16.3 Aggregate Supply

Between 1929 and 1933 there was a sharp fall in aggregate demand—

The aggregate supply curve shows the relationship between the aggregate price level and the quantity of aggregate output supplied in the economy.

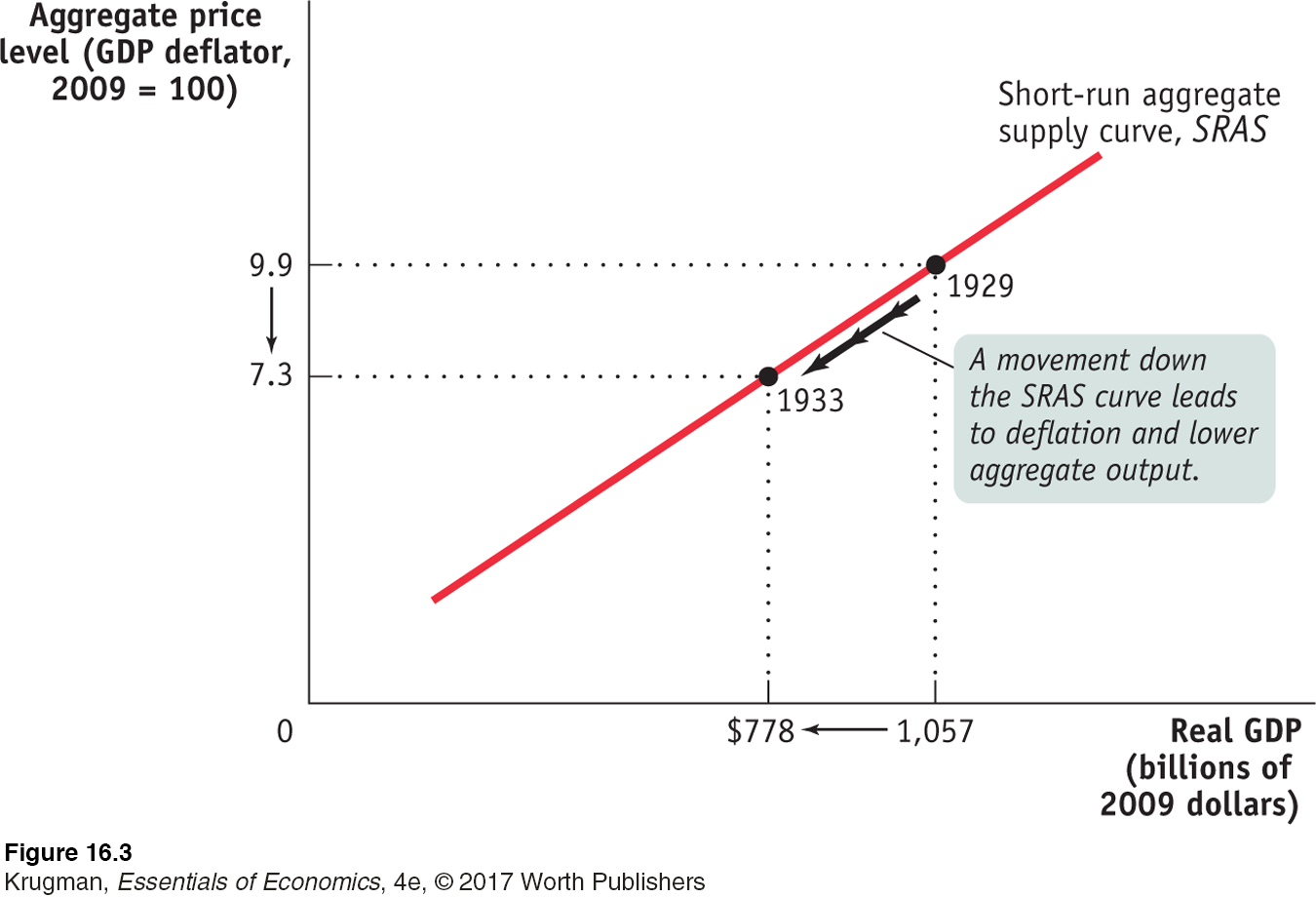

The association between the plunge in real GDP and the plunge in prices wasn’t an accident. Between 1929 and 1933, the U.S. economy was moving down its aggregate supply curve, which shows the relationship between the economy’s aggregate price level (the overall price level of final goods and services in the economy) and the total quantity of final goods and services, or aggregate output, producers are willing to supply. (As you will recall, we use real GDP to measure aggregate output. So we’ll often use the two terms interchangeably.) More specifically, between 1929 and 1933 the U.S. economy moved down its short-

The Short-Run Aggregate Supply Curve

The period from 1929 to 1933 demonstrated that there is a positive relationship in the short run between the aggregate price level and the quantity of aggregate output supplied. That is, a rise in the aggregate price level is associated with a rise in the quantity of aggregate output supplied, other things equal; a fall in the aggregate price level is associated with a fall in the quantity of aggregate output supplied, other things equal.

To understand why this positive relationship exists, consider the most basic question facing a producer: is producing a unit of output profitable or not? Let’s define profit per unit:

(16-

Price per unit of output − Production cost per unit of output

Thus, the answer to the question depends on whether the price the producer receives for a unit of output is greater or less than the cost of producing that unit of output. At any given point in time, many of the costs producers face are fixed per unit of output and can’t be changed for an extended period of time. Typically, the largest source of inflexible production cost is the wages paid to workers. Wages here refers to all forms of worker compensation, such as employer-

The nominal wage is the dollar amount of the wage paid.

Wages are typically an inflexible production cost because the dollar amount of any given wage paid, called the nominal wage, is often determined by contracts that were signed some time ago. And even when there are no formal contracts, there are often informal agreements between management and workers, making companies reluctant to change wages in response to economic conditions. For example, companies usually will not reduce wages during poor economic times—

Sticky wages are nominal wages that are slow to fall even in the face of high unemployment and slow to rise even in the face of labor shortages.

As a result of both formal and informal agreements, then, the economy is characterized by sticky wages: nominal wages that are slow to fall even in the face of high unemployment and slow to rise even in the face of labor shortages. It’s important to note, however, that nominal wages cannot be sticky forever: ultimately, formal contracts and informal agreements will be renegotiated to take into account changed economic circumstances. As the Pitfalls later in the chapter explains, how long it takes for nominal wages to become flexible is an integral component of what distinguishes the short run from the long run.

To understand how the fact that many costs are fixed in nominal terms gives rise to an upward-

Let’s start with the behavior of producers in perfectly competitive markets; remember, they take the price as given. Imagine that, for some reason, the aggregate price level falls, which means that the price received by the typical producer of a final good or service falls. Because many production costs are fixed in the short run, production cost per unit of output doesn’t fall by the same proportion as the fall in the price of output. So the profit per unit of output declines, leading perfectly competitive producers to reduce the quantity supplied in the short run.

But suppose that for some reason the aggregate price level rises. As a result, the typical producer receives a higher price for its final good or service. Again, many production costs are fixed in the short run, so production cost per unit of output doesn’t rise by the same proportion as the rise in the price of a unit. And since the typical perfectly competitive producer takes the price as given, profit per unit of output rises and output increases.

Now consider an imperfectly competitive producer that is able to set its own price. If there is a rise in the demand for this producer’s product, it will be able to sell more at any given price. Given stronger demand for its products, it will probably choose to increase its prices as well as its output, as a way of increasing profit per unit of output. In fact, industry analysts often talk about variations in an industry’s “pricing power”: when demand is strong, firms with pricing power are able to raise prices—

Conversely, if there is a fall in demand, firms will normally try to limit the fall in their sales by cutting prices.

The short-

Both the responses of firms in perfectly competitive industries and those of firms in imperfectly competitive industries lead to an upward-

Figure 16-3 shows a hypothetical short-

Shifts of the Short-Run Aggregate Supply Curve

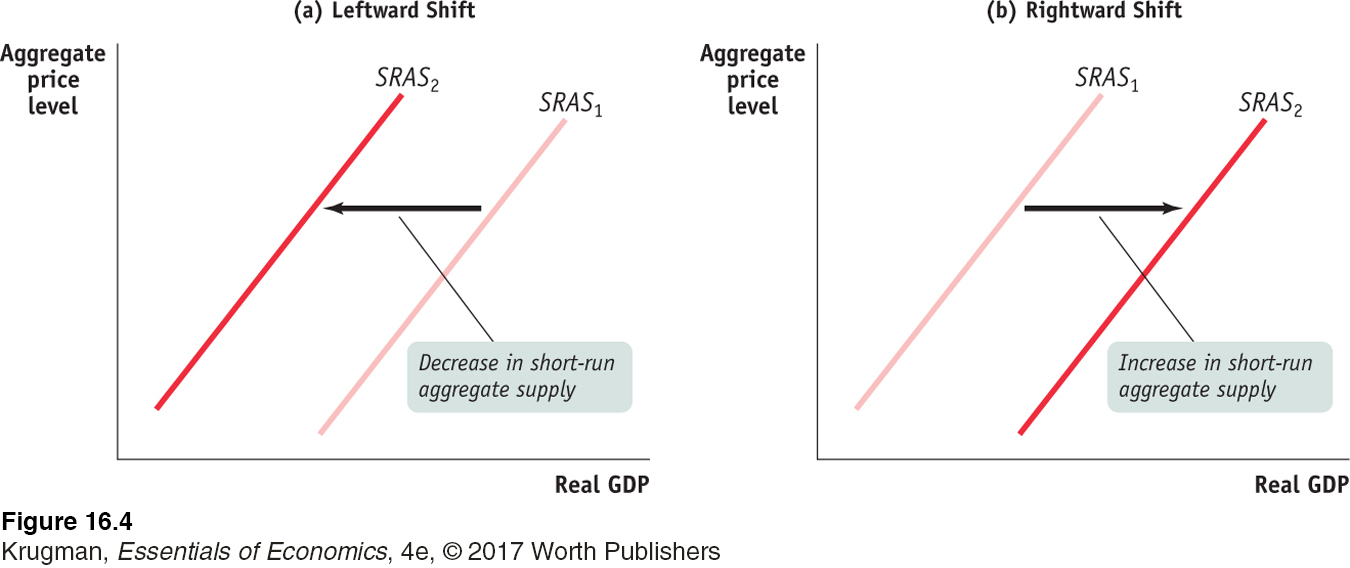

Figure 16-3 shows a movement along the short-

FOR INQUIRING MINDSWhat’s Truly Flexible, What’s Truly Sticky

Most macroeconomists agree that the basic picture shown in Figure 16-3 is correct: there is, other things equal, a positive short-

So far we’ve stressed a difference in the behavior of the aggregate price level and the behavior of nominal wages. That is, we’ve said that the aggregate price level is flexible but nominal wages are sticky in the short run. Although this assumption is a good way to explain why the short-

On one side, some nominal wages are in fact flexible even in the short run because some workers are not covered by a contract or informal agreement with their employers. Since some nominal wages are sticky but others are flexible, we observe that the average nominal wage—

On the other side, some prices of final goods and services are sticky rather than flexible. For example, some firms, particularly the makers of luxury or name-

These complications, as we’ve said, don’t change the basic picture. When the aggregate price level falls, some producers cut output because the nominal wages they pay are sticky. And some producers don’t cut their prices in the face of a falling aggregate price level, preferring instead to reduce their output. In both cases, the positive relationship between the aggregate price level and aggregate output is maintained. So, in the end, the short-

To understand why the short-

To develop some intuition, suppose that something happens that raises production costs—

Now we’ll discuss some of the important factors that affect producers’ profit per unit and so can lead to shifts of the short-

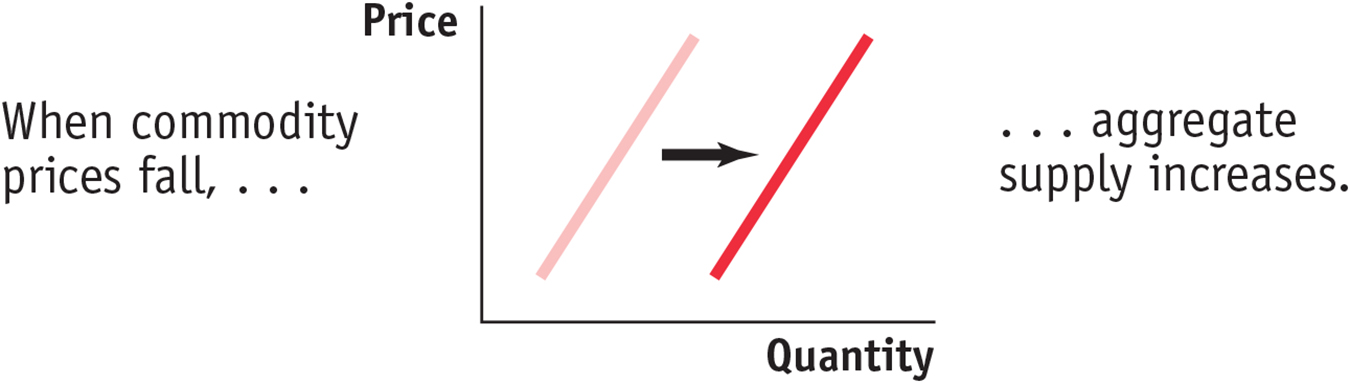

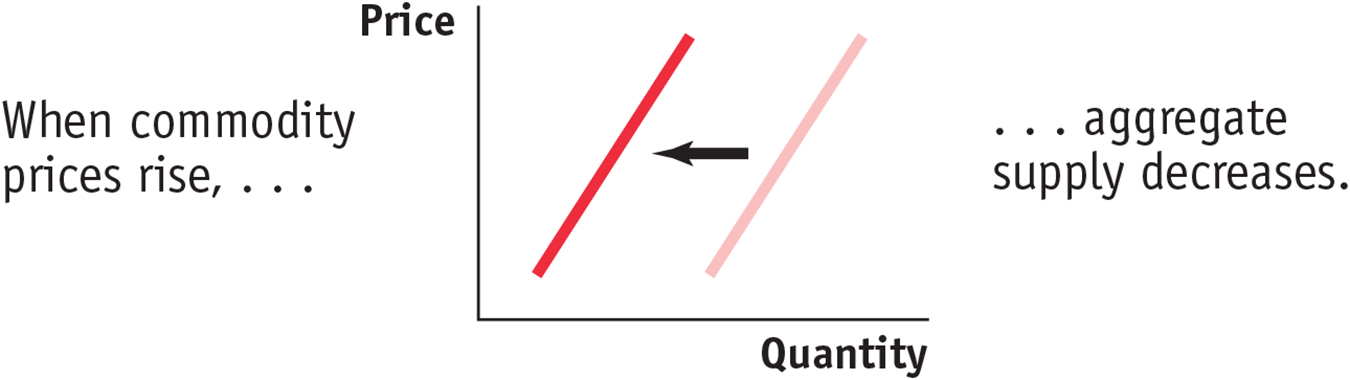

Changes in Commodity Prices In this chapter’s opening story, we described how a surge in the price of oil caused problems for the U.S. economy in the 1970s and early in 2008. Oil is a commodity, a standardized input bought and sold in bulk quantities. An increase in the price of a commodity—

Why isn’t the influence of commodity prices already captured by the short-

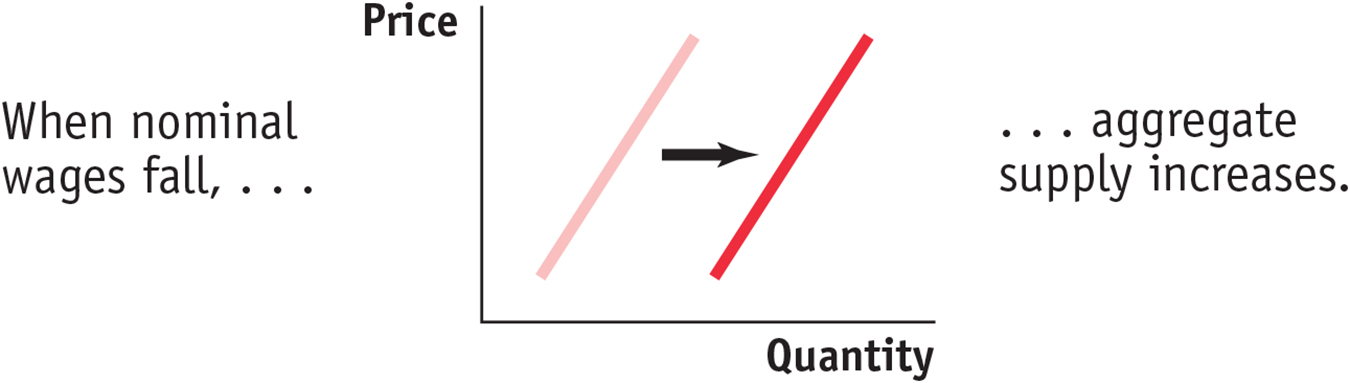

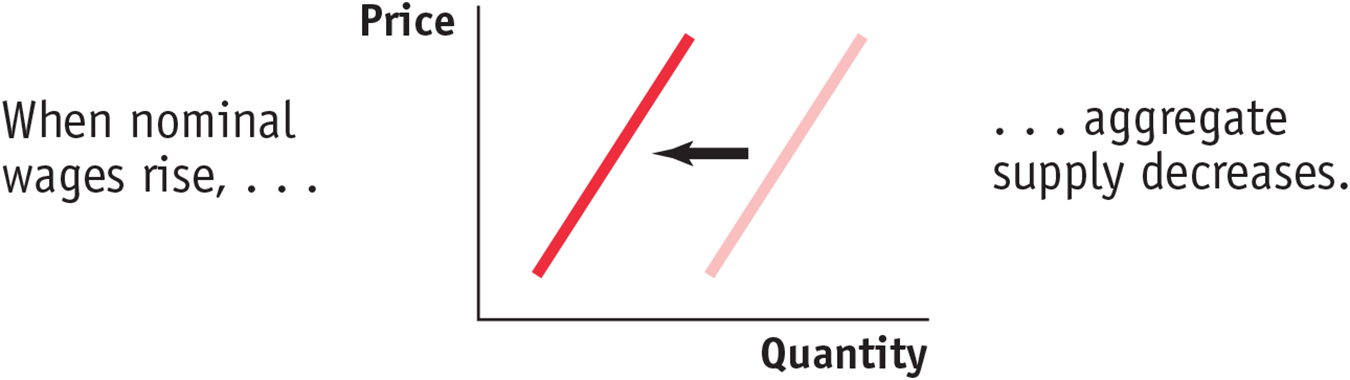

Changes in Nominal Wages At any given point in time, the dollar wages of many workers are fixed because they are set by contracts or informal agreements made in the past. Nominal wages can change, however, once enough time has passed for contracts and informal agreements to be renegotiated. Suppose, for example, that there is an economy-

An important historical fact is that during the 1970s the surge in the price of oil had the indirect effect of also raising nominal wages. This “knock-

So the economy, in the end, experienced two leftward shifts of the aggregate supply curve: the first generated by the initial surge in the price of oil, the second generated by the induced increase in nominal wages. The negative effect on the economy of rising oil prices was greatly magnified through the cost-

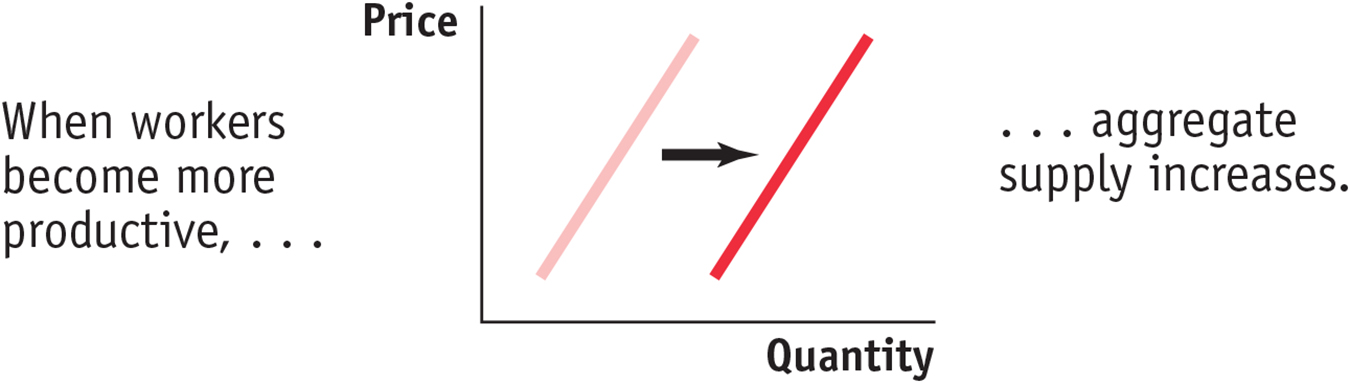

Changes in Productivity An increase in productivity means that a worker can produce more units of output with the same quantity of inputs. For example, the introduction of bar-

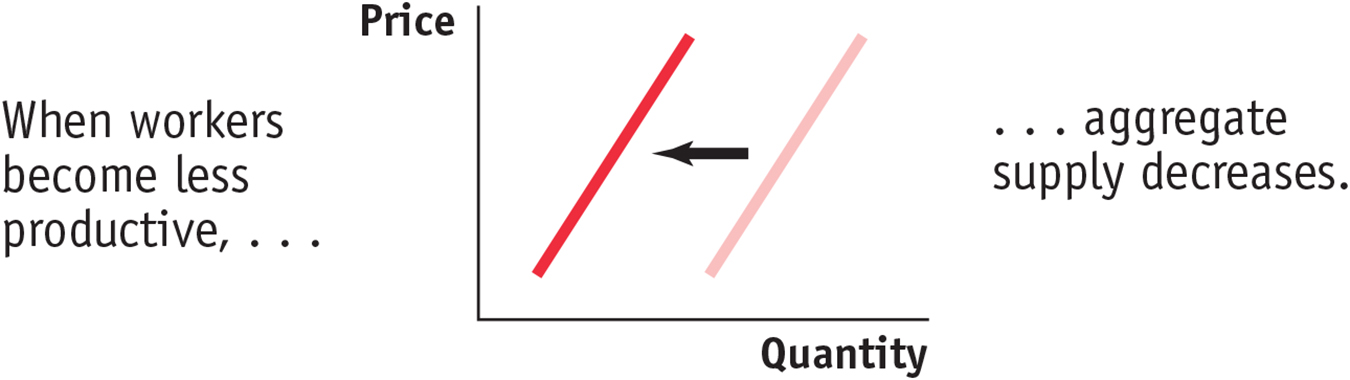

Conversely, a fall in productivity—

A summary of the factors that shift the short-

| When this happens, . . . |

. . . aggregate demand increases: |

But when this happens, . . . |

. . . aggregate demand decreases: |

| Changes in commodity prices: | |||

|

|

||

| Changes in nominal wages: | |||

|

|

||

| Changes in productivity: | |||

|

|

||

The Long-Run Aggregate Supply Curve

We’ve just seen that in the short run a fall in the aggregate price level leads to a decline in the quantity of aggregate output supplied because nominal wages are sticky in the short run. But, as we mentioned earlier, contracts and informal agreements are renegotiated in the long run. So in the long run, nominal wages—

To see why, let’s conduct a thought experiment. Imagine that you could wave a magic wand—

The answer is: nothing. Consider Equation 16-

In reality, of course, no one can change all prices by the same proportion at the same time. But we’ll now consider the long run, the period of time over which all prices are fully flexible. In the long run, inflation or deflation has the same effect as someone changing all prices by the same proportion. As a result, changes in the aggregate price level do not change the quantity of aggregate output supplied in the long run. That’s because changes in the aggregate price level will, in the long run, be accompanied by equal proportional changes in all input prices, including nominal wages.

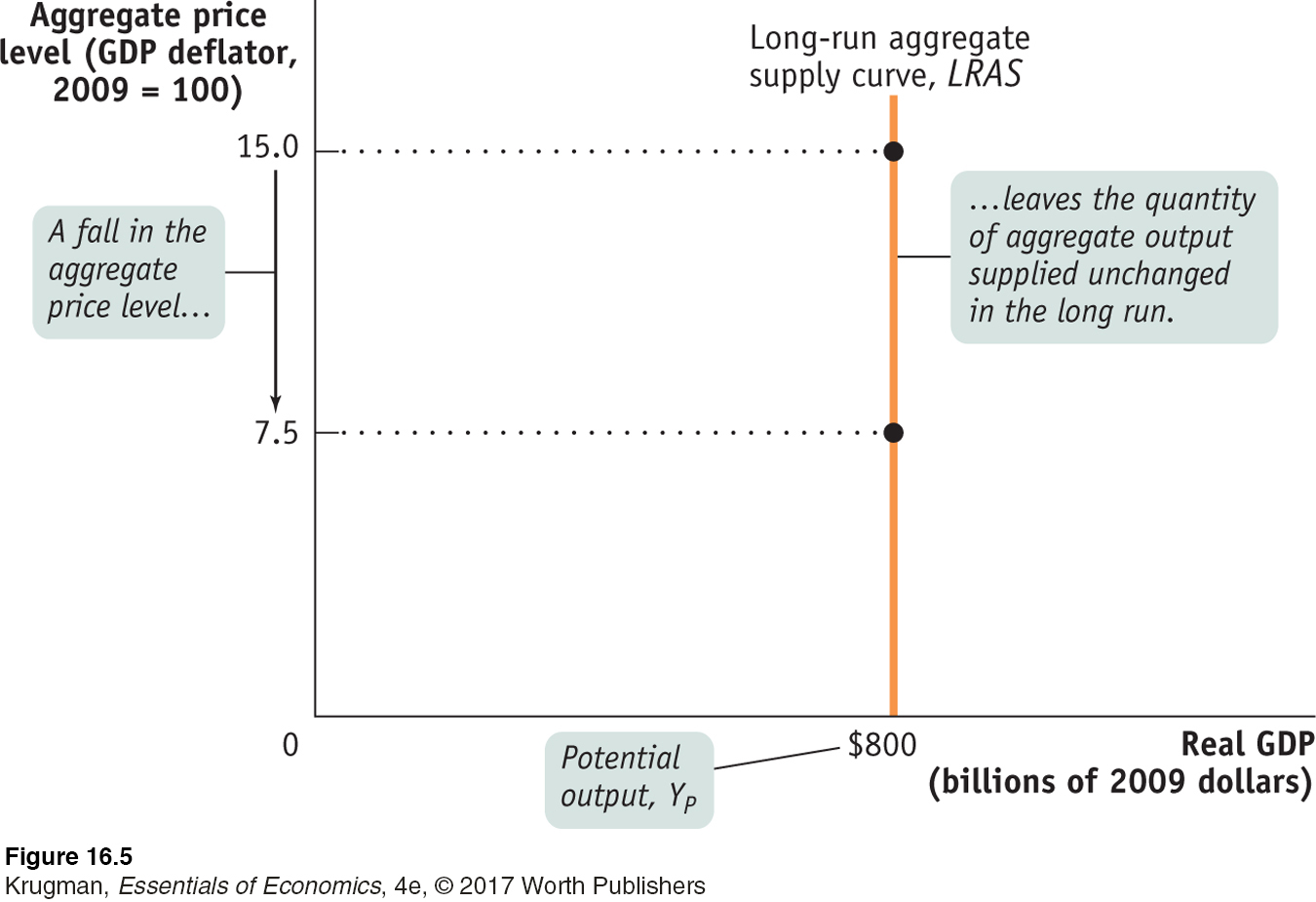

The long-

The long-

Potential output is the level of real GDP the economy would produce if all prices, including nominal wages, were fully flexible.

It’s important to understand not only that the LRAS curve is vertical but also that its position along the horizontal axis represents a significant measure. The horizontal intercept in Figure 16-5, where LRAS touches the horizontal axis ($800 billion in 2009 dollars), is the economy’s potential output, YP: the level of real GDP the economy would produce if all prices, including nominal wages, were fully flexible.

In reality, the actual level of real GDP is almost always either above or below potential output. We’ll see why later in this chapter, when we discuss the AD–AS model. Still, an economy’s potential output is an important number because it defines the trend around which actual aggregate output fluctuates from year to year.

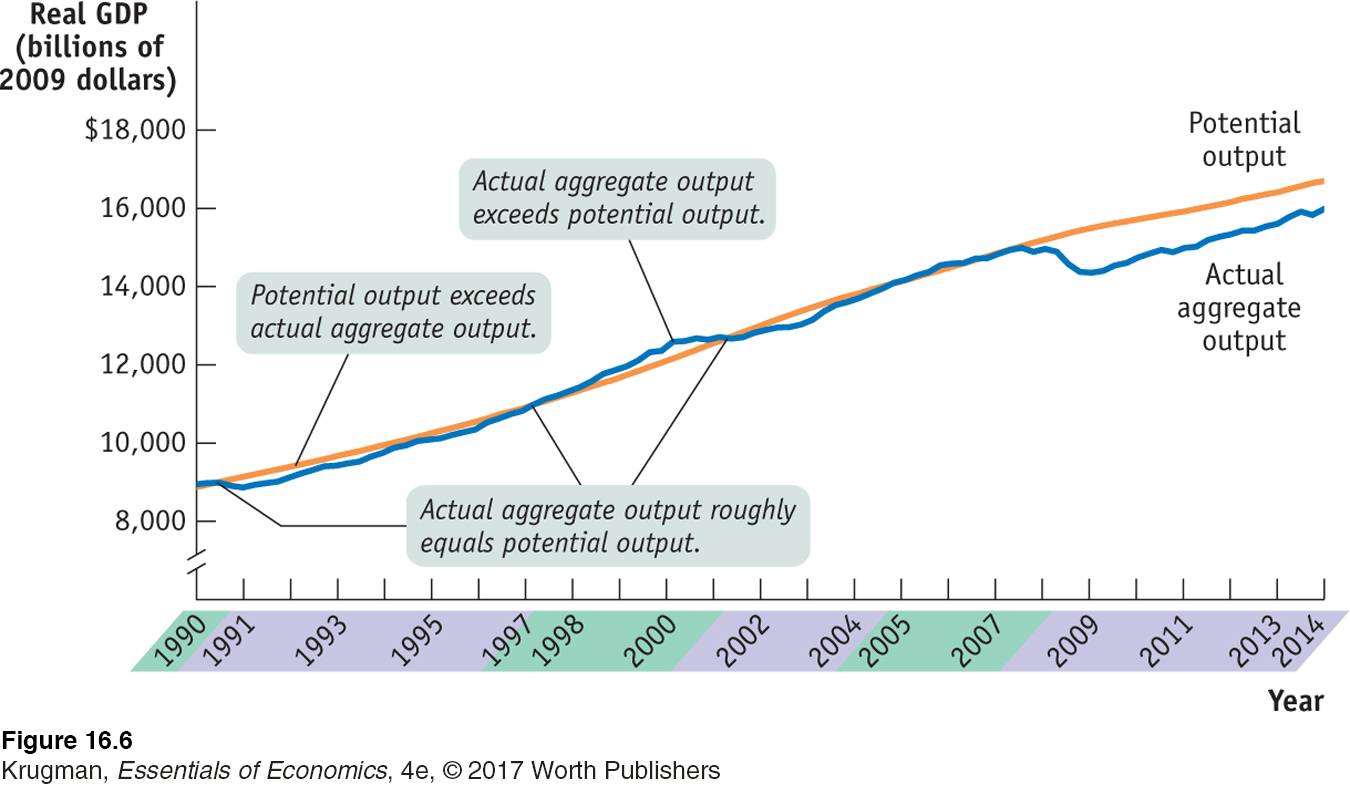

In the United States, the Congressional Budget Office, or CBO, estimates annual potential output for the purpose of federal budget analysis. In Figure 16-6, the CBO’s estimates of U.S. potential output from 1990 to 2014 are represented by the orange line and the actual values of U.S. real GDP over the same period are represented by the blue line. Years shaded purple on the horizontal axis correspond to periods in which actual aggregate output fell short of potential output, years shaded green to periods in which actual aggregate output exceeded potential output.

As you can see, U.S. potential output has risen steadily over time—

From the Short Run to the Long Run

As you can see in Figure 16-6, the economy normally produces more or less than potential output: actual aggregate output was below potential output in the early 1990s, above potential output in the late 1990s, below potential output for most of the 2000s, and significantly below potential output after the recession of 2007–2009. So the economy is normally on its short-

The first step to answering these questions is to understand that the economy is always in one of only two states with respect to the short-

It can be on both curves simultaneously by being at a point where the curves cross (as in the few years in Figure 16-6 in which actual aggregate output and potential output roughly coincided).

Or it can be on the short-

run aggregate supply curve but not the long- run aggregate supply curve (as in the years in which actual aggregate output and potential output did not coincide).

PITFALLS

ARE WE THERE YET? WHAT THE LONG RUN REALLY MEANS

We’ve used the term long run in two different contexts. In the previous chapter we focused on long-

Because the economy always tends to return to potential output in the long run, actual aggregate output fluctuates around potential output, rarely getting too far from it. As a result, the economy’s rate of growth over long periods of time—

But that is not the end of the story. If the economy is on the short-

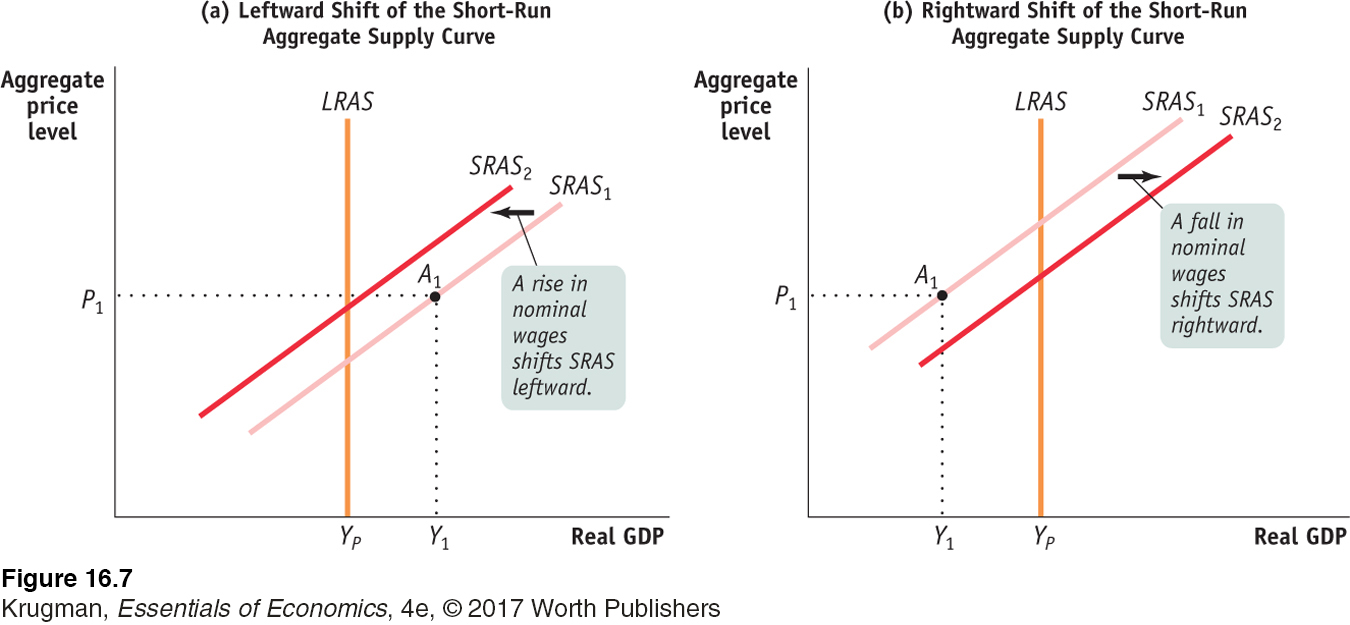

Figure 16-7 illustrates how this process works. In both panels LRAS is the long-

Until this upward adjustment in nominal wages occurs, producers are earning high profits and producing a high level of output. But a level of aggregate output higher than potential output means a low level of unemployment. Because jobs are abundant and workers are scarce, nominal wages will rise over time, gradually shifting the short-

In panel (b), the initial production point, A1, corresponds to an aggregate output level, Y1, that is lower than potential output, YP. Producing an aggregate output level (such as Y1) that is lower than potential output (YP) is possible only because nominal wages haven’t yet fully adjusted downward. Until this downward adjustment occurs, producers are earning low (or negative) profits and producing a low level of output. An aggregate output level lower than potential output means high unemployment. Because workers are abundant and jobs are scarce, nominal wages will fall over time, shifting the short-

We’ll see shortly that these shifts of the short-

ECONOMICSin Action

Sticky Wages in the Great Recession

| interactive activity

| interactive activity

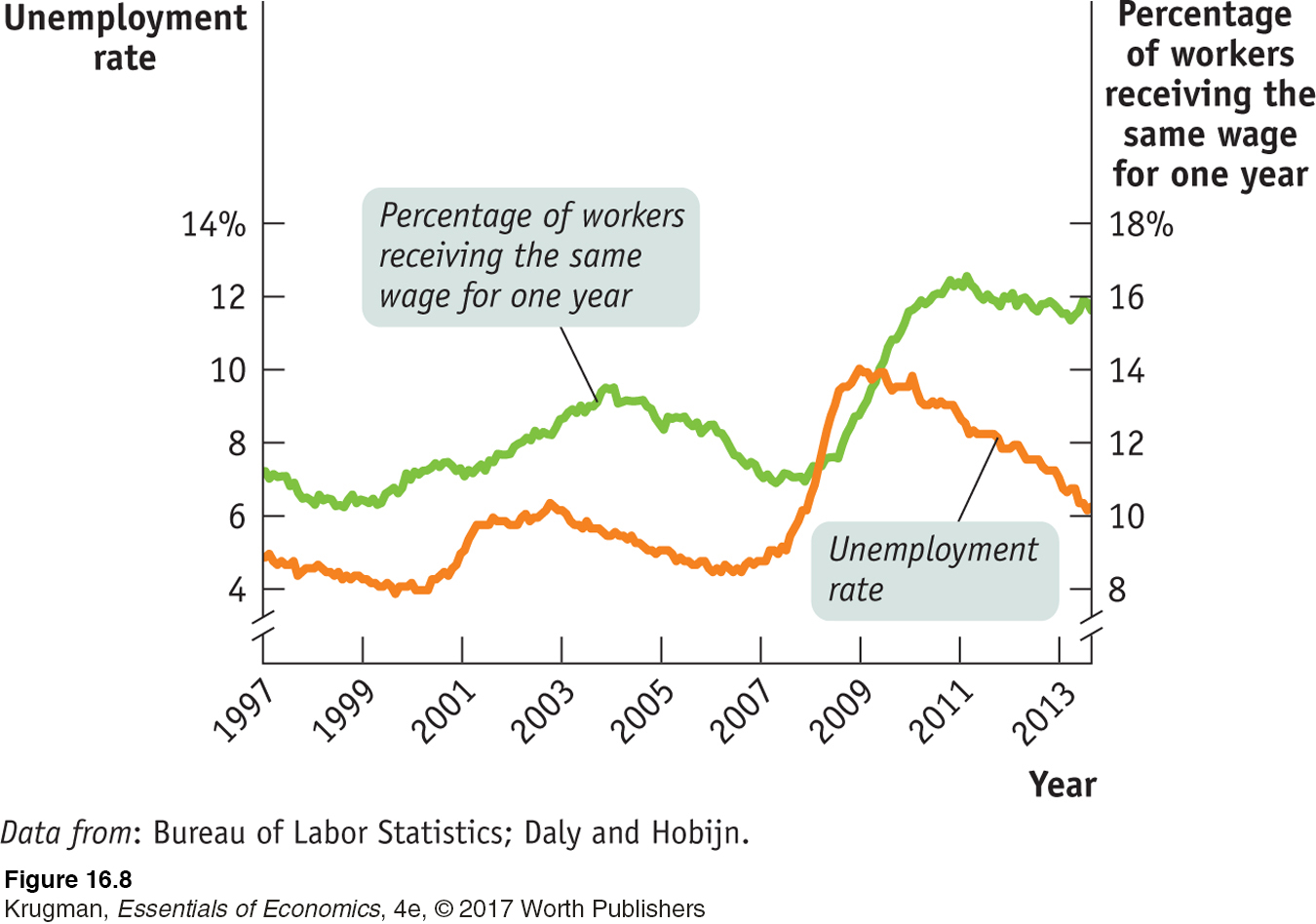

We’ve asserted that the aggregate supply curve is upward-

The answer is that we can look at what happens to wages at times when we might have expected to see many workers facing wage cuts because similar workers are unemployed and would be willing to work for less. If wages are sticky, what we would expect to find at such times is that many workers’ wages don’t change at all: there’s no reason for employers to give them a raise, but because wages are sticky, they don’t face cuts either.

And that is exactly what you find during and after the Great Recession of 2007–2009. Mary Daly and Bart Hobijn, economists at the Federal Reserve Bank of San Francisco, looked at data on wage changes for a sample of workers. Their findings are shown in Figure 16-8: as unemployment soared after 2007, so did the fraction of U.S. workers receiving the same wage as they did a year ago.

Similar results can be found in European nations facing high unemployment, such as Spain. The Great Recession provided strong confirmation that wages are indeed sticky.

When unemployment soared in the face of the economic slump following the 2008 financial crisis, you might have expected to see widespread wage cuts. But employers are reluctant to cut wages. So what we saw instead was a sharp rise in the number of workers whose wages were flat—

Quick Review

The aggregate supply curve illustrates the relationship between the aggregate price level and the quantity of aggregate output supplied.

The short-

run aggregate supply curve is upward sloping: a higher aggregate price level leads to higher aggregate output given that nominal wages are sticky.Changes in commodity prices, nominal wages, and productivity shift the short-

run aggregate supply curve. In the long run, all prices are flexible, and changes in the aggregate price level have no effect on aggregate output. The long-

run aggregate supply curve is vertical at potential output.If actual aggregate output exceeds potential output, nominal wages eventually rise and the short-

run aggregate supply curve shifts leftward. If potential output exceeds actual aggregate output, nominal wages eventually fall and the short- run aggregate supply curve shifts rightward.

Check Your Understanding16-2

Question 16.2

1. Determine the effect on short-

A rise in the consumer price index (CPI) leads producers to increase output.

This represents a movement along the SRAS curve because the CPI—

like the GDP deflator— is a measure of the aggregate price level, the overall price level of final goods and services in the economy. A fall in the price of oil leads producers to increase output.

This represents a shift of the SRAS curve because oil is a commodity. The SRAS curve will shift to the right because production costs are now lower, leading to a higher quantity of aggregate output supplied at any given aggregate price level.

A rise in legally mandated retirement benefits paid to workers leads producers to reduce output.

This represents a shift of the SRAS curve because it involves a change in nominal wages. An increase in legally mandated benefits to workers is equivalent to an increase in nominal wages. As a result, the SRAS curve will shift leftward because production costs are now higher, leading to a lower quantity of aggregate output supplied at any given aggregate price level.

Question 16.3

2. Suppose the economy is initially at potential output and the quantity of aggregate output supplied increases. What information would you need to determine whether this was due to a movement along the SRAS curve or a shift of the LRAS curve?

You would need to know what happened to the aggregate price level. If the increase in the quantity of aggregate output supplied was due to a movement along the SRAS curve, the aggregate price level would have increased at the same time as the quantity of aggregate output supplied increased. If the increase in the quantity of aggregate output supplied was due to a rightward shift of the LRAS curve, the aggregate price level might not rise. Alternatively, you could make the determination by observing what happened to aggregate output in the long run. If it fell back to its initial level in the long run, then the temporary increase in aggregate output was due to a movement along the SRAS curve. If it stayed at the higher level in the long run, the increase in aggregate output was due to a rightward shift of the LRAS curve.

Solutions appear at back of book.