13.5 Other Perfectly Competitive Factor Markets

In this section, we investigate the markets for other factors. Capital is one of the more prominent of these. Because capital markets involve elements of timing and uncertainty, we discuss the market for capital in the next chapter when we introduce these topics. However, any input firms use in production, such as intermediate materials (steel and fiberglass to make cars, leather to make shoes, etc.), business services, energy, and land, are bought and sold in factor markets. These markets have many similarities to the labor market.

Demand in Other Factor Markets

The markets for factors other than labor and capital operate, for the most part, just as the labor market does.

The demand for any factor is similar to that for labor:

A firm’s demand for any factor is given by the marginal revenue product of that factor.

A factor’s marginal revenue product falls as more of it is bought because of its diminishing marginal product (and because of falling revenue, too, if the market for the firm’s output isn’t perfectly competitive).

526

A price-

taking firm will optimally buy the quantity of a factor that equates its marginal revenue product to its market price. Total market demand for a factor is the horizontal (i.e., quantity) sum of the firm-

level demands.

Supply in Other Factor Markets

The supply of a factor comes from producers or owners of those factors.

intermediate good

Product that is made specifically to be used as a factor input into the production of another good.

Intermediate Goods Many factors are outputs of firms. Products that are made specifically to be used as factor inputs into the production of another good are called intermediate goods. Examples of intermediate goods include steel, advertising, mining equipment, and accounting services. The supply of an intermediate good is like the supply of any other product. It slopes upward because as the market price increases, producers of the factor are willing and able to supply more of their good to the factor market. The equilibrium price of intermediate goods (as with labor) is the price at which the quantity demanded equals the quantity supplied.

Application: Smartphones, Coltan, and Conflict Minerals

Inside of all smartphones are complex electronics that use small amounts of rare materials. One of those materials is tantalum, a chemical element used to make tantalum capacitors, which are very heat-

Producing tantalum requires extracting it from columbite–

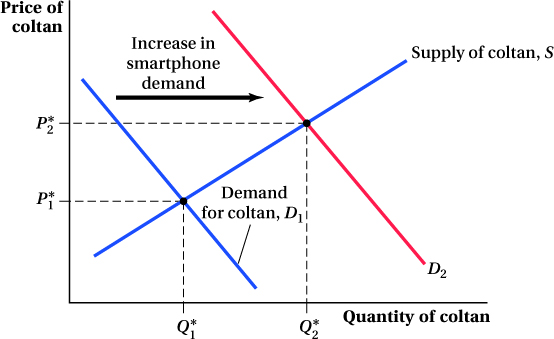

As the demand for smartphones has grown dramatically over time, so has the demand for the tantalum in coltan. This shift out in the coltan demand curve has raised coltan prices, as shown in Figure 13.9. Initially, demand for tantalum (in the form of coltan ore) is D1, leading to a market price for coltan of P*1 and a quantity of Q*1. As demand for smartphones rises, the marginal revenue product of tantalum to phone makers—

The supply curve for coltan S is upward-

Sadly, some of the costs of obtaining more coltan aren’t just borne by the miners, but also by the people of these regions, who have suffered additional social and environmental problems as a result of coltan mining. (These additional costs not borne by the producers are called externalities; we discuss externalities in detail in Chapter 17.)

527

unimproved land

The physical space on which economic activity (such as agriculture, housing, manufacturing, etc.) takes place.

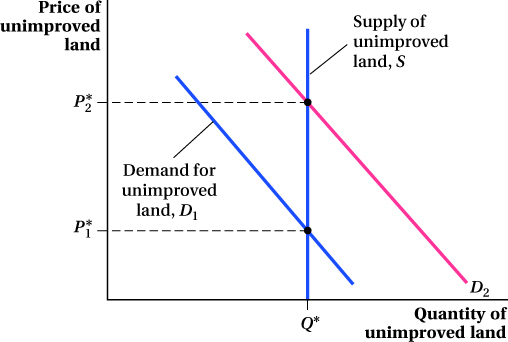

Land One factor market that is a bit different from the labor and intermediate goods markets is the market for unimproved land, the physical space on which economic activity (such as agriculture, housing, manufacturing, or office space) takes place. The difference is that unlike most other factors, the supply of unimproved land is essentially fixed. The land area of the earth is what it is, excepting very expensive reclamation projects that account for a miniscule fraction of existing land.

The fixed supply of unimproved land does not pose a problem for our standard supply and demand analysis; it just means that the supply curve is vertical. Thus, any changes in the demand for unimproved land affect only the equilibrium price of land—

Note that the supply of land for any particular use, however, is not fixed. If the prices of crops rise, for example, you can expect people to begin to cultivate some land that wasn’t formerly farmed. Likewise, if crop prices fall, some farmland will be transformed into other uses such as housing or industry. And, if the demand to live in an area rises, land that was once a farm or logging forest will be converted to housing, commercial, or industrial use.