Problems

(Solutions to problems marked * appear at the back of this book. Problems adapted to use calculus are available online at www.macmillanhighered.com/

People are always complaining about Facebook: It changed the way its news feed works, the privacy settings are awful, there are too many game notifications, and so on. Recognizing dissatisfaction with Facebook, Google tried three times to enter the social networking market, first with Buzz, then with Wave, and now with Google Plus. Users say that the Google Plus platform is far superior to Facebook’s, yet Google Plus appears to be failing. Explain why consumers might reject a superior product for an inferior one in a market like this.

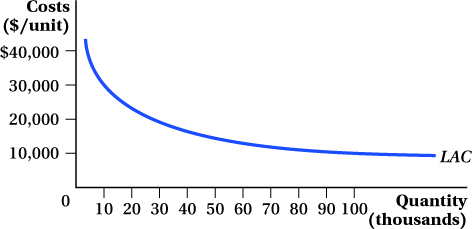

Consumers in Carlandia are willing to purchase up to 100,000 cars each year. Suppose the long-

run average cost curve for auto producers in Carlandia looks like that shown in the figure below:

If the supply side of Carlandia’s auto market has 10 identical firms operating, what is the lowest potential price that consumers might be able to purchase a car for?

If the supply side of Carlandia’s auto market is served by a monopolist, what is the lowest potential price that consumers might be able to purchase a car for?

Conventional wisdom suggests that competition is preferred to a monopoly. Do your answers to (a) and (b) support this widely held view?

Suppose the car market in Carlandia is served by a monopolist. One day, fed up with the mediocre quality of the existing supplier’s offerings, a resident decides to open a competing car company. What are the new company’s chances of lasting in this industry? Explain your reasoning.

Identify and explain the sources of market power for each case listed below:

In the early 1990s, the DeBeers diamond cartel controlled almost all of the world’s rough diamond production.

Microsoft’s Word has a virtual monopoly in word processing.

Union Pacific dominates the rail shipping market in the north central United States.

In Louisiana, people must pass a licensing test before they can arrange flowers for a living.

Indicate whether the following statements are true or false, and then explain your answers:

The marginal revenue from selling another unit of eggs can never be higher than the price of eggs.

Because the price a seller charges is always greater than $0, the marginal revenue from selling another unit must also be greater than $0.

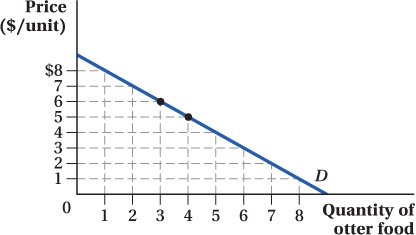

Consider the demand curve for otter food shown below:

Indicate the area representing the total revenue Oscar, the otter food seller, would receive if he chose a price of $6.

On the same graph, indicate the area representing the total revenue Oscar the seller would receive if he chose a price of $5.

You should now have added two rectangles to your graph; however, because of some overlap, it actually appears that you’ve added three. One of the three is common to both scenarios above. The other two (smaller) rectangles are specific to scenario (a) or scenario (b). Label each rectangle with “A,” “B,” or “both” to indicate which scenario each rectangle belongs to.

Indicate what happens (gain or loss) to rectangle A as Oscar reduces his price from $6 to $5. Why?

As Oscar reduces his price from $6 to $5, the rectangle A represents the loss. This is the revenue lost from decreasing the price.

Indicate what happens (gain or loss) to rectangle B as Oscar reduces his price from $6 to $5. Why?

As Oscar reduces his price from $6 to $5, the rectangle B represents the gain. This is the revenue gained from decreasing the price and selling more units.

Calculate the area of rectangle A and the area of rectangle B. Then, subtract the area of A from the area of B.

The area of rectangle A is

($6 – $5) × 3 = $3

The area of rectangle B is

$5 × (4 – 3) = $5

Subtracting area A from area B, we obtain $5 – $3 = $2.

Calculate the marginal revenue Oscar receives when he sells a 4th unit by subtracting the total revenue from selling 3 units from the total revenue from selling 4 units. Does your answer agree with the number you calculated in (f)? Explain.

The marginal revenue from selling a 4th unit is

MR = TRB – TRA = ($5 × 4) – ($6 × 3) = $2

Therefore, the result corresponds to the value obtained in (f).

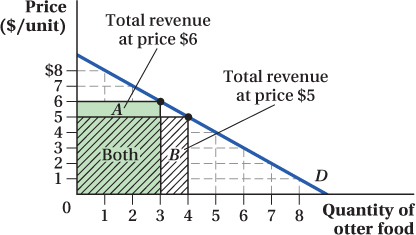

a., b. and c.

368

In Cleveland, Clive sells 15 cloves at a price of $5 each. If Clive lowers his price by 10%, to $4.50 per clove, he will sell 16, or 6.67% more. In Dallas, Delores sells 15 cloves for $5 each. If Delores lowers her price by 2%, to $4.90, she will sell 16 cloves, or 6.67% more.

Classify the demand curves that Clive and Delores face as elastic or inelastic.

Determine the marginal revenue of the 16th unit for Clive. Then, compute the marginal revenue of the 16th unit for Delores.

How does the marginal revenue received by a seller depend on the price elasticity of demand? Explain your answer.

In the chapter, we noted that the marginal revenue a seller receives can be expressed as MR = P + (ΔP/ΔQ) × Q.

Using this formula as a starting point, show that marginal revenue can be expressed as MR = P(1 + 1/ ED), where ED is the price elasticity of demand.

Using your knowledge about the price elasticity of demand, explain why the marginal revenue a firm with market power receives must always be less than the price.

Using your knowledge of the price elasticity of demand, explain why the marginal revenue a perfectly competitive firm receives must be equal to the price.

Juanita maintains the only greenhouse in isolated Point Barrow, Alaska, and therefore has a monopoly on the sale of fresh flowers. Her hired-

gun statistician estimates that the elasticity of demand for her flowers is –0.5. Explain intuitively how you know that Juanita cannot be maximizing profits. (Hint: Think about total revenue and total costs.) The inverse demand for fresh flowers in Point Barrow, Alaska, is given by P = 10 – 0.01Qd.

Use the demand function above to derive the associated marginal revenue function. (In other words, express marginal revenue as a function of Q.)

At what quantity does MR = 0?

What is special about a situation where marginal revenue equals zero? (Hint: You may want to graph the demand and marginal revenue curves, and incorporate what you learned about elasticity in Chapter 2.)

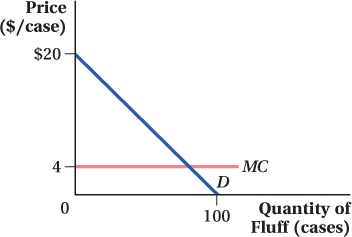

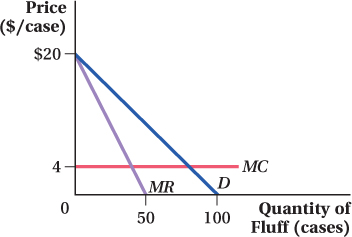

Consider the graph below, which illustrates the demand for Fluff. Fluff can be produced at a constant marginal and average total cost of $4 per case:

Draw in a carefully constructed marginal revenue curve.

The inverse demand function is

P = 20 – 0.2Q

Find MR by doubling the coefficient on Q in the inverse demand function.

MR = 20 – 0.4Q

Apply the MR = MC rule to determine the profit-

maximizing level of output. What price must the monopolist charge to maximize profit? Applying the MR = MC rule, we get

20 – 0.4Q = 4

Q = 40

The profit-

maximizing level of output is 40. The price that the monopolist must charge to maximize profit is P = 20 – (0.2 × 40) = $12

Calculate the profit earned by the monopolist.

The profit earned by the monopolist is

π = TR – TC = ($12 × 40) – ($4 × 40) = $320

The slope of the demand curve indicates that in order to sell one more unit, the price must fall by 20 cents. Verify that the seller cannot increase profit by reducing price and selling slightly more.

Suppose that the seller decreases the price by 20 cents to sell one more unit of the good. The profit becomes

π = TR – TC = ($11.80 × 41) – ($4 × 41)

= $483.8 – $164 = $319.80

The slope of the demand curve indicates that if the price of Fluff increases by 20 cents, consumers will buy one less unit. Verify that the seller cannot increase profit by increasing price and selling slightly less.

Suppose that the seller increases the price by 20 cents and sells one less unit of the good. The profit becomes

π = TR – TC = ($12.20 × 39) – ($4 × 39)

= $319.80

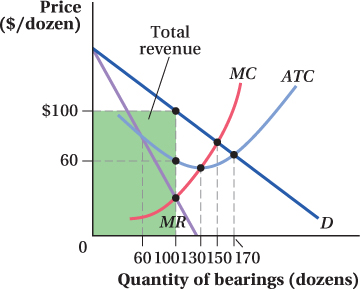

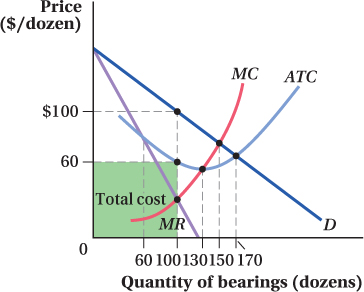

Irwin is a monopoly seller of specialty bearings. Consider the graph below, which illustrates the demand and marginal revenue curves for Irwin’s 30-

weight ball bearings, along with the marginal and average total costs of producing bearings: Find the monopolist’s profit-

maximizing level of output. The monopolist will maximize its profit by producing the level of output at which MR = MC, that is, 100 dozen bearings.

Determine the price the monopolist should charge to maximize profit.

The monopolist should charge $100 per dozen to maximize profit.

Draw an appropriate rectangle on your graph to represent the total revenue the seller receives from selling the profit-

maximizing quantity of bearings at the profit- maximizing price.

Draw an appropriate rectangle on your graph to represent the total cost of producing ball bearings at the profit-

maximizing quantity.

The difference in the areas you drew in (c) and (d) represents profit. Calculate the profit Irwin earns from selling 30-

weight ball bearings.

The profit is

π = TR – TC = (100 × $100) – (100 × $60)

= $4,000

369

-

Suppose that the demand for bentonite is given by Q = 40 – 0.5P, where Q is in tons of bentonite per day and P is the price per ton. Bentonite is produced by a monopolist at a constant marginal and average total cost of $10 per ton.

Derive the inverse demand and marginal revenue curves faced by the monopolist.

The inverse demand curve is

Q = 40 – 0.5P

P = 80 – 2Q

The marginal revenue is

MR = 80 – 4Q

Equate marginal cost and marginal revenue to determine the profit-

maximizing level of output. MR = 80 – 4Q = 10 = MC

4Q = 70

Q = 17.5

The profit-

maximizing level of output is 17.5 tons of bentonite. Find the profit-

maximizing price by plugging the ideal quantity back into the demand curve. The profit-

maximizing price is 17.5 = 40 – 0.5P

0.5P = 40 – 17.5

P = $45

How would your answer change if marginal cost were instead given by MC = 20 + Q?

If the marginal cost is 20 + Q, the profit-

maximizing quantity is MR = 80 – 4Q = 20 + Q = MC

5Q = 60

Q = 12

The profit-

maximizing price is 12 = 40 – 0.5P

P = $56

Suppose that econometricians at Hallmark Cards determine that the price elasticity of demand for greeting cards is –2.

If Hallmark’s marginal cost of producing cards is constant and equal to $1.00, use the Lerner index to determine what price Hallmark should charge to maximize profit.

Hallmark hires you to estimate the price elasticity of demand faced by its archrival, American Greetings. Hallmark estimates that American’s marginal cost of producing a greeting card is $1.22. You note that American’s cards sell for an average of $3.25. Assuming that American Greetings is maximizing profit, calculate its price elasticity of demand.

Many industry-

wide studies of the elasticity of demand for cigarettes (an industry dominated by a few firms with tremendous market power) indicate a price elasticity near –0.5. Yet, our study of market power tells us that a firm with any market power at all should never operate at a point on its demand curve where demand is inelastic. How can you reconcile these apparently contradictory statements? When it comes to CD sales, country artist Taylor Swift is twice as popular as Carrie Underwood, and at least four times as popular as Blake Shelton. Yet all of their albums retail for the same price. Does this suggest that music producers are failing to maximize profits? (Hint: Make the reasonable assumption that the marginal cost of producing a CD for any artist is a constant $2. Then try to construct a graphical example in which very different demand curves produce the same price.)

-

Suppose that a monopolistic seller of designer handbags faces the following inverse demand curve: P = 50 – 0.4Q. The seller can produce handbags for a constant marginal and average total cost of $10.

Calculate the profit-

maximizing price for this seller. Suppose the government levies a $4 tax per unit on sellers of handbags. Calculate how this tax will affect the price the monopolist charges its customers.

Who bears the burden of this tax?

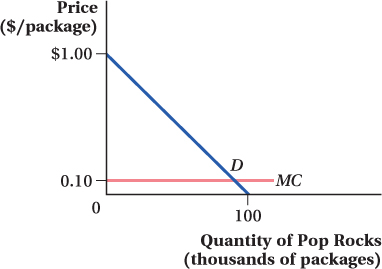

Consider the market for Pop Rocks depicted in the diagram below:

If the Pop Rock industry were competitive, what would the competitive price and quantity be?

If the Pop Rock industry were competitive, what would the consumer and producer surpluses be, respectively?

Suppose that gangland figure Tommy Vercetti monopolizes the Pop Rock market. What price and quantity would he choose to maximize profit?

Calculate the consumer and producer surpluses of this Pop Rock monopoly.

Compare your answers in (d) to (b). How big is the deadweight loss of monopoly?

370

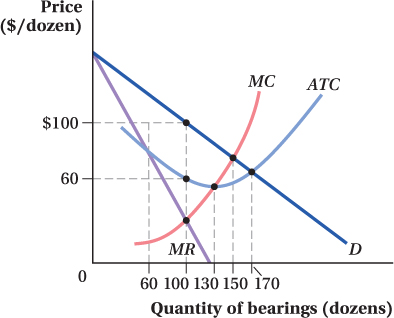

The graph in Problem 11 depicts the market demand for 30-

weight ball bearings. That particular market segment is monopolized by a single producer named Irwin. Referring to that graph: How do the monopolist’s price and quantity compare to the price and quantity that would prevail under perfect competition?

Shade an area in the graph that represents the deadweight loss due to Irwin’s monopoly.

-

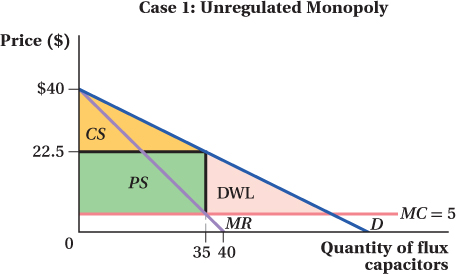

Suppose that a monopolistic seller of flux capacitors faces the inverse demand curve P = 40 – 0.5Q, and that the monopolist can produce flux capacitors at a constant marginal cost of $5.

How many units will an unregulated monopolist sell?

The marginal revenue is 40 – Q:

MR = 40 – Q = 5 = MC

Q = 35

The unregulated monopolist constant will sell 35 flux capacitors.

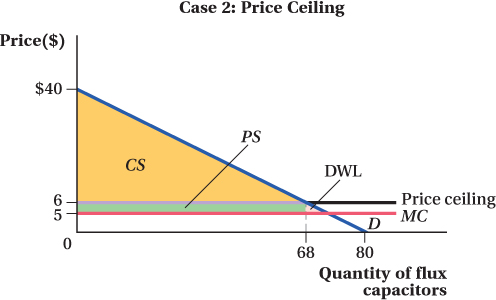

Suppose that the government imposes a price ceiling of $6. What does this price ceiling do to the monopolist’s marginal revenue curve? Specifically, what is the marginal revenue of the 10th unit? The 68th? How about the 69th?

The price ceiling is also the marginal revenue for the first 68 units; that is, MR = 6 because consumers are willing to pay $6 or more. Therefore, the marginal revenue for the 10th unit and the 68th unit is $6. However, selling the 69th unit requires reducing the price to $5.50. Thus, the total revenue from selling 68 units is $6 × 68 = $408, and the total revenue from selling 69 units is $5.50 × 69 = $379.50. Therefore, the marginal revenue of the 69th unit is $408 – $379.50 = –$28.50.

How many units will a profit-

maximizing monopolist sell when the price ceiling is in place? At what price? The monopolist will sell the first 68 units at a price of $6, since the marginal revenue exceeds the marginal cost. The monopolist will not sell the 69th unit because the marginal cost is greater than the marginal revenue.

Compare the deadweight loss of unregulated monopoly to the deadweight losses with the price ceiling. Does the price ceiling improve social welfare?

As shown in the diagrams below, the price ceiling indeed reduces the deadweight loss.

-

Consider a small, isolated town in which a brewery faces the following inverse demand: P = 15 – 0.33Q. The brewery can produce beer at a constant marginal and average total cost of $1 per bottle.

Calculate the profit-

maximizing price and quantity, as well as producer and consumer surplus and the deadweight loss from market power. If it were possible to organize the townsfolk, how much would they be willing to pay the brewery to sell beer at a price equal to its marginal cost?

What is the minimum payment the brewery would be willing to accept to sell beer at a price equal to marginal cost?

Is there potentially a bargain that can be struck between the townsfolk and brewery? What would the deadweight loss be if such a bargain were struck?

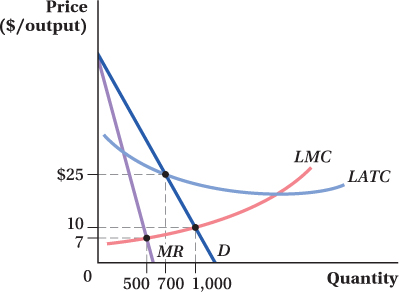

Consider the firm depicted in the following diagram:

Is the firm a natural monopoly? How do you know?

Will this firm earn a profit if it is not subject to regulation? How do you know?

If the government requires the firm to charge no more than its marginal cost of production, how many units will be sold? At what price? What is the problem with the government capping prices at marginal cost?

Suppose the government allows firms to charge no more than their average total costs of production. How many units will this firm sell? At what price? What is the problem with capping prices at average total cost?

Evaluate the deadweight loss under each of the three pricing regimes above. Show each regime’s deadweight loss as an area on the graph.

-

Five networks are vying to receive the pay-

per- view broadcast rights to the World Series of Yahtzee. Each estimates that the inverse demand for watching this nail- biter of an event is given by P = 100 – 0.01Q. Each can provide the broadcast at a constant marginal cost of $1 per viewer. Calculate the deadweight loss of monopoly in the market for the televised Yahtzee tournament.

Suppose that Yahtzee’s tournament governing body plans to select one network at its discretion to air the tournament. How much will each network be willing to spend lobbying for the broadcast rights?

Explain why, in this situation, the losses to society are much greater than just the deadweight losses of monopoly.

In the early days of navigation, sailors had a tough time figuring out exactly where they were. Pinpointing latitude was easy enough with a sextant, but because the earth was constantly spinning, pinpointing longitude by using celestial bodies was impossible. Anxious for a solution to this problem, the British government sponsored a contest with a prize of £20,000 (about $5 million in today’s dollars) to the inventor who could devise a reliable method of calculating longitude. Once invented, the method would be made available to anybody who wanted to use it. Explain the advantages of such a system in maximizing social well-

being relative to the traditional system of awarding patents.

Work this problem with calculus

Work this problem with calculus