units of each product will the consumer purchase?

Prob 15 1a. How many units of each product will the consumer purchase?Question

Assume the price of product B rises to $10 per unit. How will this consumer allocate her budget now?

Prob 15 1b. Assume the price of product B rises to $10 per unit. How will this consumer allocate her budget now?Question

If the prices of both products rise to $10 per unit, what will be the budget allocation?

Prob 15 1c. If the prices of both products rise to $10 per unit, what will be the budget allocation?

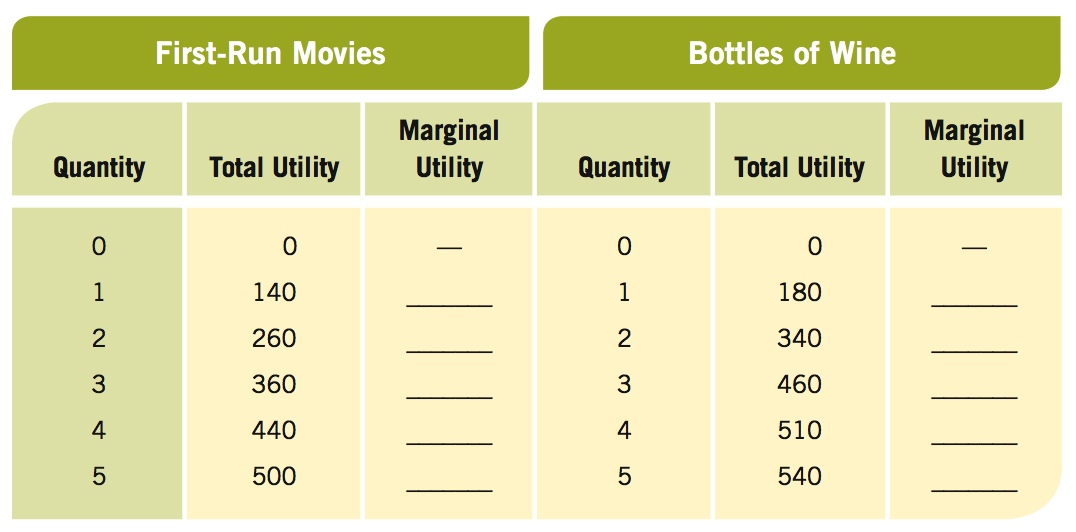

- Answer the questions following the table below.

Question

Complete the table.

Prob 16 1a. Complete the table.Question

Assume that you have $50 a month to devote to entertainment (column labeled First-Run Movies) and wine with dinner (column labeled Bottles of Wine). What will be your equilibrium allocation if the price to see a movie is $10 and a bottle of wine cost $10 as well?

Prob 16 1b. Assume that you have $50 a month to devote to entertainment (column labeled First-Run Movies) and wine with dinner (column labeled Bottles of Wine). What will be your equilibrium allocation if the price to see a movie is $10 and a bottle of wine cost $10 as well?Question

A grape glut in California results in Napa Valley wine dropping in price to $5 per bottle, and you view this wine as a perfect substitute for what you were drinking earlier. Now what will be your equilibrium allocation between movies and wine?

Prob 16 1c. A grape glut in California results in Napa Valley wine dropping in price to $5 per bottle, and you view this wine as a perfect substitute for what you were drinking earlier. Now what will be your equilibrium allocation between movies and wine?

Question

Using By the Numbers, list the top five categories that the average American household spent their incomes on in the year 2011 (start with the largest expenditure and proceed downward in terms of percentage of household budget).

Prob 6 17. Using By the Numbers, list the top five categories that the average American household spent their incomes on in the year 2011 (start with the largest expenditure and proceed downward in terms of percentage of household budget).Question

According to By the Numbers, what category or categories of goods and services have increased in price (on average) every year from 2009 to 2011? What category or categories have fallen in price every year from 2009 to 2011?

Prob 6 18. According to By the Numbers, what category or categories of goods and services have increased in price (on average) every year from 2009 to 2011? What category or categories have fallen in price every year from 2009 to 2011?