16.7 PROBLEMS

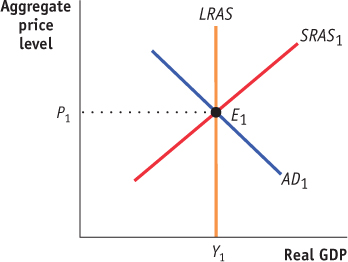

In the economy of Scottopia, policy-

makers want to lower the unemployment rate and raise real GDP by using monetary policy. Using the accompanying diagram, show why this policy will ultimately result in a higher aggregate price level but no change in real GDP.

In the following examples, would the classical model of the price level be relevant?

There is a great deal of unemployment in the economy and no history of inflation.

The economy has just experienced five years of hyperinflation.

Although the economy experienced inflation in the 10% to 20% range three years ago, prices have recently been stable and the unemployment rate has approximated the natural rate of unemployment.

The Bank of Canada and Statistics Canada release data on the Canadian monetary base regularly. You can access that data on Statistics Canada’s website. Go to www.statcan.gc.ca/

start-debut-eng.html and click on “CANSIM,” from the “Features” section. Then enter “v37253” and click the “Search” button, followed by “Continue.” Pick a time period that runs for the past 14 months and then click on “Retrieve now.”The numbers retrieved show the levels of the monetary base over the past last year. How much did it change in the most recent 12-month period?

How did this help in the government’s efforts to finance its deficit?

Why is it important for the central bank to be independent from the part of the government responsible for spending?

Answer the following questions about the (real) inflation tax, assuming that the price level starts at 1.

Maria Moneybags keeps $1000 in her sock drawer for a year. Over the year, the inflation rate is 10%. What is the real inflation tax paid by Maria for this year?

Maria continues to keep the $1000 in her drawer for a second year. What is the real value of this $1000 at the beginning of the second year? Over the year, the inflation rate is again 10%. What is the real inflation tax paid by Maria for the second year?

For a third year, Maria keeps the $1000 in the drawer. What is the real value of this $1000 at the beginning of the third year? Over the year, the inflation rate is again 10%. What is the real inflation tax paid by Maria for the third year?

After three years, what is the cumulative real inflation tax paid?

Redo parts (a) through (d) with an inflation rate of 25%. Why is hyperinflation such a problem?

The inflation tax is often used as a significant source of revenue in developing countries where the tax collection and reporting system is not well developed and tax evasion may be high.

Use the numbers in the accompanying table to calculate the inflation tax in Canada, the United States, and India (Rp = rupees).

Sources: Statistics Canada; Department of Finance Canada; U.S. Bureau ofEconomic Analysis; Federal Reserve Bank of St. Louis; Controller General of Accounts (India); Reserve Bank of India; International Monetary Fund.

Sources: Statistics Canada; Department of Finance Canada; U.S. Bureau ofEconomic Analysis; Federal Reserve Bank of St. Louis; Controller General of Accounts (India); Reserve Bank of India; International Monetary Fund.How large is the inflation tax for these three countries when calculated as a percentage of government receipts?

Concerned about the crowding-

out effects of government borrowing on private investment spending, a candidate for member of parliament argues that the Government of Canada should just print money to cover the government’s budget deficit. What are the advantages and disadvantages of such a plan?

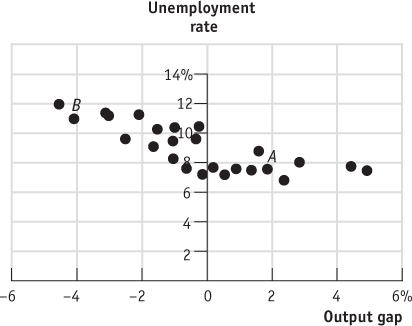

The accompanying scatter diagram shows the relationship between the unemployment rate and the output gap in Canada from 1980 to 2004. Draw a straight line through the scatter of dots in the figure. Assume that this line represents Okun’s law:

Unemployment rate = b − (m × Output gap) where b is the vertical intercept and −m is the slope

What would the unemployment rate be if the output gap were 1.9%? What if the output gap were −4%? What do these results tell us about the coefficient m in Okun’s law? Use this value of m to determine what the unemployment rate would be when aggregate output equals potential output. What does this tell us about the coefficient b in Okun’s law?

After experiencing a recession for the past two years, the residents of Albernia were looking forward to a decrease in the unemployment rate. Yet after six months of strong positive economic growth, the unemployment rate has fallen only slightly below what it was at the end of the recession. How can you explain why the unemployment rate did not fall as much although the economy was experiencing strong economic growth?

Due to historical differences, countries often differ in how quickly a change in actual inflation is incorporated into a change in expected inflation. In a country such as Japan, which has had very little inflation in recent memory, it will take longer for a change in the actual inflation rate to be reflected in a corresponding change in the expected inflation rate. In contrast, in a country such as Zimbabwe, which has recently had very high inflation, a change in the actual inflation rate will immediately be reflected in a corresponding change in the expected inflation rate. What does this imply about the short-

run and long- run Phillips curves in these two types of countries? What does this imply about the effectiveness of monetary and fiscal policy to reduce the unemployment rate?

Go to www.statcan.gc.ca/

start-debut-eng.html . In the “Latest indicators” window, click on “CPI annual inflation.” Scroll to the bottom of the page and click on “326-0020 to 326-0022,” then click on “326-0021.” What is the value of the percent change in the All-items CPI from 2008 to 2009? Note: You can extend the time span of the data by clicking on “Add/Remove data,” scrolling to the bottom of the page, selecting the time frame of your choice from the drop- down menu, and then clicking on “Apply.” Now go to www.bankofcanada.ca. Click on “Rates and Statistics” and select “Interest rates” from the drop-

down menu. From there, click on “Selected treasury bill yields” on the left side of the page, and then click on “Selected treasury bill yields: 10-year lookup” on the left side of the page. Then click on “Start (or single date)” and pick start and end dates for the data (select the start and end of 2009 to retrieve all the data for this year). Click “1 month” to select data on 1-month treasury bills. Now click “Submit.” Examine the observed yields for 1-month treasury bills in 2009. What is the maximum? The minimum? Follow the same steps to retrieve observed yields for 1-month treasury bills in 2007. How do the data for 2009 and 2007 compare? How would you relate this to your answer in part (a)? From the data on treasury bill interest rates, what would you infer about the level of the inflation rate in 2007 compared to 2009? (You can check your answer by going back to www.statcan.gc.ca/ start-debut-eng.html to find the percent change in the CPI from 2006 to 2007.)How would you characterize the change in the Canadian economy from 2007 to 2009?

The accompanying table provides data from Canada on the average annual rates of unemployment and inflation. Use the numbers to construct a scatter plot similar to Figure 16-5. Discuss why, in the short run, the unemployment rate rises when inflation falls.

Source: Statistics Canada.

Source: Statistics Canada.

The economy of Brittania has been suffering from high inflation with an unemployment rate equal to its natural rate. Policy-

makers would like to disinflate the economy with the lowest economic cost possible. Assume that the state of the economy is not the result of a negative supply shock. How can they try to minimize the unemployment cost of disinflation? Is it possible for there to be no cost of disinflation?

Who are the winners and losers when a mortgage company lends $100 000 to the Miller family to buy a house worth $105 000 and during the first year prices unexpectedly fall by 10%? What would you expect to happen if the deflation continued over the next few years? How would continuing deflation affect borrowers and lenders throughout the economy as a whole?