Banking and Finance Reform.

Printed Page 658 Chapter Chronology

Banking and Finance Reform. Roosevelt wasted no time making good on his inaugural pledge for "action now." As he took the oath of office on March 4, the nation's banking system was on the brink of collapse. Roosevelt immediately devised a plan to shore up banks and restore depositors' confidence. Working round the clock, New Dealers drafted the Emergency Banking Act, which propped up the private banking system with federal funds and subjected banks to federal regulation and oversight. To secure the confidence of depositors, Congress passed the Glass-Steagall Banking Act, setting up the Federal Deposit Insurance Corporation (FDIC), which guaranteed bank customers that the federal government would reimburse them for deposits if their banks failed. In addition, the act required the separation of commercial banks (which accept deposits and make loans to individuals and small businesses) and investment banks (which make speculative investments with their funds), in an effort to insulate the finances of Main Street America from the risky speculations of Wall Street wheeler-dealers.

Federal Deposit Insurance Corporation (FDIC)

Regulatory body established by the Glass-Steagall Banking Act that guaranteed the federal government would reimburse bank depositors if their banks failed. This key feature of the New Deal restored depositors' confidence in the banking system during the Great Depression.

fireside chats

Series of informal radio addresses Franklin Roosevelt made to the nation in which he explained New Deal initiatives. The chats helped bolster Roosevelt's popularity and secured popular support for his reforms.

On Sunday night, March 12, while the banks were still closed, Roosevelt broadcast the first of a series of fireside chats. Speaking in a friendly, informal manner, he explained the new banking legislation that, he said, made it "safer to keep your money in a reopened bank than under the mattress." With such plain talk, Roosevelt translated complex matters into common sense. This and subsequent fireside chats forged a direct connection — via radio — between Roosevelt and millions of Americans, a connection felt by a man from Paris, Texas, who wrote to Roosevelt, "You are the one & only President that ever helped a Working Class of People. ...Please help us some way I Pray to God for relief."

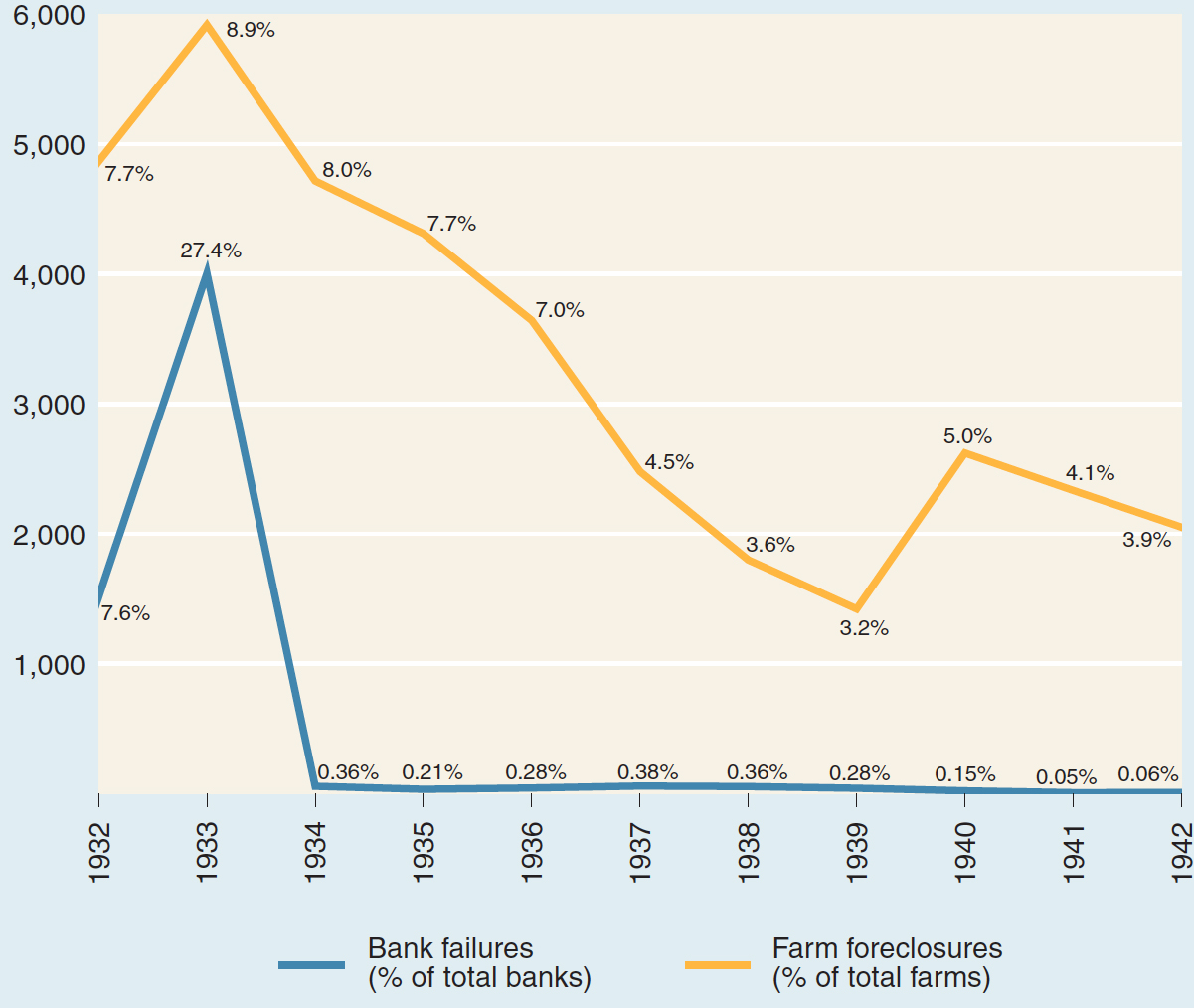

The banking legislation and fireside chat worked. Within a few days, most of the nation's major banks reopened, and they remained solvent as reassured depositors switched funds from their mattresses to their bank accounts (Figure 24.1).

In his inaugural address, Roosevelt criticized financiers for their greed and incompetence. To prevent the fraud, corruption, and insider trading that had tainted Wall Street and contributed to the crash of 1929, New Dealers created the Securities and Exchange Commission (SEC) in 1934 to oversee financial markets by licensing investment dealers, monitoring all stock transactions, and requiring corporate officers to make full disclosures about their companies. The SEC helped clean up and regulate Wall Street, which slowly recovered.