12.5 Strategic Moves, Credibility, and Commitment

There’s something not very satisfying about the equilibrium of the play or pass bargaining game. There was a big payoff for both players (11, 11) available later in the game, yet because each player followed his own self-

492

FREAKONOMICS

Game Theory in Track Cycling Competitions

Usain Bolt can run 100 meters in 9.58 seconds. Not quite as fast as a cheetah (which would take about 5.8 seconds to run that far), but still, faster than any other human who has ever lived. As a reward for his extreme speed, Bolt earned six Olympic gold medals between 2008 and 2012, and his estimated yearly earnings total $23.2 million.

Jason Kenny, the 2012 Olympic gold medalist in the track cycling individual sprint, probably won’t impress you quite as much as Usain Bolt. The event he won involves two cyclists racing three laps around a 250-

It’s not that Jason Kenny can’t bike faster than this. In a full sprint, he travels at frighteningly high speeds—

So why does Kenny go so slow at the start? Because he understands game theory.

Here is the problem. The racer who is behind, counterintuitively, has an inherent advantage over the racer who is in front. The reason is drafting, the act of riding behind another cyclist to take advantage of the reduction in air resistance in that cyclist’s wake. It requires less physical effort to draft off another rider than to ride in front. The faster the rider in front goes, the greater the advantage that accrues to the rider who is behind because of the ability to draft.

This means the riders are not at an equilibrium when one leads and rides quickly; if a rider does that, he will surely lose as the other rider “slingshots” past him because of the draft he creates. Instead, the riders creep around the track until one suddenly tries to make a break away, hoping that the head start he gets is enough to offset the disadvantage of allowing the other rider to draft. The longer the riders wait, the more the scales tip toward the rider in front, so eventually one of the riders starts to sprint. That is when things get exciting. Unless, of course, you are an economist, in which case the application of game theory in the first few laps may be what really gets your adrenaline flowing.

strategic move

An action taken early in a game that favorably influences the ultimate outcome of the game.

In this section, we discuss ways in which players can avoid such poor outcomes in certain kinds of sequential games. The key is for players to use strategic moves. These are defined by Nobel Laureate Thomas Schelling in his wonderful book The Strategy of Conflict as actions taken early in a game to influence the ultimate outcome in a way that benefits the player.4 Examples of such actions include side payments, promises, and threats, and their purpose is to alter the payoffs of a game to change its outcome in a way that is favorable for the player taking the action.

Side Payments

493

side payment

A type of bribe that influences the outcome of a strategic game.

One of the simplest types of strategic behavior is a side payment, a promise of a payment from one player to an opposing player conditional on the choice the opponent makes. A side payment is, in essence, a type of bribe aimed at compelling the opponent to choose the strategy that is in the player’s best interest.

Let’s think about side payments in the context of the “Play or Pass” game. What’s the essence of the problem? Dan chooses to play right away in the game because he knows that if he doesn’t, Patrick’s best choice is to choose “Play” and leave him, Dan, with nothing. But note how much Patrick’s “best” choice hurts him: Because “Play” is Patrick’s best choice at node B, Dan has no choice but to choose to play at node A, end the game early, and cause Patrick to lose 10. This poor outcome for Patrick could be avoided if Patrick was able to convince Dan that he will choose “Pass” at node B if given the opportunity to do so (i.e., if Dan will not immediately end the game at node A by choosing to play). Moreover, Dan would like to be convinced that Patrick will choose “Pass” at node B because then Dan would earn 11 rather than the measly 1 he receives at the Nash equilibrium.

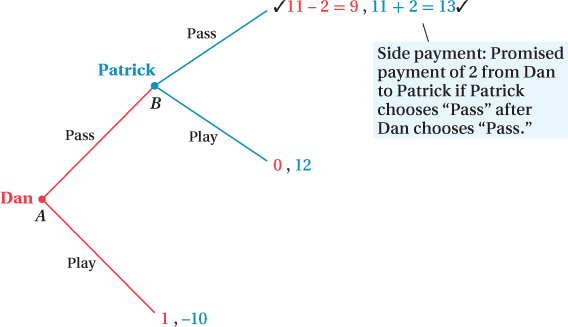

How might Dan get Patrick to commit to choosing “Pass” at node B? He can make a side payment. Suppose Dan, instead of choosing to play right away, ending the game, and receiving a payoff of 1, makes the following take-

How does this side payment of 2 affect the game’s outcome? As Figure 12.4 shows, Patrick’s payoff from “Pass” at node B is now 13 instead of 11. Because this is more than he would get by choosing to play, he’ll now want to choose to pass instead. Dan is just fine with this: He gets a payoff of 9 (the original payoff of 11 minus the side payment of 2), which is a lot better than the 1 he would have received by choosing to play.

Effective use of side payments, then, can alter the game in beneficial ways for both players. In this game, the players have figured out how to take some of the extra payment they receive in the coordinated outcome and split it in a way that creates incentives for them to coordinate.

494

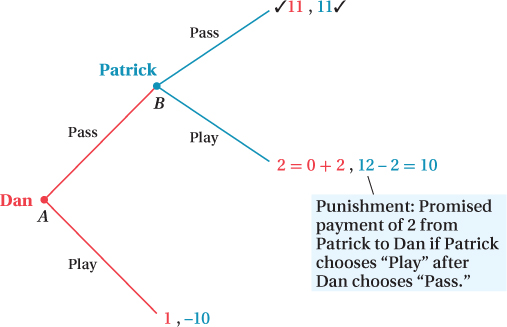

Somewhat amazingly, just having the ability to make side payments can sometimes work, even if no money ever changes hands. Suppose, for example, that Patrick proposes the side payment this time. Before the game starts, he promises Dan that if he (Patrick) chooses “Play” at node B, he will give Dan a payment of 2 as a punishment to himself for hurting Dan. This promised punishment reduces Patrick’s payoffs from “Play” at node B from 12 to 10 (Figure 12.5) and changes his node B best option from “Play” to “Pass.” Realizing that the side payment punishment makes “Pass” Patrick’s best option, Dan now faces the following node A options: Choose “Play” and receive 1, or choose “Pass” and receive 11. Dan now chooses “Pass.” Patrick responds by choosing “Pass” at node B, and both earn 11.

Note that no side payment actually needs to be made: The punished option (Patrick choosing “Play”) is not chosen because the punishment makes “Pass” the better choice for Patrick. This promised punishment encourages Dan to choose “Pass” at node A because it eliminates Dan’s worry about what Patrick will do at node B. With the punishment in place, Patrick is better off by also selecting “Pass.”

In fact, if Patrick wants to send a really strong message, he could promise to pay Dan the full payment of 12 if he (Patrick) chooses “Play,” or an even bigger amount. The key is that the side payment must be large enough to make “Play” a lower-

Commitment

Side payments might not always work. In our “Play or Pass” game, we assumed that Dan and Patrick would have no difficulty in sticking to the choice encouraged by the promised side payment, but that’s not always the case. In real life, a player might have incentives to renege on side-

Let’s think about this some more by returning once again to the simultaneous-

noncredible threat

A threat made in a game that is not rational for the player to follow through on and, as such, is an empty threat.

One possible approach to gaining first-

credible commitment

A choice or a restriction of choices that guarantees a player will take a particular future action if certain conditions occur.

The key to making a successful strategic move toward an exclusive May opening is a credible commitment, a choice (or a restriction of choices) that guarantees a player will take a particular future action if certain conditions occur that transform the game. A firm not only needs to threaten to open in May, it also needs to take actions ahead of time that would make it costly for it to not do so and thus signal to the firm’s opponent that the firm will carry out its threat.

Suppose Warner Brothers funds an early national advertising campaign for The LEGO Movie 2 with “Opening This May” all over the ads and leaks word to the media during production that it expects the film to be a “summer blockbuster.” Suppose Warner Brothers even signs contracts for distribution that incorporate huge penalty payments to theaters if the movie does not arrive on screens in May. Or, perhaps Warner Brothers creates copies of the movie that will disintegrate after the summer so that The LEGO Movie 2 can never be viewed again (yes, this is a stretch, but we are making the point of what counts as a credible move).

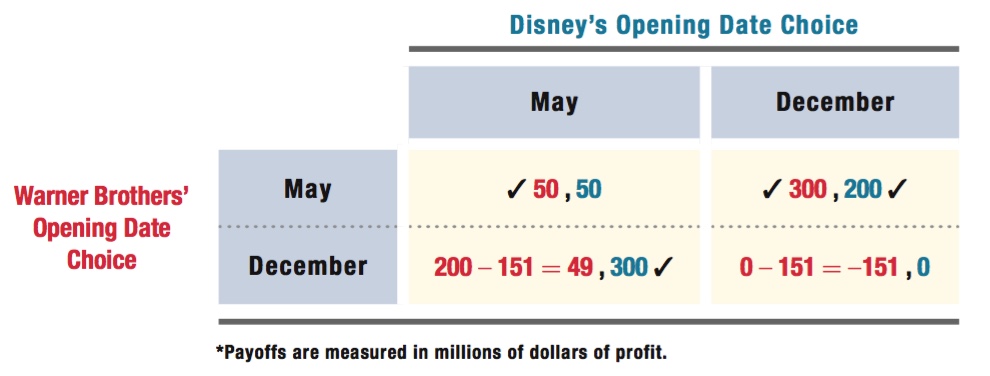

Each of these actions gives Warner Brothers a way to credibly commit to a May opening and thus change its payoffs. If the payoff changes from this commitment are large enough, Warner Brothers can alter the basic structure of the game. As long as Warner Brothers makes less than $50 million if it opens in December, opening in May will become a dominant strategy for Warner Brothers, as you can see in Table 12.11. Suppose that Warner Brothers makes commitments that will cost it $151 million if The LEGO Movie 2 opens in December. Subtracting 151 from Warner Brothers’ payoffs in the “December” row changes its payoffs to 49 in the lower left and –151 in the lower right. Now, no matter what Disney does, Warner Brothers is better off if it chooses May.

Once Warner Brothers has made its threat to open in May credible, Disney’s best response is to choose a December release date. Therefore, Warner Brothers has achieved what it wanted (forcing Disney to choose a December opening) by limiting its own options ahead of time. By making a December choice so unappealing as to be impossible, Warner Brothers effectively commits itself to take its threatened action (opening in May).

496

What is so compelling about this strategic move is that on its face it looks irrational. Imagine explaining to your boss that she should make the movie disintegrate after the summer. “You took microeconomics for that?!” you hear, as security escorts you to your desk to box up your possessions. But, by taking these seemingly detrimental actions, you have actually helped the studio earn $100 million more profit ($300 million instead of $200 million) than it may have earned without them (because the studio could have ended up with a December opening while its competitor chose May). “Nicely done, kid,” your boss says as you move into a corner office.

figure it out 12.4

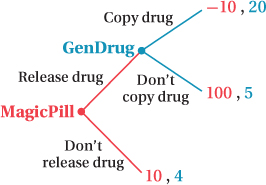

MagicPill Inc. has developed a new wonder drug for curing obesity that has been approved by the Food and Drug Administration. If the drug is released for sale, a competitor, GenDrug, will attempt to copy the formula and steal all of MagicPill’s customers by offering the wonder drug at a lower price. (Assume there are no patent laws at this time.) The extensive form of the game is shown below (payoffs represent profits in millions of dollars):

Should MagicPill release this new wonder drug for sale? Explain.

Would your answer to (a) change if GenDrug promised not to copy the new drug? Explain.

Would your answer to (a) change if GenDrug signed a contract with MagicPill promising to pay $10 million if it copies the drug? Explain.

How would your answer to (a) change if patent laws protect MagicPill’s exclusive right to produce its new wonder drug?

Solution:

No. MagicPill will not release the drug. Using backward induction, we can see that if the drug is released, GenDrug will choose to copy it (because it can earn $20 million profit rather than $5 million). Knowing this, MagicPill is better off not releasing the drug (because it can earn $10 million rather than losing $10 million).

No. GenDrug’s promise would not be credible. The incentive ($15 million additional profit) is large enough that MagicPill cannot believe the promise by GenDrug.

497

No. The payment of $10 million by GenDrug will not change GenDrug’s incentive for copying the drug ($20 million – $10 million > $5 million). Furthermore, the payment of $10 million would not be enough to induce MagicPill to release the drug (–$10 million + $10 million < $10 million).

Yes. If the patent prohibited GenDrug from copying the wonder drug, we can ignore the “Copy Drug” option in the game. In this case, MagicPill will want to release the drug because $100 million > $10 million.

Application: Dr. Strangelove and the Perils of Secrecy

Stanley Kubrick’s classic black comedy Dr. Strangelove or: How I Learned to Stop Worrying and Love the Bomb is set in the midst of the Cold War and the nuclear arms race between the United States and the Soviet Union.

In real life, the military consulted extensively with game theorists in the realm of nuclear deterrence. For example, two Nobel Laureate game theorists mentioned in this chapter, John Nash and Thomas Schelling, worked for a time at RAND Corporation analyzing various facets of the Cold War conflict.

The movie mocks the game theory basis of nuclear deterrence. The plot features a rogue U.S. general who, convinced that water fluoridation is a Communist conspiracy to “sap and impurify all of our precious bodily fluids,” orders his bomber squadron to launch a nuclear attack on the Soviets. The president orders his top commander to stop the bombers, but the commander says it’s impossible; to establish a credible commitment to fight back against a Soviet attack, the bombers cannot be recalled once they pass the point of no return. The president calls the Soviet premier to plead with him not to respond with a massive retaliation, but discovers that, unfortunately, the Soviets have recently installed a doomsday machine that automatically responds to any attack by launching a world-

But, the Soviets had been keeping the machine a secret for the prior six months. The president’s game theory advisor, Dr. Strangelove (thought by some to be a parody of John von Neumann, one of the inventors of game theory), asks the Soviet ambassador incredulously, “The whole point of the doomsday machine is lost if you keep it a secret! WHY DIDN’T YOU TELL THE WORLD, EH?” The ambassador answers, “It was to be announced at the Party Congress on Monday. As you know, the premier loves surprises.”

We’re not sure this is the message that Stanley Kubrick wanted to deliver by making this movie, but it’s still right: If you have a doomsday machine, make it credible, and TELL PEOPLE.

Entry Deterrence: Credibility Applied

One of the most common applications of strategic moves in microeconomics relates to deterring firms from entering an industry.

We have seen repeatedly throughout the past several chapters that firms can earn much higher profit levels if they are able to prevent other firms from entering their market. Preventing entry isn’t always easy, though. One reason, as with Warner Brothers’ threat to open in May no matter what, is the issue of credibility.

498

Think of the iPad as if it were the only tablet on the market and Apple as a monopolist (it wasn’t far from it in the beginning). Now suppose another company comes along—

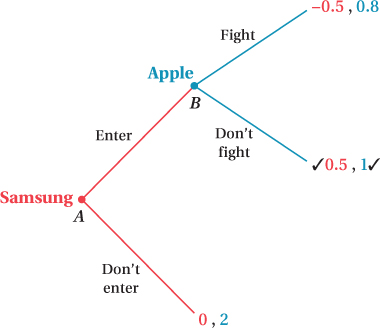

We can think of this as a sequential game. The extensive form of the game is shown in Figure 12.6. The payoffs are profits in billions of dollars.

First, Samsung decides whether to enter the market. If it doesn’t enter, the game is over. Samsung earns a profit of zero and Apple earns the monopoly profit of $2 billion (Samsung’s payoffs are listed in red, first in every payoff pair). If Samsung enters the market, however, then Apple must decide how to react. If Apple fights Samsung’s entry by starting a price war, Samsung will lose $0.5 billion and Apple will earn only $0.8 billion. If Apple doesn’t fight, Samsung will earn $0.5 billion and Apple $1 billion—

It might seem as though Apple could crush a new entrant like the Samsung Galaxy Note anytime it wants by just promising to start a price war. If so, Samsung will lose money if it enters. Therefore, Samsung should look ahead and realize what Apple wants to do, leading Samsung to the conclusion that it’s better if it doesn’t enter, right?

Not so fast. Samsung will consider the credibility of a price-

From our previous discussion, we know that the only way Apple can deter entry is by initiating a strategic move that somehow makes the threat to fight credible. One classic maneuver discussed by business strategists is the use of excess capacity. Under this strategy, the incumbent (Apple) builds all the capacity it would need if Samsung were to enter and there was a price war—

499

This strategy wouldn’t affect Apple’s payoffs much in the event of an actual price war, because it’s going to be fully utilizing the capacity it has already built. But the fact that Apple has so much capacity also tends to reduce its price (and profits) if it remains a monopolist, or if Samsung enters and Apple rolls over (since its output would be greater because of its capacity). This output effect of the extra capacity occurs because it greatly lowers Apple’s marginal cost, causing its optimal price to fall. A closely related interpretation of this effect is that if the two firms operate in a Cournot oligopoly, Apple’s extra capacity is used to raise its output, thus lowering the market price.

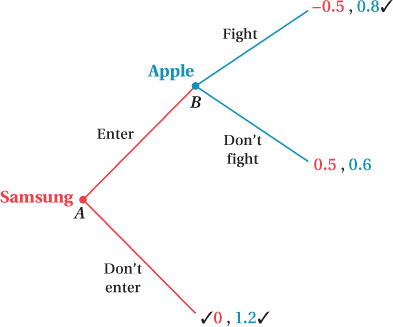

Let’s suppose Apple invests in extra capacity at an earlier date, and this investment lowers its profit to $1.2 billion in the monopoly case with no entry (because the extra factory capacity sits idle) and to $0.6 billion if Samsung enters and Apple chooses not to fight. This investment would change the game tree from the one shown in Figure 12.6 to the one in Figure 12.7 because Apple’s threat to fight is now credible.

The strategic use of overcapacity affects the game’s payoffs in an advantageous way for Apple. Now, if Samsung enters, Apple makes more profit by fighting ($0.8 billion) than not ($0.6 billion). Samsung realizes that Apple will definitely fight and chooses to not enter, because zero profit is better than incurring a half billion dollar loss (–$0.5 billion). Apple remains a monopolist, earning $1.2 billion instead of the $1 billion it would have made as a duopolist in the original equilibrium (Figure 12.6). Apple has therefore made its threat to start a price war credible by making a strategic move (early capacity investment choices).

Again, strategic considerations have made seemingly irrational actions beneficial. Imagine trying to explain this strategy to the boss: “We need to build a series of factories that we will never use to create massive excess capacity for making iPads.”

“Wait, what? Why would we pay for factories we don’t need?” the boss asks.

“So we can credibly prove that our profit will be lower if Samsung enters the market and we don’t try to stop them,” you say.

Somewhere in the accounting department, someone reads this plan and feels his blood pressure rise. “Now the economist wants us to pay for factories that we won’t even use!” But, the logic is absolutely right—

500

Application: Incumbent Airlines’ Responses to Threatened Entry by Southwest

While economists rightfully pay a lot of attention to theories about strategic behavior in response to entry threats, actually testing these theories is difficult. By nature, most market data are about firms already operating in a market. But entry threats come from firms that aren’t yet in a market. Rarely can economists actually observe data that measure this potential for entry before it ever happens.

Two of this book’s authors (Austan Goolsbee and Chad Syverson)5 figured out a way around this problem in a study testing for strategic behavior among incumbents in the passenger airline industry. Goolsbee and Syverson measured how incumbents responded when Southwest Airlines threatened to offer service on the incumbents’ routes. They measured this strategic response by tracking what happened to incumbents’ fares, passenger traffic, and capacity when Southwest Airlines loomed as a potential competitor.

How can one measure the threat of entry in this industry before actual entry ever occurs? The secret is in understanding the way Southwest expands its route network. When Southwest begins operating in a new airport (and it has entered a lot of new airports during the past 25 years), it does not immediately offer service from that new airport to every other airport in its route network. Instead, it ramps up its operations at the new airport over time. It begins by offering service between the new airport and only a handful of other airports in the Southwest network. It then gradually adds flights to more destinations from the new airport, connecting more of the dots in its network. It’s this practice of gradually rolling out routes that allows one to observe entry threats before entry actually occurs. Once Southwest has started operating in that new airport, even if it hasn’t started flying a particular route yet, it’s much more likely to do so soon.

An example of this principle in action occurred in November 2013, when Southwest began operations at the Memphis airport. Southwest’s service to and from Memphis began with nonstop flights to only five locations. Delta Airlines, a major incumbent carrier in Memphis, had a new competitor to deal with as a result. Those five routes were cases of Southwest actually entering markets. But the route-

Goolsbee and Syverson tested for strategic behavior by looking at how incumbents like Delta and American behaved on hundreds of routes like these that Southwest similarly threatened to enter as it expanded into roughly 20 new airports over a 12-

501

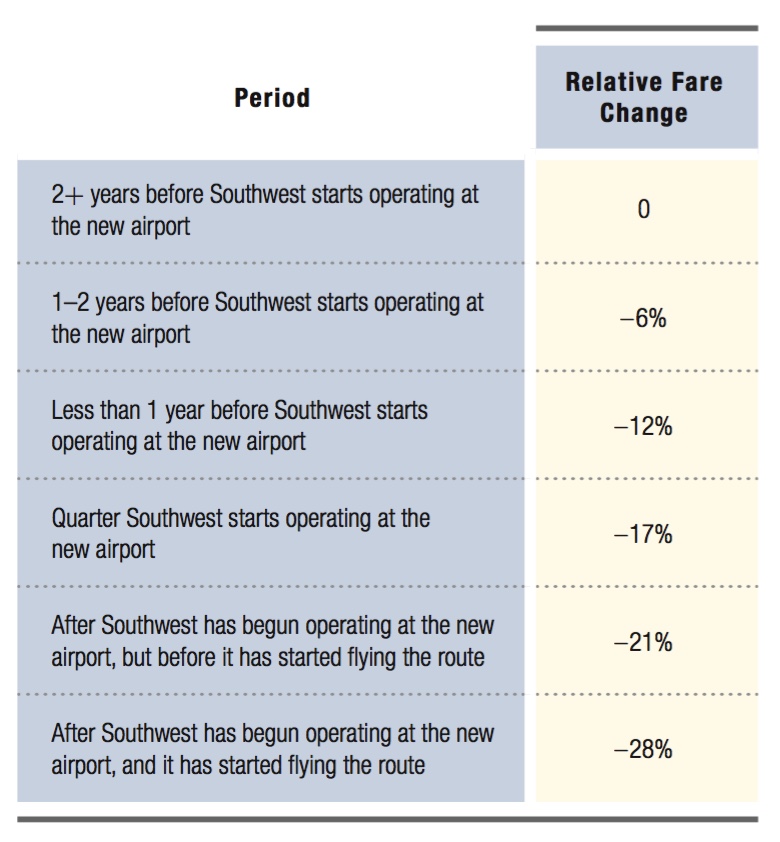

The data indicate that incumbents did indeed engage in strategic behavior on routes when Southwest loomed as a potential competitor. Table 12.12 illustrates how incumbents’ average fares changed on threatened routes around the time Southwest entered the new airport. It shows incumbents’ average fares on threatened routes relative to what they were on those same routes more than two years before Southwest entered the new airport.

By the quarter in which Southwest entered the new airport, incumbents had dropped their fares by 17% on the routes that Southwest threatened. Incumbents continued to drop fares after Southwest was in the new airport, on average, to levels 21% below their prior levels. This is a fairly substantial fare cut. It can be compared to the total 28% fare cut (again, relative to fares more than two years prior) that incumbents made when Southwest finally did enter those routes it was threatening. In other words, about two-

Goolsbee and Syverson hypothesized that these strategic responses to threatened entry were attempts by the incumbent airlines to build up loyalty among their flyers on the threatened routes, especially highly valuable frequent-

One interesting thing to note is that the incumbents actually began cutting prices before Southwest started operating in the new airport—

However, in many cases, Southwest was simply a tide that the incumbents weren’t going to be able to stop, no matter how aggressively they responded to the entry threat. That is, in fact, what happened to American in Memphis. Southwest now flies from Memphis to Dallas. But don’t think this necessarily means that American’s efforts were futile. By cutting fares early, it may have been able to keep business flyers whom it otherwise would have lost to Southwest. While American would have preferred that Southwest had never shown up, it may have been making the best of a tough competitive situation.

Reputation

502

One last example of a strategic behavior a player might undertake to deter the entry of a rival is to establish a reputation. Reputations themselves can be sources of commitment to a game-

Suppose Apple is facing potential entry not just by Samsung, but by scores of potential tablet makers. Apple could benefit from establishing a reputation for aggressively fighting any entry in any market. If Apple didn’t fight the entry by Samsung, such behavior may leave them open to even more new entrants like HTC, Xiaomi, or Amazon. Thus, Apple may incur the costs of fighting Samsung (even though doing so could harm its current profit) in order to promote its reputation as a fighter to deter future entrants. In this case, its desire to establish and then preserve a tough reputation becomes a commitment device itself.

Tobacco companies tried this strategy in their response to lawsuits by their former (and sometimes still current) customers. These suits were often for relatively small sums of money. Many of the suing smokers figured they could get the tobacco companies to settle the cases, essentially paying them off to avoid the high costs of a full trial.

But the companies realized that settling one case would only encourage more lawsuits. Other smokers would observe the settlement and then file suit in hopes of obtaining their own. While going to trial in any one case would be a money-

The companies therefore tried to establish a reputation for fighting any lawsuit with everything they had. They might pay millions in legal fees to fight a $1,000 lawsuit. While this practice seems irrational at first glance, the hope was that developing such a reputation would effectively commit them to fight any suit in the future, thereby cutting off the “entry” of new plaintiffs before they even filed papers.

Ultimately, though, the cigarette companies’ strategy fell apart. The lawsuits grew so numerous and so massive that the companies reached a multi-

But, a reputation for being crazy can be valuable. Return to the case of Apple facing entry by Samsung. Suppose Apple could convince Samsung that, regardless of the profit implications, it was just crazy enough to ignite a self-