14.5 Uncertainty, Risk, and Insurance

Expected value gives us a way to think about risks in the context of investment. But, as we see in this section, when we use expected value analysis, we are implicitly assuming that people aren’t especially afraid of risk. For example, in expected value terms, a 1% chance of $100 million is worth just as much as having $1 million in cash, even though the former is a much less certain proposition than the latter. In this section, we explore what happens when people do not like taking risks and see why insurance is valuable to these people. In addition, we learn how risk changes investment decisions.

Expected Income, Expected Utility, and the Risk Premium

To understand what we mean by people not liking risk, think about a person and the utility he gets from consuming the goods he can buy with his income. Our analysis in Chapter 4 explains what bundle of goods a person picks given the goods’ prices and the person’s income, but when trying to figure out consumers’ distastes for risk, we don’t need to keep track of exactly what goods are in that bundle. All we need to know is the total amount of utility this person enjoys at any given income level.

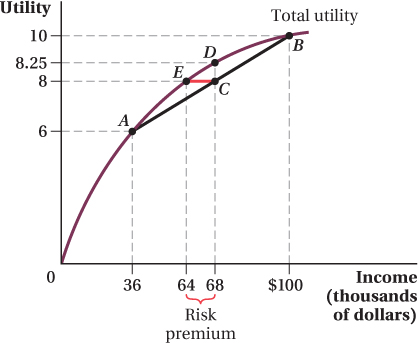

We plot the relationship between utility and income for a random guy named Adam in Figure 14.3. Adam’s income is shown on the horizontal axis, and his utility from consuming the goods he buys with that income level is on the vertical axis. Utility rises with income, as we would expect, because the more income he has, the more stuff he can buy. However, the curve becomes less steep as his income rises. That is, Adam has diminishing marginal utility of income. The bump in utility he would enjoy from an increase in income of, say, $10,000 to $15,000 is more than the extra utility he’d experience from moving from an income of $1,000,000 to $1,005,000. It turns out that if diminishing marginal utility holds, Adam will be sensitive to risk and willing to pay to eliminate or reduce uncertainty.

To make the relationship between risk and diminishing marginal utility as clear as possible, take a specific example. Suppose most of Adam’s income comes from a country store he owns, and that the only important uncertainty his business faces is whether the store is destroyed by a tornado (causing Adam’s income to take a big hit).

560

We assume the utility, U, that Adam enjoys from goods purchased with his income is given by the function

where I is Adam’s income in thousands of dollars. This utility function is plotted in Figure 14.3, and it exhibits diminishing marginal utility of income.

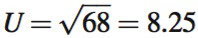

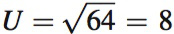

Now suppose that Adam’s income is $100,000 in a year there is no tornado and only $36,000 if there is a tornado. The utility levels corresponding to these incomes are shown as points B and A, respectively, in Figure 14.3. With $100,000 in income, Adam’s utility is  with $36,000 in income, it’s

with $36,000 in income, it’s  .

.

Let’s say the probability of a tornado is ridiculously high, 50%, to make the math easy. This is where the uncertainty comes from.

Following a basic expected value calculation, we first compute Adam’s expected income for the year. There’s a 50% chance his store blows down, giving him an income of $36,000. There’s a 50% chance of no tornado, and his income is $100,000. Applying the formula for computing expected values, we find that Adam’s expected income is $68,000:

Expected income = (0.5 × $36,000) + (0.5 × $100,000)

= $18,000 + $50,000

= $68,000

Similarly, we can compute his expected utility:

Expected utility = (0.5 × 6) + (0.5 × 10)

= 3 + 5

= 8

We plot these expected income and utility levels at point C. Notice how this point is halfway along the straight line connecting A and B, the income-

risk-

Suffering an expected utility loss from uncertainty, or equivalently, being willing to pay to have that risk reduced.

Notice another important thing about point C: It’s at an expected utility level, 8, that is below Adam’s utility function at that same income level. According to Adam’s utility function, an income level of $68,000 allows him to achieve a utility of  , as shown at point D in Figure 14.3. What this means is that the same expected income, $68,000, can give Adam different levels of expected utility depending on the riskiness of the underlying income levels on which the expectation is based. Due to the chance of tornado, Adam’s income is uncertain, and his $68,000 in expected income delivers an expected utility of 8. But, if his income is guaranteed to be $68,000, even though his expected income of $68,000 has not changed, his expected utility would be 8.25. In other words, the very uncertainty about what his income will be reduces Adam’s expected utility. If a person prefers having a guaranteed amount to having a risky but equivalent-

, as shown at point D in Figure 14.3. What this means is that the same expected income, $68,000, can give Adam different levels of expected utility depending on the riskiness of the underlying income levels on which the expectation is based. Due to the chance of tornado, Adam’s income is uncertain, and his $68,000 in expected income delivers an expected utility of 8. But, if his income is guaranteed to be $68,000, even though his expected income of $68,000 has not changed, his expected utility would be 8.25. In other words, the very uncertainty about what his income will be reduces Adam’s expected utility. If a person prefers having a guaranteed amount to having a risky but equivalent-

561

certainty equivalent

The guaranteed income level at which an individual would receive the same expected utility level as from an uncertain income.

risk premium

The compensation an individual would require to bear risk without suffering a loss in expected utility.

A related way to see how uncertainty reduces expected utility is to ask what guaranteed income would offer Adam the same expected utility level as his uncertain income. That equivalent income level, sometimes referred to as the certainty equivalent, is shown at point E in Figure 14.3. The certainty equivalent in this example is $64,000, because  . Adam derives the same expected utility from a guaranteed $64,000 income as he does from having a 50% chance of a $36,000 income and a 50% chance of a $100,000 income. Another way to put this is that Adam is willing to give up $4,000 in expected income ($68,000 – $64,000) in exchange for eliminating his income uncertainty. This income difference is called the risk premium—it’s the extra amount of expected income (here, $4,000) Adam must receive to make him as well off when his income is uncertain as when it is guaranteed.

. Adam derives the same expected utility from a guaranteed $64,000 income as he does from having a 50% chance of a $36,000 income and a 50% chance of a $100,000 income. Another way to put this is that Adam is willing to give up $4,000 in expected income ($68,000 – $64,000) in exchange for eliminating his income uncertainty. This income difference is called the risk premium—it’s the extra amount of expected income (here, $4,000) Adam must receive to make him as well off when his income is uncertain as when it is guaranteed.

Notice how these relationships we’ve just pointed out—

Insurance Markets

A world full of uncertainties and risk-

The Value of Insurance The loss in expected utility Adam experiences due to the uncertainty of his income and his willingness to give up some expected income to reduce this loss suggest a way to make him better off. Suppose someone or some company offers him an insurance contract to reduce his uncertainty and that it involves the following arrangement. If Adam’s store blows down, the insurer will pay him a sum of money. This will reduce his losses in the bad situation. In exchange, Adam makes a payment to the insurer—

complete insurance or full insurance

An insurance policy that leaves the insured individual equally well off regardless of the outcome.

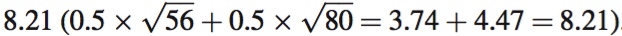

We can see this benefit more explicitly in some examples. A straightforward policy would have the insurer pay Adam $32,000 if a tornado destroys his store, while having Adam pay the insurer a $32,000 premium if there is no tornado. Under such a policy, Adam’s income is $68,000 regardless of whether a tornado occurs. If there’s a tornado, his income is $36,000 and his payout from the insurer is $32,000, and $36,000 + $32,000 = $68,000; if no tornado occurs, his income is $100,000 and his insurance premium is $32,000, and $100,000 – $32,000 = $68,000. As we saw above, that guaranteed income of $68,000 yields Adam an expected utility of 8.25, greater than the expected utility of 8 he would receive without an insurance policy and the same expected income of $68,000. This policy offers what is sometimes called complete insurance or full insurance: All uncertainty has been eliminated for Adam; he ends up equally well off no matter what event happens (tornado or no tornado). Even partial insurance is valuable, however. Suppose that the policy instead pays Adam $20,000 if there is a tornado in exchange for a $20,000 premium in the case of no tornado. This makes his income $36,000 + $20,000 = $56,000 in the case of a tornado and $100,000 – $20,000 = $80,000 if no tornado occurs. This policy keeps Adam’s expected income at $68,000 (0.5 × $56,000 + 0.5 × $80,000 = $68,000), but gives him an expected utility of  . While this is less than the expected utility of 8.25 from having a guaranteed $68,000 in income, it is higher than Adam’s expected utility of 8 without a policy.

. While this is less than the expected utility of 8.25 from having a guaranteed $68,000 in income, it is higher than Adam’s expected utility of 8 without a policy.

562

Insurance is a good deal for Adam, but what’s in it for the insurer? An insurance policy basically shifts Adam’s risk to the insurer: The insurer does not know for certain what its profit from the policy will be. However, insurers don’t typically suffer a loss as a result of this transfer because they issue a large number of policies like Adam’s. By adding together all these risks from all the policies they issue, insurers greatly reduce the uncertainty of their profits.

diversification

A strategy to reduce risk by combining uncertain outcomes.

To see why adding risks together helps an insurer, suppose that an insurer has sold policies to thousands of people exactly like Adam, each of whom owns a store that delivers income to the storeowner but also has a 50% chance of blowing down. Although it is uncertain if any particular store is going to blow down, because the insurer covers thousands of such stores, in a given year that insurer can expect almost exactly half of its covered stores to blow down. Thus, rather than having high uncertainty over the claims it will have to pay, the insurer actually has low uncertainty. The insurer doesn’t make big profits half the time and lose big money the other half; instead, it knows it’s going to almost surely have to pay claims on about half its stores while collecting premiums from the other half. This diversification—reducing risk by combining uncertain outcomes—

actuarially fair

Description of an insurance policy with expected net payments equal to zero.

Insurers can benefit from offering to take away policyholder’s risks in another way. Remember that risk aversion creates a willingness to pay to remove or reduce risk. Insurers can design policies to capture some of this value. Both of the example policies we discussed above have the same expected profit for the insurer: zero. The payment the insurer makes to Adam in case of a tornado equals the policy premium he pays in the absence of a tornado, and both outcomes happen with equal probability. (For example, 0.5 × –$32,000 + 0.5 × $32,000 = –$16,000 + $16,000 = $0.) When the expected net payments of an insurance policy total zero—

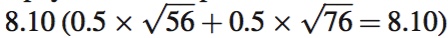

But, we’ve just seen how insurance has value for consumers like Adam; in real life, insurers design policies to capture some of this value. Consider the following policy: The insurer pays Adam $20,000 if there is a tornado, while Adam pays a $24,000 premium if no tornado occurs. Adam’s expected utility under this policy is  . The policy raises his expected utility relative to the level it would be without the policy. Adam’s expected income under the policy is (0.5 × $56,000) + (0.5 × $76,000) = $66,000. This is $2,000 less than his expected income of $68,000 without the policy, but Adam is willing to give up this $2,000 because his expected utility is higher with the policy than without it. As we saw above, in fact, Adam is willing to give up as much as $4,000 in expected income to purchase a policy that would remove all of his income uncertainty.

. The policy raises his expected utility relative to the level it would be without the policy. Adam’s expected income under the policy is (0.5 × $56,000) + (0.5 × $76,000) = $66,000. This is $2,000 less than his expected income of $68,000 without the policy, but Adam is willing to give up this $2,000 because his expected utility is higher with the policy than without it. As we saw above, in fact, Adam is willing to give up as much as $4,000 in expected income to purchase a policy that would remove all of his income uncertainty.

563

From the insurer’s point of view, Adam’s $2,000 drop in expected income is its expected profit from the policy: There is a 50% chance it will have to pay Adam $20,000 and a 50% chance it will not have to pay Adam anything, but will earn a $24,000 premium, yielding an expected profit of (0.5 × $24,000) – (0.5 × $20,000) = $2,000. While this outcome from Adam’s policy is uncertain, again, if the insurer sells thousands of such policies to unrelated risks, it can expect to earn profits of nearly $2,000 per policy without much uncertainty around that total.7

Why would the insurer design a policy that only has an expected profit of $2,000 when Adam would give up as much as $4,000 in expected income for insurance? Well, the insurer can only charge the higher premium if the market isn’t competitive. The more competition, the more the terms of policies will be tilted in the favor of policyholders and toward being actuarially fair.

Application: The Insurance Value of Medicare

The Medicare program, which provides insurance coverage to almost every person over age 65 in the United States, came into being in 1965. It was the largest expansion of health insurance coverage of the twentieth century. A study by economists Amy Finkelstein and Robin McKnight of the program’s effects over the decade following its introduction showed, rather startlingly, that it had virtually no impact on the mortality of the elderly.8 Given the program’s size, evidence that it did not improve mortality rates among the elderly seems fairly discouraging.

Finkelstein and McKnight documented, however, that although it did not improve survival rates, Medicare did dramatically reduce the out-

Finkelstein and McKnight then used survey data of elderly pre-

564

The Degree of Risk Aversion

Given the connection between diminishing marginal utility of income (reflected in how curved the utility-

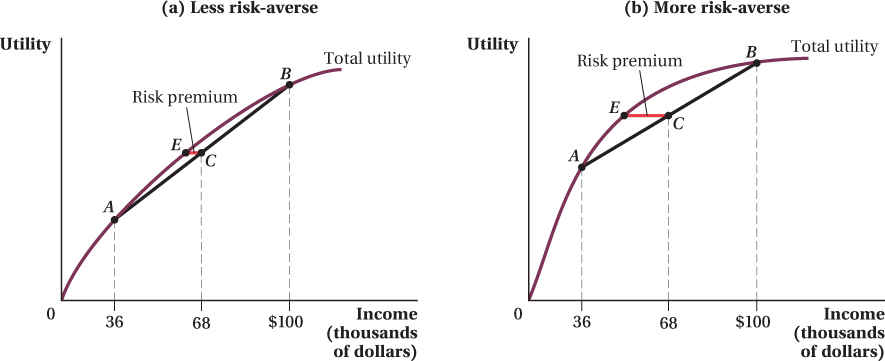

Figure 14.4 demonstrates this in an example. The figure’s two panels show portions of the utility-

Suppose that these consumers faced a situation like Adam’s, with a 50% chance of a $36,000 income and a 50% chance of a $100,000 income. The utility-

The horizontal distances between points C and E in each panel—

565

566

If the curve stays straight, we call the consumers risk-

FREAKONOMICS

Insurance for Subway Fare Evaders

If you ride the subway in Stockholm, you might see an odd site: a dog jumping up and down, over and over, just beyond the turnstiles where you enter the station. You might at first think that the poor dog has gone crazy, but that is not the case. Rather, the dog is quite sane. It is also quite well-

Not many fare dodgers are this creative, but in one way or another, over 40,000 commuters a day find a way to slip through the gates in Stockholm, saving the cost of a $140 monthly pass.

There are, however, risks associated with fare dodging. If you are caught just once, you face a fine of about $150. That might not happen very often, but when it does, it stings.

Enter Planka.nu, an enterprising Swedish non-

By far the most interesting thing it’s done, however, is to use economic thinking to further its mission. Most people are risk-

It turns out that a combination of plenty of people unbothered by cheating and a low detection rate of fare evaders has made the insurance plan a profit maker for Planka.nu. The non-

The people who run the Stockholm subway understandably hate this insurance program. So, what can they do about it? One approach is fighting it politically. In India, when a company offered a similar product, the transit authorities pressured the government into passing a law that made such an insurance program illegal. The other way to fight Planka.nu is to use economics. The only reason that this insurance program can profitably be offered is that the detection rates of cheaters are so low. The fine if you are caught is $150. If Planka.nu can make a profit offering insurance for $12 a month, it means that the average insured person is caught less than once a year: 12 months × $12 a month = $144 a year in insurance premiums, approximately the price of getting caught just once. Assuming that the typical insured person takes the subway, say, once per day, and sneaks in every time, that means the detection rate per trip is less than 1 in 365!

Essentially, Stockholm’s subway system is not trying very hard to catch evaders. If the authorities want to stop this cheating behavior, they need to make the marginal cost greater than the marginal benefit by hiring more people to check that riders on trains actually have tickets. It is estimated that 15 million trips a year aren’t paid for. At a few dollars per trip (remember, the monthly pass costs $140), that is $30 million in lost revenue. For that kind of money, Stockholm Transport should definitely be posting some help-

figure it out 14.4

The Hotel California faces a risk that it will suffer a fire causing a $200 million loss with a probability of 0.02. The owner of the firm, Don Glenn, has a utility function of U = W0.5, where W is the owner’s wealth (as measured by the value of the hotel in millions of dollars). Suppose that the initial value of the hotel is $225 million (W = 225).

What is Don Glenn’s expected loss?

What is Don Glenn’s expected utility?

What is Don Glenn’s risk premium?

Solution:

The expected loss is calculated by multiplying the probability of a loss by its dollar amount:

Expected loss = 0.02 × $200 million = $4 million

Another way to calculate the loss is to compute Don Glenn’s expected wealth and subtract it from his wealth if there were no fire:

Expected wealth = (0.98 × $225 million) + (0.02 × $25 million)

= $220.5 million + $0.5 million = $221 million

Therefore, his expected loss is $225 million – $221 million = $4 million.

Without a loss, Don has $225 million. With a loss, he has $225 million – $200 million = $25 million. His utility without a loss (when W = 225) is U = W0.5 = (225)0.5 = 15. His utility with a loss (when W = 25) is U = W0.5 = (25)0.5 = 5.

Because a 0.02 probability of a fire exists, there is a 0.98 probability that no fire will occur. Therefore, Don Glenn’s expected utility is

Expected utility = (0.98 × 15) + (0.02 × 5) = 14.7 + 0.1 = 14.8

With no insurance, Don Glenn has an expected utility of 14.8. There is a guaranteed wealth level that would deliver a certain utility of 14.8, however. If an insurance policy could guarantee him that wealth level or higher, Don Glenn would be willing to purchase it. Therefore, we must first determine how much guaranteed wealth would offer him a utility level of 14.8:

U = W0.5 = 14.8

W = (14.8)2 = 219.04

Thus, a certain wealth of $219.04 million would provide Don Glenn with a guaranteed utility of 14.8.

From part (a) above, his expected wealth without insurance is $221 million. But he’s willing to accept a guaranteed income of only $219.04 million to ensure he receives the same expected utility as in the case without insurance. Therefore, the risk premium is $221 million – $219.04 million = $1.96 million.

567