EXTERNALITIES

Actions by individuals and firms affect not only those involved, but also can create side effects for others in ways that can be either beneficial or costly. For example, suppose you share an apartment with a neat and organized person. Because your roommate always keeps the apartment clean and uncluttered, you reap the benefits of not having dishes piling up in the sink or potato chip crumbs all over the sofa. Clearly, you benefit from this situation. On the other hand, suppose the occupants of the apartment next door are members of an aspiring heavy metal band. They blast loud music all day, and occasionally have a jam session—

externalities The impact on third parties of some transaction between others in which the third parties are not involved. An external cost (or negative externality) harms the third parties, whereas external benefits (positive externalities) result in gains to them.

Externalities, often called spillovers, arise when actions or market transactions by an individual or a firm cause some other party not involved in the activity or transaction to benefit or be harmed. If the activity imposes costs on others, it is called a negative externality and it creates an external cost. If the activity creates benefits to others, this is a positive externality and it creates an external benefit. Negative externalities include air and water pollution, littering, and chemical runoff that affect fish stocks. Examples of activities that generate positive externalities include getting a flu shot, acquiring more education, landscaping, and maintaining beehives next to apple orchards.

market failure When markets fail to provide a socially optimal level of output, and will provide output at too high or low a price.

The presence of externalities leads to a misallocation of resources, causing a market failure to occur, when markets fail to provide a socially optimal level of goods and services. Both producers and consumers can create externalities and can feel the effects of them. Table 1 identifies the origin and impact of some common external effects.

| TABLE 1 | EXTERNALITIES BY ORIGIN AND IMPACT | |||

| Impact Victims and Beneficiaries of an Externality |

||||

| Origin of Externality | Consumers | Producers | ||

| Positive | Negative | Positive | Negative | |

| Consumers |

|

|

|

|

| Positive | Negative | Positive | Negative | |

| Producers |

|

|

|

|

Negative Externalities

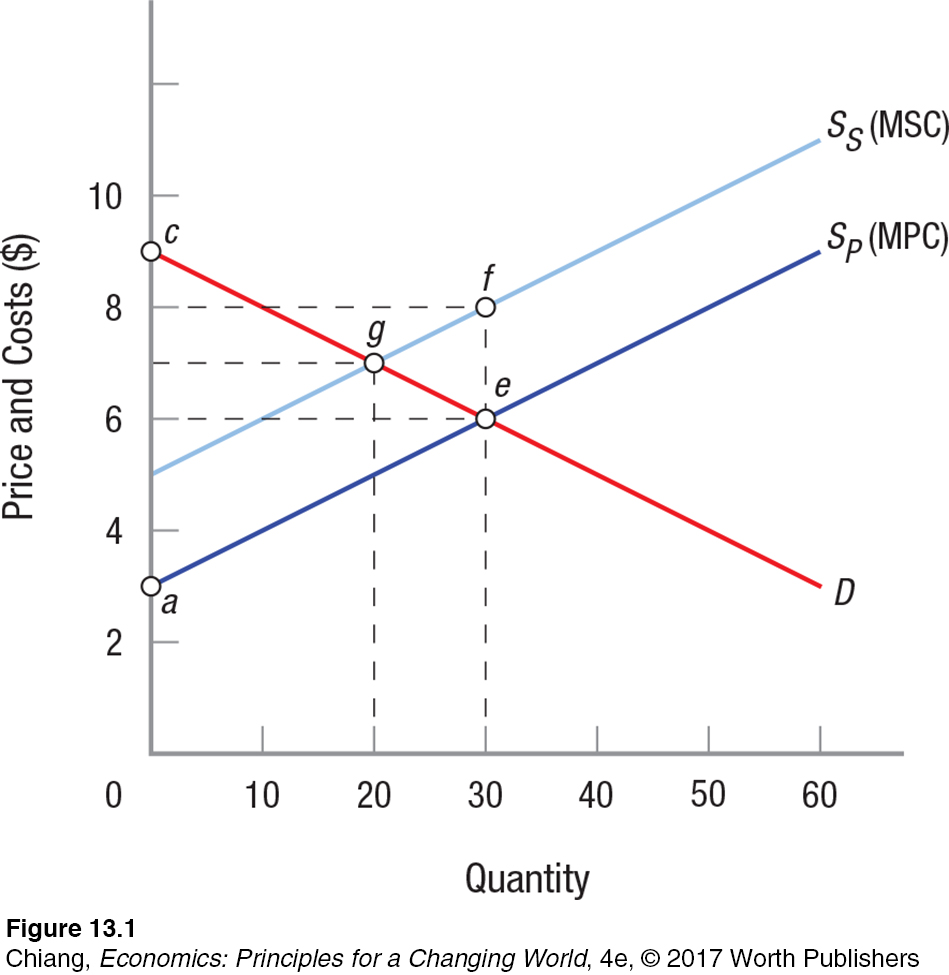

When a market transaction harms people not involved in the transaction, negative externalities exist. Pollution of all sorts is the classic example. Firms and consumers rarely consider the impact their production or consumption will have on others. For simplicity, we focus on the pollution caused by production. Figure 1 shows a typical market.

Supply curve SP represents the manufacturer’s marginal private cost (MPC) of production. This supply curve ignores the external costs imposed on others from the pollution generated during production. These external costs might include toxic wastes dumped into lakes or streams, smokestack soot, or the clear-

One way to measure the well-

Now let’s assume that for every unit of the product produced, pollution costs (or effluent) equal to $2 are generated. Thus, at an output level of 30 units (point e), $60 in pollution costs (or negative externalities) is generated. Subtracting this $60 in pollution from total consumer and producer surplus results in $30 of real social benefit from this output.

This means that the true marginal cost of producing the product, including pollution costs, is equal to supply curve SS, representing the marginal social cost (MSC) of production. This new supply curve incorporates both the private and social costs of production, thus shifting supply upward by an amount equal to ef, or $2. Equilibrium moves to point g, at which 20 units of the product are sold at $7. This is the socially optimal production for this product given the pollution it creates.

So why is it better for society than when 30 units were produced? First, notice that when output is 20, the cost of the last unit produced—

Each unit of output produced beyond 20 costs more—

Imagine a situation in which external costs exceed the consumer and producer surplus from consuming the good. Such a situation might arise when an extremely toxic substance is a by-

What has this analysis shown? First, when negative externalities are present, an unregulated market will produce too much of a good at too low a price. Second, optimal pollution levels are not zero, except in the case just mentioned of extremely toxic agents. In Figure 1, the socially optimal production is 20 units with total pollution costs of $2 × 20. Pollution reduction as a good has no price. Even so, we can infer a price, known as a shadow price, equal to the marginal damages—

The Coase Theorem

Ronald Coase was awarded the Nobel Prize in Economics for his seminal paper “The Problem of Social Cost.” Coase has written few articles—

1 Peter Passell, “Economics Nobel to a Basic Thinker,” New York Times, October 16, 1991, p. D6.

Reducing output to an optimal level results in gains to “victims” because pollution is reduced. The reduction in output, however, causes losses to producers. The presence of losses and gains to two distinct parties, Coase argued, introduces the possibility of bargaining, provided that the parties are awarded the property rights necessary for negotiation.

Coase theorem If transaction costs are minimal (near zero), a bargain struck between beneficiaries and victims of externalities will be efficient from a resource allocation perspective. As a result, a socially optimal level of production will be reached.

The Coase theorem states that if transaction costs are minimal (near zero), the resulting bargain or allocation of resources will be efficient—

Even so, the distribution of benefits or income will be different in these two cases. If victims, for example, are assigned the property rights, their income will grow, but if polluters are assigned these rights, the income of victims will decline.

As Coase noted, for these efficient results to be achieved, transaction costs must approach zero. This means it must be possible for polluters and victims to determine their collective interests accurately, then negotiate and enforce an agreement. In many situations, however, this is simply not feasible. In cases involving air pollution, for instance, polluters and victims are so widely dispersed that negotiating is not practical. In other cases, individuals may be both victims and polluters, making it difficult for an agreement to be reached and enforced.

Another problem associated with assigning rights to one party or another might be called environmental mugging. Polluters might at first threaten to pollute more than they anticipate, for instance, to increase their bargaining leverage and, ultimately, their income. Victims, in like manner, might assert exaggerated environmental concerns, again to bid up their compensation. Alternatively, if negotiations should prove to be unfruitful, polluters might start lobbying for legal relief, thus devoting their money to rent-

Although the private negotiations Coase proposed have their limitations, his insights proved to be a turning point in environmental policy. Coase challenged the prevailing practice of assuming that victims had a right to be pollution-

RONALD COASE (1910–2013)

NOBEL PRIZE

University of Chicago Professor Ronald Coase won the Nobel Prize in Economic Sciences in 1991 for “his discovery and clarification of the significance of transaction costs and property rights for the institutional structure and functioning of the economy.” According to his analysis, traditional microeconomic theory was incomplete because it neglected the costs of executing contracts and managing firms. To Coase, these “transaction costs” were the principal reason that firms existed. Coase also introduced the concept of property rights as an important element of economic analysis.

Born in 1910 in Willesden, a suburb of London, Coase attended the London School of Economics (LSE), where he earned a Bachelor of Commerce degree in 1932, and returned 15 years later and earned a Doctor of Science degree in economics in 1951. Having “a liking for life in America,” he migrated to the United States in 1951 and taught at the University of Buffalo. Coase’s 1960 article “The Problem of Social Cost” questioned whether governments could efficiently allocate resources for social purposes through taxes and subsidies. He argued that arbitrarily assigning property rights and using markets to reach a solution was usually better than costly government regulation. This was instantly controversial and led to a lengthy exchange of papers in economics journals. In 1964 Coase joined the faculty at the University of Chicago and became editor of the Journal of Law and Economics. The journal was an important catalyst in developing the economic interpretation of legal issues. Coase died in 2013 at the age of 102.

This idea was so radical when Coase published “The Problem of Social Cost” in 1960 that another Nobel Prize winner, George Stigler, wondered “how so fine an economist could make such an obvious mistake.” Coase was later invited to the University of Chicago to discuss his ideas; Stigler described what transpired2:

We strongly objected to this heresy. Milton Friedman did most of the talking, as usual. He also did much of the thinking, as usual. In the course of two hours of argument the vote went from twenty against and one for Coase to twenty-

2 George Stigler, Memoirs of an Unregulated Economist (New York: Basic Books, 1988), p. 76.

The Coase theorem has changed the way economists look at many issues, not just environmental problems. In cases in which the costs of negotiation are negligible and the number of parties involved is small, economists and jurists have begun to look more closely at legal rules assigning liability.

Positive Externalities

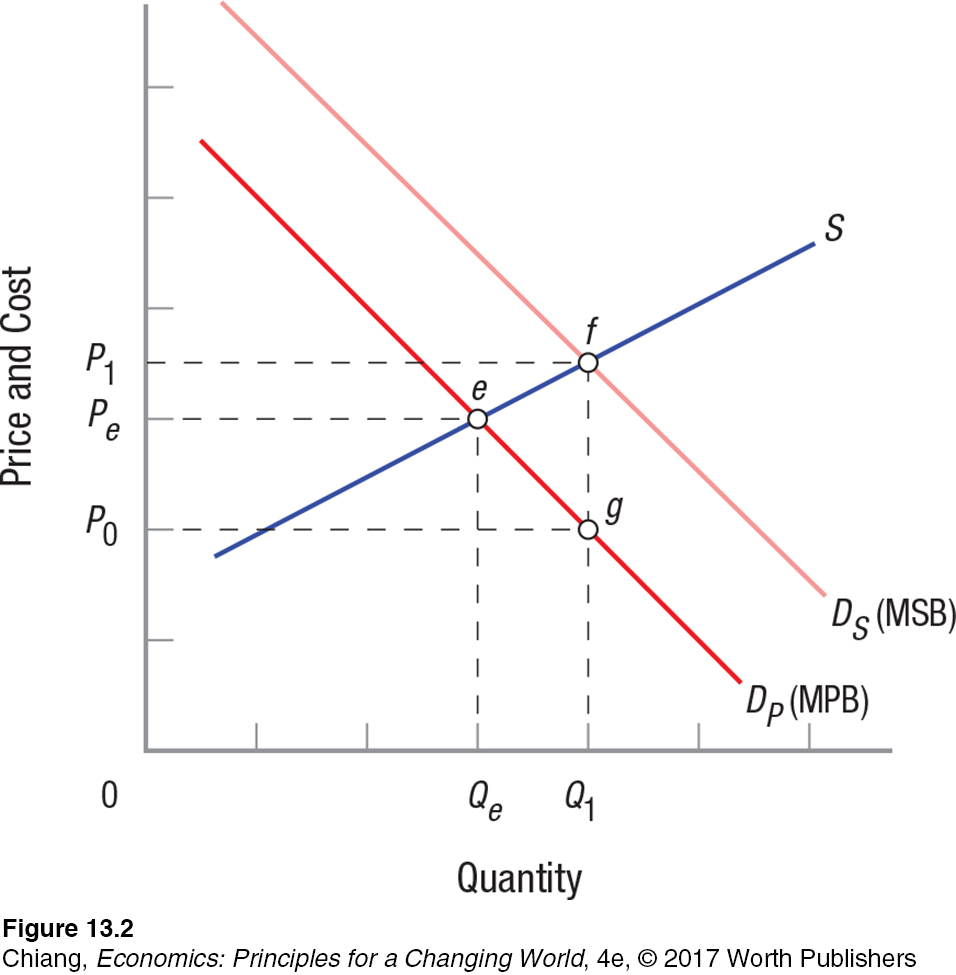

When private market transactions generate benefits for others, a situation opposite to that just described results. Figure 2 illustrates a positive externality. Market supply curve S and private demand curve DP (equal to the marginal private benefit, MPB, of consumption) represent the market for college education. Equilibrium occurs at point e, with Qe students enrolling. Society would clearly benefit, however, if more people received a college education. Tax revenues would rise, crime rates would fall, and a better-

Taking these considerations into account, social demand curve DS is the private demand for college education plus the external benefits that flow from it. Socially optimal enrollment would be Q1 (point f ). How can society tweak the market so that more students will attend college? Students will demand Q1 levels of enrollment only if its price is P0 (point g). The public must therefore subsidize college education by fg to draw its price down to P0.

The U.S. government recognizes that college education benefits society at large when it provides low-

Limitations

The analysis of externalities is important when determining public policy. However, some caveats need to be noted. For example, consumer surplus and producer surplus are good measures of a society’s welfare if incomes are distributed in an equitable manner. When they are not, efforts to increase efficiency can be unconvincing for public policy. Because it is difficult to reach consensus on issues of income distribution, economists generally focus on efficiency. Also, our analysis of externalities with respect to pollution does not fully take into account important aspects such as the cumulative long-

We now turn our attention to another type of market failure that occurs when resources are not privately owned.

CHECKPOINT

EXTERNALITIES

Externalities arise when the production of one good generates benefits (positive externalities) or costs (negative externalities) for others not involved in the transaction.

When negative externalities exist, overproduction results. When positive externalities are generated, underproduction of the good is the norm.

The Coase theorem states that if transaction costs are minimal (near zero), no matter which party is provided the property rights to pollution (polluter or victim), the resulting bargain will result in a socially optimal level of pollution.

QUESTION: A major problem facing many cities today is traffic congestion. One policy proposal to ease traffic congestion is to make all public transportation free, paid for either by a higher local gasoline tax or higher auto registration fees. What would be an external benefit and an external cost of implementing such a proposal to alleviate traffic congestion?

Answers to the Checkpoint question can be found at the end of this chapter.

An external benefit of the policy would be reduced commuting times, which may contribute to improved standards of living and increased work productivity. Removing cars from the road and reducing cars idling in slow traffic would also reduce greenhouse gases. And income inequality can be reduced by providing low-