14-2 Inflation, Unemployment, and the Phillips Curve

Two goals of economic policymakers are low inflation and low unemployment, but often these goals conflict. Suppose, for instance, that policymakers were to use monetary or fiscal policy to expand aggregate demand. This policy would move the economy along the short-run aggregate supply curve to a point of higher output and a higher price level. (Figure 14-2 shows this as the change from point A to point B.) Higher output means lower unemployment because firms employ more workers when they produce more. A higher price level, given the previous year’s price level, means higher inflation. Thus, when policymakers move the economy up along the short-run aggregate supply curve, they reduce the unemployment rate and raise the inflation rate. Conversely, when they contract aggregate demand and move the economy down the short-run aggregate supply curve, unemployment rises and inflation falls.

This tradeoff between inflation and unemployment, called the Phillips curve, is our topic in this section. As we have just seen (and will derive more formally in a moment), the Phillips curve is a reflection of the short-run aggregate supply curve: as policymakers move the economy along the short-run aggregate supply curve, unemployment and inflation move in opposite directions. The Phillips curve is a useful way to express aggregate supply because inflation and unemployment are such important measures of economic performance.

Deriving the Phillips Curve From the Aggregate Supply Curve

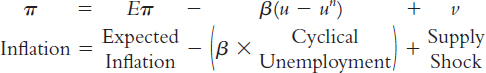

The Phillips curve in its modern form states that the inflation rate depends on three forces:

expected inflation;

the deviation of unemployment from the natural rate, called cyclical unemployment; and

supply shocks.

These three forces are expressed in the following equation:

where β is a parameter measuring the response of inflation to cyclical unemployment. Notice that there is a minus sign before the cyclical unemployment term: other things equal, higher unemployment is associated with lower inflation.

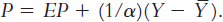

Where does this equation for the Phillips curve come from? Although it may not seem familiar, we can derive it from our equation for aggregate supply. To see how, write the aggregate supply equation as

419

With one addition, one subtraction, and one substitution, we can transform this equation into the Phillips curve relationship between inflation and unemployment.

Here are the three steps. First, add to the right-hand side of the equation a supply shock v to represent exogenous events (such as a change in world oil prices) that alter the price level and shift the short-run aggregate supply curve:

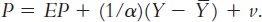

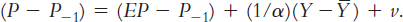

Next, to go from the price level to inflation rates, subtract last year’s price level P−1 from both sides of the equation to obtain

The term on the left-hand side, P − P−1, is the difference between the current price level and last year’s price level, which is inflation π.6 The term on the right-hand side, EP − P−1, is the difference between the expected price level and last year’s price level, which is expected inflation Eπ. Therefore, we can replace P − P−1 with π and EP − P−1 with Eπ:

Third, to go from output to unemployment, recall from Chapter 10 that Okun’s law gives a relationship between these two variables. One version of Okun’s law states that the deviation of output from its natural level is inversely related to the deviation of unemployment from its natural rate; that is, when output is higher than the natural level of output, unemployment is lower than the natural rate of unemployment. We can write this as

Using this Okun’s law relationship, we can substitute −β(u − un) for  in the previous equation to obtain:

in the previous equation to obtain:

π = Eπ − β(u − un) + v.

Thus, we can derive the Phillips curve equation from the aggregate supply equation.

All this algebra is meant to show one thing: the Phillips curve equation and the short-run aggregate supply equation represent essentially the same macroeconomic ideas. In particular, both equations show a link between real and nominal variables that causes the classical dichotomy (the theoretical separation of real and nominal variables) to break down in the short run. According to the short-run aggregate supply equation, output is related to unexpected movements in the price level. According to the Phillips curve equation, unemployment is related to unexpected movements in the inflation rate. The aggregate supply curve is more convenient when we are studying output and the price level, whereas the Phillips curve is more convenient when we are studying unemployment and inflation. But we should not lose sight of the fact that the Phillips curve and the aggregate supply curve are two sides of the same coin.

420

FYI

The History of the Modern Phillips Curve

The Phillips curve is named after New Zealand–born economist A. W. Phillips. In 1958 Phillips observed a negative relationship between the unemployment rate and the rate of wage inflation in data for the United Kingdom.7 The Phillips curve that economists use today differs in three ways from the relationship Phillips examined.

First, the modern Phillips curve substitutes price inflation for wage inflation. This difference is not crucial because price inflation and wage inflation are closely related. In periods when wages are rising quickly, prices are rising quickly as well.

Second, the modern Phillips curve includes expected inflation. This addition is due to the work of Milton Friedman and Edmund Phelps. In developing early versions of the imperfect-information model in the 1960s, these two economists emphasized the importance of expectations for aggregate supply.

Third, the modern Phillips curve includes supply shocks. Credit for this addition goes to OPEC, the Organization of the Petroleum Exporting Countries. In the 1970s OPEC caused large increases in the world price of oil, which made economists more aware of the importance of shocks to aggregate supply.

Adaptive Expectations and Inflation Inertia

To make the Phillips curve useful for analyzing the choices facing policymakers, we need to specify what determines expected inflation. A simple and often plausible assumption is that people form their expectations of inflation based on recently observed inflation. This assumption is called adaptive expectations. For example, suppose that people expect prices to rise this year at the same rate as they did last year. Then expected inflation Eπ equals last year’s inflation π−1:

Eπ = π−1.

In this case, we can write the Phillips curve as

π = π−1 − β(u − un) + v,

which states that inflation depends on past inflation, cyclical unemployment, and a supply shock. When the Phillips curve is written in this form, the natural rate of unemployment is sometimes called the nonaccelerating inflation rate of unemployment, or NAIRU.

The first term in this form of the Phillips curve, π−1, implies that inflation has inertia. That is, like an object moving through space, inflation keeps going unless something acts to stop it. In particular, if unemployment is at the NAIRU and if there are no supply shocks, the continued increase in the price level neither speeds up nor slows down. This inertia arises because past inflation influences expectations of future inflation and because these expectations influence the wages and prices that people set. Robert Solow captured the concept of inflation inertia well when, during the high inflation of the 1970s, he wrote, “Why is our money ever less valuable? Perhaps it is simply that we have inflation because we expect inflation, and we expect inflation because we’ve had it.”

421

In the model of aggregate supply and aggregate demand, inflation inertia is interpreted as persistent upward shifts in both the aggregate supply curve and the aggregate demand curve. First, consider aggregate supply. If prices have been rising quickly, people will expect them to continue to rise quickly. Because the position of the short-run aggregate supply curve depends on the expected price level, the short-run aggregate supply curve will shift upward over time. It will continue to shift upward until some event, such as a recession or a supply shock, changes inflation and thereby changes expectations of inflation.

The aggregate demand curve must also shift upward to confirm the expectations of inflation. Most often, the continued rise in aggregate demand is due to persistent growth in the money supply. If the Fed suddenly halted money growth, aggregate demand would stabilize, and the upward shift in aggregate supply would cause a recession. The high unemployment in the recession would reduce inflation and expected inflation, causing inflation inertia to subside.

Two Causes of Rising and Falling Inflation

The second and third terms in the Phillips curve equation show the two forces that can change the rate of inflation.

The second term, β(u – un), shows that cyclical unemployment—the deviation of unemployment from its natural rate—exerts upward or downward pressure on inflation. Low unemployment pulls the inflation rate up. This is called demand-pull inflation because high aggregate demand is responsible for this type of inflation. High unemployment pulls the inflation rate down. The parameter β measures how responsive inflation is to cyclical unemployment.

The third term, v, shows that inflation also rises and falls because of supply shocks. An adverse supply shock, such as the rise in world oil prices in the 1970s, implies a positive value of v and causes inflation to rise. This is called cost-push inflation because adverse supply shocks are typically events that push up the costs of production. A beneficial supply shock, such as the oil glut that led to a fall in oil prices in the 1980s, makes v negative and causes inflation to fall.

CASE STUDY

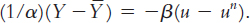

Inflation and Unemployment in the United States

Because inflation and unemployment are such important measures of economic performance, macroeconomic developments are often viewed through the lens of the Phillips curve. Figure 14-3 displays the history of inflation and unemployment in the United States from 1960 to 2013. These data, spanning more than half a century, illustrate some of the causes of rising or falling inflation.

FIGURE 14-3

The 1960s showed how policymakers can, in the short run, lower unemployment at the cost of higher inflation. The tax cut of 1964, together with expansionary monetary policy, expanded aggregate demand and pushed the unemployment rate below 5 percent. This expansion of aggregate demand continued in the late 1960s largely as a by-product of government spending for the Vietnam War. Unemployment fell lower and inflation rose higher than policymakers intended.

422

The 1970s were a period of economic turmoil. The decade began with policymakers trying to lower the inflation inherited from the 1960s. President Nixon imposed temporary controls on wages and prices, and the Federal Reserve engineered a recession through contractionary monetary policy, but the inflation rate fell only slightly. The effects of wage and price controls ended when the controls were lifted, and the recession was too small to counteract the inflationary impact of the boom that had preceded it. By 1972 the unemployment rate was the same as a decade earlier, while inflation was about 3 percentage points higher.

Beginning in 1973 policymakers had to cope with the large supply shocks caused by OPEC. OPEC first raised oil prices in the mid-1970s, pushing the inflation rate above 9 percent. This adverse supply shock, together with temporarily tight monetary policy, led to a recession in 1975. High unemployment during the recession reduced inflation somewhat, but further OPEC price hikes pushed inflation up again in the late 1970s.

The 1980s began with high inflation and high expectations of inflation. Under the leadership of Chairman Paul Volcker, the Federal Reserve doggedly pursued monetary policies aimed at reducing inflation. In 1982 and 1983 the unemployment rate reached its highest level in 40 years. High unemployment, aided by a fall in oil prices in 1986, pulled the inflation rate down from about 9 percent to about 2 percent. By 1987 the unemployment rate of about 6 percent was close to most estimates of the natural rate. Unemployment continued to fall through the 1980s, however, reaching a low of 5.3 percent in 1989 and beginning a new round of demand-pull inflation.

423

Compared to the preceding 30 years, the 1990s and early 2000s were relatively quiet. The 1990s began with a recession caused by several contractionary shocks to aggregate demand: tight monetary policy, the savings-and-loan crisis, and a fall in consumer confidence coinciding with the Gulf War. The unemployment rate rose to 7.5 percent in 1992, and inflation fell slightly. Unlike in the 1982 recession, unemployment in the 1990 recession was never far above the natural rate, so the effect on inflation was small. Similarly, a recession in 2001 (discussed in Chapter 12) raised unemployment, but the downturn was mild by historical standards, and the impact on inflation was once again slight.

A more severe recession began in 2008. As we discussed in Chapter 12, the cause of this downturn was a financial crisis, leading to a substantial decline in aggregate demand. Unemployment rose significantly in 2009, and the inflation rate fell to low levels, much as the conventional Phillips curve predicts. With unemployment so persistently high, some economists worried that the economy would experience deflation (a negative inflation rate). Yet that did not occur. One possible explanation is that expectations of inflation remained anchored at around 2 percent, instead of changing as the assumption of adaptive expectations would indicate. That is, the Fed’s recent history had given the central bank enough credibility about its target rate of inflation that expected inflation did not change as quickly as it might have in past episodes.

Thus, U.S. macroeconomic history illustrates the many forces working on the inflation rate, as described in the Phillips curve equation. The 1960s and 1980s show the two sides of demand-pull inflation: in the 1960s low unemployment pulled inflation up, and in the 1980s high unemployment pulled inflation down. The oil-price hikes of the 1970s show the effects of cost-push inflation. And the aftermath of the recession of 2008–2009 shows that inflation sometimes surprises us, in part because changing expectations are not always easy to predict.8

The Short-Run Tradeoff Between Inflation and Unemployment

Consider the options the Phillips curve gives to a policymaker who can influence aggregate demand with monetary or fiscal policy. At any moment, expected inflation and supply shocks are beyond the policymaker’s immediate control. Yet, by changing aggregate demand, the policymaker can alter output, unemployment, and inflation. The policymaker can expand aggregate demand to lower unemployment and raise inflation. Or the policymaker can depress aggregate demand to raise unemployment and lower inflation.

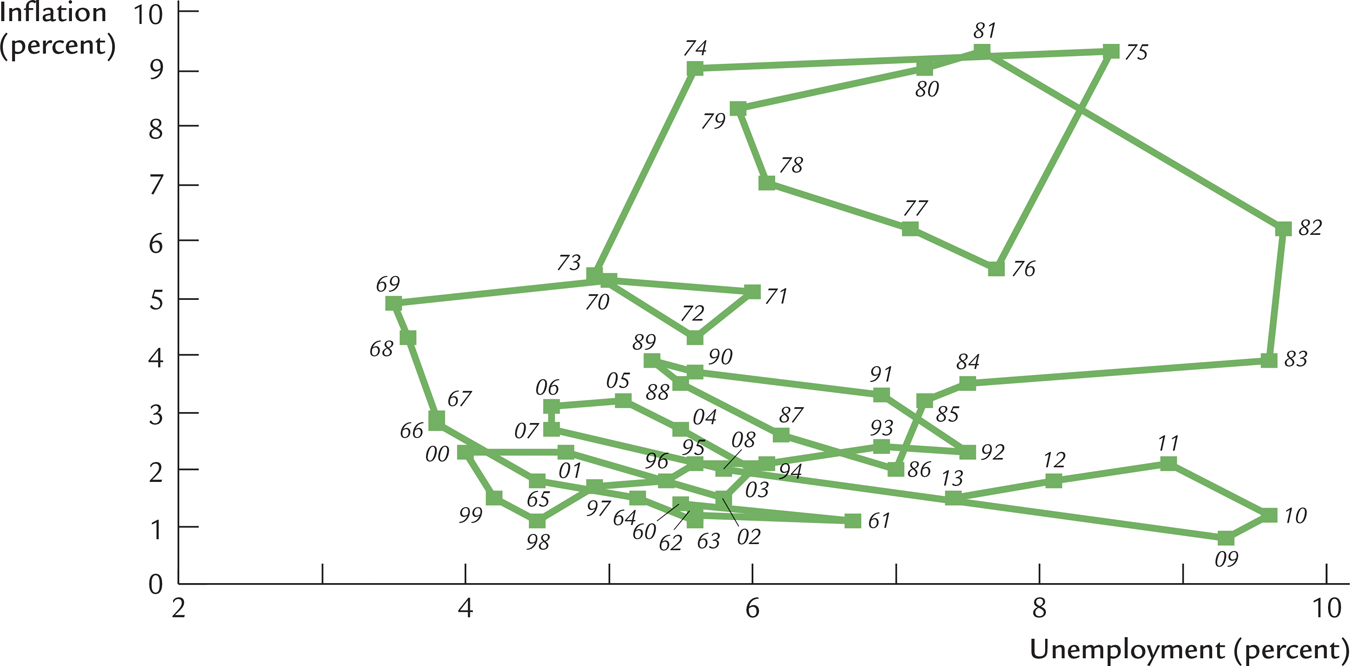

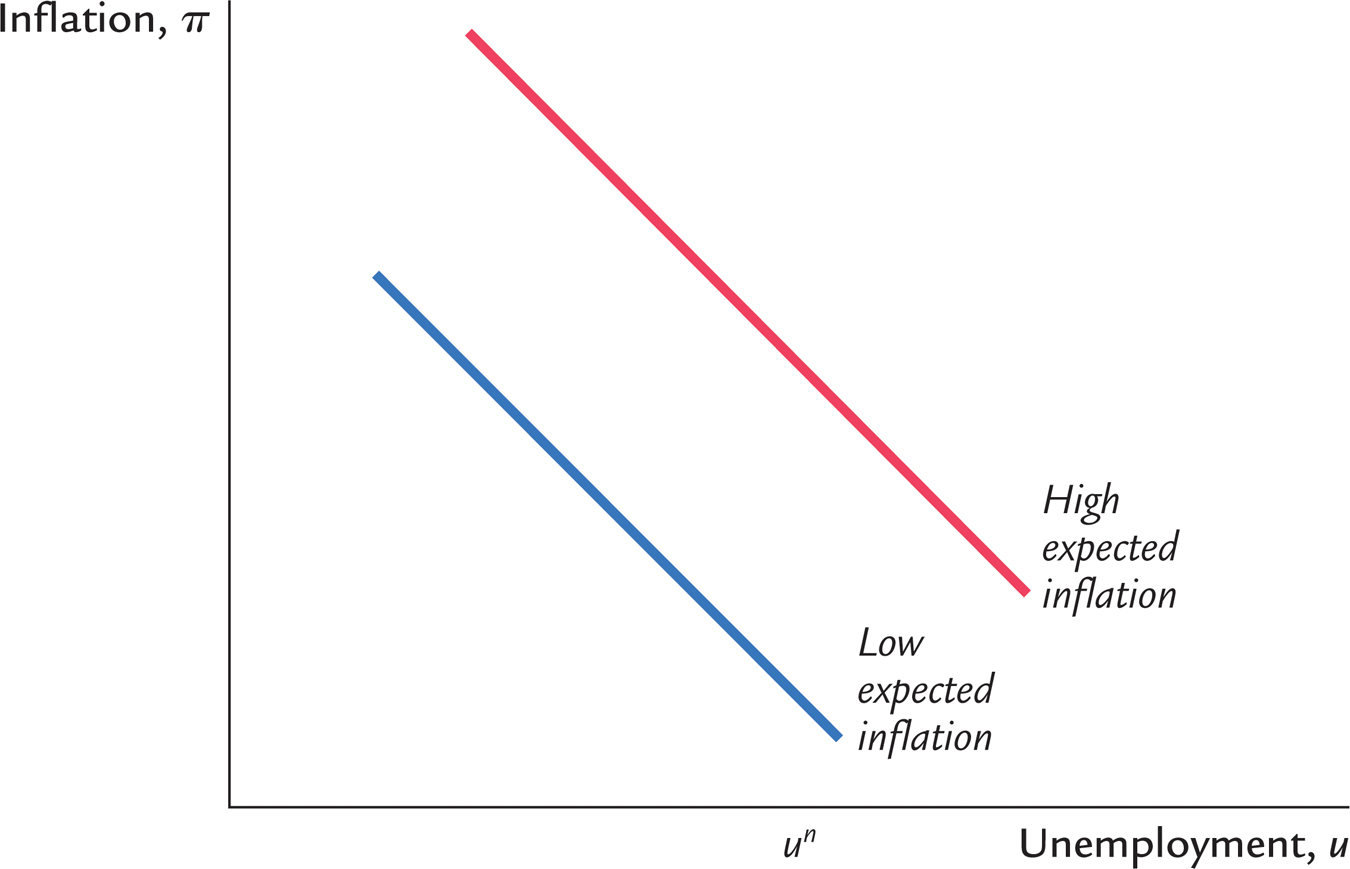

Figure 14-4 plots the Phillips curve equation and shows the short-run tradeoff between inflation and unemployment. When unemployment is at its natural rate (u = un), inflation depends on expected inflation and the supply shock (π =Eπ + v). The parameter β determines the slope of the tradeoff between inflation and unemployment. In the short run, for a given level of expected inflation, policymakers can manipulate aggregate demand to choose any combination of inflation and unemployment on this curve, called the short-run Phillips curve.

FIGURE 14-4

424

Notice that the position of the short-run Phillips curve depends on the expected rate of inflation. If expected inflation rises, the curve shifts upward, and the policymaker’s tradeoff becomes less favorable: inflation is higher for any level of unemployment. Figure 14-5 shows how the tradeoff depends on expected inflation.

FIGURE 14-5

425

FYI

How Precise Are Estimates of the Natural Rate of Unemployment?

If you ask an astronomer how far a particular star is from our sun, he’ll give you a number, but it won’t be accurate. Our ability to measure astronomical distances is still limited. An astronomer might well take better measurements and conclude that a star is really twice or half as far away as he previously thought.

Estimates of the natural rate of unemployment, or NAIRU, are also far from precise. One problem is supply shocks. Shocks to oil supplies, crop harvests, or technological progress can cause inflation to rise or fall in the short run. When we observe rising inflation, therefore, we cannot be sure whether it is evidence that the unemployment rate is below the natural rate or evidence that the economy is experiencing an adverse supply shock.

A second problem is that the natural rate changes over time. Demographic changes (such as the aging of the baby-boom generation), policy changes (such as minimum-wage laws), and institutional changes (such as the declining role of unions) all influence the economy’s normal level of unemployment. Estimating the natural rate is like hitting a moving target.

Economists deal with these problems using statistical techniques that yield a best guess about the natural rate and allow them to gauge the uncertainty associated with their estimates. In one such study, Douglas Staiger, James Stock, and Mark Watson estimated the natural rate to be 6.2 percent in 1990, with a 95 percent confidence interval from 5.1 to 7.7 percent. A 95 percent confidence interval is a range such that the statistician is 95 percent confident that the true value falls in that range. A recent study by economists at the Federal Reserve put the natural rate in 2013 at 5.8 percent, with a 95 percent confidence interval from 4.5 to 7 percent. These large confidence intervals show that estimates of the natural rate of unemployment are not at all precise.

This conclusion has profound implications. Policymakers may want to keep unemployment close to its natural rate, but their ability to do so is limited by the fact that they cannot be sure what that natural rate is.9

Because people adjust their expectations of inflation over time, the tradeoff between inflation and unemployment holds only in the short run. The policymaker cannot keep inflation above expected inflation (and thus unemployment below its natural rate) forever. Eventually, expectations adapt to whatever inflation rate the policymaker has chosen. In the long run, the classical dichotomy holds, unemployment returns to its natural rate, and there is no tradeoff between inflation and unemployment.

Disinflation and the Sacrifice Ratio

Imagine an economy in which unemployment is at its natural rate and inflation is running at 6 percent. What would happen to unemployment and output if the central bank pursued a policy to reduce inflation from 6 to 2 percent?

426

The Phillips curve shows that in the absence of a beneficial supply shock, lowering inflation requires a period of high unemployment and reduced output. But by how much and for how long would unemployment need to rise above the natural rate? Before deciding whether to reduce inflation, policymakers must know how much output would be lost during the transition to lower inflation. This cost can then be compared with the benefits of lower inflation.

Much research has used the available data to examine the Phillips curve quantitatively. The results of these studies are often summarized in a number called the sacrifice ratio, the percentage of a year’s real GDP that must be forgone to reduce inflation by 1 percentage point. Although estimates of the sacrifice ratio vary substantially, a typical estimate is about 5: for every percentage point that inflation is to fall, 5 percent of one year’s GDP must be sacrificed.10

We can also express the sacrifice ratio in terms of unemployment. Okun’s law says that a change of 1 percentage point in the unemployment rate translates into a change of 2 percentage points in GDP. Therefore, reducing inflation by 1 percentage point requires about 2.5 percentage points of cyclical unemployment.

We can use the sacrifice ratio to estimate by how much and for how long unemployment must rise to reduce inflation. If reducing inflation by 1 percentage point requires a sacrifice of 5 percent of a year’s GDP, reducing inflation by 4 percentage points requires a sacrifice of 20 percent of a year’s GDP. Equivalently, this reduction in inflation requires a sacrifice of 10 percentage points of cyclical unemployment.

This disinflation could take various forms, each totaling the same sacrifice of 20 percent of a year’s GDP. For example, a rapid disinflation would lower output by 10 percent for two years: this is sometimes called the cold-turkey solution to inflation. A moderate disinflation would lower output by 5 percent for four years. An even more gradual disinflation would depress output by 2 percent for a decade.

Rational Expectations and the Possibility of Painless Disinflation

Because the expectation of inflation influences the short-run tradeoff between inflation and unemployment, it is crucial to understand how people form expectations. So far, we have been assuming that expected inflation depends on recently observed inflation. Although this assumption of adaptive expectations is plausible, it is probably too simple to apply in all circumstances.

An alternative approach is to assume that people have rational expectations. That is, we might assume that people optimally use all the available information, including information about current government policies, to forecast the future. Because monetary and fiscal policies influence inflation, expected inflation should also depend on the monetary and fiscal policies in effect. According to the theory of rational expectations, a change in monetary or fiscal policy will change expectations, and an evaluation of any policy change must incorporate this effect on expectations. If people do form their expectations rationally, then inflation may have less inertia than first appears.

427

Here is how Thomas Sargent, a prominent advocate of rational expectations and a 2011 Nobel laureate in economics, describes its implications for the Phillips curve:

An alternative “rational expectations” view denies that there is any inherent momentum to the present process of inflation. This view maintains that firms and workers have now come to expect high rates of inflation in the future and that they strike inflationary bargains in light of these expectations. However, it is held that people expect high rates of inflation in the future precisely because the government’s current and prospective monetary and fiscal policies warrant those expectations…. Thus inflation only seems to have a momentum of its own; it is actually the long-term government policy of persistently running large deficits and creating money at high rates which imparts the momentum to the inflation rate. An implication of this view is that inflation can be stopped much more quickly than advocates of the “momentum” view have indicated and that their estimates of the length of time and the costs of stopping inflation in terms of foregone output are erroneous…. [Stopping inflation] would require a change in the policy regime: there must be an abrupt change in the continuing government policy, or strategy, for setting deficits now and in the future that is sufficiently binding as to be widely believed…. How costly such a move would be in terms of foregone output and how long it would be in taking effect would depend partly on how resolute and evident the government’s commitment was.11

Thus, advocates of rational expectations argue that the short-run Phillips curve does not accurately represent the options that policymakers have available. They believe that if policymakers are credibly committed to reducing inflation, rational people will understand the commitment and will quickly lower their expectations of inflation. Inflation can then come down without a rise in unemployment and fall in output. According to the theory of rational expectations, traditional estimates of the sacrifice ratio are not useful for evaluating the impact of alternative policies. Under a credible policy, the costs of reducing inflation may be much lower than estimates of the sacrifice ratio suggest.

In the most extreme case, one can imagine reducing the rate of inflation without causing any recession at all. A painless disinflation has two requirements. First, the plan to reduce inflation must be announced before the workers and firms that set wages and prices have formed their expectations. Second, the workers and firms must believe the announcement; otherwise, they will not reduce their expectations of inflation. If both requirements are met, the announcement will immediately shift the short-run tradeoff between inflation and unemployment downward, permitting a lower rate of inflation without higher unemployment.

428

Although the rational-expectations approach remains controversial, almost all economists agree that expectations of inflation influence the short-run tradeoff between inflation and unemployment. The credibility of a policy to reduce inflation is therefore one determinant of how costly the policy will be. Unfortunately, it is often difficult to predict whether the public will view the announcement of a new policy as credible. The central role of expectations makes forecasting the results of alternative policies far more difficult.

CASE STUDY

The Sacrifice Ratio in Practice

The Phillips curve with adaptive expectations implies that reducing inflation requires a period of high unemployment and low output. By contrast, the rational-expectations approach suggests that reducing inflation can be much less costly. What happens during actual disinflations?

Consider the U.S. disinflation in the early 1980s. This decade began with some of the highest rates of inflation in U.S. history. Yet because of the tight monetary policies the Fed pursued under Chairman Paul Volcker, the rate of inflation fell substantially in the first few years of the decade. This episode provides a natural experiment with which to estimate how much output is lost during the process of disinflation.

The first question is, how much did inflation fall? As measured by the GDP deflator, inflation reached a peak of 9.3 percent in 1981. It is natural to end the episode in 1985 because oil prices plunged in 1986—a large, beneficial supply shock unrelated to Fed policy. In 1985, inflation was 3.2 percent, so we can estimate that the Fed engineered a reduction in inflation of 6.1 percentage points over four years.

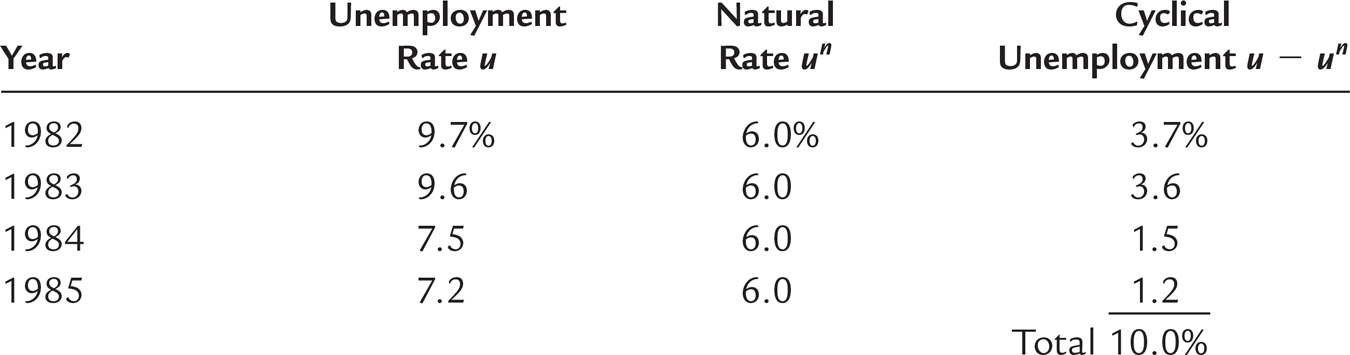

The second question is, how much output was lost during this period? Table 14-1 shows the unemployment rate from 1982 to 1985. Assuming that the natural rate of unemployment was 6 percent, we can compute the amount of cyclical unemployment in each year. In total over this period, there were 10.0 percentage points of cyclical unemployment. Okun’s law says that 1 percentage point of unemployment translates into 2 percentage points of GDP. Therefore, 20.0 percentage points of annual GDP were lost during the disinflation.

TABLE 14-1

TABLE 14-1: Unemployment During the Volcker Disinflation

429

Now we can compute the sacrifice ratio for this episode. We know that 20.0 percentage points of GDP were lost and that inflation fell by 6.1 percentage points. Hence, 20.0/6.1, or 3.3, percentage points of GDP were lost for each percentage-point reduction in inflation. The estimate of the sacrifice ratio from the Volcker disinflation is 3.3.

This estimate of the sacrifice ratio is smaller than the estimates made before Volcker was appointed Fed chairman. In other words, Volcker reduced inflation at a smaller cost than many economists had predicted. One explanation is that Volcker’s tough stand was credible enough to influence expectations of inflation directly. Yet the change in expectations was not large enough to make the disinflation painless: in 1982 unemployment reached its highest level since the Great Depression.

Although the Volcker disinflation is only one historical episode, this kind of analysis can be applied to other disinflations. One comprehensive study documented the results of 65 disinflations in 19 countries. In almost all cases, the reduction in inflation came at the cost of temporarily lower output. Yet the size of the output loss varied from episode to episode. Rapid disinflations usually had smaller sacrifice ratios than slower ones. That is, in contrast to what the Phillips curve with adaptive expectations suggests, a cold-turkey approach appears less costly than a gradual one. Moreover, countries with more flexible wage-setting institutions, such as shorter labor contracts, had smaller sacrifice ratios. These findings indicate that reducing inflation always has some cost but that policies and institutions can affect its magnitude.12

Hysteresis and the Challenge to the Natural-Rate Hypothesis

Our discussion of the cost of disinflation—and indeed our entire discussion of economic fluctuations in the past four chapters—has been based on an assumption called the natural-rate hypothesis. This hypothesis is summarized in the following statement:

Fluctuations in aggregate demand affect output and employment only in the short run. In the long run, the economy returns to the levels of output, employment, and unemployment described by the classical model.

The natural-rate hypothesis allows macroeconomists to separately study short-run and long-run developments in the economy. It is one expression of the classical dichotomy.

Some economists, however, have challenged the natural-rate hypothesis by suggesting that aggregate demand may affect output and employment even in the long run. They have pointed out a number of mechanisms through which recessions might leave permanent scars on the economy by altering the natural rate of unemployment. Hysteresis is the term used to describe the long-lasting influence of history on the natural rate.

430

A recession can have permanent effects if it changes the people who become unemployed. For instance, workers might lose valuable job skills when unemployed, which diminishes their ability to find a job even after the recession ends. Alternatively, a long period of unemployment may change an individual’s attitude toward work and reduce his desire to find employment. In either case, the recession permanently inhibits the process of job search and raises the amount of frictional unemployment.

Another way in which a recession can permanently affect the economy is by changing the process that determines wages. Those who become unemployed may lose their influence on the wage-setting process. Unemployed workers may lose their status as union members, for example. More generally, some of the insiders in the wage-setting process become outsiders. If the smaller group of insiders cares more about high real wages and less about high employment, then the recession may permanently push real wages farther above the equilibrium level and raise the amount of structural unemployment.

Hysteresis remains a controversial theory. Some economists believe this theory helps explain persistently high unemployment in Europe because the rise in European unemployment, which started in the early 1980s, coincided with disinflation but continued after inflation stabilized. Moreover, the increase in unemployment tended to be larger for those countries that experienced the greatest reductions in inflations, such as Ireland, Italy, and Spain. As these episodes suggest, hysteresis can increase the sacrifice ratio because output is lost even after the period of disinflation is over. Yet there is still no consensus on whether the hysteresis phenomenon is significant or why it might be more pronounced in some countries than in others. (Alternative explanations of high European unemployment, discussed in Chapter 7, point to forces other than disinflation.) If the theory of hysteresis is true, however, it is important because it greatly increases the cost of recessions.

The issue rose to prominence once again in the aftermath of the Great Recession of 2008–2009. Many economists wondered whether the high levels of long-term unemployment and depressed labor-force participation (discussed in Chapter 7) would leave permanent scars on the economy. By the end of 2014, the unemployment rate had fallen below 6 percent, but because many people had stopped looking for work, the employment-to-population ratio remained well below the levels experienced before the recession. As this book was going to press, policymakers continued to debate what the “new normal” in the labor market would be in the years ahead.13

431