4.5 Price Ceilings

Aside from rent control, which you read about in the opening story, there are not many price ceilings in the United States today. But at times they have been widespread. Price ceilings are typically imposed during crises—

The U.S. government imposed ceilings on many prices during World War II: the war sharply increased demand for raw materials, such as aluminum and steel, and price controls prevented those with access to these raw materials from earning huge profits. Price controls on oil were imposed in 1973, when an embargo by Arab oil-

Rent control in New York is a legacy of World War II: it was imposed because wartime production produced an economic boom, which increased demand for apartments at a time when the labor and raw materials that might have been used to build them were being used to win the war instead. Although most price controls were removed soon after the war ended, New York’s rent limits were retained and gradually extended to buildings not previously covered, leading to some very strange situations.

You can rent a one-

Aside from producing great deals for some renters, however, what are the broader consequences of New York’s rent-

Modeling a Price Ceiling

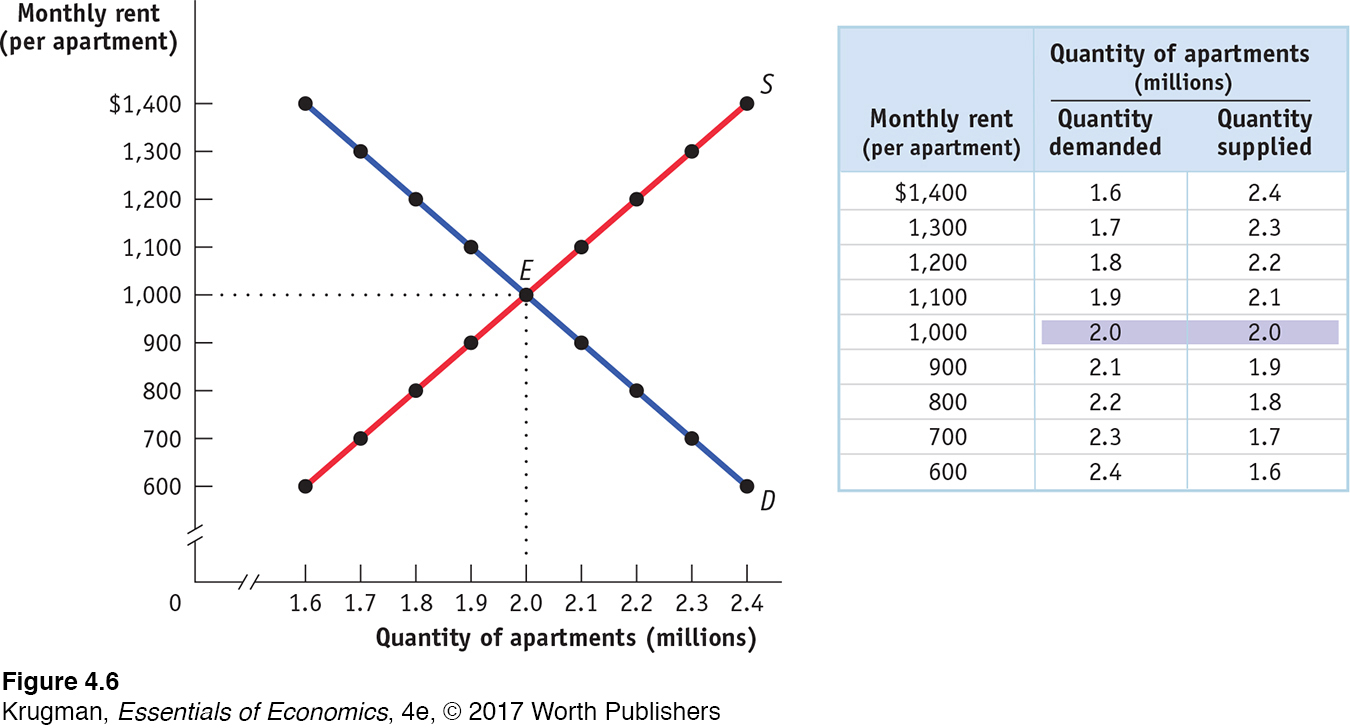

To see what can go wrong when a government imposes a price ceiling on an efficient market, consider Figure 4-6, which shows a simplified model of the market for apartments in New York. For the sake of simplicity, we imagine that all apartments are exactly the same and so would rent for the same price in an unregulated market.

The table in Figure 4-6 shows the demand and supply schedules; the demand and supply curves are shown on the left. We show the quantity of apartments on the horizontal axis and the monthly rent per apartment on the vertical axis. You can see that in an unregulated market the equilibrium would be at point E: 2 million apartments would be rented for $1,000 each per month.

Now suppose that the government imposes a price ceiling, limiting rents to a price below the equilibrium price—

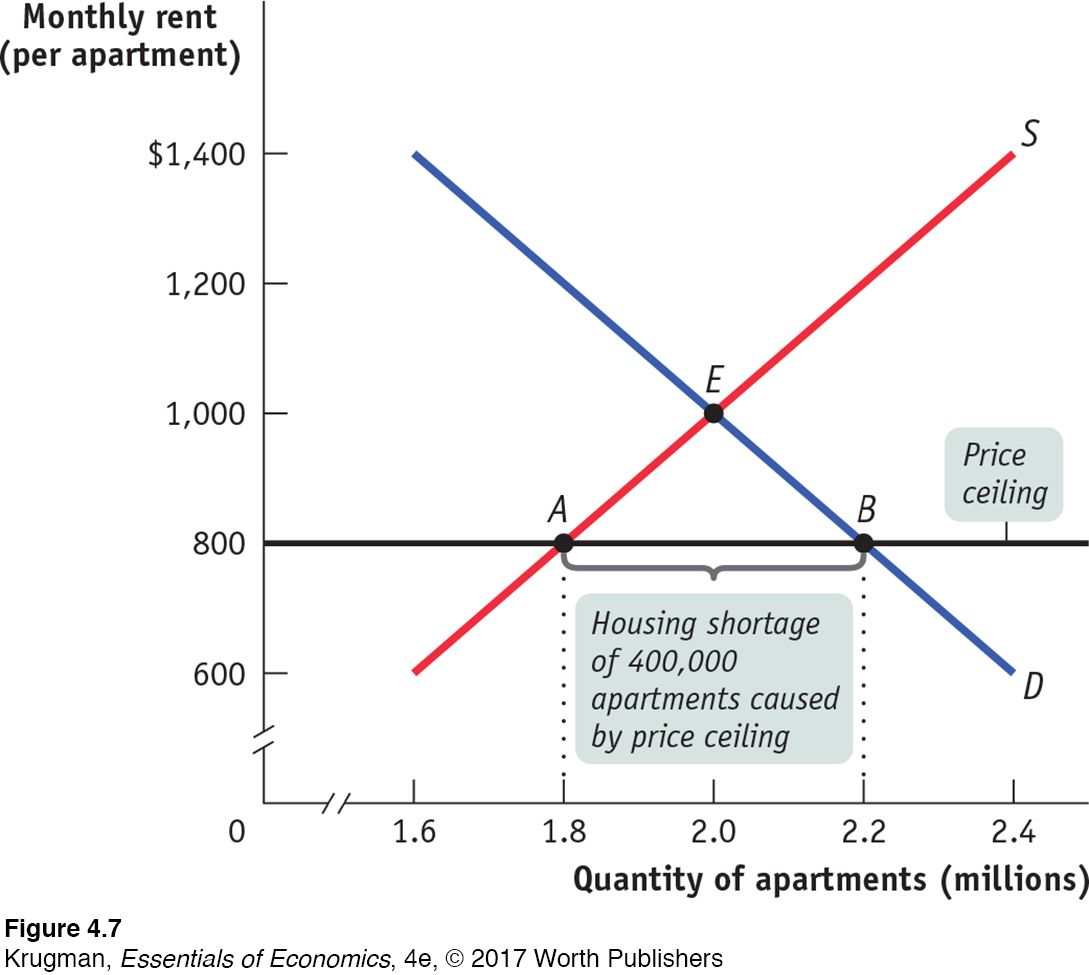

Figure 4-7 shows the effect of the price ceiling, represented by the line at $800. At the enforced rental rate of $800, landlords have less incentive to offer apartments, so they won’t be willing to supply as many as they would at the equilibrium rate of $1,000. They will choose point A on the supply curve, offering only 1.8 million apartments for rent, 200,000 fewer than in the unregulated market.

At the same time, more people will want to rent apartments at a price of $800 than at the equilibrium price of $1,000; as shown at point B on the demand curve, at a monthly rent of $800 the quantity of apartments demanded rises to 2.2 million, 200,000 more than in the unregulated market and 400,000 more than are actually available at the price of $800. So there is now a persistent shortage of rental housing: at that price, 400,000 more people want to rent than are able to find apartments.

Do price ceilings always cause shortages? No. If a price ceiling is set above the equilibrium price, it won’t have any effect. Suppose that the equilibrium rental rate on apartments is $1,000 per month and the city government sets a ceiling of $1,200. Who cares? In this case, the price ceiling won’t be binding—it won’t actually constrain market behavior—

How a Price Ceiling Causes Inefficiency

The housing shortage shown in Figure 4-7 is not merely annoying: like any shortage induced by price controls, it can be seriously harmful because it leads to inefficiency. In other words, there are gains from trade that go unrealized.

Rent control, like all price ceilings, creates inefficiency in at least four distinct ways.

It reduces the quantity of apartments rented below the efficient level.

It typically leads to inefficient allocation of apartments among would-

be renters. It leads to wasted time and effort as people search for apartments.

It leads landlords to maintain apartments in inefficiently low quality or condition.

In addition to inefficiency, price ceilings give rise to illegal behavior as people try to circumvent them.

We’ll now look at each of these inefficiencies caused by price ceilings.

Inefficiently Low Quantity Because rent controls reduce the number of apartments supplied, they reduce the number of apartments rented, too.

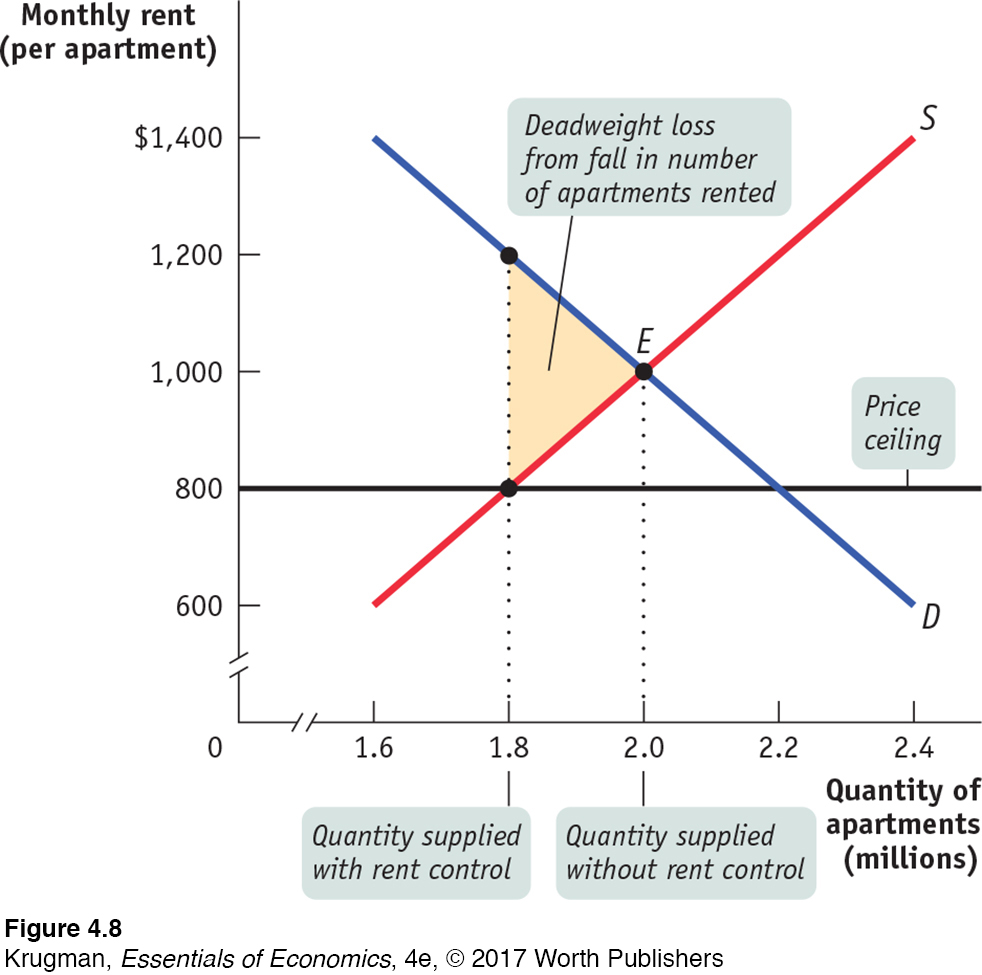

Figure 4-8 shows the implications for total surplus. Recall that total surplus is the sum of the area above the supply curve and below the demand curve. If the only effect of rent control was to reduce the number of apartments available, it would cause a loss of surplus equal to the area of the shaded triangle in the figure.

Deadweight loss is the loss in total surplus that occurs whenever an action or a policy reduces the quantity transacted below the efficient market equilibrium quantity.

The area represented by that triangle has a special name in economics, deadweight loss: the lost surplus associated with the transactions that no longer occur due to the market intervention. In this example, the deadweight loss is the lost surplus associated with the apartment rentals that no longer occur due to the price ceiling, a loss that is experienced by both disappointed renters and frustrated landlords. Economists often call triangles like the one in Figure 4-8 a deadweight-

Deadweight loss is a key concept in economics, one that we will encounter whenever an action or a policy leads to a reduction in the quantity transacted below the efficient market equilibrium quantity. It is important to realize that deadweight loss is a loss to society—it is a reduction in total surplus, a loss in surplus that accrues to no one as a gain. It is not the same as a loss in surplus to one person that then accrues as a gain to someone else, what an economist would call a transfer of surplus from one person to another. For an example of how a price ceiling can create deadweight loss as well as a transfer of surplus between renters and landlords, see the upcoming For Inquiring Minds.

Deadweight loss is not the only type of inefficiency that arises from a price ceiling. The types of inefficiency created by rent control go beyond reducing the quantity of apartments available. These additional inefficiencies—

Inefficient Allocation to Consumers Rent control doesn’t just lead to too few apartments being available. It can also lead to misallocation of the apartments that are available: people who badly need a place to live may not be able to find an apartment, but some apartments may be occupied by people with much less urgent needs.

In the case shown in Figure 4-7, 2.2 million people would like to rent an apartment at $800 per month, but only 1.8 million apartments are available. Of those 2.2 million who are seeking an apartment, some want one badly and are willing to pay a high price to get it. Others have a less urgent need and are only willing to pay a low price, perhaps because they have alternative housing.

An efficient allocation of apartments would reflect these differences: people who really want an apartment will get one and people who aren’t all that anxious to find an apartment won’t. In an inefficient distribution of apartments, the opposite will happen: some people who are not especially anxious to find an apartment will get one and others who are very anxious to find an apartment won’t.

Price ceilings often lead to inefficiency in the form of inefficient allocation to consumers: some people who want the good badly and are willing to pay a high price don’t get it, and some who care relatively little about the good and are only willing to pay a low price do get it.

Because people usually get apartments through luck or personal connections under rent control, it generally results in an inefficient allocation to consumers of the few apartments available.

To see the inefficiency involved, consider the plight of the Lees, a family with young children who have no alternative housing and would be willing to pay up to $1,500 for an apartment—

FOR INQUIRING MINDSWinners, Losers, and Rent Control

Price controls create winners and losers: some people benefit from the policy but others are made worse off.

In New York City, some of the biggest beneficiaries of rent control are affluent tenants who have lived for decades in choice apartments that would now command very high rents. These winners include celebrities like actor Al Pacino and singer and songwriter Cyndi Lauper. Similarly, in 2014, there were stories in the news citing the cases of rent-

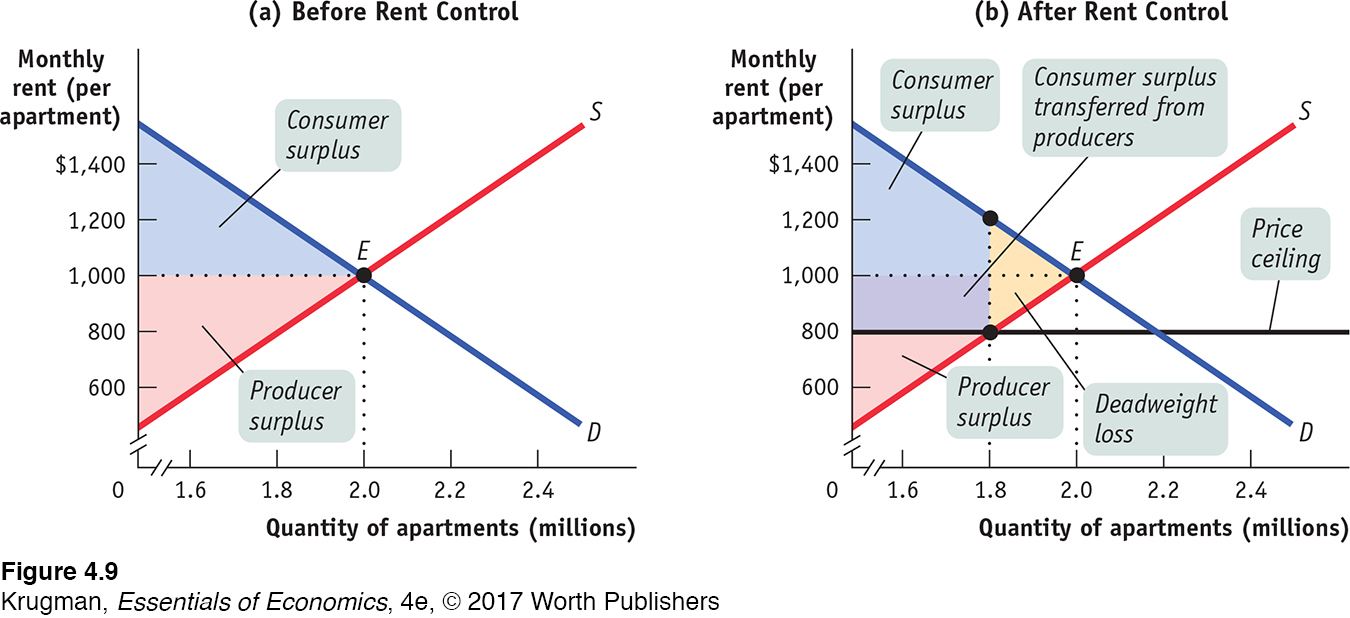

We can use the concepts of consumer and producer surplus to graphically evaluate the winners and the losers from rent control. Panel (a) of Figure 4-9 shows the consumer surplus and producer surplus in the equilibrium of the unregulated market for apartments—

Panel (b) of this figure shows the consumer and producer surplus in the market after the price ceiling of $800 has been imposed. As you can see, for consumers who can still obtain apartments under rent control, consumer surplus has increased. These renters are clearly winners: they obtain an apartment at $800, paying $200 less than the unregulated market price. These people receive a direct transfer of surplus from landlords in the form of lower rent. But not all renters win: there are fewer apartments to rent now than if the market had remained unregulated, making it hard, if not impossible, for some to find a place to call home.

Without direct calculation of the surpluses gained and lost, it is generally unclear whether renters as a whole are made better or worse off by rent control. What we can say is that the greater the deadweight loss—

However, we can say unambiguously that landlords are worse off: producer surplus has clearly decreased. Landlords who continue to rent out their apartments get $200 a month less in rent, and others withdraw their apartments from the market altogether. The deadweight-

This allocation of apartments—

Generally, if people who really want apartments could sublease them from people who are less eager to live there, both those who gain apartments and those who trade their occupancy for money would be better off. However, subletting is illegal under rent control because it would occur at prices above the price ceiling.

The fact that subletting is illegal doesn’t mean it never happens. In fact, chasing down illegal subletting is a major business for New York private investigators. An article in the New York Times described how private investigators use hidden cameras and other tricks to prove that the legal tenants in rent-

Although landlords and legal agencies actively discourage the practice of illegal subletting, the problem of inefficient allocation of apartments remains.

Price ceilings typically lead to inefficiency in the form of wasted resources: people expend money, effort, and time to cope with the shortages caused by the price ceiling.

Wasted Resources Another reason a price ceiling causes inefficiency is that it leads to wasted resources: people expend money, effort, and time to cope with the shortages caused by the price ceiling. Back in 1979, U.S. price controls on gasoline led to shortages that forced millions of Americans to wait in lines at gas stations for hours each week. The opportunity cost of the time spent in gas lines—

Because of rent control, the Lees will spend all their spare time for several months searching for an apartment, time they would rather have spent working or in family activities. That is, there is an opportunity cost to the Lees’ prolonged search for an apartment—

If the market for apartments worked freely, the Lees would quickly find an apartment at the equilibrium rent of $1,000, leaving them time to earn more or to enjoy themselves—

Price ceilings often lead to inefficiency in that the goods being offered are of inefficiently low quality: sellers offer low-

Inefficiently Low Quality Yet another way a price ceiling creates inefficiency is by causing goods to be of inefficiently low quality. Inefficiently low quality means that sellers offer low-

Again, consider rent control. Landlords have no incentive to provide better conditions because they cannot raise rents to cover their repair costs but are able to find tenants easily. In many cases, tenants would be willing to pay much more for improved conditions than it would cost for the landlord to provide them—

This whole situation is a missed opportunity—

A black market is a market in which goods or services are bought and sold illegally—

Black Markets In addition to these four inefficiencies there is a final aspect of price ceilings: the incentive they provide for illegal activities, specifically the emergence of black markets. We have already described one kind of black market activity—

What’s wrong with black markets? In general, it’s a bad thing if people break any law, because it encourages disrespect for the law in general. Worse yet, in this case illegal activity worsens the position of those who are honest. If the Lees are scrupulous about upholding the rent-

So Why Are There Price Ceilings?

We have seen three common results of price ceilings:

A persistent shortage of the good

Inefficiency arising from this persistent shortage in the form of inefficiently low quantity (deadweight loss), inefficient allocation of the good to consumers, resources wasted in searching for the good, and the inefficiently low quality of the good offered for sale

The emergence of illegal, black market activity

Given these unpleasant consequences of price ceilings, why do governments still sometimes impose them? Why does rent control, in particular, persist in New York?

One answer is that although price ceilings may have adverse effects, they do benefit some people. In practice, New York’s rent-

Also, when price ceilings have been in effect for a long time, buyers may not have a realistic idea of what would happen without them. In our previous example, the rental rate in an unregulated market (Figure 4-6) would be only 25% higher than in the regulated market (Figure 4-7): $1,000 instead of $800. But how would renters know that? Indeed, they might have heard about black market transactions at much higher prices—

A last answer is that government officials often do not understand supply and demand analysis! It is a great mistake to suppose that economic policies in the real world are always sensible or well informed.

ECONOMICS in Action

Price Controls in Venezuela: “You Buy What They Have”

| interactive activity

| interactive activity

By all accounts, Venezuela is a rich country—

The origins of Venezuela’s food shortages can be traced to the policies put in place by former Venezuelan president Hugo Chávez and continued by his successor, Nicolás Maduro. Chávez came to power in 1998 on a platform denouncing the country’s economic elite and promising policies that favored the poor and working class, including price controls on basic foodstuffs. These price controls led to shortages that began in 2003 and became severe by 2006. Prices were set so low that farmers reduced production. For example, Venezuela was a coffee exporter until 2009 when it was forced to import large amounts of coffee to make up for a steep fall in production. Venezuela now imports more than 70% of its food.

In addition, generous government programs for the poor and working class led to higher demand. The combination of price controls and higher demand led to sharply rising prices for goods that weren’t subject to price controls or that were bought on the black market. The result was a big increase in the demand for price-

Worse yet, a sharp decline in the value of the Venezuelan currency made foreign imports more expensive. And it increased the incentives for smuggling: when goods are available at the government-

Venezuelans, queuing for hours to purchase goods at state-

Quick Review

Price controls take the form of either legal maximum prices—

price ceilings— or legal minimum prices— price floors. A price ceiling below the equilibrium price benefits successful buyers but causes predictable adverse effects such as persistent shortages, which lead to four types of inefficiencies: deadweight loss, inefficient allocation to consumers, wasted resources, and inefficiently low quality.

A deadweight loss is a loss of total surplus that occurs whenever a policy or action reduces the quantity transacted below the efficient market equilibrium level.

Price ceilings also lead to black markets, as buyers and sellers attempt to evade the price controls.

Check Your Understanding 4-2

Question 4.3

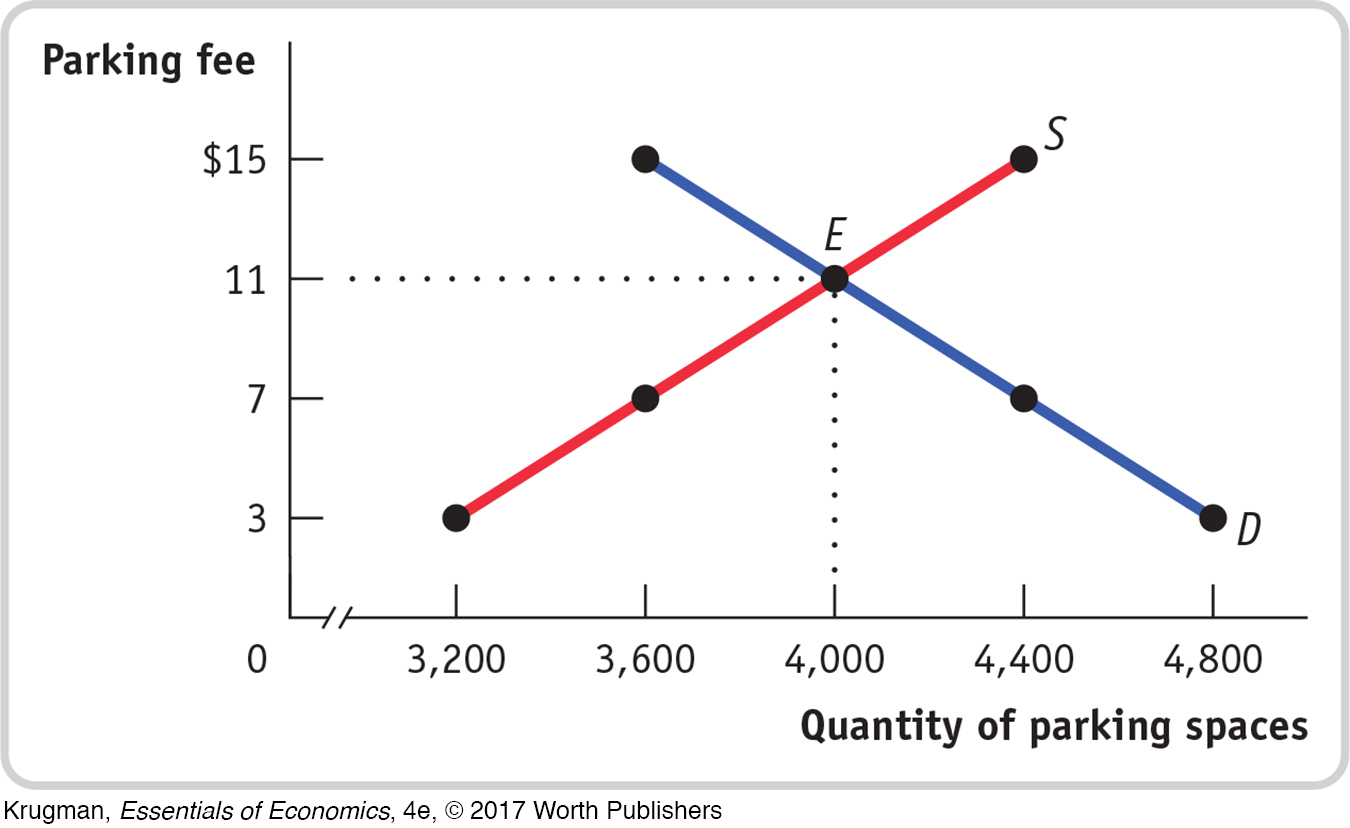

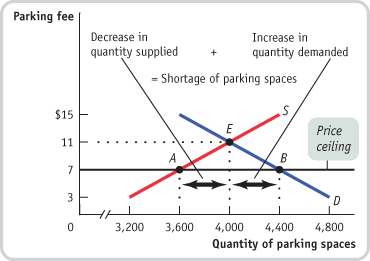

1. On game days, homeowners near Middletown University’s stadium used to rent parking spaces in their driveways to fans at a going rate of $11. A new town ordinance now sets a maximum parking fee of $7. Use the accompanying supply and demand diagram to explain how each of the following corresponds to a price-

Some homeowners now think it’s not worth the hassle to rent out spaces.

Fewer homeowners are willing to rent out their driveways because the price ceiling has reduced the payment they receive. This is an example of a fall in price leading to a fall in the quantity supplied. It is shown in the accompanying diagram by the movement from point E to point A along the supply curve, a reduction in quantity of 400 parking spaces.

Some fans who used to carpool to the game now drive alone.

The quantity demanded increases by 400 spaces as the price decreases. At a lower price, more fans are willing to drive and rent a parking space. It is shown in the diagram by the movement from point E to point B along the demand curve.

Some fans can’t find parking and leave without seeing the game.

Under a price ceiling, the quantity demanded exceeds the quantity supplied; as a result, shortages arise. In this case, there will be a shortage of 800 parking spaces. It is shown by the horizontal distance between points A and B.

Page 117Explain how each of the following adverse effects arises from the price ceiling.

Some fans now arrive several hours early to find parking.

Price ceilings result in wasted resources. The additional time fans spend to guarantee a parking space is wasted time.

Friends of homeowners near the stadium regularly attend games, even if they aren’t big fans. But some serious fans have given up because of the parking situation.

Price ceilings lead to inefficient allocation of a good—

here, the parking spaces— to consumers. Some homeowners rent spaces for more than $7 but pretend that the buyers are nonpaying friends or family.

Price ceilings lead to black markets.

Question 4.4

2. True or false? Explain your answer. A price ceiling below the equilibrium price of an otherwise efficient market does the following:

Increases quantity supplied

False. By lowering the price that producers receive, a price ceiling leads to a decrease in the quantity supplied.

Makes some people who want to consume the good worse off

True. A price ceiling leads to a lower quantity supplied than in an efficient, unregulated market. As a result, some people who would have been willing to pay the market price, and so would have gotten the good in an unregulated market, are unable to obtain it when a price ceiling is imposed.

Makes all producers worse off

True. Those producers who still sell the product now receive less for it and are therefore worse off. Other producers will no longer find it worthwhile to sell the product at all and so will also be made worse off.

Question 4.5

3. Which of the following create deadweight loss? Which do not and are simply a transfer of surplus from one person to another? Explain your answer.

You have been evicted from your rent-

controlled apartment after the landlord discovered your pet boa constrictor. The apartment is quickly rented to someone else at the same price. You and the new renter do not necessarily have the same willingness to pay for the apartment. Since the apartment is rented quickly at the same price, there is no change (either gain or loss) in producer surplus. So any change in total surplus comes from changes in consumer surplus. When you are evicted, the amount of consumer surplus you lose is equal to the difference between your willingness to pay for the apartment and the rent-

controlled price. When the apartment is rented to someone else at the same price, the amount of consumer surplus the new renter gains is equal to the difference between his or her willingness to pay and the rent- controlled price. So this will be a pure transfer of surplus from one person to another only if both your willingness to pay and the new renter’s willingness to pay are the same. Since under rent control apartments are not always allocated to those who have the highest willingness to pay, the new renter’s willingness to pay may be either equal to, lower, or higher than your willingness to pay. If the new renter’s willingness to pay is lower than yours, this will create additional deadweight loss: there is some additional consumer surplus that is lost. However, if the new renter’s willingness to pay is higher than yours, this will create an increase in total surplus, as the new renter gains more consumer surplus than you lost. In a contest, you won a ticket to a jazz concert. But you can’t go to the concert because of an exam, and the terms of the contest do not allow you to sell the ticket or give it to someone else. Would your answer to this question change if you could not sell the ticket but could give it to someone else?

This creates deadweight loss: if you were able to give the ticket away, someone else would be able to obtain consumer surplus, equal to their willingness to pay for the ticket. You neither gain nor lose any surplus, since you cannot go to the concert whether or not you give the ticket away. If you were able to sell the ticket, the buyer would obtain consumer surplus equal to the difference between their willingness to pay for the ticket and the price at which you sell the ticket. In addition, you would obtain producer surplus equal to the difference between the price at which you sell the ticket and your cost of selling the ticket (which, since you won the ticket, is presumably zero). Since the restriction to neither sell nor give away the ticket means that this surplus cannot be obtained by anybody, it creates deadweight loss. If you could give the ticket away, as described above, there would be consumer surplus that accrues to the recipient of the ticket; and if you give the ticket to the person with the highest willingness to pay, there would be no deadweight loss.

Your school’s dean of students, who is a proponent of a low-

fat diet, decrees that ice cream can no longer be served on campus. This creates deadweight loss. If students buy ice cream on campus, they obtain consumer surplus: their willingness to pay must have been higher than the price of the ice cream. Your college obtains producer surplus: the price is higher than your college’s cost of selling the ice cream. Prohibiting the sale of ice cream on campus means that these two sources of total surplus are lost: there is deadweight loss.

Your ice-

cream cone falls on the ground and your dog eats it. (Take the liberty of counting your dog as a member of society, and assume that, if he could, your dog would be willing to pay the same amount for the ice- cream cone as you.) Given that your dog values ice cream equally as much as you do, this is a pure transfer of surplus. As you lose consumer surplus, your dog gains equally as much consumer surplus.

Solutions appear at back of book.