1 Foreign Exchange: Currencies and Crises

Exchange rates affect

the relative prices of goods, services, and assets in different countries.

1. How Exchange Rates Behave

Compare data on the yuan–dollar rate and the dollar–euro rate. Introduce the distinction between fixed and flexible rates.

a. Key Topics: How are exchange rates determined? Why do some fluctuate, while others do not? What makes exchange rates increase or decrease in the long run?

2. Why Exchange Rates Matter

Two mechanisms: They can affect relative prices of goods (example of a Swiss cheese maker trading with EU countries) and they can affect relative prices of assets (example of Swiss investors holding U.S. securities).

a. Key Topics: How do changes in exchanges affect the real economy? How do they affect prices, the demands for goods, and income in different countries? How do they affect the values of foreign assets and national wealth?

3. When Exchange Rates Misbehave

Currency crises. Recent historical episodes and their economic consequences.

a. Key Topics: Why do crises occur? Are they caused by fundamentals, or by irrational speculation? Why are they so costly, politically and economically? How could they be prevented?

4. Summary and Plan of Study

Coming chapters: Chapter 13, foreign exchange markets; Chapter 14 and Chapter 15, exchange rate determination; Chapter 16, exchange rates and financial transactions; Chapter 17, gains from globalization; Chapter 18, exchange rates and goods markets in the short run; Chapter 19, fixed versus flexible rates; Chapter 20, currency crises; Chapter 21, the euro; Chapter 22, more detailed discussion of a variety of topics on exchange rates.

In most branches of economics, and even in the study of international trade, it is common to assume that all goods are priced in a common currency. Despite this unrealistic assumption, such analysis delivers important insights into the workings of the global economy.

Emphasize that this is the price of the FOREIGN currency in terms of domestic currency, not the price of domestic currency in terms of foreign. It takes a while for students to get this straight.

In the real world, however, countries have different currencies, and a complete understanding of how a country’s economy works requires that we study the exchange rate, the price of foreign currency. Because products and investments move across borders, fluctuations in exchange rates have significant effects on the relative prices of home and foreign goods (such as autos and clothing), services (such as insurance and tourism), and assets (such as equities and bonds). We start our analysis of the global economy with the theory of exchange rates, and learn how and why they fluctuate. In later chapters, we’ll see why exchange rates matter for economic outcomes and why they are an important focus of economic policy making.

3

How Exchange Rates Behave

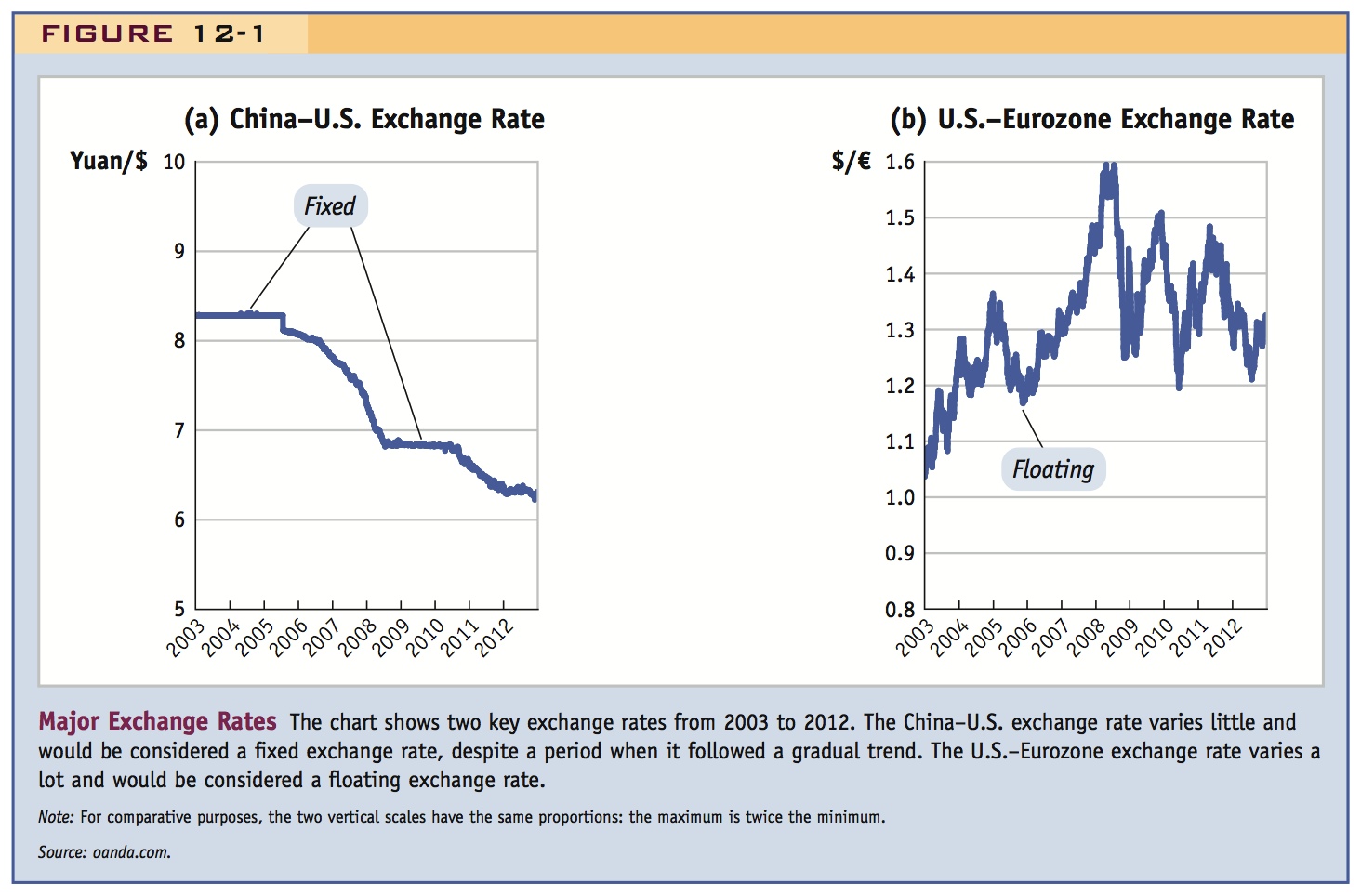

In studying exchange rates, it is important to understand the types of behavior that any theory of exchange rate determination must explain. Figure 12-1 illustrates some basic facts about exchange rates. Panel (a) shows the exchange rate of China with the United States, in yuan per U.S. dollar ($).1 Panel (b) shows the exchange rate of the United States with the Eurozone, in U.S. dollars per euro.

©John T. Fowler/Alamy

Go online to show students current data too. A good source is "International Economic Trends" at the St. Louis Federal Bank.

The behavior of the two exchange rates is very different. The yuan–dollar rate is almost flat. In fact, for many years it was literally unchanged, day after day, at 8.28 yuan/$. Finally, on July 23, 2005, it dropped exactly 2%. Then it followed a fairly smooth, slow downward trend for a while: by September 2008 (when the global financial crisis began), it had fallen a further 15%. After the crisis, it reverted to a flat line once again at 6.83 yuan/$, and then on June 21, 2010, it resumed a gradual slow decline. During the period shown, the daily average absolute change in the exchange rate was less than five-hundredths of one percent (0.05%).

4

In contrast, the euro–dollar exchange rate experienced much wider fluctuations over the same period. On a daily basis, the average absolute change in this exchange rate was one-third of one percent (0.33%), about 6 or 7 times as large as the average change in the yuan–dollar rate.

Build the lecture around two things: (1) stylized facts, of which this is the first; (2) fundamental questions, such as the following "key topics." Highlight which chapters will address which facts and which topics.

Based on such clearly visible differences in exchange rate behavior, economists divide the world into two groups of countries: those with fixed (or pegged) exchange rates and those with floating (or flexible) exchange rates. In Figure 12-1, China’s exchange rate with the United States would be considered fixed. It was officially set at a fixed exchange rate with the dollar until July 2005, and again in 2008–10, but even at other times its very limited range of movement was so controlled that it was effectively “fixed.”2 In contrast, the euro–dollar exchange rate is a floating exchange rate, one that moves up and down over a much wider range.

Key Topics How are exchange rates determined? Why do some exchange rates fluctuate sharply in the short run, while others remain almost constant? What explains why exchange rates rise, fall, or stay flat in the long run?

Why Exchange Rates Matter

This is a little imprecise, since it is real rates that matter. But don't wade into that yet. Think of other examples like this that might be familiar to your students.

Ask the students to construct their own example, using hypothetical values of the securities and the exchange rate.

Changes in exchange rates affect an economy in two ways:

- Changes in exchange rates cause a change in the international relative prices of goods. That is, one country’s goods and services become more or less expensive relative to another’s when expressed in a common unit of currency. For example, in 2011 Spiegel interviewed one Swiss cheesemaker:

When Hans Stadelmann talks about currency speculators, it seems like two worlds are colliding…. Five men are working at the boilers, making the most popular Swiss cheese in Germany according to a traditional recipe…then there are the international financial markets, that abstract global entity whose actors have decided that the Swiss franc is a safe investment and, in doing so, have pushed the currency’s value to record levels…. A year back, one euro was worth 1.35 francs. Two weeks ago, the value was 1-to-1. This presents a problem for Stadelmann. About 40% of his products are exported, most of them to EU countries. In order to keep his earnings level in francs, he’s being forced to charge higher prices in euros—and not all of his customers are willing to pay them. ‘I’m already selling less, and I’m afraid it’s going to get much worse,’ Stadelmann says. And it’s not just his company he’s worried about. ‘I get my milk from 50 small family farmers,’ he says. ‘If I close up shop, I’d be destroying the livelihoods of 50 families.’”3 - Changes in exchange rates can cause a change in the international relative prices of assets. These fluctuations in wealth can then affect firms, governments, and individuals. For example, in June 2010, Swiss investors held $397 billion of U.S. securities, when $1 was worth 1.05 Swiss francs (SFr). So these assets were worth 1.05 times 397, or SFr 417 billion. One year later $1 was worth only SFr 0.85, so the same securities would have been worth just 0.85 times 397 or SFr 337 billion, all else equal. That capital loss of SFr 80 billion (about 20%) came about purely because of exchange rate changes. Although other factors affect securities values in domestic transactions with a single currency, all cross-border transactions involving two currencies are strongly affected by exchange rates as well.4

5

Key Topics How do exchange rates affect the real economy? How do changes in exchange rates affect international prices, the demand for goods from different countries, and hence the levels of national output? How do changes in exchange rates affect the values of foreign assets, and hence change national wealth?

When Exchange Rates Misbehave

Even after studying how exchange rates behave and why they matter, we still face the challenge of explaining one type of event that is almost guaranteed to put exchange rates front and center in the news: an exchange rate crisis. In such a crisis, a currency experiences a sudden and pronounced loss of value against another currency, following a period in which the exchange rate had been fixed or relatively stable.

One of the most dramatic currency crises in recent history occurred in Argentina from December 2001 to January 2002. For a decade, the Argentine peso had been fixed to the U.S. dollar at a one-to-one rate of exchange. But in January 2002, the fixed exchange rate became a floating exchange rate. A few months later, 1 Argentine peso, which had been worth one U.S. dollar prior to 2002, had fallen in value to just $0.25 (equivalently, the price of a U.S. dollar rose from 1 peso to almost 4 pesos).

The drama was not confined to the foreign exchange market. The Argentine government declared a then-record default (i.e., a suspension of payments) on its $155 billion of debt; the financial system was in a state of near closure for months; inflation climbed; output collapsed and unemployment soared; and more than 50% of Argentine households fell below the poverty line. At the height of the crisis, violence flared and the country had five presidents in the space of two weeks.

Emphasize how important it is to understand these crises, because they have such devastating effects on the countries in question.

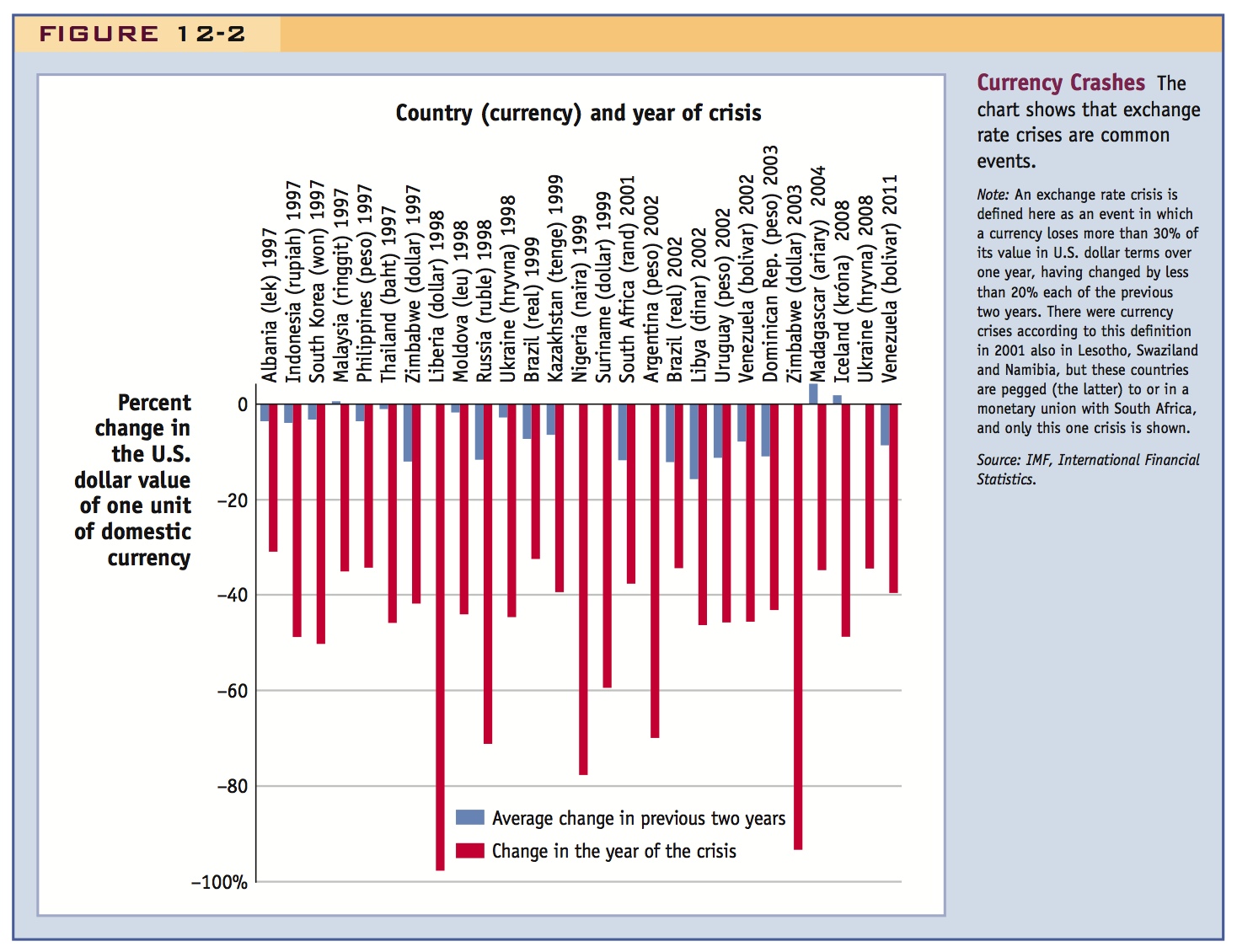

Argentina’s experience was extreme but hardly unique. Exchange rate crises are fairly common. Figure 12-2 lists 27 exchange rate crises in the 12-year period from 1997 to 2011. In almost all cases, a fairly stable exchange rate experienced a large and sudden change. The year 1997 was especially eventful, with seven crises, five of them in East Asia. The Indonesian rupiah lost 49% of its U.S. dollar value, but severe collapses also occurred in Thailand, Korea, Malaysia, and the Philippines. Other notable crises during this period included Liberia in 1998, Russia in 1998, and Brazil in 1999. More recently, Iceland and Ukraine saw their exchange rates crash during the global financial crisis of 2008 (see Headlines: Economic Crisis in Iceland).

Crisis episodes display some regular patterns. Output typically falls, banking and debt problems emerge, households and firms suffer. In addition, political turmoil often ensues. Government finances worsen and embarrassed authorities may appeal for external help from international organizations, such as the International Monetary Fund (IMF) or World Bank, or other entities. The economic setbacks are often more pronounced in poorer countries. Although we could confine our study of exchange rates to normal times, the frequent and damaging occurrence of crises obliges us to pay attention to these abnormal episodes, too.

6

Key Topics Why do exchange rate crises occur? Are they an inevitable consequence of deeper fundamental problems in an economy or are they an avoidable result of “animal spirits”—irrational forces in financial markets? Why are these crises so economically and politically costly? What steps might be taken to prevent crises, and at what cost?

Summary and Plan of Study

International macroeconomists frequently refer to the exchange rate as “the single most important price in an open economy.” If we treat this statement as more than self-promotion, we should learn why it might be true. In our course of study, we will explore the factors that determine the exchange rate, how the exchange rate affects the economy, and how crises occur.

Our study of exchange rates proceeds as follows: in Chapter 13, we learn about the structure and operation of the markets in which foreign currencies are traded. Chapters 3 and 4 present the theory of exchange rates. Chapter 16 discusses how exchange rates affect international transactions in assets. We examine the short-run impact of exchange rates on the demand for goods in Chapter 18, and with this understanding Chapter 19 examines the trade-offs governments face as they choose between fixed and floating exchange rates. Chapter 20 covers exchange rate crises in detail and Chapter 21 covers the euro, a common currency used in many countries. Chapter 22 presents further exploration of some exchange rate topics.

7

An article recounting the devastating effects of the currency crisis on Iceland

Economic Crisis in Iceland

International macroeconomics can often seem like a dry and abstract subject, but it must be remembered that societies and individuals can be profoundly shaken by the issues we will study. This article was written just after the start of the severe economic crisis that engulfed Iceland in 2008, following the collapse of its exchange rate, a financial crisis, and a government fiscal crisis. Real output per person shrank by more than 10%, and unemployment rose from 1% to 9%. Five years later a recovery was just beginning to take shape.

Reykjavik—The crisis that brought down Iceland’s economy in late 2008 threw thousands of formerly well-off families into poverty, forcing people like Iris to turn to charity to survive.

Each week, up to 550 families queue up at a small white brick warehouse in Reykjavik to receive free food from the Icelandic Aid to Families organisation, three times more than before the crisis.

Rutur Jonsson, a 65-year-old retired mechanical engineer, and his fellow volunteers spend their days distributing milk, bread, eggs and canned food donated by businesses and individuals or bought in bulk at the supermarket.

“I have time to spend on others and that’s the best thing I think I can do,” he said as he pre-packed grocery bags full of produce.

In a small, close-knit country of just 317,000 people, where everyone knows everyone, the stigma of accepting a hand-out is hard to live down and of the dozens of people waiting outside the food bank in the snow on a dreary March afternoon, Iris is the only one willing to talk.

“It was very difficult for me to come here in the beginning. But now I try not to care so much anymore,” said the weary-looking 41-year-old, who lost her job in a pharmacy last summer, as she wrung her hands nervously.

The contrast is brutal with the ostentatious wealth that was on display across the island just two years ago, as a hyperactive banking sector flooded the small, formerly fishing-based economy with fast cash.

Back then, the biggest worry for many Icelanders was who had the nicest SUV, or the most opulent flat.

But today visible signs of poverty are quickly multiplying in the Nordic island nation, despite its generous welfare state, as the middle class is increasingly hit by unemployment, which is up from one to nine per cent in about a year, and a large number of defaults on mortgages.

Icelanders who lose their job are initially entitled to benefits worth 70 per cent of their wages—but the amount dwindles fast the longer they are without work. Coupled with growing debt, the spike in long-term unemployment is taking a heavy toll.

“The 550 families we welcome here represent about 2,700 people, and the number keeps going up. And we think it will keep growing until next year, at least,” said Asgerdur Jona Flosadottir, who manages the Reykjavik food bank.

For Iris, the fall came quickly.

She is struggling to keep up with payments on two car loans, which she took out in foreign currencies on what proved to be disastrous advice from her bank, and which have tripled since the kronur’s collapse.

Threatened in November with eviction from her home in the village of Vogar, some 40 kilometres (25 miles) southwest of Reykjavik, she managed to negotiate a year’s respite with her bank.

“I feel very bad and I am very worried,” she said, running her fingers through her long, brown hair.

8

“I’ve thought about going abroad, but decided to stay because friends have come forward to guarantee my loans,” she added sadly, before leaving with a friend who was driving her back home.

To avoid resorting to charity, many other Icelanders are choosing to pack their bags and try for a new future abroad, with official statistics showing the country’s biggest emigration wave in more than a century is underway.

“I just don’t see any future here. There isn’t going to be any future in this country for the next 20 years,” laments Anna Margret Bjoernsdottir, a 46-year-old single mother who is preparing to move to Norway in June if she is unable to ward off eviction from her home near Reykjavik.

For those left behind, a growing number are having trouble scraping together enough money to put decent food on their children’s plates.

While only a minority have been forced to seek out food banks to feed their families, some parents admit to going hungry to feed their children.

“I must admit that with the hike in food prices, my two sons eat most of what my husband and I bring home,” Arna Borgthorsdottir Cors confessed in a Reykjavik cafe.

“We get what is left over,” she says.

Source: Excerpted from Marc Preel, “Iceland’s new poor line up for food,” AFP, 8 April 2010.