FISCAL POLICY AND AGGREGATE SUPPLY

supply-

Fiscal policies that influence aggregate supply are different from policies that influence aggregate demand, as they do not always require tradeoffs between price levels and output. That is the good news. The bad news is that supply-

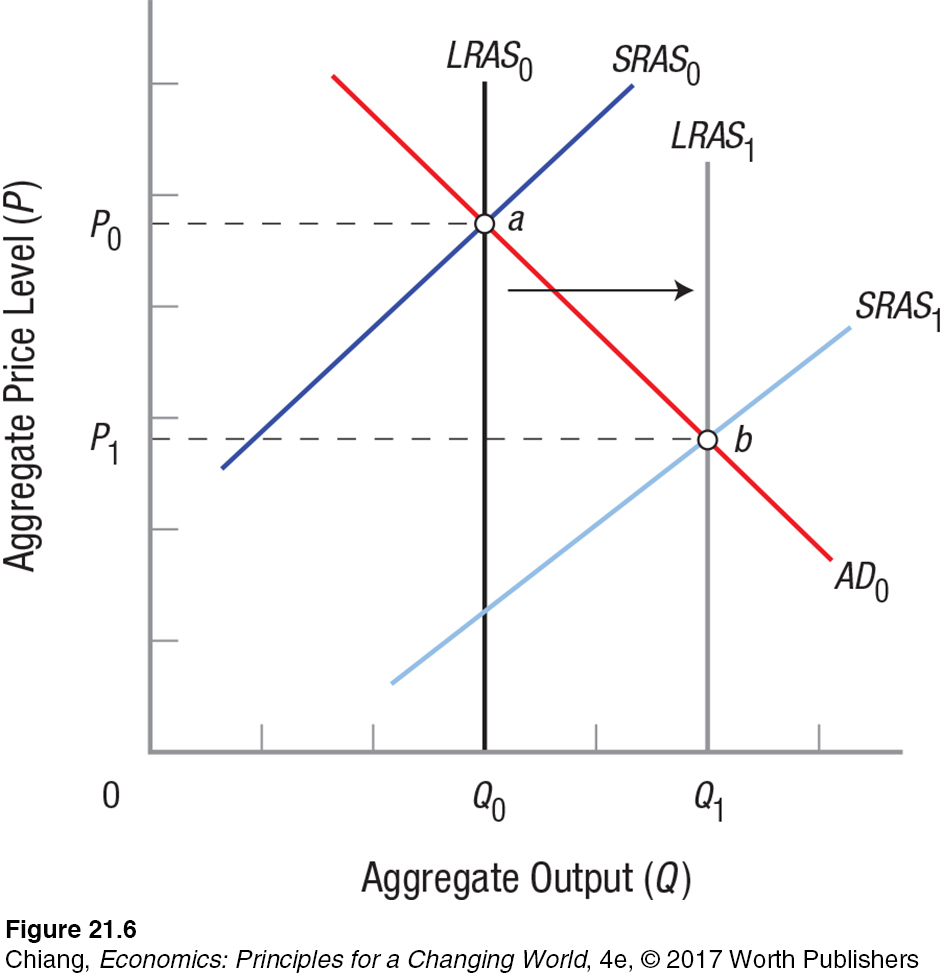

Figure 6 shows the impact that fiscal policy can have on the economy over the long run. The goal of these fiscal policies is to shift the long-

Figure 6 may well reflect what happens in general as the world economy embraces trade and globalization. Improvements in technology and communications increase productivity to the point that global long-

Just what fiscal policies will allow the economy to expand without generating price pressures? First, there are government policies that encourage investment in human capital (education) and policies that encourage the development and transfer of new technologies. Second, there are the fiscal policies that focus on reducing tax rates. Third, there are policies that promote investment in new capital equipment, encourage investment in research and development, and trim burdensome business regulations. These policies are intended to expand the supply curves of all businesses and industries.

Infrastructure Spending

Governments can do a great deal to create the right environment to encourage economic growth. We already have seen the benefits of building and maintaining a nation’s infrastructure, including roads, bridges, dams, and communications networks, or setting up a fair and efficient legal system and stable financial system. Further, the higher the levels of human capital and the more easily technology is transferred to other firms and industries (the public good aspect of technology), the more robust economic growth. Therefore, long-

Reducing Tax Rates

Reducing tax rates has an impact on both aggregate demand and aggregate supply. Lower tax rates increase aggregate demand because households now have more money to spend. At the same time, lower tax rates mean that take-

At other times, administrations have reduced marginal tax rates, the rate paid on the next dollar earned, with the express purpose of stimulating incentives to work and for businesses to take risks. President Kennedy reduced the top marginal rate from 70% to 50%, and President Reagan reduced the top marginal rate from 50% to 28%.

Clearly, high marginal income tax rates can have adverse effects on the economy. Still, there is considerable controversy regarding the benefits of the supply-

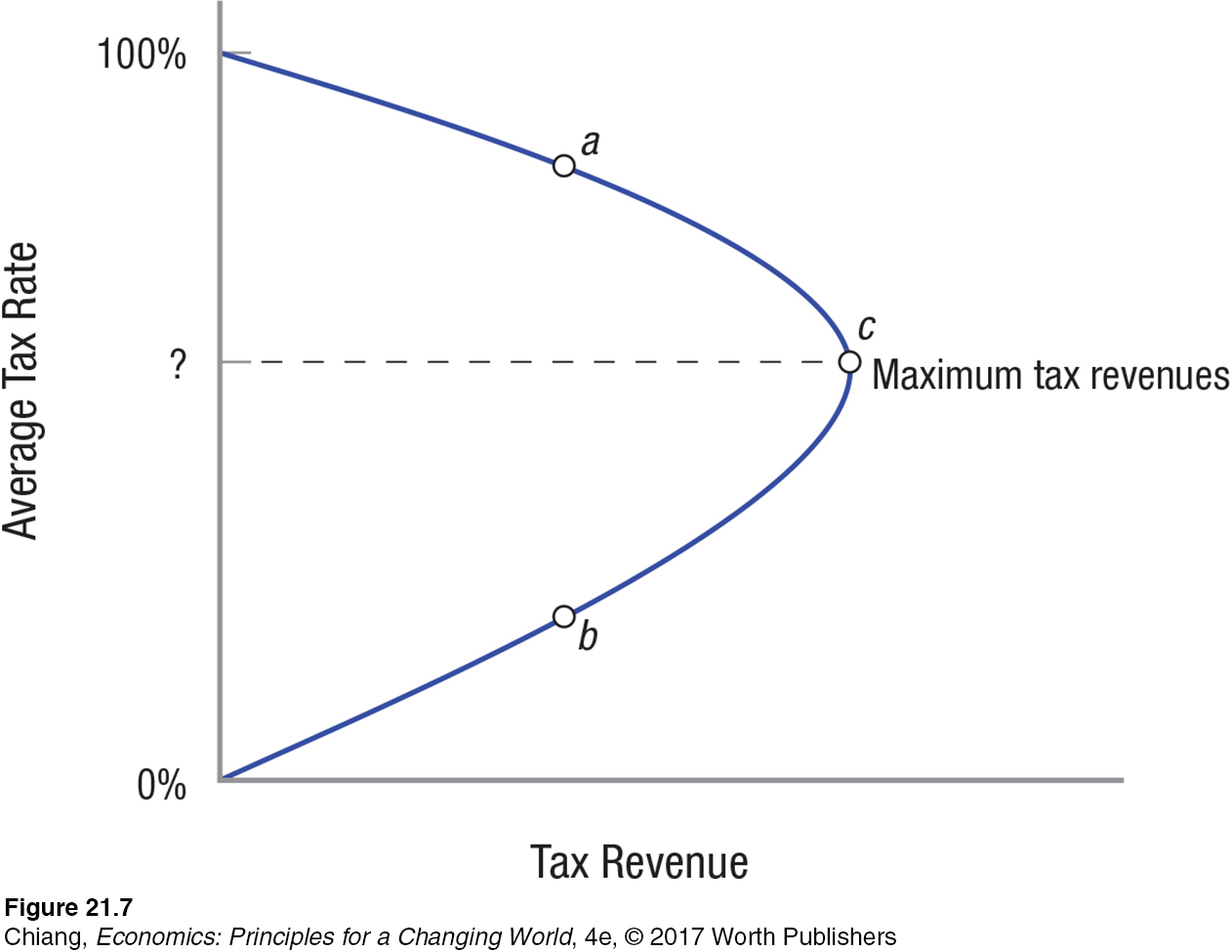

Laffer curve A curve that shows a hypothetical relationship between income tax rates and tax revenues. As tax rates rise from zero, revenues rise, reach a maximum, then decline until revenues reach zero again at a 100% tax rate.

The Laffer curve in Figure 7 shows that if tax rates are 0% or 100%, tax revenues will be zero (the latter because there would be no incentive to earn income). In between these two extreme tax rates, tax revenues will be positive. Laffer argued that high tax rates (such as the one that generates revenues at point a on the Laffer curve) create disincentives to work and invest. He claimed that a lower tax rate would generate the same amount of revenue, seen as point b on the curve. Economists debate about what the tax rate corresponding to point b would be. Further, it raises a bigger debate about the tax rate at which the disincentive to work begins to reduce tax revenues. In other words, what tax rate corresponds to point c on the Laffer curve?

Expanding Investment and Reducing Regulations

We have already seen how closely standards of living are tied to productivity. Investment increases the capital with which labor works, thereby increasing productivity. Rising productivity drives increased economic growth and raises the average standard of living, shifting the long-

Investment can be encouraged by such policies as investment tax credits (direct reductions in taxes for new investment) and more rapid depreciation schedules for plant and equipment. When a firm can expense (depreciate) its capital equipment over a shorter period of time, it cuts its taxes now rather than later, and therefore earns a higher return on the capital now. Similarly, government grants for basic research help firms increase their budgets for research and development, which results in new products and technologies brought to market.

Nowhere is this impact more evident than in the health care field. The National Institutes of Health, part of the U.S. Department of Health and Human Services, invests over $30 billion in health care research each year, mostly in grants to medical schools, universities, and research institutions. These investments have enabled new medicines to be developed at a much faster rate than previously. And beyond the obvious benefits this has for the people who require such medicines, investments of this sort pay dividends for the entire economy. As health care improves, workers’ absentee rates are lower and productivity rises.

Another way of increasing long-

Fiscal policies to increase aggregate supply are promoted mainly through the government’s encouragement of human capital development and technology improvements, its power to tax, its ability to promote investment in infrastructure and research, and the degree and efficiency of regulation. Cutting marginal tax rates, offering investment tax credits, and offering grants for research are the favored policies. The political fervor of the 1980s supply-

Qatar: A Nation Built for the Future

How did Qatar, a tiny nation in the Middle East that has never participated in a World Cup soccer match, win its bid to host the biggest sporting event in the world?

In November 2022 around 4 billion people from 200 countries will be focused on the world’s most popular sports tournament, the FIFA World Cup. That year’s tournament will be held in one of the smallest nations on Earth, both in size and in population. This country is still relatively unknown to most people, and its national soccer team has never qualified for the World Cup in its history. How then, did Qatar become the host of the 2022 World Cup?

Qatar is located on a peninsula off of the Persian Gulf in the Middle East, with an area smaller than the size of Connecticut and fewer than 2 million residents. But what it lacks in size and population is offset by its abundance of resources, particularly oil and natural gas. According to statistics from the World Bank, in 2015 Qatar was the richest nation on Earth in terms of GDP per capita. Its government is flush with cash from its resource exports, which has allowed it to use expansionary fiscal policy with ease.

Over the past two decades, Qatar’s government invested heavily to build infrastructure, increase human capital, and attract foreign investment. These policies not only increased Qatar’s aggregate demand, but also its capacity to produce through its long-

In its bid to host the World Cup in 2022, Qatar promised to build at least eight new stadiums, including five high-

Qatar’s use of expansionary fiscal policy has helped diversify its economy. This strategy is especially important given the volatility of oil prices, which will encourage oil-

CHECKPOINT

FISCAL POLICY AND AGGREGATE SUPPLY

The goal of fiscal policies that influence aggregate supply is to shift the long-

run aggregate supply curve to the right. Expanding long-

run aggregate supply can occur through higher investments in human capital and a focus on technological infrastructure with “public good” benefits. The Laffer curve suggests that reducing tax rates could lead to higher revenues if tax rates are high enough.

Other fiscal policies to increase long-

run aggregate supply include providing incentives for business investment and reducing burdensome regulation. The major limitation of fiscal policies to influence long-

run aggregate supply is that they take a longer time to have an impact compared to polices aimed at influencing aggregate demand.

QUESTIONS: Some economists have suggested that an improved tax structure would entail a reduction in income taxes for individuals, corporations (corporate income tax), and investors (capital gains taxes), which is offset by an increase in consumption taxes (such as sales and excise taxes). Which part(s) of this type of proposal would be consistent with supply-

Answers to the Checkpoint questions can be found at the end of this chapter.

Supply-